Enterprise Products Partners announced its pending acquisition of Delaware Basin-based Piñon Midstream on Aug. 21 in a $950 million, cash-only deal. (Source: Shutterstock)

Enterprise Products Partners announced its pending acquisition of Delaware Basin-based Piñon Midstream on Aug. 21 in a $950 million, cash-only deal.

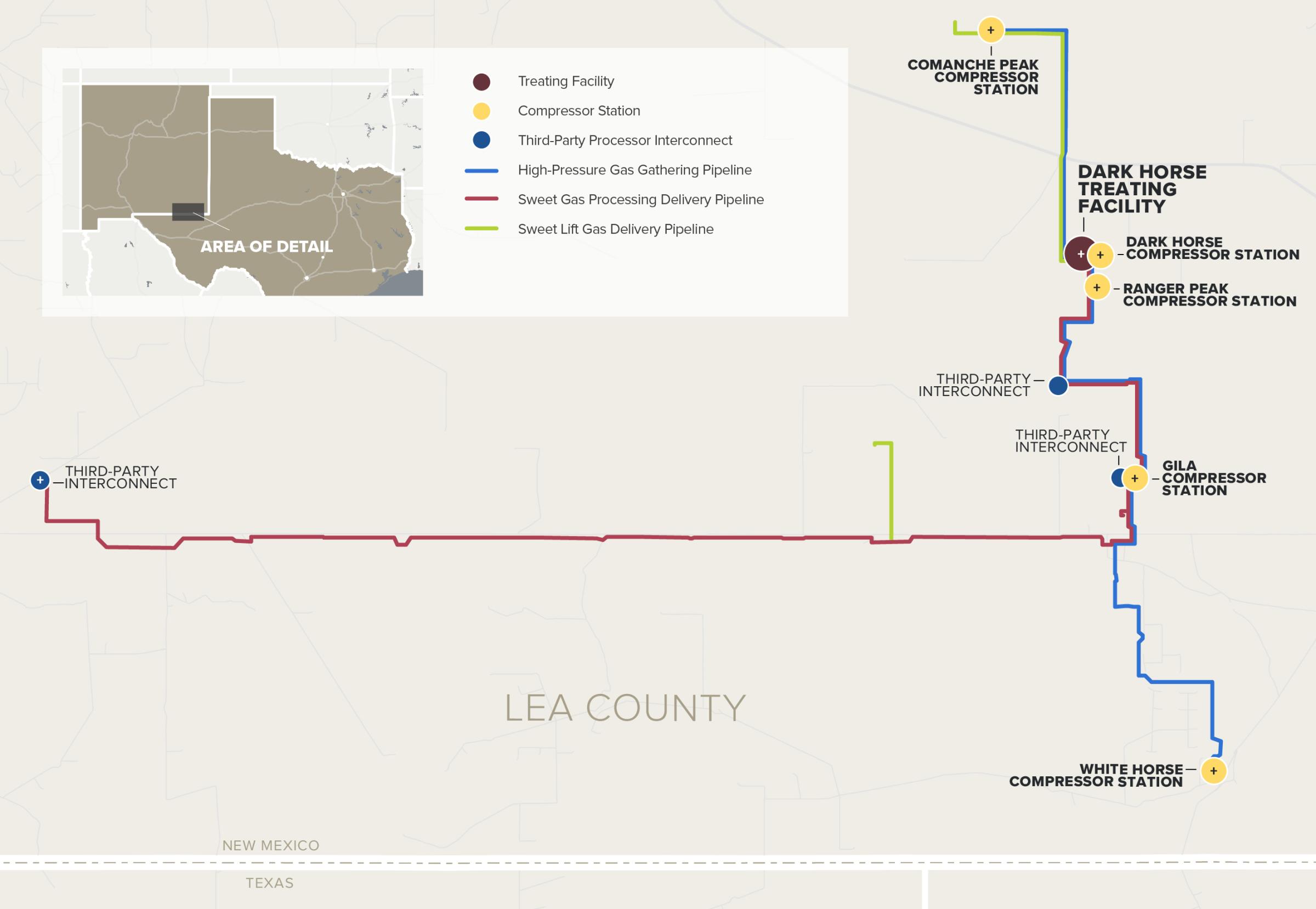

With the acquisition, Enterprise gains control of a developing regional player in gas processing and sour gas disposal. In the announcement of the deal, Enterprise called Piñon’s assets “highly complementary” to its midstream system, expanding the company’s natural gas processing footprint with an entry point into the eastern flank of the Delaware.

“We believe the Piñon management team has developed the premier sour natural gas treating system in the Delaware Basin,” said Jim Teague, co-CEO of Enterprise’s general partner. “These assets accelerate our entry into this region by at least three or four years.”

Both companies are based in Houston.

Piñon has been in a cycle of development, and the company’s assets have drawn interest from other companies. In June, oil producer Matador Resources bought a 19% stake in the company as part of an overall $1.9 billion acquisition of Delaware assets from portfolio company EnCap Investments.

The same month, Piñon announced the Environmental Protection Agency had approved plans to permanently store CO2 in acid gas injection (AGI) wells at the company’s primary facility in New Mexico. The approval satisfies a major requirement for 45Q tax credit eligibility, according to the Enterprise announcement.

Piñon’s AGI system is the largest in the state and injects gas about 18,000 ft below the surface. The two gas wells are permitted for a total of 20 MMcf/d of CO2 and hydrogen sulfide injection.

Enterprise said it was evaluating a third injection well as part of the acquisition.

The company’s assets also include about 50 miles of natural gas gathering and redelivery pipelines, five 3-stage compressor stations, 270 MMcf/d of hydrogen sulfide and CO2 treating facilities.

Piñon is supported by fee-based contracts with long-term acreage dedications, including minimum volume commitments.

Teague said the acquisition would generate distributable cash flow accretion of $0.03 per unit in 2025.

The companies expect the acquisition to be finalized by the end of 2024. Black Bay Energy Capital was a partner for Piñon during the process, according to the announcement.

Piñon Midstream retained Piper Sandler & Co. as its financial adviser and Kirkland & Ellis LLP as its legal advisor, while Locke Lord LLP and Sidley Austin LLP served as legal advisers to Enterprise during the process.

Recommended Reading

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

CNOOC Starts Production at Two Offshore Projects

2025-03-17 - The Caofeidian 6-4 Oilfield and Wenchang 19-1 Oilfield Phase II projects by CNOOC Ltd. are expected to produce more than 20,000 bbl/d of crude combined.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.