EOG Resources spud the well June 25 in Burns Ranch with rights to the Pearsall well about 4,000 ft below the Eagle Ford, according to myriad sources. (Source: Shutterstock.com)

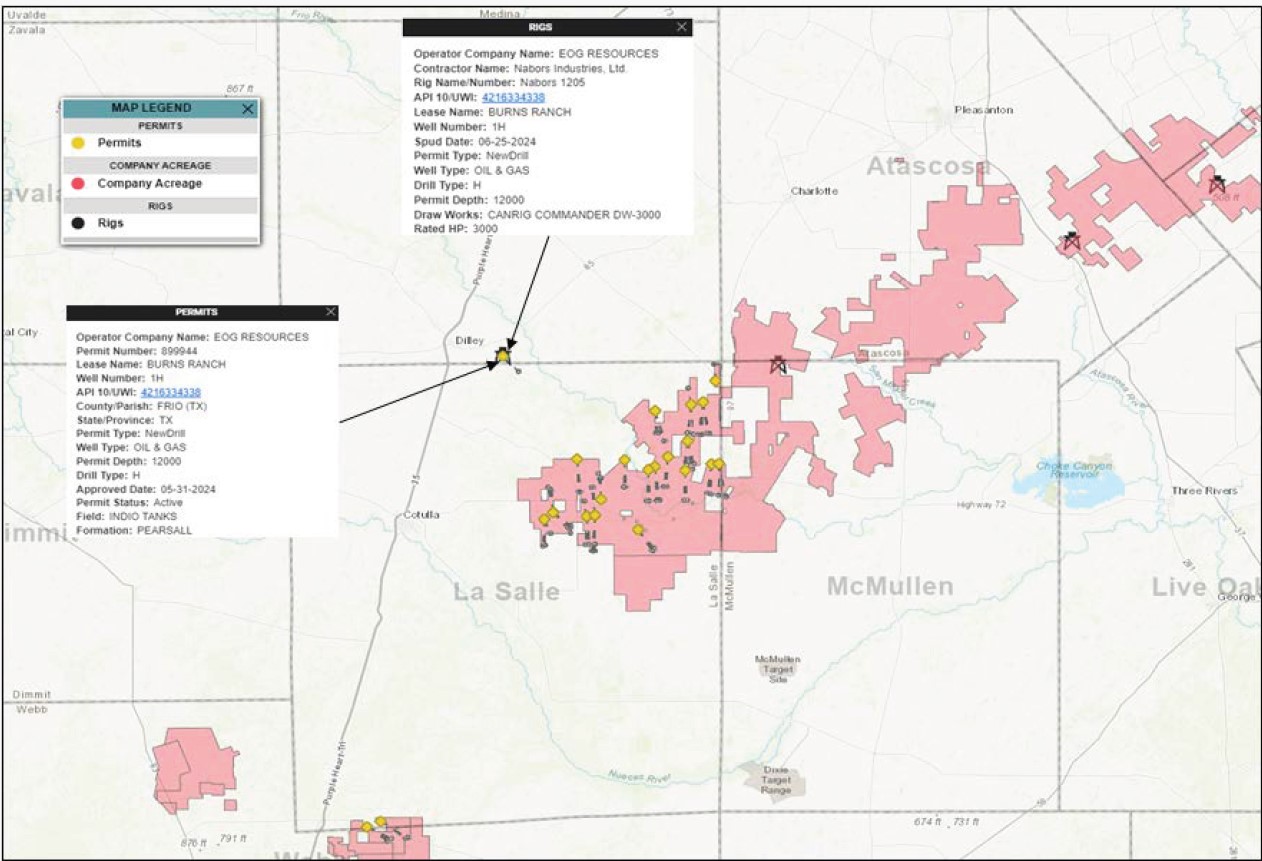

EOG Resources has a Nabors Industries rig drilling a wildcat Pearsall well in Burns Ranch’s Indio Tanks Field in southern Frio County, Texas, in a half-county stepout from its Eagle Ford Shale development east of there.

EOG received the permit on May 31 and Nabors rig #1205 spud the two-section wildcat on June 25, according to Texas Railroad Commission (RRC) files and J.P. Morgan Securities analyst Arun Jayaram.

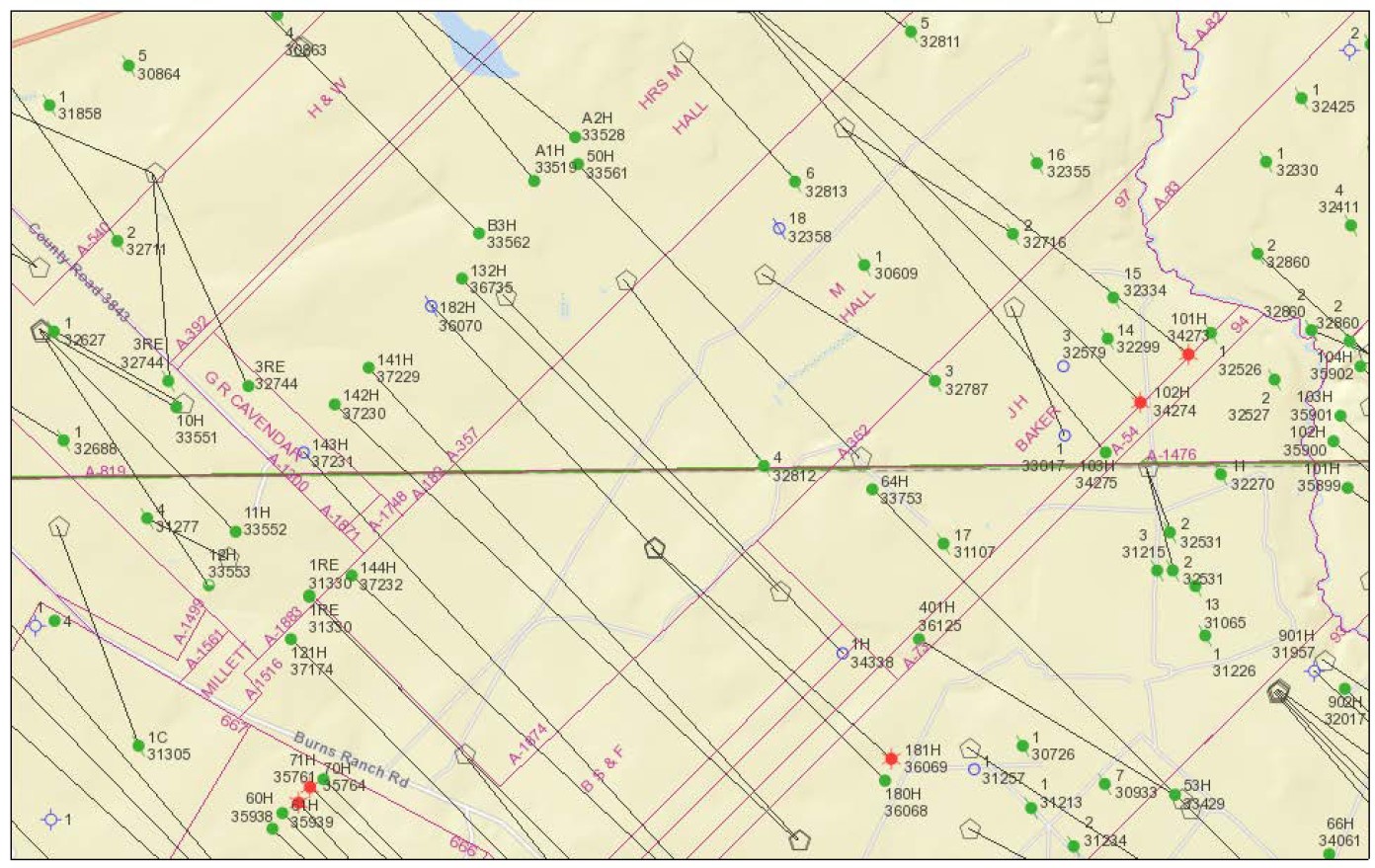

The well, Burns Ranch #1H, about six miles east of Dilley, Texas, has a permitted depth of up to 12,000 ft. The Early Cretaceous system’s Pearsall underlies the Late Cretaceous’ Eagle Ford.

EOG’s lease has Pearsall rights where Texas American Resources, the leading operator in the area, doesn’t, said Troy Gieselman, Texas American’s senior vice president, land.

Texas American has 9,000 acres with Pearsall rights adjacent to the EOG leasehold. “So we’re hoping they make a great well,” Gieselman told Hart Energy.

Overlying the EOG leasehold, Texas American has rights to the base of the Buda Formation immediately under the Eagle Ford.

EOG’s next-nearest rig drilling in South Texas is about 30 miles east of the Burns Ranch #1H wildcat, according to J.P. Morgan, citing Enverus data. Its next-nearest permit is about 20 miles east.

While the EOG wellhead is in Frio County, the lateral’s terminus is in La Salle County, Texas, according to RRC files.

EOG did not respond to a request for comment by press time.

Alongside it is a Texas American horizontal, Burns Ranch T #132H, that is landed in the Briscoe Ranch-Eagle Ford Field at some 7,300 ft. It travels opposite of the EOG well, kicking off in La Salle and coming to a toe in Frio.

Texas American brought that two-section well online in December of 2018. It’s made 818,467 bbl of oil through April, the most recent month for which production data was available from the RRC.

Another nearby Texas American well, the 1.5-section Burns Ranch #180H, is producing from the Eagleville (Eagle Ford-1) Field at 7,900 ft. Brought online by Carrizo Oil & Gas in October of 2016 and bought by Texas American from Callon Petroleum in November of 2021, it has produced 1.7 MMbbl of oil through April.

J.P. Morgan’s Jayaram described the Pearsall wildcat as “intriguing.”

EOG ‘stealth play’

EOG has acknowledged in public comments it has a “stealth play” underway but has not identified it yet. Industry members have suggested it is referring to its wildcatting in southern Dawson County in the northern Midland Basin.

First Reserve Corp.-backed Texas American is the primary operator in the Frio-La Salle area. The 34-year-old company, led by David Honeycutt, president and CEO, sold its first iteration of Texas American, which produced in Frio and Atascosa counties, to Venado Oil & Gas in 2018.

Jayaram reported in a research report earlier this month, “We have not observed a lot of activity in Frio County by the industry over the past two years, with Enverus data indicating only 67 horizontal completions by all operators in the county since 2022.”

Only six permits have been issued for wells in Frio County this year, according to RRC data. Operators, in addition to EOG pulling a permit in the county recently, are Blackbrush Oil & Gas and Crescent Energy (operating as Javelin Energy Partners).

Meanwhile, operators have taken 150 permits so far this year for wells in La Salle County, including by Crescent Energy (operating as El Paso E&P), Repsol Oil & Gas USA and Lewis Energy Group.

Recommended Reading

Valeura Boosts Production, Finds New Targets in Gulf of Thailand

2025-03-03 - Valeura Energy Inc. has boosted production after drilling three development wells and two appraisal wells in the Gulf of Thailand.

Judgment Call: Ranking the Haynesville Shale’s Top E&P Producers

2025-03-03 - Companies such as Comstock Resources and Expand Energy topped rankings, based on the greatest productivity per lateral foot and other metrics— and depending on who did the scoring.

Baker Hughes, Frontier Form CCS, Powergen Partnership

2025-03-03 - Baker Hughes will provide technology solutions to support the Sweetwater Carbon Storage Hub being developed by Frontier Infrastructure in Wyoming.

US Drillers Add Oil, Gas Rigs for Fifth Week in a Row

2025-02-28 - The oil and gas rig count rose by one to 593 in the week to February 28, its highest since June.

BKV Positions Itself to Meet Growing Power, CCS Demand

2025-02-26 - Electricity needs across the U.S. are expected to soar as industrial and manufacturing facilities, data centers and other consumers crave more power. BKV is exploring ways to bridge the gap between demand and energy supply.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.