Blackstone Credit & Insurance entered a joint venture with EQT Corp. to take a non-controlling interest in the Mountain Valley Pipeline and other infrastructure from the Equitrans transactions for $3.5 billion.

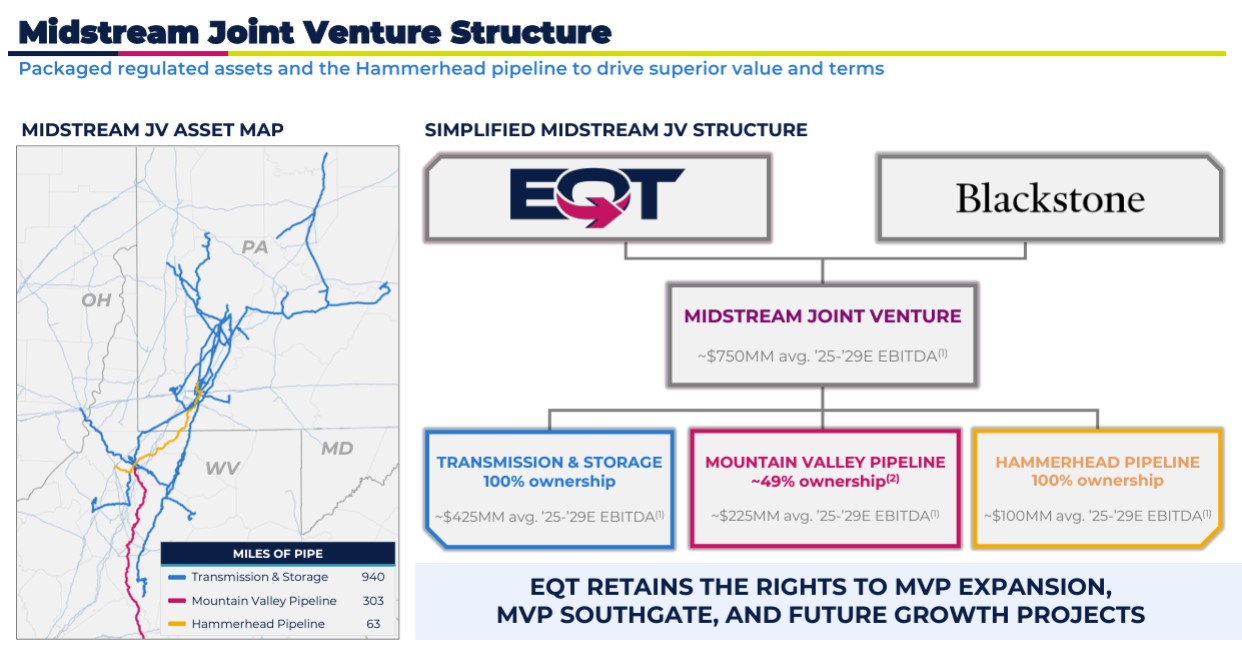

EQT Corp. and Blackstone Credit & Insurance will form a new midstream joint venture in which Blackstone will take a non-controlling interest in EQT's Mountain Valley Pipeline (MVP), transmission and storage assets and the Hammerhead Pipeline. Blackstone will provide cash consideration of $3.5 billion for the interests.

EQT said Nov. 25 the company entered into a definitive JV agreement with Blackstone. EQT said the investment implies a total JV valuation of approximately $8.8 billion, or 12x EBITDA. EQT said the JV valuation was derived by dividing projected 2025-2029 average JV free cash flow by target return. The EBITDA multiple was derived by dividing JV valuation by projected 2025-2029 average JV EBITDA.

The Hammerhead Pipeline is a 1.6 Bcf/d gathering header pipeline primarily designed to connect natural gas produced in Pennsylvania and West Virginia to MVP, Texas Eastern Transmission and Eastern Gas Transmission.

The JV provides EQT with a large-scale equity capital solution at an accretive cost of capital, the E&P said. Additionally, EQT will retain the rights to growth projects associated with the assets contributed to the JV, including the planned Mountain Valley Pipeline expansion and the MVP Southgate project.

EQT said it will use proceeds from the transaction to pay down its term loan and revolving credit facility and redeem and tender for senior notes. Pro forma for the transaction, along with the E&P’s recent divesture of its remaining non-operated assets in northeast Pennsylvania, EQT expects to exit 2024 with approximately $9 billion of net debt.

RELATED

Blackstone in Talks to Buy US Pipeline Stakes from EQT for $3.5B, Sources Say

EQT President and CEO Toby Z. Rice said the transaction underscores the “ultra-high-quality nature of EQT's regulated midstream assets, which service one of the strongest power demand growth regions in the United States underpinned by long-term contracts with the region's leading utilities.”

“Importantly, through this joint venture EQT preserves the benefits of the Equitrans acquisition by retaining the long-term value from synergy capture and growth projects. We look forward to working with Blackstone to optimize the value of these assets and together explore strategic opportunities across its leading portfolio of energy, power and digital infrastructure in the years ahead."

EQT Chief Financial Officer Jeremy Knop said Blackstone is a leader in providing capital solutions to large corporations the transaction offers a “tailor-made equity financing solution at a price significantly below EQT's equity cost of capital while preserving key tax attributes.”

“When we announced the Equitrans acquisition earlier this year, we made an unwavering commitment to debt reduction. We have now delivered on that promise, with announced divestitures to date totaling $5.25 billion of projected cash proceeds, above the high-end of our $3-$5 billion asset sale target, and several quarters ahead of schedule."

Robert Horn, Global Head of Infrastructure & Asset-Based Credit at BXCI said EQT is one of the leading energy and infrastructure companies in North America and the firm is partnering for future growth.

“The transaction highlights Blackstone's focus on providing large scale and flexible high-grade capital solutions to the world's leading corporations," Horn said.

The transaction is subject to customary closing adjustments, required regulatory approvals and clearances, and is expected to close in the fourth quarter of 2024.

RBC Capital Markets LLC acted as financial adviser to EQT. Kirkland & Ellis LLP is serving as EQT's legal counsel on the transaction.

Citi acted as financial adviser to Blackstone. Milbank LLP is serving as Blackstone's legal counsel on the transaction.

Recommended Reading

Baker Hughes to Supply Multi-Fuel Gas Tech to TURBINE-X

2025-03-17 - Baker Hughes will provide TURBINE-X with its NovaLT gas turbine is capable of running on different fuels including natural gas, various blends of natural gas and hydrogen.

Element Six, Master Drilling Announce Tunnel Development Partnership

2025-02-19 - Element Six and Master Drilling will deliver a diamond-enabled solution designed to increase tunneling development speed, reducing costs and minimize the environmental impact of tunnel construction.

New Era Helium, Sharon AI Cement Permian Basin Data Center JV

2025-01-21 - New Era Helium and Sharon AI have created a JV, Texas Critical Data Centers, and are working on offtake gas supply agreements and site selection.

Pioneer Energy’s Tech Offers More Pad Throughput, Fewer Emissions

2025-01-14 - Pioneer Energy’s Emission Control Treater technology reduces emissions and can boost a well’s crude yield by 5% to10%, executives say.

No Drivers Necessary: Atlas RoboTrucks Haul Proppant, Sans Humans

2025-03-04 - Atlas Energy Solutions and Kodiak Robotics have teamed up to put two autonomous trucks to work in the Permian Basin. Many more are on the way.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.