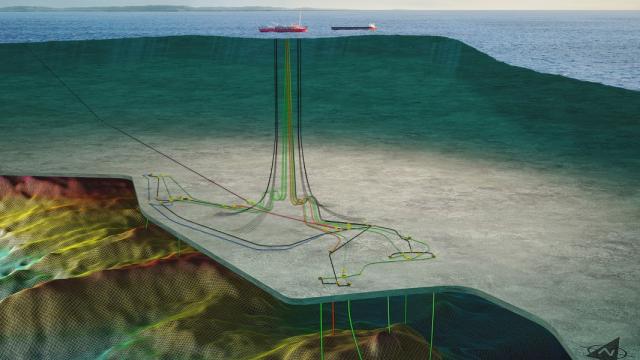

Artist rendering of the BM-C-33 project offshore Brazil. (Source: Equinor)

Norway’s Equinor along with partners Repsol Sinopec Brasil and Petrobras announced a $9 billion final investment decision (FID) to develop the BM-C-33 project offshore Brazil.

The project, slated to start-up in 2028, will utilize an FPSO with a production capacity of 16 million cubic meters of gas per day (MMcm/d) with expected average exports of 14 MMcm/d, Equinor said in a May 8 press release.

“BM-C-33 is one of the main projects in the country to bring new supplies of domestic gas, being a key contributor to the further development of the Brazilian gas market,” Equinor Brazil country manager Veronica Coelho said in the release. “Gas exported from the project could represent 15% of the total Brazilian gas demand at start-up. Its development will also contribute to energy security and economic development, enabling a lot of new job opportunities locally.”

BM-C-33 is located in the Campos Basin and comprises three different pre-salt discoveries – Pão de Açúcar, Gávea and Seat. Combined, the discoveries contain natural gas, oil, and condensate recoverable reserves that exceed one billion boe.

BM-C-33 to reduce emissions

BM-C-33 will be Equinor’s second FPSO in Brazil using combined-cycle gas turbines, significantly reducing carbon emissions during operations. By implementing this technology, the average CO2 intensity of BM-C-33 over its lifetime will be lower than 6 kg/boe, the Norwegian energy giant said.

RELATED: E&P Highlights: Sept. 26, 2022

OTC: Brazil Targets 5 MMbbl/d Production by 2030

Equinor, which operates the project, said BM-C-33 will be the first project to treat gas offshore Brazil and be connected to the national grid without further onshore processing.

Gas from the project will be exported through a 200 km offshore gas pipeline from the FPSO to Cabiúnas, in the city of Macaé, in the state of Rio de Janeiro. Liquids to flow from the project will be offloaded by shuttle tankers.

Recommended Reading

US NatGas Dominance Collides with Permitting, Tariffs, Layoffs

2025-03-16 - Executives at BP, Sempra Infrastructure and the American Petroleum Institute weighed in on U.S. natural gas prowess and the obstacles that could stand in the way: snagged permitting, prohibitive steel tariffs and layoffs of federal workers needed to approve projects.

Glenfarne CEO Expects FID on Texas LNG by End of 2025

2025-03-16 - Glenfarne Energy Transition executives are waiting on a re-issue of a vacated FERC permit for Texas LNG.

Kissler: Is it Time to Worry About Crude Prices?

2025-03-14 - Oil trends will hinge on China’s economy, plans to refill the SPR and how tariff threats play out.

FERC Chair: Gas Needed to Head Off US Grid’s ‘Rendezvous with Reality’

2025-03-13 - Federal Energy Regulatory Commission Chairman Mark Christie is pushing natural gas to feed U.S. electrical grids before a “rendezvous with reality” occurs.

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.