(Source: Shutterstock.com)

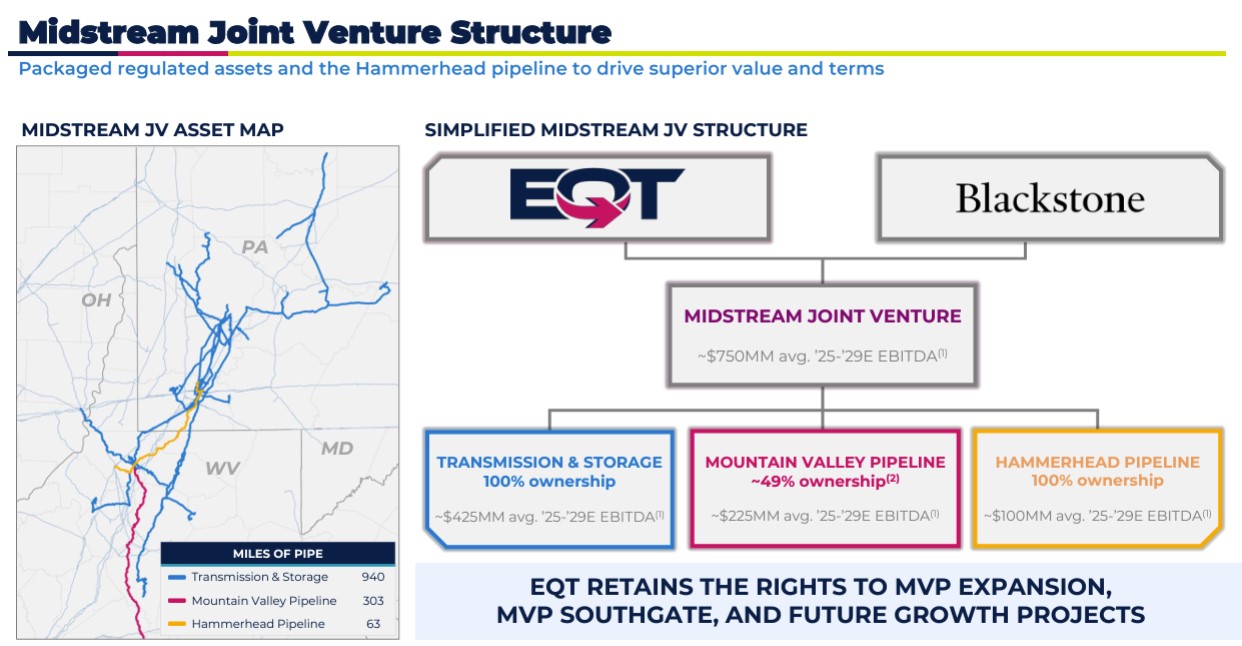

EQT Corp. has closed on the formation and funding of its new midstream joint venture (JV) with Blackstone Credit & Insurance, the company said Dec. 30.

Blackstone now holds non-controlling common equity interest in the JV, which include EQT’s Mountain Valley Pipeline and Hammerhead Pipeline, as well as some storage and transmission assets.

In exchange, EQT received $3.5 billion cash. EQT used the proceeds to pay down debt, including its term loan, revolving credit facility and bridge term loan facility used to fund the repurchase of EQM Midstream Partners LP senior notes.

RBC Capital Markets LLC acted as financial adviser and Kirkland & Ellis LLP served as legal counsel to EQT on the transaction. For Blackstone, Citi acted as financial adviser and Milbank LLP served as legal counsel on the transaction.

RELATED

EQT, Blackstone Credit Enter $3.5 Billion Midstream Joint Venture

Recommended Reading

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

2025-03-13 - Hedge fund giant Citadel’s acquisition includes approximately 60 undeveloped Haynesville locations, sources told Hart Energy.

Stonepeak Acquires Stake in Woodside’s Louisiana LNG for $5.7B

2025-04-07 - Investment firm Stonepeak purchased a 40% interest in a project Australia’s Woodside Energy bought last year for $900 million.

Glenfarne Deal Makes Company Lead Developer of Alaska LNG Project

2025-03-28 - Glenfarne Group LLC is taking over as the lead developer of the Alaska LNG project with the acquisition of a majority interest in the project from Alaska Gasline Development Corp.

Will TG Natural Resources Be the Next Haynesville M&A Buyer?

2025-03-23 - TG Natural Resources, majority owned by Tokyo Gas, is looking to add Haynesville locations as inventory grows scarce, CEO Craig Jarchow said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.