Evolution expects to fund the transactions from cash on hand and borrowings from its senior credit facility with MidFirst Bank. (Source: Shutterstock)

Evolution Petroleum Corp. entered into agreements to purchase non-operated oil and gas assets in the SCOOP and STACK plays in Oklahoma from three companies for $43.5 million cash — together equaling the largest transaction in the company’s history.

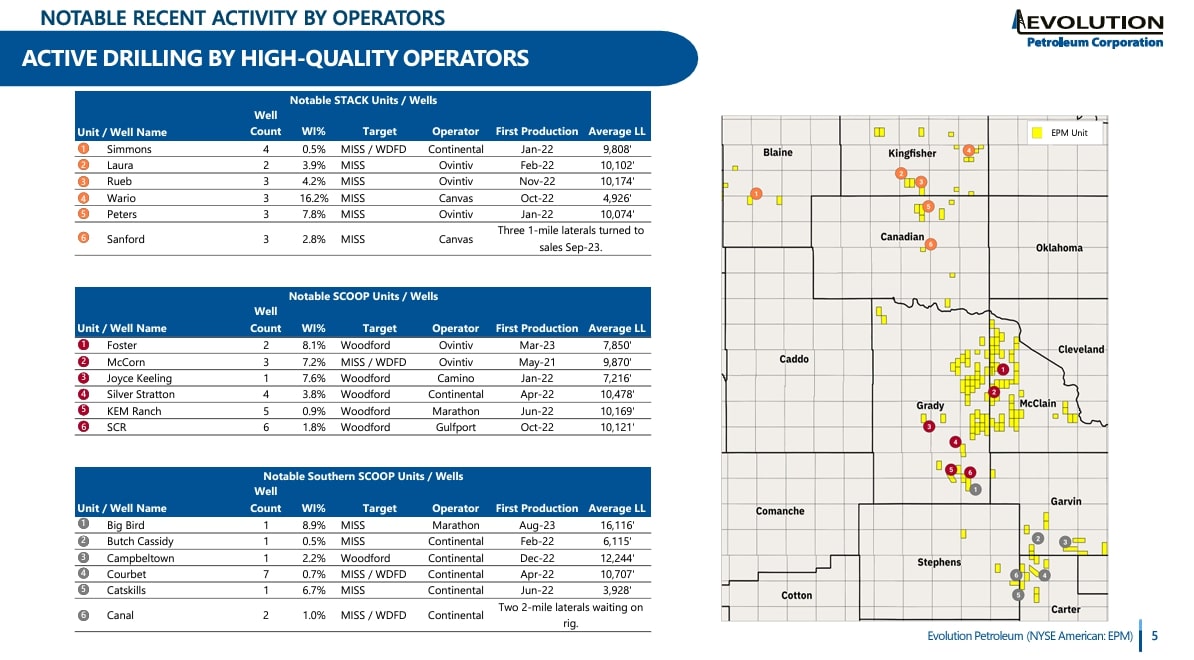

Evolution will acquire an average of 1,550 boe/d in production consisting of 42% oil, 15% NGL and 43% natural gas from Red Sky Resources III LLC, Red Sky Resources IV LLC and Coriolis Energy Partners I LLC. The deal includes approximately 230 production wells with an average working interest of about 3%. The interests are in the Anadarko Basin’s Blaine, Canadian, Carter, Custer, Dewey, Garvin, Grady, Kingfisher, McClain and Stephens counties.

Evolution said the transaction comes with “significant upside associated with approximately 3,700 net acres in the SCOOP and STACK plays with more than 300 gross undeveloped locations” with an average working interest of about 3%.

Evolution expects to fund the transactions from cash on hand and borrowings from its senior credit facility with MidFirst Bank. As of Dec. 31, and prior to the transaction, the company had approximately $8 million in cash on hand and had no outstanding borrowings under the facility. The company estimates that net debt after closing the transaction will be within its targeted leverage ratio of 1x pro forma Adjusted EBITDA.

Kelly Loyd, Evolution’s president and CEO, said the transactions are a significant achievement for the company and demonstrate its ability to buy high-quality assets in a core basin with “best-in-class operating parties.”

The assets are managed by E&Ps including Continental Resources, Ovintiv and EOG Resources, among others.

"In addition to the roughly 1,550 [boe/d] of production, these transactions further our strategy of ‘making acquisitions through the drill bit’ which was emphasized in our Permian drilling partnership in Chaveroo,” Loyd said. “We view this as crucial to enhancing our ability to accretively maintain or increase production at an attractive rate of return outside of making acquisitions.”

Loyd said the acquisitions are “more than self-funding, meaning they are expected to generate sufficient free cash flow to both participate in future wells and to contribute excess free cash flow back to the company to be used for dividends, debt repayment and other corporate uses."

The acquisitions also continue Evolution’s strategy to diversify its asset base in “world-class” basins with ample takeaway and processing infrastructure and well-established end sales markets.

“They also greatly diversify our portfolio classification by adding not just PDP wells but also low working interest exposure to more than 300 gross, high-quality undeveloped locations,” he said.

The acquisitions are expected to close in mid-February.

Recommended Reading

DOE Approves Non-FTA Permit Extension for Golden Pass LNG

2025-03-05 - Golden Pass LNG will become the ninth U.S. LNG export facility following the U.S. Department of Energy’s approval for an extension of its non-free trade agreement permit.

Dell: Folly of the Forecast—Why DOE’s LNG Study Will Invariably Be Wrong

2025-01-07 - Kimmeridge’s Ben Dell says the Department of Energy’s premise that increased LNG exports will raise domestic natural gas prices ignores a market full of surprises.

Trade War! Or Maybe Not

2025-03-06 - An energy industry that prefers stability gets hit with whiplash as it attempts to adjust to the Great Disruptor taking over the White House.

DOE Secretary Wright Grants Delfin LNG Extension for Exports

2025-03-10 - Delfin LNG's floating LNG export project in the Gulf of Mexico is authorized to export up to 1.8 Bcf/d, U.S. Energy Secretary Chris Wright said at CERAWeek.

Trump to End Need for Some LNG Export Permit Renewals, Sources Say

2025-01-15 - Trump, who takes office on Jan. 20, has said he would issue an LNG order on day one that would end the pause on approvals for new LNG projects that outgoing President Joe Biden put in place in January last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.