U.S. energy production, transmission and consumption keeps the nation, as well as the global economy, moving. In this election cycle, not only is the outcome of the presidential race between former President Donald Trump and Vice President Kamala Harris unclear, but down-ballot races are up for grabs and the regulatory impact of those election results will affect the oil and gas industry for years to come.

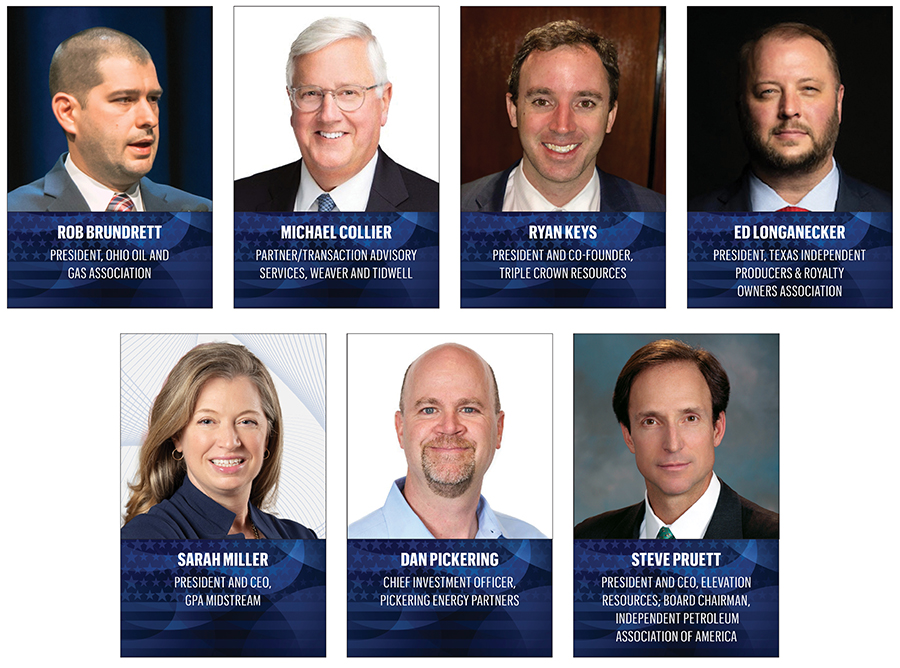

In this roundtable, Oil and Gas Investor asked key industry players to share their perspective on issues to keep in mind as readers exercise one of their most fundamental rights.

There are varying issues at play, including federal methane emissions rulemaking, the so-called pause on LNG permitting and the recent Supreme Court ruling striking down the Chevron deference doctrine—potentially limiting the powers of federal regulating agencies.

Deon Daugherty, editor-in-chief, Oil and Gas Investor: What are the top policy issues and potential regulations ahead for oil and gas operations in top U.S. producing regions?

Rob Brundrett, president, Ohio Oil and Gas Association: In Ohio, we are focused on engaging with our membership regarding the new methane rule and methane tax, particularly how their implementation and enforcement will impact all of our producers. Additionally, the permitting reform bill making its way through Congress is of great significance to our membership.

Michael Collier, partner in transaction advisory services, Weaver and Tidwell: The future of natural gas should be on every policymaker’s mind. The pause in LNG export licensing, which in my opinion was driven by political rather than policy considerations, should be reversed. The U.S. should be the leading exporter of LNG because it’s a clean substitute for coal-fired power generation and because a vibrant natural gas industry is vital to our national security.

Here at home, concerns about the Texas grid in light of exploding demand from data centers should also be top of mind. Policymakers need to figure out quickly how to attract investment in dispatchable power generation, and natural gas will play a prominent, if not dominant, role in this.

Ryan Keys, president and co-founder, Triple Crown Resources: I can only speak to regulations in Texas and at the federal level, as state regulations vary wildly from state to state. In Texas, it will be interesting to see how sentiment evolves regarding orphan wells, water and induced seismicity.

At the federal level, among the biggest issues is the implementation of new emissions rules from EPA 0000b/c, EPA Subpart W, and the Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA). There’s still a lot of uncertainty how some of these rules will play out in the real world. The Waste Emissions Charge (WEC) will be assessed through EPA Subpart W starting next year on methane emissions that exceed certain thresholds, so this is imminent. The Supreme Court’s ending of the Chevron deference introduces more uncertainty in this evolving emissions regulation landscape.

Ed Longanecker, president, Texas Independent Producers & Royalty Owners Association: In July, U.S. Sens. Joe Manchin (I-W.Va.) and John Barrasso (R-Wyo.) released a long-awaited bill that aims to expedite the development of domestic energy projects by streamlining the federal government’s energy infrastructure permitting process. Overregulation is consistently cited as an obstacle that has stalled energy projects across the country. Electricity demand will increase rapidly in the coming years, particularly in Texas, and provisions in the Energy Permitting Reform Act of 2024 (EPRA) will help streamline processes for natural gas producers to meet that demand and provide reliable, affordable energy for years to come.

In the U.S., gaining permits to build energy infrastructure and connecting it to the electric grid is harder today than at any point in recent memory. Projects built between 2018 and 2022 face an average wait time of four years before they can connect to the grid, up from less than two years for projects built between 2000 and 2007. Unclear and overlapping mandates, poor coordination among federal agencies, and unnecessarily long timelines are just some of the many hurdles energy projects face in development.

Natural gas producers in Texas and across the country continue to prove their commitment to providing reliable and affordable energy with record-setting production. But with great production comes great responsibility; particularly, the responsibility to provide adequate transportation to keep the energy flowing. As pipelines in the Permian Basin reach capacity, future production is threatened. The approval process for building additional pipelines can be convoluted, but the introduction of the EPRA is a promising step toward simplifying that process and ensuring that we can continue to meet our state’s growing energy demand.

Sarah Miller, president and CEO, GPA Midstream: The industry’s top priority is establishing regulatory certainty and sensibility to enable the long-term planning and capital allocations necessary to build the infrastructure that reliably, sustainably and affordably powers our economic vitality.

We will continue to bring a spotlight on how the regulations implementing the tax on methane emissions should be drafted to achieve congressional intent. For example, Congress wrote the Inflation Reduction Act [IRA] to provide exemptions that recognize good action, and it’s critical that such exemptions are part of EPA’s [WEC] rules. We will continue fighting for regulations that follow the law and promote cost-effective emission reduction.

We will also continue to advocate for methane regulations, greenhouse-gas reporting rules and leak detection and reporting requirements that are within the scope of agency authority, consistent with empirical data and aligned with other regulations.

Dan Pickering, chief investment officer, Pickering Energy Partners: Methane and ESG reporting looms large. Permitting generally—LNG export facilities, pipelines, drilling, offshore wells, CCUS sites, the list goes on. Sanctions on bad actors that happen to be big oil suppliers (Russia and Iran are two examples). Rejuvenation and enhancement of the power grid. Carbon taxes—will we ever have one?

Steve Pruett, president and CEO, Elevation Resources; board chairman, Independent Petroleum Association of America: Methane Emissions Reduction Program; the Waste Emissions Charge (methane tax); U.S. District Judge Deborah Boardman’s recent decision to vacate the 2020 Gulf of Mexico Biological Opinion, a ruling that could lead to a shutdown of a “wide and substantial swath of offshore oil and gas operations and activities on Dec. 20, 2024.” The IPAA stated “the shutdown is likely unless a legal, regulatory or legislative solution that prevents a gap between biological opinions is in place before then.”

DD: Which down-ballot races are you watching, and how might those results impact the industry?

RB: The Ohio U.S. Senate race pitting incumbent Democrat Sherrod Brown versus Republican businessman Bernie Moreno is one of the most watched races in the country. It is one of a handful of races nationwide that will determine which party controls the U.S. Senate. Control of the Senate will go a long way in determining the future of U.S. energy policy.

In Ohio, the biggest issue we are watching is State Issue 1, the constitutional amendment to change how statehouse districts are drawn. Additionally, the outcome of the three Ohio Supreme Court races will no doubt impact what is happening in our industry as well as others.

MC: Regardless of the down-ballot winners in Texas, our Texas representatives and senators will, in my view, work to shield the oil and gas industry as best they can from the kinds of attacks we’ve seen lately. That said, my observation is that our energy literacy as a country is on the rise; the Democratic presidential nominee, for example, is under less pressure to criticize the oil and gas industry as was her predecessor.

Again, it’s not been an issue with Texas politicians, but I see Democrats in non-oil producing regions far less vocally opposed to us as we saw in the past. The industry is doing a good job explaining their work in such areas as carbon capture, geothermal and hydrogen, which I believe has had an impact on public opinion.

RK: The direct election by popular vote of the Texas Railroad Commissioners is always a curiosity. Since the average Texan has no idea what the Texas Railroad Commission does, with added confusion from their antiquated name, the candidates often win their primaries and elections on policy positions that have nothing to do with the oil and gas industry.

I think it would be better if they were appointed by the governor and serve the same six-year staggered terms. It’s such an important position for the Texas economy, and I think it would benefit everyone in the industry to keep the RRC focused on regulation that balances the interests of all stakeholders instead of being distracted by trying to appeal to people who have no idea what the RRC is.

Otherwise, there are some congressional races all over the country that I’m interested in—there’s a lot of bipartisan support for American dominance in global LNG markets, and I hope that grows.

EL: Without question, there will be some tight races this election cycle. We are watching some tough fights along the Rio Grande Valley, in our key oil producing regions and in some of the major metroplexes across the state. By and large, however, elected officials in Texas understand the importance of oil and gas. They recognize the contributions of Texas oil and gas to employment in their districts, the state’s Rainy Day Fund, or Economic Stabilization Fund, state infrastructure, public schools, universities, first responders and other essential services.

Texas elected officials, regardless of party, generally understand that Texas oil and gas producers live, work and raise families in the very communities that they develop mineral resources and that they have a genuine commitment to positive stewardship.

SP: Balance of power in the Senate and House is critical to our industry. There are a number of pivotal Senate races, including Ted Cruz (R-Texas) along with races in Michigan, Montana, Maryland, Nevada, Ohio, Pennsylvania and Wisconsin.

The House is a toss-up on the majority and is critical, given the chairs of the committees affecting our industry are at stake.

In the event of a Harris-Walz victory, Republicans must control at least the House to prevent permanent damage to the energy industry, capitalism and consumers.

DD: How might the outcome of the November election improve the economics of domestic oil and gas production?

RB: Our message is the same regardless of who wins in November, and that is energy should not be a partisan issue. We will continue to advocate for common-sense rules so our members can do what they do best, which is to responsibly and efficiently produce natural gas and oil to serve the needs of American families.

Answers to this question are going to vary wildly depending on where someone operates and what kind of assets they have. We operate in Texas, don’t have any federal leases and our hydrocarbons are transported to Texas markets in pipelines that don’t cross state lines, so we aren’t affected as much from political volatility at the federal level, at least in terms of regulation. With that said, I think everyone in the industry needs to keep an eye on policy positions on these macroeconomic and geopolitical themes:

1. Iranian sanctions. A more hawkish stance towards Iran will likely result in lower exports, which would be bullish for oil prices.

2. Conflicts in the Middle East and Ukraine. As far as we can tell, there’s very little geopolitical risk premium in the current price, and there hasn’t been since 2022. We see little spikes here and there (missile strikes, Houthis, etc.), but they don’t last very long. If things really heat up, we’ll see that risk premium return. Short term, that would benefit producers, but long term, that results in demand destruction, so it’s to everyone’s benefit to have a stable, peaceful world with low market volatility.

3. OPEC. The populist rhetoric for low energy prices is coming from all corners of the political spectrum, albeit with different philosophies on how to get there. The U.S. is the world’s largest oil producer, but the projections calling for another 1 MMbbl/d of growth in the next few years are not grounded in reality. Consolidation and lower prices have driven rig counts to levels we haven’t seen since 2021, and we are drilling our inventory faster than we can replace it. So, the balance of power in global oil markets is shifting back to OPEC with its substantial spare capacity. In other words, in terms of global supply and demand balances, I don’t think there’s much that a Trump or Harris administration can do to affect oil prices over the long term. If OPEC wants the price at $50/bbl (and they can live with the fiscal consequences), it will go to $50/bbl. If they want the price at $100/bbl, it will go to $100/bbl. The domestic oil and gas industry has lived with this reality for most of the last 50 years, so we should be used to it.

4. The Strategic Petroleum Reserve. This is a drop in the ocean compared to OPEC, but the SPR is 300 MMbbl below where it was in 2021. It’s getting refilled very slowly. I’m not sure which of Trump or Harris is more likely to support filling it back to where it was, but the precedent has been set that it can be used to temporarily suppress a spike in oil prices, but only if the reserve is there.

5. The EU border carbon tax, and more broadly, growing LNG exports. Bypassing or mitigating the border carbon tax in the European Union is a potential windfall for everyone in the American oil and gas supply chain. This will need cooperation from our entire supply chain and the federal government. There’s bipartisan support for this, but it’s weighted to the R side.

MC: Regardless of who wins the presidency, the pause in LNG licensing will likely be lifted because the political imperative for the pause will be behind us. Beyond that, I don’t see the parties as terribly far apart on oil and gas policy as some might think, except perhaps when it comes to federal lands and the development of the Gulf of Mexico. There, too, political expediency, as opposed to thoughtful policy, was at play and, post-election, I hope to see us return to rational policy regardless of who wins.

EL: Federal policies, especially those enabling the expansion of LNG export capacity, more efficient environmental reviews for infrastructure, and continued leasing on federal lands and waters are crucial to safeguarding American energy and national security. Currently, four multibillion-dollar LNG projects in Texas are at risk from the current permitting pause. An administration that lifts the currently imposed LNG pause and recognizes the significance of American energy security is paramount.

The oil and gas industry, particularly here in Texas, where we lead the nation in producing these valuable resources, is a major job creator and contributor to economic growth in our communities. It’s also critical for supplying energy across the United States and globally. Whatever the outcome in November, we need elected officials who understand what’s at stake and work alongside the industry to ensure workable regulations and less uncertainty for investments. A drop in production would lead to destabilized global energy markets, supply shortages and high energy prices for not only Americans, but our strategic allies who are as dependent on strong American production as we are.

The need for regulatory certainty at the state and federal levels remains a top priority and elections can have a significant impact. Fortunately, we have that in Texas with our pro-business environment and common-sense energy policy, but the federal government has consistently made it more challenging and costly to produce domestic energy.

Despite this reality, we see some candidates taking credit for record levels of production, when their policy decisions reflect the opposite. Increased domestic production is the result of growing global demand, a recovery from the COVID-19 pandemic, production cuts by OPEC and efficiencies gained by U.S. operators during extreme periods of market volatility, not the policy actions taken in recent years that are considered anti-oil and natural gas. It’s not the first time we’ve seen this during an election cycle, nor will it be the last, but we are producing more oil and natural gas despite current federal policy, not as a result of it. It’s our hope that the focus on energy policy by various candidates, including “banning” hydraulic fracturing, will help to educate more Americans on how critical our industry is in every aspect of their lives.

Some of the more impactful federal regulations facing our industry that could be bolstered or reversed depending on the outcome of the elections are in the methane emissions category, including: the [WEC], which is the natural fee or tax in the Inflation Reduction Act; revisions to Subpart W reporting that will be used to determine the amount of methane that will be subject to the [WEC]; and New Source Performance Standards OOOO B&C. The latter, and most impactful, directly regulates the oil and gas industry through setting emission standards for both new and existing sites.

SM: Our country has an opportunity to enhance its domestic energy production and support allies who need energy security. The United States produces the cleanest natural gas in the world and our international partners, especially in Europe, need a reliable energy partner. We’re hopeful that either presidential candidate will execute energy policy that realizes the potential for stability and economic prosperity for the United States and our international partners.

DP: To state the obvious, this clearly depends on which candidate wins. Harris is likely to make it tougher on oil and gas business, with potentially more restrictive regulations, taxes, access, etc., while supporting and encouraging clean energy (and thus shortening the ultimate runway of the conventional energy industry). However, these actions could result in lower/tighter oil and gas supply and potentially higher prices, boosting profitability.

Trump is more likely to be a friend to the conventional energy industry with less restrictive regulations, taxes, access, etc. He’ll also likely hammer the clean energy business (removing incentives), thus lengthening the oil and gas runway. While business conditions would be more favorable, Trump’s “drill, baby, drill” mentality could result in higher supply and lower commodity prices.

SP: A Harris-Walz victory and one or more houses of Congress with a Democratic majority will raise the cost of doing business in energy, damage markets for our products, increase cycle time for projects (permitting), and severely reduce access to developing and producing on federal lands, which is already in place under Biden-Harris. A Trump-Vance administration with one or more houses of Congress will reverse the Biden-Harris punitive regulatory policies by replacing the progressive heads of the regulatory agencies affecting the energy industry, along with imposing stronger sanctions on Iranian and Russian oil exports. Post the Supreme Court’s reversal of the “Chevron deference” case, federal agencies need to be reined in and follow legislative and judicial directives.

DD: What opportunities and challenges may result from the election outcome?

RB: Those involved in the natural gas and oil industry are authentic entrepreneurs whose focus will continue to be turning challenges into opportunities and will always find ways to operate and innovate. Politics sometimes slows things down but, regardless of who wins in November, we have a responsibility to find, lift and process the natural gas and oil that will continue to power the global economy.

MC: There is no question Democrats will be less vocal in support of oil and gas than Republicans; but I believe sentiment within the Democratic Party is not as profoundly anti-oil and gas as it once was. Nor do I believe a Democratic victory will pose a threat to our industry. I often remind my friends that oil and gas production, even under a Democratic president, is at an all-time high.

RK: Presidents get too much credit when things go well, and too much blame when they don’t. For most, macroeconomic trends and state/local regulations have a greater impact. With that said, smaller operators and those with federal leases and/or insufficient pipeline egress will likely face more challenges with Harris in the White House.

EL: There is only one thing that is certain from whatever the outcome in November might be—change is on the horizon, and with it, a multitude of challenges and opportunities for our industry. As with any election where a new president is guaranteed, we’ll be navigating a period of uncertainty as the new administration settles in and establishes what its regulatory priorities will be.

Whether there will be a continuation or expansion of current policies or a reversal of them is unknown at this point. What we do know is that new administrations mean opportunity to sit down and discuss current policies, what’s needed and what challenges the industry is facing to hopefully reach some solutions together, if they are willing.

SM: Election cycles have repeatedly caused stop-start regulatory challenges in recent decades, complicating and interrupting development of the infrastructure necessary to satisfy energy demand, which is increasing due to AI data centers, new technologies, population growth, rising living standards and industrialization. That stop-start cycle needs to end. Regardless of the election outcome, we look forward to working with the new administration to enact a realistic, real-world regulatory framework that supports the goal of reliable, affordable and cleaner energy.

DP: One unknown regards the geopolitical actions the new president will take. Will they push for a conclusion to the Russia/Ukraine conflict and the Israel/Gaza turmoil? Will they sanction countries like Iran and Venezuela? Will they be a friend or foe to OPEC+ and Saudi Arabia?

SP: The oil and gas industry just needs a pragmatic, stable regulatory environment to continue producing and processing clean, affordable natural gas and petroleum products for our citizens and our allies across the globe. For challenges, a Harris-Walz administration will permanently threaten the existence of the small operator in the United States, impacting almost 1 MMboe/d of production and countless jobs and tax revenue to localities.

The other threat to independents and royalty owners is the Democrats’ plans to eliminate intangible drilling cost deductions and percentage depletion, along with raising corporate and individual tax rates. These changes leave less funds available to reinvest in the upstream industry, but in all forms of manufacturing and thus destroy jobs and our economy.

DD: How will the election affect innovation and technological advances in the industry?

RB: Over the next several years, as we continue to explore opportunities within the hydrogen space, we expect to see additional advances in technology that very well may be applicable to other sectors within the industry. We are hopeful that industry innovation will continue to outpace political roadblocks.

MC: There is always the possibility that IRA subsidies will be rolled back, depending on who wins. But I think the possibility is remote. As long as IRA money doesn’t prevent investment in oil and gas, opposition to subsidies will be muted at best. Deficit hawks will form the most vocal opposition to continued IRA subsidies, but politicians stopped listening to deficit hawks (sadly) many years ago.

Controlling methane leaks may be one area where the election could make a difference. The majors are already working on this, but some smaller operators aren’t. If Democrats take over completely, we could see much more stringent rules; but from a macro perspective, I don’t think stricter rules will have a profound impact on the whole industry, just smaller players.

RK: A good idea that lowers the cost of supply is going to be successful regardless of who is in the White House.

EL: Innovation and technological advancement are at the heart of the U.S. oil and gas industry. We’re continuously researching and studying to find ways to improve efficiency, reduce our environmental footprint, and continue to supply the energy that fuels the world. That won’t change with a shift in administration.

Depending on the outcome, we could see increased incentives, R&D funding through the Department of Energy and related policy to support one form of energy over another, but it’s irrefutable that oil and natural gas will continue to play a dominant role in meeting growing energy demand. Policy and any federal-oriented funding should reflect that reality.

To be clear, the Texas oil and natural gas industry is not asking for more incentives at the federal level. We are asking for a level playing field that does not pick winners and losers to the detriment of American consumers.

SM: The shale revolution brought about an energy reality previously unfathomable to energy economists and experts across the globe. That revolution reflected the ingenuity, expertise and intellect of the oil and gas industry, which has a proven record for solving problems. Any new administration will best benefit our country by listening to oil and gas industry leaders and partnering with them as problem-solving experts who can nurture the next innovations that will facilitate our nation meeting its challenges. Top-down mandates built on assumptions untethered from practical realities will fail to achieve our shared goal for reliable, affordable and sustainable energy.

DP: It feels like the election is a relatively small influence on innovation and technological advances in the oil and gas portion of the energy sector. Industry profitability is solid, which allows companies to invest in R&D and technology that brings down costs and boosts productivity. Profitability, not the president, will keep these advances moving ahead.

Turning to clean energy, the election could meaningfully impact the pace of technology development and rollout. If the loans, grants, tax credits and subsidies associated with the IRA are halted or reversed, technology-dependent clean energy will take a hit.

DD: What should top the priorities of those officials who take the oath of office in January?

RB: The top priority of the next administration should be to unleash American natural gas and oil. We have seen firsthand the growth and positive change that comes directly to communities when our members invest in the people and infrastructure it takes to grow our industry.

MC: In my opinion, the U.S. needs to maximize oil and gas production, for economic and national security reasons. We also need to lead the way in terms of carbon capture, geothermal, hydrogen and supplying the world with LNG. These imperatives complement each other, and it has been good for the general public to see this. Irrational critiques of the oil and gas industry need to stop, and this goes a long way.

RK: Affordable, abundant energy from all sources—an “all of the above” approach that relies on market solutions and avoids perverse incentives. Oil, gas, nuclear, wind, solar, batteries, coal, biofuels. All of it. If a company produces affordable energy profitably in a way that balances the needs of society, then it deserves a seat at the table.

EL: Producers in the Lone Star State look to state and federal officials for common-sense legislation, like the Energy Permitting Reform Act, that supports responsible production and meeting energy demand. Over the last 12 years, natural gas demand has increased 45% within the United States, yet pipeline capacity has only expanded 28% in that same time period. The industry is dedicated to helping meet this demand, and we urge lawmakers to do their part in ensuring the industry has the critical infrastructure to deliver energy when and where it’s needed.

SM: From midstream’s perspective, the top priority should be designing energy policy that reflects the need to facilitate a diversity of energy sources to satisfy increasing energy demand. We take for granted the growing quantity of energy required to maintain the lifestyle we enjoy in this country today. Government policies should reflect the challenges faced in all sectors of the energy industry when setting goals and targets. Policies should reflect an understanding of the practical realities affecting the delivery of reliable, affordable and sustainable energy.

DP: Top energy priorities should be making sure the U.S. oil and gas industry maintains its status as the world’s biggest energy producer. Domestic energy stability and “independence” gives the United States so much strategic flexibility. The U.S. is no longer beholden to foreign oil producers for oil or gasoline. This must be maintained. Another priority is to thread the needle on the cost/benefit of new energy technologies and renewables. Balancing fiscal responsibility and speed of decarbonization will move the U.S. forward without inefficient spending or unnecessary declines in standard of living.

SP: Securing the border, reforming welfare and other federal programs that are bankrupting the country, eliminate subsidies on energy and carbon projects that do not improve the quality of life for our citizens, and get out of the way of the business that is focused on providing energy of all forms to its citizens.

DD: How do you view the energy policies of Kamala Harris and Donald Trump? Whose leadership would advantage the oil and gas industry, including its ability to address growing local, national and global demand for energy?

RB: Energy in general and oil and gas specifically will continue to be debated during the remaining weeks of this election cycle and both candidates and their campaigns will refine their messages. Our hope is that both see the value that the industry brings to the country and the economy. American energy is vital to the growing global economy as well as the mission to reduce carbon emissions. Demand is expected to surge, and we can meet that growing need today and into the future.

MC: I believe a Trump administration will be more singularly focused on oil and gas than a Harris administration. But the broader focus of a Harris administration, i.e., an “all of the above” approach embracing new sources of energy and innovative technologies to manage carbon, need not be harmful to oil and gas interests. A Harris administration is not likely to feel anywhere near the pressure to vilify the oil and gas industry as the current president felt at the start of his term. If the oil industry continues to lead in such areas as carbon capture, geothermal, hydrogen and reducing methane emission, we may find an ally in Harris if she wins the presidency. That, in my opinion, should be the industry’s objective.

EL: Both Harris and Trump have acknowledged the importance of domestic energy production and are committed to not banning fracking. Trump has a strong record of supporting realistic regulation and providing opportunities for increased oil and gas production. The Biden-Harris administration has issued a long list of policies that are considered anti-oil and natural gas, like the pauses on LNG permits and leasing on federal lands that have created uncertainty for U.S. investment. Not to say elected officials can’t change course, but we generally know what to expect in both scenarios and will work with either administration to craft an energy platform that reflects our needs from an energy security, economic and environmental standpoint.

SM: The need for energy—at home and abroad—won’t change based on who’s in office. Regardless of the outcome in November, our task is to build bipartisan support for real-world solutions to our energy needs. That means working with lawmakers and regulators so we can build the infrastructure necessary for America to remain the world leader in producing clean, reliable and affordable energy.

Recommended Reading

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.