Turn the clock back about 50 years. Joe Powell recalls pumping gasoline for customers at a Texaco station in a Maryland suburb during a time of panic.

It was his first job in high school, an introduction of sorts to the energy industry for the former chief scientist for Shell, who now serves as director of the University of Houston Energy Transition Institute. At the time, it wasn’t the threat of global warming that nudged the industry to shift to different energy sources to meet demand. Instead, fears of peak oil ran rampant in the U.S.

“We thought we’d run out of oil resources and there was gasoline rationing because of the oil embargo,” Powell said. “So, you could only buy gas on an odd or even day, depending upon your license plate number. We had really no idea.”

Little global oil exploration had occurred, and “we certainly didn’t know what we had in the U.S. very well,” he said, hinting at massive natural gas reserves and shale oil. The president “was telling people we were out of energy, put on a sweater or get used to being cold. Then, we had a national speed limit of 55 miles per hour because cars were more efficient at a lower speed.”

The energy crisis led to a push for energy security as President Richard Nixon’s Project Independence aimed to eliminate oil imports by 1980. The focus was on domestic oil and gas production, nuclear energy, technology and fast-tracking projects, including approval of the Trans-Alaska Pipeline System.

President Gerald Ford followed with more emphasis on oil production, nuclear and coal. Powell remembers the coal gasification movement as being one of the major shifts in energy, one that drew him into the energy field.

“We knew we had coal and you could gasify that to make gasoline and diesel by technology that had been 30 years old by then,” Powell said, later characterizing the shift in energy during the 1970s as “scary, about having to do without and concerns on what it meant for quality of life going forward for U.S. citizens.”

While a supply crisis drove shifts in energy and policy during that decade, innovation and economics, the move from firewood to coal to oil and natural gas. Renewable energy and low-carbon energy resources have taken center stage in the latest energy transition to combat climate change. Just as with previous energy transitions, demand continues to grow.

A changing world

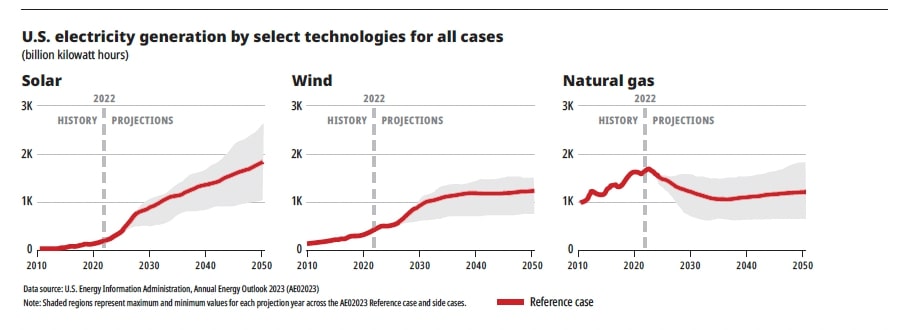

Declining capital costs combined with government subsidies, including from the Inflation Reduction Act (IRA), are expected to continue fueling growth and investment in renewables in the U.S. to meet electricity demand. The U.S. Energy Information Administration (EIA) forecasts the electricity mix will shift from fossil fuels to renewables by 2050 with power generation from renewables jumping to 44%.

Across cases examined in the EIA’s “Annual Energy Outlook 2023,” solar and wind generating capacity could see triple-digit increases between 2022 and 2050. Under different scenarios, solar generating capacity rises by about 325% to 1,019% by 2050, while wind generating capacity increases by about 138% to 235%.

Policy momentum, including the IRA, REPowerEU in the EU and China’s 14th Five-year Plan for Renewable Energy, and global energy crises are driving renewable power growth in 2023, according the International Energy Agency (IEA). In a Renewable

Energy Market update, the IEA said global renewable electricity capacity could jump to 4,500 GW in 2024, equivalent to the combined power output of China and the U.S.

Despite the growth, only three of the 50 components tracked by the IEA are fully on track with the Net Zero Emissions (NZE) by 2050 Scenario. These are solar photovoltaic, electric vehicles and lighting. “Wind, hydro, geothermal, solar thermal and ocean energy use needs to expand significantly faster in order to get on track. Non-bioenergy renewables need to increase their share of total energy supply from close to 5% today to approximately 17% by 2030 in the NZE Scenario,” the IEA said. “To achieve this, annual renewable energy use must increase at an average rate of about 13% during 2023-2030, twice as much as the average over the past five years.”

The IEA pointed out there has been rapid growth in clean energy technology deployment, despite not being fully on track globally. For example, installed capacity for electrolyzers—key in the production of electrolytic hydrogen—grew by more than 20% in 2022, while manufacturing capacity increased by more than 25%.

Progress is faster in areas with available technology and falling costs, the IEA said. It also noted that the transition is taking place at “different speeds across regions and sectors.”

Others seem to agree.

Energy trilemma lingers

Experts from the Washington, D.C.-based Energy Policy Research Foundation (EPRINC), a nonprofit that studies energy economics and policy issues, discussed how the world could look in 2030 and 2050 during a Hart Energy conference.

“The global energy transition will not be linear, but it will be multispeed and multi-track,” said Batt Odgerel, director of energy transition research at EPRINC.

The starting points are different for countries and each face different economic development and social challenges, he said.

“The U.S. and European Union have made some significant strides in the past decades toward achieving greater adoption in clean energy technologies,” Odgerel said. “But if you look at other regions like Africa, energy access and equity are still major challenges. In India and China, coal is still the king and it’s hard to imagine coal going away any time soon.”

Oil and gas investment in new fields, something the IEA said must cease in order to meet net-zero goals, could be detrimental for energy-poor countries if the energy trilemma—the interdependency among energy security, energy affordability and carbon reduction—isn’t solved.

“The social cost of carbon is very high, and it’s important to take it seriously,” Odgerel said. “But at the same time, any abrupt change in oil and gas production and cessation of oil and gas investment will likely lead to unintended consequences in the long- and medium run. So, business leaders and policymakers have to balance and navigate between the two or, even better, find solutions to address both of these challenges.”

Similar sentiments were shared by others.

“We need to double the amount of energy production so that the developing world can have equity with the standard of living that we have today, and that’s our obligation,” Powell told Hart Energy. “We have the dual challenge of providing global access to energy and then also reducing the impact of greenhouse gases, which is quite a challenge to be solved globally.”

Trillions of dollars

It will take a lot of effort and a lot of money, perhaps trillions of dollars.

By Wood Mackenzie’s estimates, at least U.S.$1.4 trillion must be invested annually in renewables, infrastructure and energy transition technologies to hold global warming to no more than 2.5 C and $2.4 trillion to achieve the net-zero goal of 1.5 C by 2050.

In a report released in September, the data-driven energy consultancy said no major country was on track to meet 2030 emissions goals. The firm’s base case of 2.5 degrees show energy-related emissions peaking in 2027 and dropping about 25% by 2050 from 2019 levels. Low-carbon energy’s share of the global energy mix rises to 14% by 2030 and 28% by 2050. In its net-zero case, low-carbon supply rises to 78% by 2050, up from 42% of power generation today. Wind and solar’s share rise to more than 53%, up from today’s 13%.

“The supply of low-carbon energy has grown by a third since 2015, but the world’s energy demand has grown much faster with rising incomes and populations,” Simon Flowers, chairman and chief analyst at Wood Mackenzie, said in a news release.

“The good news is that sustainability is alive and kicking, spurred on by policy including the introduction of the U.S. Inflation Reduction Act and Europe’s REPowerEU. Achieving 1.5 C is going to be extremely challenging, but it is possible and greatly depends on actions taken this decade.”

Such actions include adoption of energy storage, small-module nuclear and geothermal, along with expanded power transmission infrastructure, hydrogen and carbon capture, utilization and storage, according to Wood Mackenzie. Carbon pricing is needed to help drive uptake of cleaner energy in the cement, chemicals and steel sectors.

“Oil and gas still have a role to play as part of a managed transition. There will be a natural depletion as low and zero-carbon options develop but supply still needs to be replenished

Prakash Sharma, vice president of scenarios and technologies research at Wood Mackenzie and lead author of the report.

Improved end-use efficiency and electrification are expected to push fossil fuels’ share of end-use energy demand from 69% in 2023 to 53% by 2050, according to Wood Mackenzie’s report.

Shifts in energy

A look at past energy transitions and the magnitude of the one underway indicate that only time will tell which technologies will stick around and which ones won’t.

Powell recalled shifts in energy during the past 50 years or so. Following the oil crisis in the 1970s, he recalled focus moving to stranded natural gas opportunities going into the 1980s and how it could be converted to chemicals or liquid fuels. That was followed by growth of the LNG business, which helped make natural gas tradeable globally.

“Despite all of that going into the ’90s, natural gas prices were high in the United States. So, there was a concern about whether we could be competitive in terms of manufacturing and, specifically, in manufacturing of chemicals,” Powell said. “Major companies were looking to relocate to Southeast Asia, where you may have better pricing opportunities. We worked really hard to find some promising technologies. Then, there was a fracking revolution and all of a sudden, the U.S. then had the most abundant natural gas and the lowest prices,” plus light, tight oil.

In the midst of the fracking craze was a biofuels phase. Companies looked to use woodchips as feedstock and produce ethanol from corn stover, he said. But biomass and its low-energy density proved to be too big of a challenge back then.

Now, focus is on low-carbon fuels, Powell said, noting he is working on a report on the topic. “One of the things we’re looking at is, can you take CO2 out of the atmosphere and use the renewable energy to upgrade it back to a fuel and then use that in aviation fuel? Can you get the cost of that to come down if the renewable energy is cheap enough, so that it could be a future source of aviation fuel?”

Looking ahead to the next 50 years, he sees more electrification, renewables and storage. He sees lives becoming more integrated with computations, big data and AI algorithms.

“Some say save the last drop of petroleum for chemicals because a lot of those can go into sequestered products,” Powell said, adding there will be opportunity to make products from biomass or CO2 captured from the air. “And hopefully, a lot more of that will be recycled.… So, [there’s a] tremendous number of problems to solve. There’s been nothing but transition throughout my career and it’s going to be quite a wild ride over the next 50 years to get all that sorted out.”

Recommended Reading

Pioneer Energy’s Tech Offers More Pad Throughput, Fewer Emissions

2025-01-14 - Pioneer Energy’s Emission Control Treater technology reduces emissions and can boost a well’s crude yield by 5% to10%, executives say.

SLB’s Big Boost from Digital Offsets Flat Trends in Oil, E&P

2025-01-20 - SLB’s digital revenue grew 20% in 2024 as customers continue to adopt the company's digital products, artificial intelligence and cloud computing.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

No Drivers Necessary: Atlas RoboTrucks Haul Proppant, Sans Humans

2025-03-04 - Atlas Energy Solutions and Kodiak Robotics have teamed up to put two autonomous trucks to work in the Permian Basin. Many more are on the way.

Diamondback in Talks to Build Permian NatGas Power for Data Centers

2025-02-26 - With ample gas production and surface acreage, Diamondback Energy is working to lure power producers and data center builders into the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.