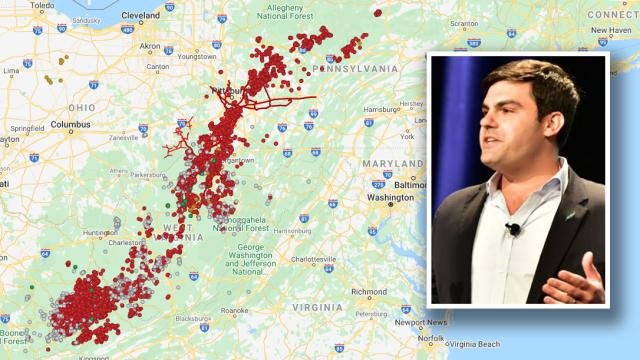

EQT Corp.'s gas wells (red) and oil and gas wells (gold) in Appalachia are shown on an Energy DataLink map. Inset: Toby Rice, president and CEO of EQT Corp. (Source: Energy DataLink, Hart Energy)

Natural gas producer EQT Corp. unveiled an aggressive plan of spending cuts, including a renegotiated rate structure on gathering and transportation pipelines, as it released fourth-quarter 2019 earnings that were better than expected.

EQT’s deal with EQM Midstream Partners LP, which was part of the same company until 2018, will result in a 35% reduction in gathering fees from 2024 through 2035. In exchange, EQT increased its minimum volume commitment to EQM to 3 billion cubic feet per day (Bcf/d) from the present 2.2 Bcf/d. After the in-service of the EQM-operated Mountain Valley Pipeline, expected on Jan. 1, 2021, the volume will increase to 4 Bcf/d by 2023.

“At a high level, this deal provides EQT with meaningful fee relief in the short term and favorable rates for the long term,” EQT President and CEO Toby Rice said during a call Feb. 27 with analysts. Rice and brother Derek Rice took over EQT in July following a nine-month proxy fight.

Click here for more data on EQT’s upstream and midstream operations.

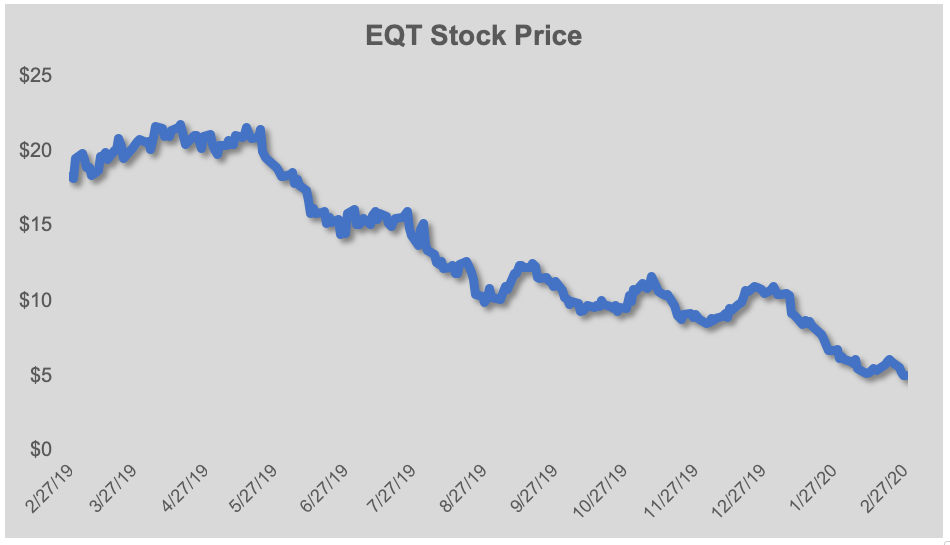

The company’s plans to trim its budget and focus on free cash flow generation instead of increased production did not immediately impress investors. EQT’s unit price sunk to a 12-month low early on Feb. 27 although it had recovered some of the loss by mid-afternoon. The price has fallen about 20% in the last week and about 70% since the Rice brothers succeeded in their takeover bid.

Click here for more data on EQT’s upstream and midstream operations.

Other aspects of the deal include dedicating an additional 100,000 acres in West Virginia to EQM and the midstream operator agreeing to defer about $250 million in current credit assurance posting requirements.

Separately, EQT sold half of its equity stake (25.3 million shares) in Equitrans Midstream Corp. to Equitrans for $52 million. EQT will also receive about $200 million in present value of estimated future revenues, discounted at an annual rate of 10% (PV10), that will be represented by lower gathering fees.

“This is a strategic use of our stake and the EBITDA impact of our imbedded fee relief is meaningfully more accretive to leverage than if we were to monetize our stake and apply proceeds directly to debt reduction,” Rice said. He added that EQT still maintains stock in Equitrans worth about $230 million but expects to have sold it by midyear.

EQT’s fourth-quarter loss of $1.18 billion was about double the loss from fourth-quarter 2018. However, the net loss of 3 cents per share was well below analysts’ expectation of 21 cents/share.

CFO David Khani pointed to the $203 million reduction in capex during the quarter, down to $355 million, and stressed that a more thorough hedging program will help minimize commodity price volatility.

“Our hedge strategy goes out four years,” Khani said. “Our goal is to protect the balance sheet while focusing on free cash flow. We will mostly use plain vanilla tools, including swaps and collars.”

Recommended Reading

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Williams Cos. COO Dunn to Retire

2025-03-13 - Williams Cos. COO Micheal Dunn was crediting with helping the company focus on a natural gas strategy.

Baker Hughes to Supply Equipment for NextDecade’s Rio Grande LNG

2025-03-11 - Baker Hughes will provide turbine and compression for NextDecade’s trains at Rio Grande LNG.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Chord Announces $750MM Notes Offering to Reduce Debt

2025-03-05 - Chord Energy said it will use part of the funds to reduce its credit facility borrowings. The company is also looking to sell its Marcellus non-operated gas interests.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.