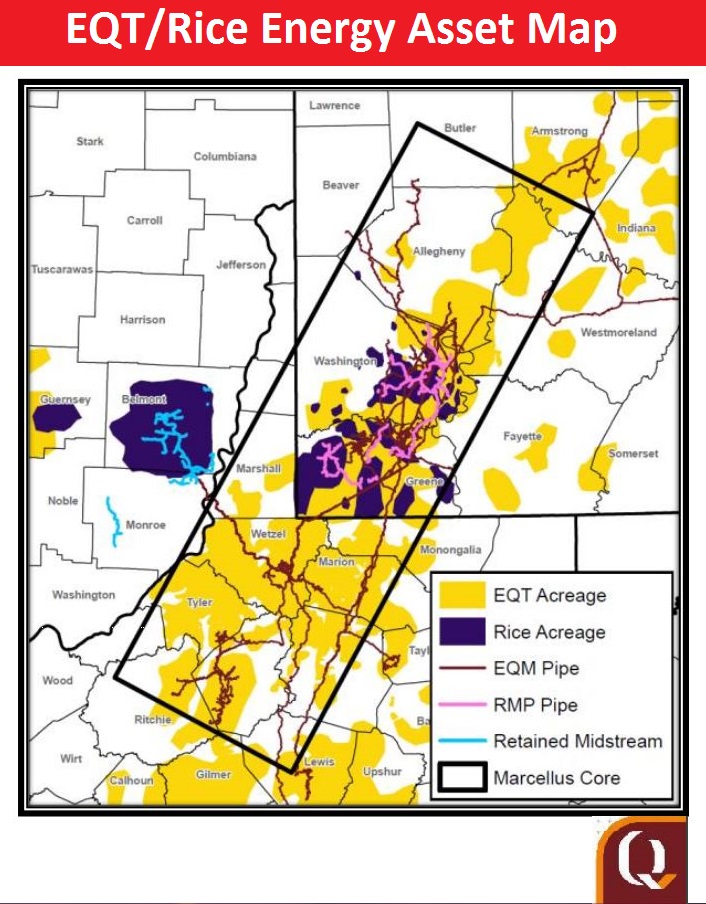

The acquisition of Rice’s acreage and midstream business in the Marcellus and Utica is set to make EQT the largest producer of natural gas in the U.S. (Source: Hart Energy)

[Editor's note: this is a developing story. Please check back for updates.]

In the most expensive U.S. shale merger of the year, EQT Corp. (NYSE: EQT) said June 19 it will buy fellow Northeast gas producer Rice Energy Inc. (NYSE: RICE) for roughly $8.2 billion, including about $1.5 billion in debt or preferred equity.

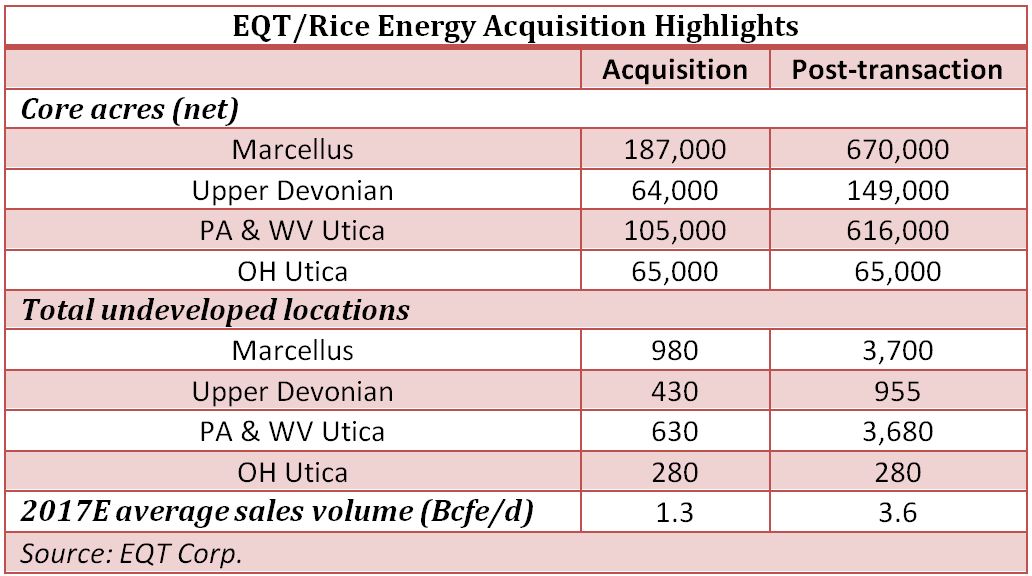

The acquisition of Rice’s 252,000 contiguous net acres—and midstream business—in the Marcellus and Utica is set to make Pittsburgh-based EQT the largest producer of natural gas in the U.S. The purchase price, consisting of stock and cash worth $6.7 billion, represents a 37% premium on Rice’s share price.

The deal marks a continued shift from last year’s oil-centric Permian Basin buying spree to more gas-focused deals in the Marcellus, Utica and Haynesville shales and Louisiana.

UPDATE: Empire Building: EQT Targets Balance After $8.2 Billion Rice Conquest

Pro forma for the acquisition, EQT will hold about 1 million total net acres in the Marcellus Shale. As a result, the company said it expects a 50% increase in average lateral lengths for future wells located in Greene and Washington counties, Pa.

In addition, EQT said the two companies’ infrastructure footprint complements EQT Midstream Partners LP (NYSE: EQM), where the company is planning dropdowns and additional organic projects.

Placing a $1.8 billion valuation on the midstream assets, Gabriele Sorbara, senior equity analyst with The Williams Capital Group LP, estimates the value of the deal at about $9,900 per undeveloped acre, which he said is roughly in line with core acreage valuations over the past year.

“The transaction makes sense for EQT, expanding its Marcellus/Utica position significantly with contiguous core acreage which adds synergies, in our view,” Sorbara said in a June 19 report.

Steve Schlotterbeck, EQT’s president and CEO, said the merger with Rice, which is based in Canonsburg, Pa., will form “a natural gas operating position that will be unmatched in the industry.”

“Rice has built an outstanding company with an acreage footprint that is largely contiguous to our existing acreage, which will provide substantial synergies and make this transaction significantly accretive in the first year,” Schlotterbeck said in a statement.

EQT itself has been on the forefront of deal making adding more than 485,000 acres since the beginning of 2016, Schlotterbeck said.

“We will now shift our focus from acquisitions to integration as we work to drive higher capital efficiency through longer laterals; reduce per unit operating costs through operational and G&A synergies; improve our sales portfolio by expanding access to premium markets; and deliver increased value to our shareholders,” he said.

Pro forma the merger with Rice, EQT will hold an estimated 670,000 core Marcellus acres and estimated 2017 sales volumes of 3.5 billion cubic feet equivalent per day—representing nearly 19% of all Marcellus production based on June figures from the Energy Information Administration.

As part of the merger agreement, EQT will acquire all of Rice’s outstanding common stock for 0.37 shares of EQT common stock and $5.30 in cash per share of Rice stock. EQT will assume or refinance Rice’s $1.5 billion net debt and preferred equity.

EQT will also obtain Rice’s midstream assets, including a 92% interest in Rice Midstream GP Holdings LP which owns 100% of the general partner incentive distribution rights and 28% of the limited partner interests in Rice Midstream Partners LP (NYSE: RMP), and the retained midstream assets currently held at Rice.

The retained midstream assets, which EQT intends to sell to EQT Midstream Partners in the future through dropdown transactions, are expected to generate about $130 million of EBITDA in 2018, according to the company release.

EQT said it expects the transaction to close in fourth-quarter 2017. The boards of directors of both companies have unanimously approved the transaction. Completion of the transaction is subject to the approval of both EQT and Rice shareholders, as well as certain customary regulatory and other closing conditions.

Citigroup was EQT’s financial adviser and Wachtell, Lipton, Rosen & Katz acted as legal adviser to the company for the transaction. Barclays Capital Inc. was Rice’s financial adviser and Vinson & Elkins LLP acted as its legal adviser.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Liberty Bolsters Mobile Power Business with Acquisition of IMG Energy

2025-03-05 - Liberty Energy Inc. said March 5 it had purchased IMG Energy Solutions as the company expands its mobile power business.

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.