The proposed sale will clear about $320 million P&A obligations and also give the Houston-based E&P much needed capital. (Source: Shutterstock.com)

[Editor's note: This story was updated at 3:21 p.m. CT May 14.]

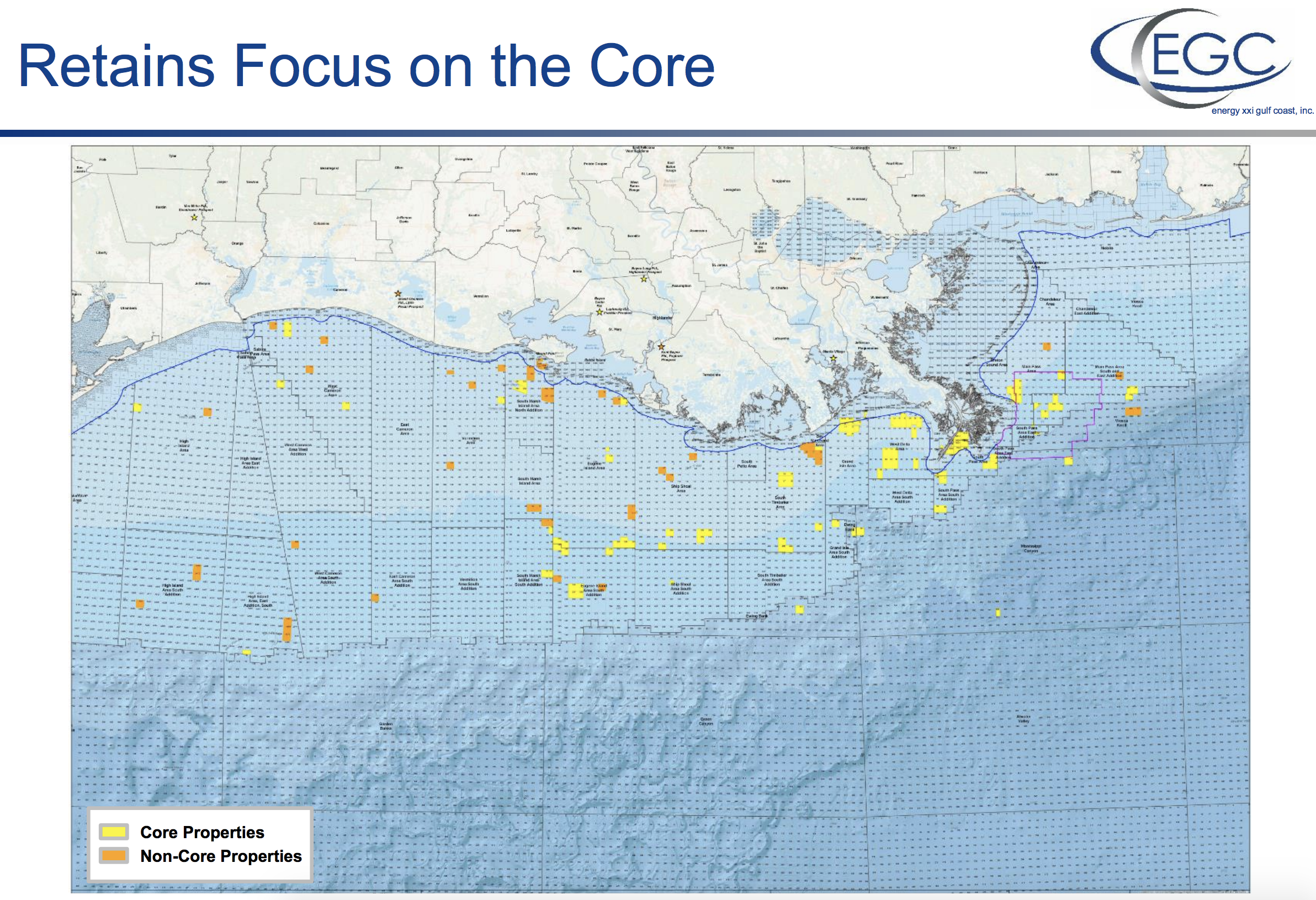

Energy XXI Gulf Coast Inc. (NASDAQ: EGC) said May 10 it agreed to sell its noncore asset portfolio located in the Gulf of Mexico (GoM) as part of a new partnership with Orinoco Natural Resources LLC.

The proposed sale will clear about $320 million of Energy XXI's P&A obligations and also give the Houston-based E&P much needed capital to develop its remaining assets. In exchange, Orinoco, a Houston-based natural resources firm owned by billionaires Tom and Ana Clarke, will receive a 35% equity ownership position in Energy XXI.

The deal, which BMO Capital Markets estimates to be worth more than $125 million, isn't Orinoco's first acquisition of GoM assets with retirement obligations.

The firm also purchased PetroQuest Energy Inc.’s GoM operations in January through its subsidiary Northstar Offshore Ventures LLC. PetroQuest’s assets included about $35.4 million of future, undiscounted abandonment liabilities.

“We have considerable experience helping natural resource companies shed and decommission noncore assets and believe that we have found a compelling, complementary partner in EGC (Energy XXI),” Tom Clarke said in a statement.

The Clarkes also control the Virginia Conservation Legacy Fund, which seeks to conserve natural resources and address climate change in part by finding economic futures for people and communities that depend on mining.

“With this transaction, EGC can focus on its core business, and we can ensure that the assets are retired in a safe and environmentally sound manner,” Tom Clarke said.

Energy XXI emerged from Chapter 11 bankruptcy in late 2016. Since then, the company retained Morgan Stanley & Co. LLC in March 2017 to assist with an evaluation and implementation of a strategic plan.

The company also tapped industry veterans Douglas E. Brooks and Gary Hanna within the past year to lead the company—Brooks as CEO and president and Hanna as board chairman.

“Through extensive evaluation of our portfolio over the last year, we identified several critical factors that could materially enhance the sustainability and valuation of EGC’s portfolio,” Brooks said in a statement. “We believe that this proposed transaction addresses many of these factors, including a significant reduction of EGC’s asset retirement obligations, meaningful reductions to operating costs, and a renewed operational focus on our most productive assets, which generate the majority of our cash flow and value.”

Energy XXI's noncore assets have significant near-term P&A burden and limited cash flow. The assets located throughout the GoM produce about 3,000 bbl/d of oil and 9.5 MMcf/d with 67 MMboe of proved reserves (30% gas).

As part of the proposed transaction, Energy XXI will issue to Orinoco's affiliate Offshore Environmental Fund LLC (OEF) a $100 million second lien note, which interest and amortization payments on are expected to be more than offset by savings in cash P&A and G&A costs.

Further, Energy XXI will pay OEF upfront cash totaling $12.5 million at closing and an additional $12.5 million six months following the closing.

Orinoco and its affiliates have also committed to an anchor financing with at least a $25 million participation on terms to be agreed. The financing is expected to provide Energy XXI with capital to fund an enhanced drilling and development program beginning in 2019 to facilitate future growth.

Brooks added that the partnership positions Energy XXI to pursue offshore and onshore acquisition opportunities.

“The near-term components of EGC’s strategy include future drilling and development programs and pursuing potential acquisitions or future consolidations,” he said.

The proposed transaction is subject to necessary approvals from Energy XXI’s stockholders, lenders and regulatory authorities. The company said it is working on transaction documentation in accordance with the signed non-binding term sheet in order to close the deal in third-quarter 2018.

Intrepid Partners is Energy XXI's exclusive financial adviser and Sidley Austin LLP is the company's legal adviser. Latham & Watkins LLP is serving as legal adviser to Orinoco and its affiliates.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.