(Source: Larry Prado, Hart Energy)

Presented by:

Editor's note: The full version of this article originally appeared in the February issue of E&P Plus.

Subscribe to the digital publication here.

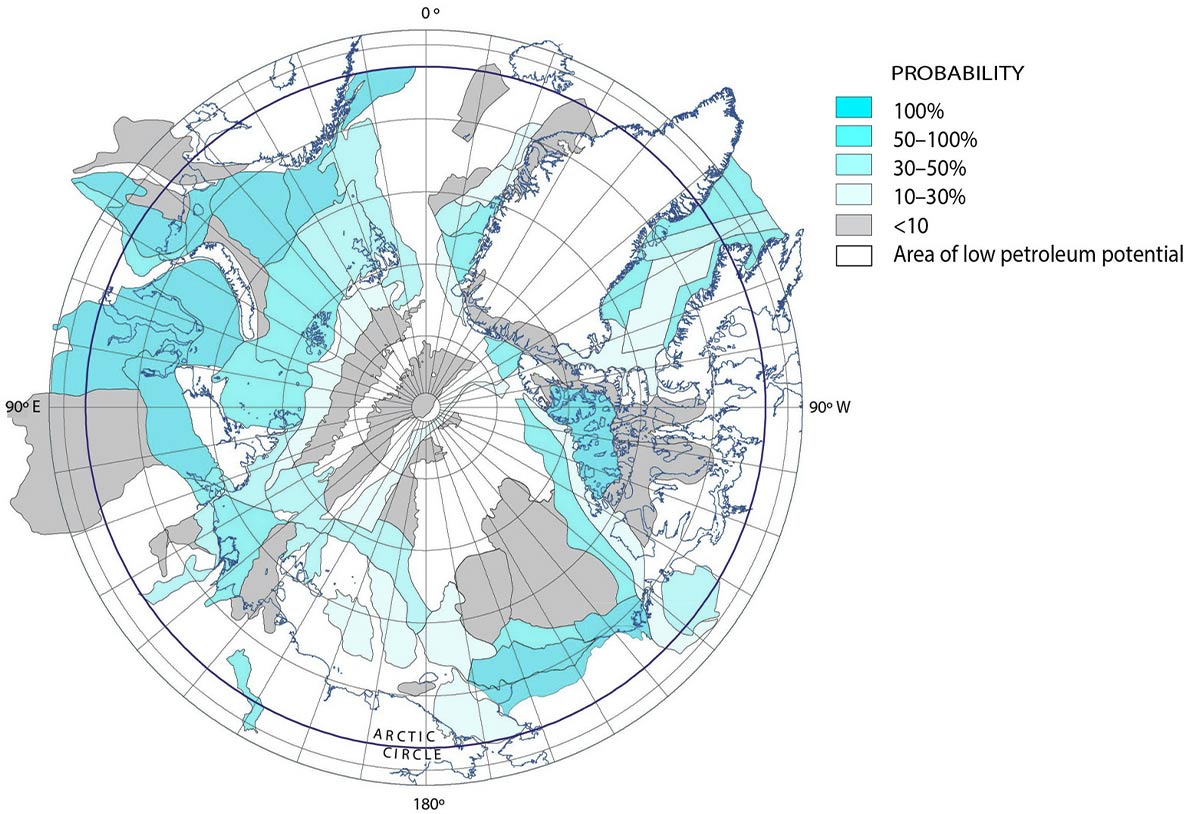

According to the U.S. Energy Information Administration (EIA), the Arctic could hold about 22% of the world’s undiscovered conventional oil and natural gas resources.

The area above the Arctic Circle encompasses about 6% of the Earth’s surface area. While the Arctic is about the size of the African continent, most of the resource area is oceanic. About 33% of the Arctic is occupied by land. Another 33% of the Arctic consists of offshore continental shelves located in less than 500 m of Arctic Ocean water. The remaining 33% of the Arctic is in Arctic Ocean waters deeper than 500 m.

The 2008 U.S. Geological Survey Arctic assessment estimated a total oil and gas resource of 412 Bboe, with 78% of those resources expected to be gas and NGL. The composition of undiscovered Arctic hydrocarbons is largely determined by the West Siberian Basin and East Barents Basin, which hold 47% of the undiscovered Arctic resources, with 94% of those resources being gas and NGL.

Jurisdictionally, the Arctic contains portions of eight countries: Canada, Denmark (Greenland), Finland, Iceland, Norway, Sweden, the U.S. and Russia. Finland and Sweden do not border the Arctic Ocean and are the only Arctic countries without jurisdictional claims in the Arctic Ocean and adjacent seas.

Large oil and gas fields (500 MMboe or more of recoverable oil and gas) are crucial to future oil and gas development—the cost of developing oil and gas fields in the Arctic is so high that large fields are initially necessary to pay for the infrastructure required to later develop the smaller oil and gas deposits. Costs are unusually high because of the extraordinarily harsh environment, long supply lines and limited civilized inhabitation.

For example, the Prudhoe Bay Field with 13.6 Bbbl of recoverable oil made the construction of the Alyeska Oil Pipeline commercially viable. Without Prudhoe Bay Field, it is likely that the smaller Alaska North Slope oil prospects, such as Pikka, Icewine, Alpine and others, would not have been developed.

In addition, ConocoPhillips has made significant discoveries at its Willow, Harpoon and Narwhal prospects as well as other finds in Caelus Energy’s Smith Bay, Repsol/Armstrong Energy’s Horseshoe discovery and Pantheon Resources’ Talitha project and Alkaid prospect.

Large Arctic oil and natural gas discoveries began in Russia (1962) and in the U.S with the Alaska’s Prudhoe Bay (1967). Approximately 61 large oil and natural gas fields have been discovered within the Arctic Circle in Russia, Alaska, Canada’s Northwest Territories and Norway. Fifteen of these 61 large Arctic fields have not yet gone into production; 11 are in Canada’s Northwest Territories, two in Russia and two in Arctic Alaska.

Of the 61 large Arctic fields, 43 are in Russia and 35 (33 gas and two oil) are located in the West Siberian Basin. Of the eight remaining large Russian fields, five are in the Timan-Pechora Basin, two are in the South Barents Basin and one is in the Ludlov Saddle.

US

Shell Oil announced plans in 2020 to resume offshore Alaska oil and gas exploration at its West Harrison Bay license in the Beaufort Sea just offshore from the National Petroleum Reserve. The company is looking for partners to explore the 86,400 acres in its 18 leases.

In its five-year plan, Shell plans to conduct seismic studies to update geological data and finalize well and reservoir design in 2021-22 and expand exploratory drilling in 2023-24. The prospect area sits atop the popular and shallow Nanushuk, one of the most promising formations on the western part of the North Slope.

The Trump administration recently announced plans to open the Arctic National Wildlife Refuge (ANWR). Previous efforts by various U.S. administrations to open ANWR for oil exploration have resulted in legal battles, and it is expected to be challenged again in the courts by a coalition of environmental groups and Alaska Natives.

ANWR is the U.S.’s largest wildlife refuge and home to a large variety of species of plants and animals, such as polar bears, grizzly bears, black bears, moose, caribou and wolves.

Russia

Russia’s Rosneft announced the discovery of a new oil and gas field, Novoogennoye, on the border of the Krasnoyarsk Territory and Yamal-Nenets autonomous region, and it is estimated to have 146 MMbbl of oil and 1 Bcf of gas.

Rosneft recently reported the discovery of large gas reserves in two locations in the Kara Sea that are estimated to contain approximately 45 Tcf of gas in the two new reservoirs.

This 1983 drilling rig operation took place near Alaska’s Colville River Delta. (Source: Larry Prado, Hart Energy)

Russia is pushing for greater development of the risky Arctic ventures despite western sanctions placed against the country for its invasion of Ukraine and Crimea. Earlier in 2020, Russian President Putin approved tax exemptions to stimulate Arctic upstream oil and gas development.

In June 2020, approximately 5 MMgal of diesel fuel spilled from a power plant storage tank near Norilsk in Siberia onto a road and into the Ambarnaya River. President Putin declared a state of emergency and ordered lawmakers to strengthen environmental legislation. The accident is the second largest in modern Russian history in terms of volume and was only exceeded by a crude oil spill in the northwestern region of Komi that took place over several months in 1994.

Norway

Norway planned to open nine frontier areas in its latest licensing round to expand exploration in the Arctic. Norway’s Ministry of Petroleum and Energy and the Petroleum Directorate offered 136 blocks in eight regions of the Arctic Barents Sea and one in the Norwegian Sea. Environmental groups immediately filed a suit against the licensing, and it will be heard before the country’s Supreme Court. The lawsuit also accuses the government of failing to keep its pledges to slash greenhouse-gas emissions under the 2015 Paris climate agreement.

Canada, Greenland

The exploration outlook is less optimistic for Canada and Greenland, where a mixture of very high costs, reluctance to use public funds and particularly harsh conditions will prevent a significant buildup. Canadian policymakers have long considered improving port and other transport infrastructure in their Arctic territories, but high costs have thus far hampered their efforts and restrained government spending is expected to continue limiting infrastructure buildup in Canada.

Financial challenges

During the past year, a number of major banks announced that they would not finance major Arctic development projects, including the largest financier of Arctic oil and gas, JP Morgan. Four of the six largest banks in the U.S.—Wells Fargo, Chase Bank, Citi Bank and Goldman Sachs—updated their lending policies to exclude financing for new Arctic drilling.

Canada’s Toronto-Dominion Bank said it will not provide project-specific financial services for oil- and gas-related activities in the Arctic Circle as part of its plan to get to net-zero emissions by 2050, joining a host of global lenders in taking similar action.

A statement from the bank noted, “The Arctic Circle is warming significantly faster than the rest of our planet, which poses the risk of increased greenhouse-gas releases and further warming.”

Deutsche Bank said it will no longer finance any new projects in the Arctic region or oil sands projects. By the end of 2020, the bank intended to review all of its existing business activities in Europe and the U.S. with regard to clients’ diversification plans in coal power and end coal mining support by 2025.

Recommended Reading

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

Slant Energy Secures Capital Commitment from Pearl Energy Investments

2025-02-25 - Newly formed Slant Energy III LLC has secured an equity commitment from Dallas-based private equity firm Pearl Energy Investments.

Pearl Backs Haynesville Mineral and Royalties Firm Wild Basin

2025-03-10 - Equity commitments from Pearl Energy Investments and others have put $75 million of backing behind Haynesville Shale minerals and royalties company Wild Basin Energy.

Spartan Delta Ups Bought Deal Financing to $59MM

2025-01-14 - Underwriters have agreed to purchase approximately 22.2 million of Spartan Delta Corp. common shares, for resale to the public, at CA$3.82 per share (US$2.66), the company said.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.