Hydraulic fracturing has always been associated with tremendous volumes of fracture fluid invading the formation matrix resulting in water blockage and reducing relative permeability to gas or oil. This has become more challenging in shale and tight formations, because capillary forces have profound impact on water retention and, hence, water recovery and subsequent oil productivity. Surfactants and microemulsions have been applied as flowback additives to lower surface and interfacial tension (IFT) to maximize water recovery.

Most of the current surfactants or microemulsion formulations were tested and validated based on a single or a few testing methods to validate for flowback use. In many cases, surface tension (ST) or IFT measurements were solely used to screen out or qualify a surfactant. The industry has not been precise on the specifications of these measurements or how they correlate to the flowback process. A packed column test with gas or oil often is adopted to simulate production and assess water recovery and hydrocarbon phase production. This method can resemble production from major fractures or gravel packing, but it will fail to mimic oil or gas production from the reservoir matrix where the water blockage occurs and critically impairs oil or gas flow.

Solvay developed a sustainable formulation to meet all specifications for a successful flowback additive, and it was qualified against other current products through a carefully designed coreflood testing method.

Key driving characteristics

Solvay has developed its flowback formulation utilizing environmentally friendly non-ionic, anionic and amphoteric surfactants. The final product, Plexflow 220, is an aqueous formulation that is 100% water-based, which makes it compatible with any type of fracturing fluid. The product is not a microemulsion, where stability can be a concern, yet it exceeds any requirement for the flowback key characteristics including ST, IFT and wettability alternation.

Although the industry standard for ST is about 30 millinewton per meter (mN/m), the new formulation shows 26 mN/m at a typical load of 1 gal to 2 gal per thousand (gpt) (0.1 wt% to 0.2 wt%) and maintains such value regardless of the level of water salinity with a critical micelle concentration between 0.1 gpt to 0.3 gpt (0.01 wt% to 0.03 wt%), depending on the water salinity.

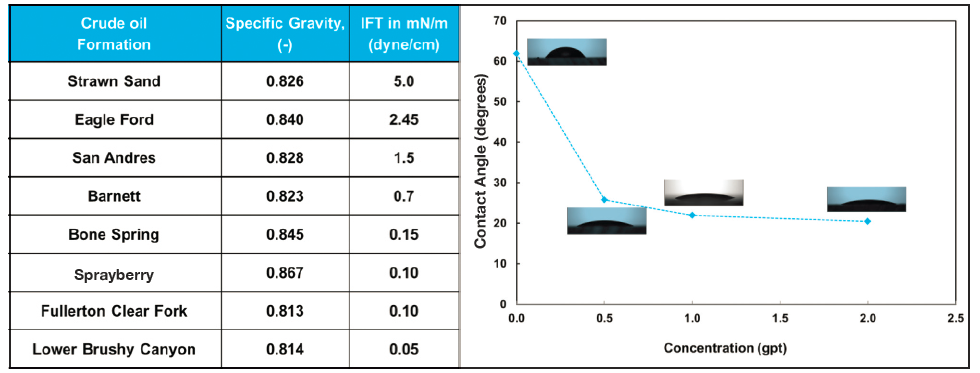

IFT measurements were conducted extensively in 0 ppm to 350,000 ppm total dissolved solids formation brine, 2% to 20% potassium choloride (KCl) and calcium chloride solutions. The hydrocarbon phase varied from simple alkanes and light distillate (Isopar-M) to actual crude oils from the Permian Basin, Eagle Ford, Strawn Sand, Central Texas and others. These measurements were taken at room temperature and up to 60 C (140 F) and also included full fracturing fluids with friction reducers, clay stabilizer and biocides. IFT was reduced significantly when Plexflow 220 was used and reached as low as 0.05 mN/m based on the crude oil type.

Wettability is best determined through contact angle measurements. A formulation that results in restoring the wettability to the original water-wet condition is desired to maximize oil-relative permeability. The low ST then enables pore pressure to overcome the capillary pressure and ease the water flow through the matrix. Solvay’s Plexflow 220 can significantly lower the contact angle and increase wettability. Polycarbonate substrate was used as a hydrophobic controlling surface, and the data show 25 degrees, 22 degrees and 20.5 degrees of 0.5 gpt, 1 gpt and 2 gpt of the new surfactant in 5% KCl. A summary of the IFT and contact angle measurements is illustrated in Figure 1.

FIGURE 1. The charts depict IFT of 2 gpt of Solvay’s Plexflow 220 flowback surfactant with various crude oils (left) and contact angles of 0.5 gpt, 1 gpt and 2 gpt of Plexflow 220 in 5% KCl at 20 minutes on polycarbonate substrate (right). (Source: Solvay)

Other desirable characteristics of flowback surfactants include good thermal stability, compatibility with various fracturing additives, high flash point and low foam or emulsion tendencies. Solvay’s Plexflow 220 flowback surfactant meets all of these criteria, and extensive laboratory testing showed the formulation has excellent emulsion-breaking capabilities and synergistically boosts friction reducer performance in terms of faster hydration time and enhanced final friction reduction.

Unique core flow testing

As mentioned previously, the vast majority of data for flowback surfactants are generated using packed column methods, which can investigate the effectiveness of flowback surfactants on enhancing the flow in relatively high-permeability zones such as main fractures and gravel packing. Simulating the flow from the reservoir matrix requires flowing through structures with much lower permeability. Although the few previous coreflood studies examined the flowback at constant flow rate, Solvay’s testing method used 0.23±0.03 md Kentucky sandstone cores saturated with brine/surfactant. Isopar-M was then injected following a constant-pressure schemes of 50 psi to 500 psi displacing the brine or the brine-surfactant phase. Samples from the effluent were collected over extended periods of time and the volume of each phase after separation was measured. Water recovery, water saturation, oil productivity and cumulative volume produced were all determined during each test. The impact of the variation in the initial permeability was minimized by normalizing the resulting Isopar-M flow rate in each case by the initial permeability of the corresponding core.

Conducting the study at constant-pressure injection allowed Solvay to compare the impact of capillary forces, represented by the IFT, versus the viscous forces on the flow of Isopar-M. At low pressures, such as 50 psi, a significant difference between the surfactant cases and the 5% KCl case was observed. That is because at this pressure, capillary force dominates and lowering the IFT is critical for the displacing efficiency. At higher pressure, viscous flow dominates and the effect of IFT is minimum. In fact, if the wettability is not restored to waterwet (or optimally non-wet), the surfactant case can even show lower Isopar flow rate.

The coreflood results confirmed this hypothesis and showed the benefit of using Solvay’s Plexflow 220 surfactant for flowback versus nonsurfactant cases at all pressure stages and more profoundly at low- to mid-pressure. At a 50-psi pressure difference, no oil was observed in the 9-hour nonsurfactant experiment, while Solvay surfactant resulted in Isopar-M breakthrough after 5 hours. Another product (benchmark 2) also resulted in early flow; however, the Isopar-M final stabilized flow was 50% less than what was observed in Solvay’s product case. At 100 psi, 250 psi and 500 psi, the oil productivity with Plexflow 220 surfactant was 63%, 16% and 22% higher than the base case, respectively.

Solvay’s testing method was applied to other industrial benchmark products, where all have shown less oil productivity than the Plexflow 220 product. A summary of the coreflood results for the different cases and the 5% KCl base case is shown in Figure 2.

FIGURE 2. The coreflood test results show normalized Isopar-M flow rate and water recovery as a function of stage pressure (top) and cumulative Isopar-M volume produced at 100 psi as a function of time (bottom). Solvay’s Plexflow 220 surfactant shows much higher Isopar-M flow rates than other products across pressures. (Source: Solvay)

Based on the results, a surfactant that combines low ST (less than 30 mN/m), low IFT (less than 1 mN/m) and a contact angle that reflects a good wettability, with no emulsion tendency will exhibit excellent potential as flowback additive. Solvay’s Plexflow 220 surfactant has fulfilled all these requirements in addition to being a sustainable, water-based solution, fully compatible with any fracture fluid.

Recommended Reading

Devon Energy’s John Krenicki to Retire from Board

2025-03-05 - Krenicki plans to focus on his full-time responsibilities as vice chairman at private equity firm CD&R, Devon Energy said

Chord Announces $750MM Notes Offering to Reduce Debt

2025-03-05 - Chord Energy said it will use part of the funds to reduce its credit facility borrowings. The company is also looking to sell its Marcellus non-operated gas interests.

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

Elliott Nominates 7 Directors for Phillips 66 Board in Big Push for Restructuring

2025-03-04 - Elliott Investment Management, which has taken a $2.5 billion stake in Phillips 66, said the nominated directors will bolster accountability and improve oversight of Phillips’ management initiatives.

Shell Shakes Up Leadership with Upstream and Gas Director to Exit

2025-03-04 - Zoë Yujnovich, Shell’s Integrated Gas and Upstream director, will step down effective March 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.