Following a 61% crash in Comstock Resources Inc.’s (NYSE: CRK) stock price since Jan. 1, the company plans to exit the South Texas region through a divestiture as it looks to fortify its finances.

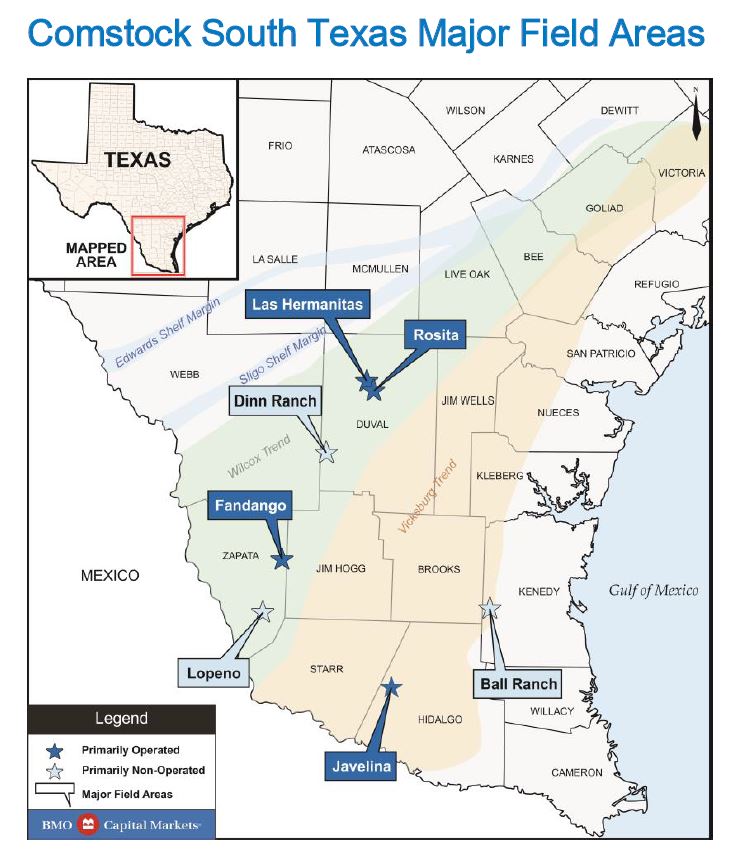

Comstock has retained BMO Capital Markets to sell 9,904 net acres of legacy gas assets in Duval, Hidalgo, Kenedy, McMullen and Zapata counties, Texas.

Comstock is among a number of companies looking to cut costs and generate cash through divestitures—particularly of gas assets—or by more direct means.

Southwestern Energy Co. (NYSE: SWN) is selling more than 350,000 net acres in Montana, Louisiana, Mississippi and the Denver-Julesburg Basin.

Bonanza Creek Energy Inc. (NYSE: BCEI) eliminated 26 employees and 17 contractors, parting ways with its CFO and general counsel, the company said March 25. Bonanza had been banking on about $255 million from the sale of its Rocky Mountain Infrastructure (RMI) but said Feb. 29 that the deal had collapsed.

Like most E&Ps, Comstock has suffered in the crumbling commodities market and the company is highly levered. Cash generated by operations in 2015 fell more than 92%, or $370.9 million, to $30.1 million compared with the previous year.

Nevertheless, on March 21 the hedge fund created by billionaire David E. Shaw took a 5.3% position in the company, according to regulatory filings.

In 2015, the company pulled back significantly on its capex and is now playing defense with its liquidity—about $184 million. Last year, Comstock retired $170 million in debt in 2015 and owed $1.3 billion at year’s end.

In July 2015, Comstock sold its Eagle Ford Shale properties in and around Burleson County, Texas, for a $112 million gain, the company said.

To the south, Comstock had purchased its remaining position in 2007 from Royal Dutch Shell Plc (NYSE: RDS.A). Comstock paid $160.1 million for the acreage—about four and a half times more than Comstock’s current market capitalization.

However, since 2009, the assets have been undercapitalized, with just three wells drilled.

The acreage is located in the heart of the Tertiary-aged Wilco and Vicksburg plays where the major operated fields include the prolific Fandango, Rosita, Javelina and Las Hermanitas. Together, the fields have produced more than 1 trillion cubic feet equivalent (Tcfe). Estimated April 2016 production is 11 MMcfe/d from 120 gross wells.

The acreage includes 10 low-risk workover wells and more than 40 recompletions, BMO said, as well as additional recompletions and operation improvement.

All of the acreage is HBP and 93% of the production is operated. In the past six months, the net average monthly cash flow was about $300,000.

Data room presentations begin April 4 and bids are due April 28. For information contact Chelsea Neville, with BMO, at 713-546-9703.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

McKinsey: Big GHG Mitigation Opportunities for Upstream Sector

2024-11-22 - Consulting firm McKinsey & Co. says a cooperative effort of upstream oil and gas companies could reduce the world’s emissions by 4% by 2030.

What Chevron’s Anchor Breakthrough Means for the GoM’s Future

2024-12-04 - WoodMac weighs in on the Gulf of Mexico Anchor project’s 20k production outlook made possible by Chevron’s ‘breakthrough’ technology.

Nabors, ProPetro Plan to Deliver High Voltage to Drillers

2024-12-10 - Nabors Industries, in partnership with e2Companies, and, separately, ProPetro Holding Corp., both launched oilfield electrification solutions on Dec. 10.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.