(Source: NicoElNino/Shutterstock.com)

Presented by:

Editor's note: This article originally appeared in the March issue of E&P Plus.

Subscribe to the digital publication here.

Amid the fallout from the COVID-19 pandemic, oil and gas companies have been forced to confront a crash in energy prices, as some industries reduced production and transportation activity collapsed. Nearly three-fourths of energy executives in the EY Realizing Strategy Survey indicated that COVID-19 will impact or even cause them to pivot their organizations’ medium- to long-term strategy.

While this crisis will hopefully be resolved in the short term, it is a prelude to a more gradual long-term reality for the sector, with a focus on decarbonization and its implications for demand. Companies continue to focus on managing cash flow, driving resilience and cutting costs to get through this period of turbulence—strategies that are useful and sustainable to survive the tumult of today but not necessarily the world of tomorrow. The energy transition to a low-carbon future has many paths, with a range of outcomes in both magnitude and timing, as examined in the EY Fueling the Future analysis.

For at least the next four years, President Joe Biden’s administration will likely reorient U.S. regulatory priorities around reducing carbon emissions, aligning them more with the norm in Europe and the Paris Agreement.

Regulations and subsidies also will influence the electric vehicle (EV) market. EVs could achieve price parity with their gasoline-fueled counterparts within the next five years, per the EY Countdown Clock, and renewables could become the world’s largest source of electric power within the same time frame.

With increased focus on climate risk and ESG issues, investors may stay on the sidelines rather than put more money in capital-intensive supply-side projects. Furthermore, the stakeholders that energy executives are beholden to are changing. A recent EY survey showed 70% of energy executives believe environmental and social-issue stakeholders to be more than or as important as shareholders (Figure 1).

Clearly, decarbonization is no longer just noise from environmental activists. To address these challenges, oil and gas executives should consider the following five questions.

FIGURE 1.

What outcomes does your company want to achieve?

What is the business’s primary need, beyond continued growth and relevance in a changing environment? Investor appetite? Social license to operate? A stronger brand with customers or consumers? Regulatory compliance and risk mitigation? All are likely factors, but how a company prioritizes depends on its purpose and place in the energy value chain.

The energy company of the future is likely to look very different than it does today. The intended outcomes should ultimately serve as the foundation for a long-term strategy and be focused on business fundamentals such as cash flow or balance sheet strength. There should be a clear link between ESG priorities, in particular decarbonization, and how they will drive the company forward.

What is your carbon exposure now and in the future?

A company’s carbon footprint is composed of both direct and indirect emissions and can vary from one company to another. Making estimates requires looking at a company’s entire operations: location, amount of acreage, efficiency, greenhouse-gas (GHG) intensity and other factors. Understanding the full dimensions of risk is necessary to mitigate them, and they’re different across markets and subsegments of the industry.

With intensity-related targets, a company should explore efficiencies such as how to capture more dry gas coming off the wellhead rather than burning it off or using less diesel and process fuel in production. Some companies can use this exercise to strategize on broader changes: an integrated company may seek to balance carbon across its portfolio through a mixture of renewables, natural gas and crude, for example, in ways that other players in the ecosystem cannot.

With intensity-related targets, a company should explore efficiencies such as how to capture more dry gas coming off the wellhead rather than burning it off or using less diesel and process fuel in production. Some companies can use this exercise to strategize on broader changes: an integrated company may seek to balance carbon across its portfolio through a mixture of renewables, natural gas and crude, for example, in ways that other players in the ecosystem cannot.

The shifting political landscape in the U.S. creates another potential area of exposure to scrutinize: new regulatory and tax burdens on fossil fuels may be implemented alongside new incentives and subsidies for renewable energy. It remains to be seen if the carbon capture, utilization and storage (CCUS) tax credit, 45Q, remains a viable mechanism for the incoming administration. This will allow oil and gas companies to create partnerships with power generators and other technology startups (such as direct air capture) to develop operating models for injection or utilization of CO2 that are economic at scale.

Although it poses challenges, decarbonization shouldn’t be seen as an existential crisis for the oil and gas sector.

What type of emissions commitment should be set and at what future dates?

To address pressure from governments and investors on ESG and the long-term planning for the sector, companies should explore de-risking portfolio allocations and what targets make the most sense to build credibility in the market—whether they are absolute or intensity-based (normalized) or both. Most companies have reduction targets for scope 1 (emissions from owned assets) and scope 2 (emissions from purchased energy). Reducing scope 3 emissions, stemming from the use of a business’s products, provide the biggest challenge for the sector. Very few upstream players, for example, have set scope 3 targets, while several supermajors have, particularly those based in Europe.

Regardless, executives should measure their company’s emissions and determine how to follow through and disclose on GHG intensity-related or absolute targets. Intensity-related targets are focused on efficiencies, to limit the emissions from each barrel of oil to the extent possible with smooth operations. Absolute reduction targets for emissions lead to a drop in production, which for some players—particularly in upstream—do not make economic sense without a drastic rethinking of strategy and diversification.

What will be needed from the perspectives of data, funding and governance?

ESG has evolved to become a strategic business imperative as investor expectations of ESG disclosures and communication have grown. Most investors (98%) evaluate nonfinancial performance based on corporate disclosures, with 72% saying they conduct a structured, methodical evaluation, according to the EY Climate Change and Sustainability Services survey of 298 institutional investors globally.

Executives need to consider their internal controls and technology needs around data collection and reporting of sustainable information. Additionally, executives should consider how cost of capital metrics could increase as a result of either limited reporting or lack of planning around carbon intensity, as some capital providers lower their allocations to carbon-heavy projects. Understanding how investors are evaluating ESG performance will be critical for accessing capital moving forward.

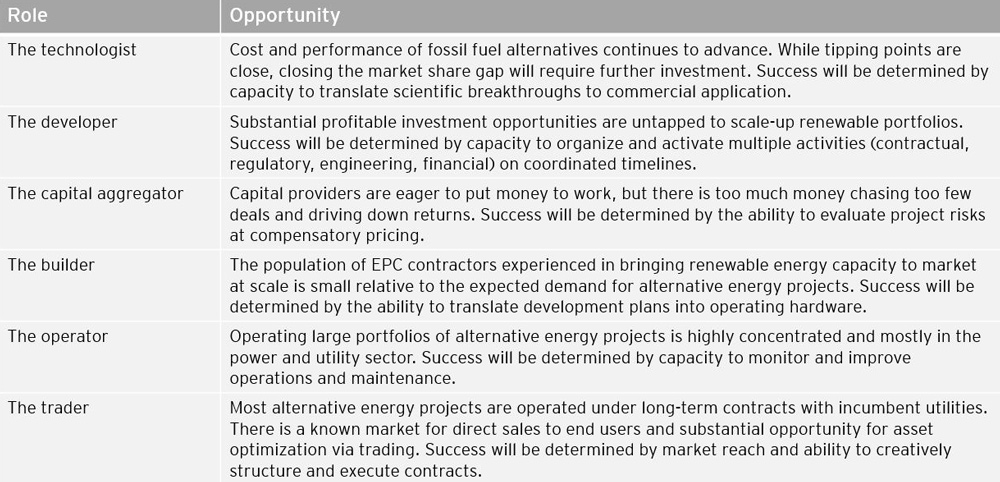

What’s our opportunity in the alternative energy value chain?

Forward-thinking companies can position themselves to capitalize on new possibilities in efficiency, decarbonization solutions (e.g., CCUS), hydrogen and biofuels. There are reasons to expect that the economic equations for some energy solutions will continue to grow more favorable. Hydrogen, for instance, will take time for new advances to create scale and bring costs in line with current fuel sources. With investment in innovation, hydrogen’s potential is very favorable as it can be delivered using existing infrastructure.

Midstream or downstream players have the flexibility to transmit natural gas or hydrogen (with some considerations); refineries also can go heavy into biofuels or retrofit processes for hydrogen. While gray or brown hydrogen isn’t produced in a carbon-neutral manner, refineries can produce more environmentally friendly blue hydrogen with natural gas and by using carbon capture and storage.

While the energy transition and decarbonization has momentum, oil clearly isn’t going away: Asia, Africa and Latin America will continue to drive demand, presenting companies a balance of different opportunities in the short and long terms. Companies are creating optionality through maintaining a core focus on oil and gas, with focus on low cost of supply and low GHG intensity, while investing a threshold amount in new alternative energy businesses (Figure 2).

Although it poses challenges, decarbonization shouldn’t be seen as an existential crisis for the oil and gas sector. The world may be changing, but it will always need energy, and forward-thinking companies will be positioned to deliver it. Gaining an advantage tomorrow means plotting the way forward today.

FIGURE 2.

Editor’s note: The views expressed are those of the authors and do not necessarily reflect the views of Ernst & Young LLP or any other member firm of the global EY organization.

This story was originally published on March 19.

RELATED: Check out March E&P Plus' Tech Trends section, which showcases new technologies focused on reducing the carbon footprint.

Recommended Reading

EIA Reports NatGas Rig Count Fall-Off in ’23, ’24

2025-03-04 - The U.S. Energy Information Administration’s report of a falling natural gas rig count backs up statements from producers in the Appalachian and Haynesville basins.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

ADNOC, OMV to Merge Petrochemical Firms to Create $60B Giant

2025-03-04 - The merged entity, Borouge Group International, is set to be the fourth largest polyolefins firm by production capacity, behind China's Sinopec and CNPC, and U.S.-based Exxon Mobil, ADNOC Downstream CEO Khaled Salmeen told Reuters.

Expand’s Dell’Osso: US LNG Facilities May Fall Below Capacity in ‘26

2025-03-04 - CEO Nick Dell’Osso said Expand Energy wants to time drilling and completion spending and grow gas output to meet a flush LNG market.

Evolution Buys Non-Op Assets in New Mexico, Texas, Louisiana

2025-03-04 - Evolution Petroleum said the acquisition adds 254 gross producing wells across three states and includes 440 boe/d of net production.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.