(Source: Shutterstock.com/Hart Energy)

[Editor's note: This article originally appeared in the November issue of E&P Plus. Subscribe to the digital publication here.]

The oil and gas industry, particularly the E&P and oilfield services subsectors, have faced significant headwinds over the last few years, most recently with the simultaneous demand destruction resulting from COVID-19 and supply shock from the Saudi Arabia-led price war. These recent events, combined with capital flight out of the industry and demands for capital discipline by remaining investors, have accelerated the push by company stakeholders, regulators and others for energy transition initiatives.

But the energy transition journey will take decades. The industry, as a whole, needs to strategically position itself to remain profitable in oil and gas while concurrently evolving over time to meet the demands of a lower-carbon future. Oil and gas will retain a significant role in the global energy mix, particularly for developing nations. However, in the U.S. and Europe, alternative energy sources will expand and take capital—both financial and human—with them.

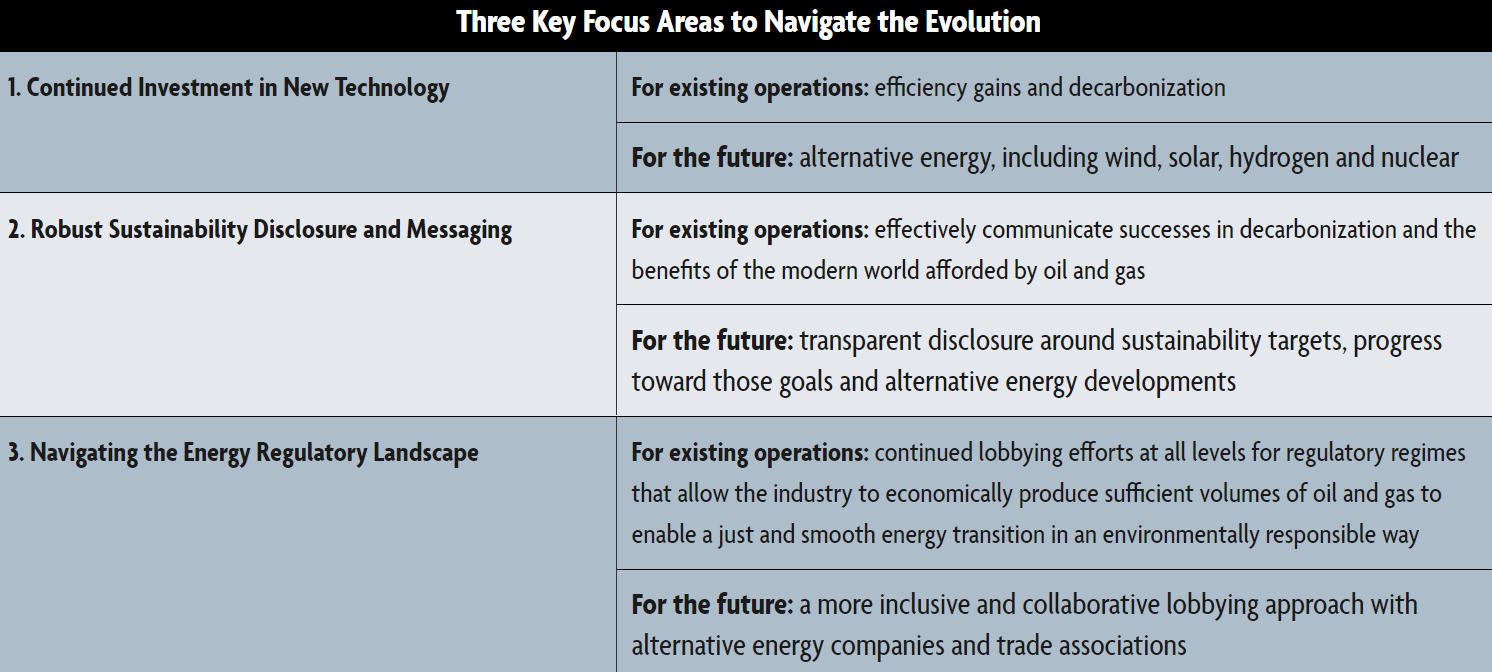

To successfully navigate this long-term evolution, the industry needs to focus on three key areas, simultaneously emphasizing both the present and the future.

Conflicting frameworks

From a regulatory perspective, the oil and gas industry finds itself facing conflicting frameworks, interests and objectives as it pursues its energy transition initiatives. Local and state regulatory regimes are becoming more restrictive while federal regulations are currently relaxing. Although the Joe Biden administration could quickly alter the landscape. Within the broader energy industry, traditional oil and gas and alternative energy, historically adversarial, are now looking to come together to push regulatory agendas, but it will be some time before the industry can truly establish the necessary “big tent.”

Even within oil and gas, many companies and subsectors are moving in different directions, pursuing their own best strategies and timetables for energy transition. To ensure the smoothest and most just transition, the oil and gas industry needs to exhibit an extraordinary amount of cooperation and forward thinking in its regulatory efforts as it threads the needle between the present and the future.

An excellent example of these conflicting regulatory frameworks, interests and objectives is the recent rollback of the President Barack Obama-era methane emission regulations. Environmental regulations applicable to the oil and gas industry have been subject to many amendments during the President Donald Trump administration, which has solicited a wide range of responses from the oil and gas industry and interested stakeholders. The reactions to the most recent changes to the air emissions standards in the New Source Performance Standards (NSPS) for the oil and gas industry have been particularly divisive, with some members of the E&P industry praising the changes and others expressing disappointment in the regulations as undermining decarbonization efforts.

On Aug. 13, 2020, the EPA issued two final rules relaxing methane gas emissions requirements applicable to various segments of the oil and gas industry.

The first of these rules, known as the policy amendments to the NSPS regulations, removes the NSPS requirements for the transmission and storage segment of the oil and gas industry altogether, including rescinding both volatile organic compound (VOC) and methane emissions standards for transmission and storage sources.

This final rule concludes that the oil and natural gas production source category only includes the production and processing segments of the industry. Because the EPA did not find that emissions from the transportation and storage segment cause or significantly contribute to air pollution that may be reasonably anticipated to endanger public health or welfare, the EPA improperly regulated emissions from the transportation and storage segment.

In addition, the EPA also rescinded the methane emission standards for the production and processing segment of the oil and gas industry, although VOC standards applicable to the production and processing segment remain in effect.

The second rule, known as the technical amendments, addresses the EPA’s reconsideration of four aspects of the NSPS regulations: fugitive emissions requirements, wellsite pneumatic pump standards, requirements for certification of closed vent systems by a certified engineer and the application process for the use of an alternative means of emissions limitation. In addition, the technical amendments include other efforts to streamline implementation of the NSPS regulations as they relate to well completion, onshore natural gas processing plants, storage vessels, and record-keeping and reporting requirements. Paired with the policy amendments, oil and gas companies are no longer required to monitor and repair methane leaks from production and processing operations.

While the API praised the rulemaking as “consistent with the requirements of the Clean Air Act,” others, such as bp, criticized the rule.

“bp believes methane should be directly regulated by the EPA” and that “the best way to tackle [climate change] is through direct federal regulation, ensuring that everyone in the industry is doing everything they can to eliminate methane leaks,” the company said.

bp’s statement comes after its February 2020 pledge to zero-out its carbon emissions by 2050, with Shell also announcing its intention to be a net-zero carbon emissions business by 2050. Shell called the rulemaking “frustrating and disappointing” and has previously urged the Trump administration to directly regulate methane emissions from existing onshore oil and gas assets. Many players within the industry, for strategic, reputational, marketing and other reasons, did not see eye to eye on the rollback of the methane emission regulations.

And, unsurprisingly, the regulatory rollback has set off a flurry of litigation, with states, municipalities and environmental groups challenging the new federal rule in several cases filed on Sept. 14, 2020. Environmental groups also filed a motion for an emergency stay of the rule during the pendency of the litigation, which was granted by the District Court.

Moving forward

The varied reactions to the methane emission regulatory rollback are not surprising. And Winston & Strawn expects, in the short term, more conflict on regulatory issues rather than common ground. But for the energy industry to move forward effectively and efficiently, everyone is going to have to come together, both in support of traditional oil and gas and our lower-carbon future. Threading the regulatory needle will be a key to industry success.

Recommended Reading

Early Innings: Uinta’s Oily Stacked Pay Exploration Only Just Starting

2025-03-04 - Operators are testing horizontal wells in less developed Uinta Basin zones, including the Douglas Creek, Castle Peak, Wasatch and deeper benches.

EIA Reports NatGas Rig Count Fall-Off in ’23, ’24

2025-03-04 - The U.S. Energy Information Administration’s report of a falling natural gas rig count backs up statements from producers in the Appalachian and Haynesville basins.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

ADNOC, OMV to Merge Petrochemical Firms to Create $60B Giant

2025-03-04 - The merged entity, Borouge Group International, is set to be the fourth largest polyolefins firm by production capacity, behind China's Sinopec and CNPC, and U.S.-based Exxon Mobil, ADNOC Downstream CEO Khaled Salmeen told Reuters.

Expand’s Dell’Osso: US LNG Facilities May Fall Below Capacity in ‘26

2025-03-04 - CEO Nick Dell’Osso said Expand Energy wants to time drilling and completion spending and grow gas output to meet a flush LNG market.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.