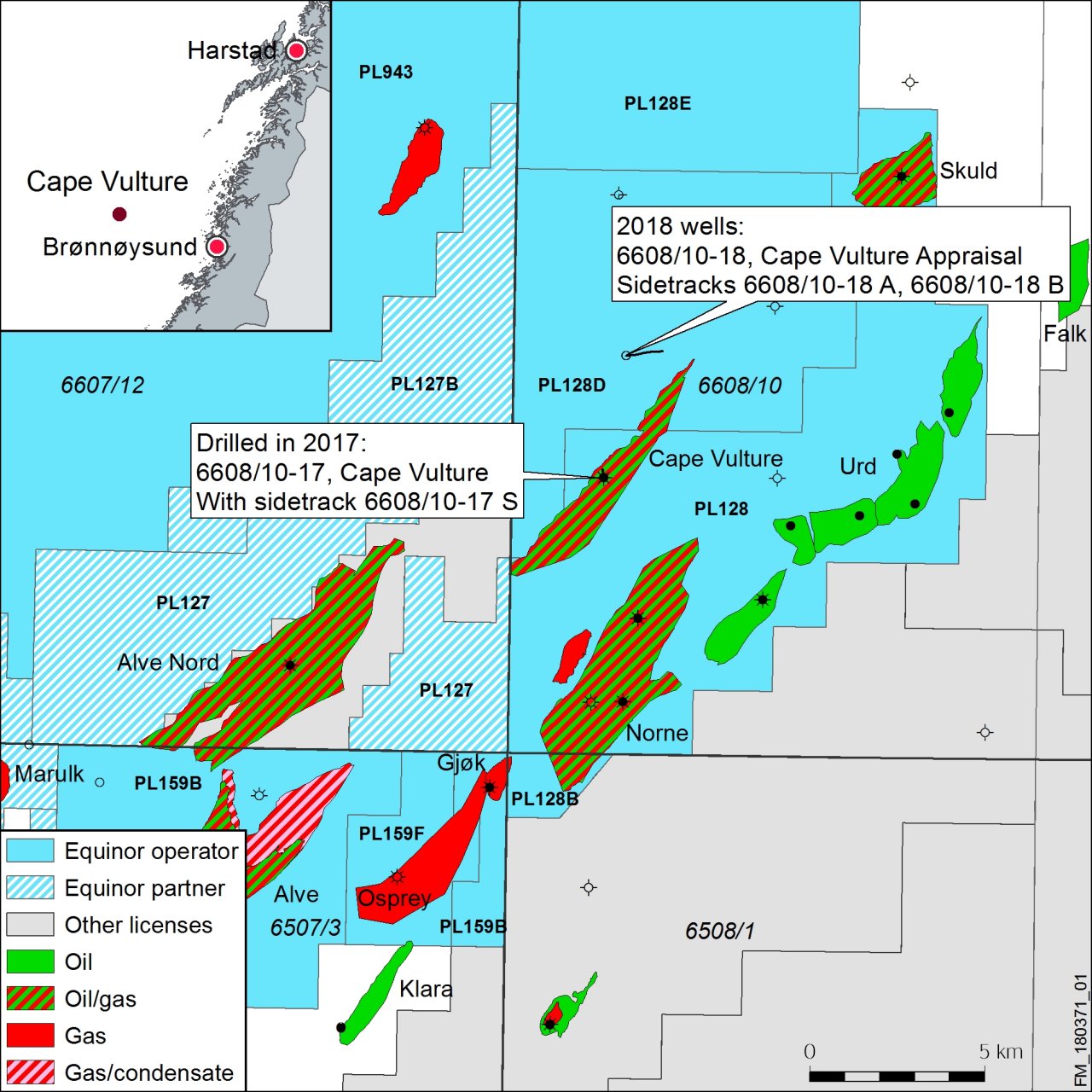

The Norne Field, along with the Alve, Urd, Skuld, Marulk fields, produces from the Norne FPSO in the Norwegian Sea. (Source: Anne-Mette Fjærli/Statoil)

Equinor (NYSE: EQNR) has confirmed a new play and doubled the remaining oil reserves to be produced at the Norne Field with Cape Vulture, one of the operator’s latest discoveries on the Norwegian Continental Shelf.

Shutdown of the field, which began production in 1997, was originally planned for 2014; however, added volumes have extended its life to 2036, the Norwegian major said in a news release Oct. 4. The appraisal wells, drilled by the Songa Encourage rig, on the Cape Vulture discovery confirmed a volume potential of between 50 million barrels (MMbbl) and 70 MMbbl of recoverable oil and a new play on the Nordland Ridge.

“Cape Vulture came as a gift in early 2017, and it confirmed that exciting subsurface secrets still remain to be unlocked in the Norne area,” Siri Espedal Kindem, Equinor’s senior vice president, operations north, said in a news release. “Our exploration people have been scrutinizing the area for more than 40 years, and they are still cracking codes.”

The appraisal wells, located 7 km (4 miles) northwest of the field’s production vessel Norne in the northern Norwegian Sea, successfully achieved their objective of delineating two reservoir zones in the 6608/10-17 S oil and gas discovery and investigating a new zone in the Lower Cretaceous-aged Lange Formation. The wells hit oil in all three reservoir zones in the formation, according to the Norwegian Petroleum Directorate (NPD).

The NPD said appraisal well 6608/10-18, drilled to a vertical depth of 3,437 m (11,276 ft), encountered an oil column of about 15 m (49 ft) in the middle zone and a 2-m (7-ft) thick sandstone layer “with good reservoir properties” in the deepest zone.

The 6608/10-18 A appraisal well, drilled to a vertical depth of 3,114 m (10,217 ft), also had success. It struck oil columns of about 10 m (33 ft) in the upper zone and about 10 m in the middle zone.

Drilled to a vertical depth of 3,256 m (10,682 ft), well 6608/10-18 B struck an oil column of about 80 m (262 ft) in the upper zone, while a 13-m (43-ft) gas column and a 110-m (361-ft) oil column were proven in the middle zone, according to the NPD.

Equinor said it began drilling the sidetracks in mid-July 2017.

“Before these appraisal wells were drilled, the operator’s resource estimate for the discovery was between 3 and 13 million standard cubic meters of recoverable oil equivalents,” the NPD said. “Preliminary estimates of the size of the discovery after the appraisal drilling are between 8 and 11 million standard cubic meters of recoverable oil equivalents. The licensees will assess the discovery further with a view toward potential future development via the Norne FPSO.”

Currently, the Alve, Urd, Skuld, Marulk and Norne fields produce from the Norne FPSO.

Equinor is already gearing up to search for more oil and gas in the area.

“As an immediate consequence, we will already next year drill a well on a similar prospect on the Nordland Ridge,” Nick Ashton, Equinor’s senior vice president, Exploration, Norway and U.K., said in the release. “The discovery demonstrates the importance of our new exploration strategy. We intend to take new approaches and try out new and untested ideas to unlock the remaining commercial resources on the Norwegian continental shelf (NCS).”

Equinor is the operator, holding a 64% stake in production license 128D (Cape Vulture). Partners are Petoro (24.5%) and Eni (11.5%).

The three companies are also partners in production license 128 (Norne), where Equinor (39.1%) is also operator. Petoro and Eni hold 54% and 6.9% interests, respectively.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

USD Completes Final Asset Sale of Hardisty Terminal

2025-04-11 - USD Partners was obligated to sell the Hardisty Terminal, in Alberta, Canada, after entering a forbearance agreement with its lenders on June 21 2024.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

BP Forecasts Dip in First-Quarter Upstream Production

2025-04-11 - BP anticipates a quarter-over-quarter decline in upstream production when it reports earnings later this month.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.