Evolution Petroleum Corp. saw a strong uplift in production from its recently acquired SCOOP/STACK plays in Oklahoma. (Source: Shutterstock)

Evolution Petroleum Corp. saw a strong uplift in production from its recently acquired SCOOP/STACK plays in Oklahoma.

In January, Evolution entered into transactions with three sellers to acquire the Midcontinent leasehold for a reported $43.5 million. In a May 7 earnings release, Evolution said the company borrowed $42.5 million under its revolving credit facility to fund the acquisitions.

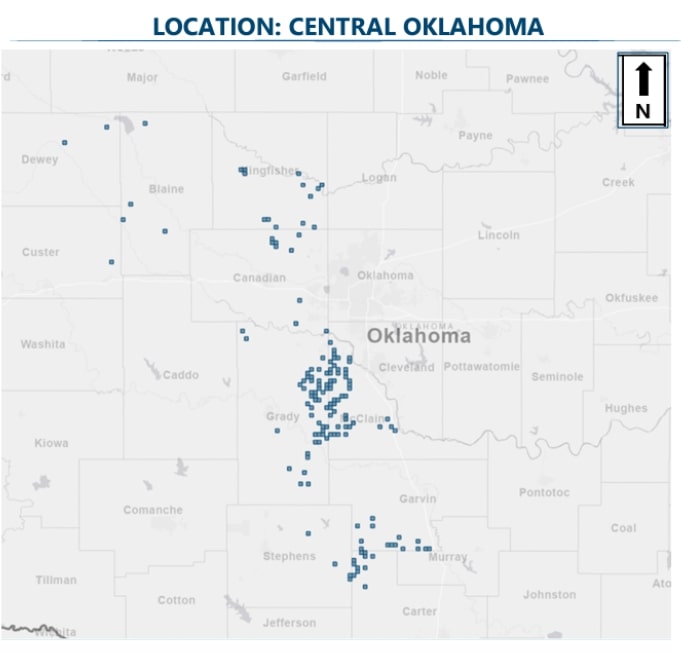

The interests are in the Anadarko Basin’s Blaine, Canadian, Carter, Custer, Dewey, Garvin, Grady, Kingfisher, McClain and Stephens counties.

As a result of the acquisitions, which closed in February, average production in the first quarter increased by 835 boe/d. Evolution said that, had the acquisition closed at the beginning of the second quarter, on a pro forma basis production on the assets would have averaged 1,550 boe/d.

The transactions also added about 300 gross undeveloped locations with an average working interest of approximately 3%. Of those locations, 21 DUCs were to be completed at the sellers’ expense.

Evolution also elected to participate in 15 wells, 13 of which were spudded by the end of the first quarter, according to its earnings release.

Additionally, 19 of the SCOOP/STACK DUCs were completed by the end of the quarter, with results “meeting or exceeding expectations for the wells for which data is available, maintaining pro forma field production for the quarter roughly flat to the production rate” as of the Nov. 1, 2023, effective date.

Kelly Loyd, Evolution president and CEO said the company has added scale, diversification and investment flexibility to its portfolio.

“The production for a portion of the quarter from our SCOOP/STACK acquisitions and the incremental production from 19 newly drilled SCOOP/STACK wells, as well as production from the initial three wells at Chaveroo [oilfield], were instrumental to our performance this quarter,” Loyd said. “Chaveroo and SCOOP/STACK not only bolstered our quarterly average production by more than 1,000 boe/d but were also key to the impressive 27% increase in quarter-over-quarter crude oil production.”

Loyd said the company’s ability to swiftly integrate the assets and capitalize on their continued development potential was a clear indication of Evolution's “agility and strategic execution.”

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

How DeepSeek Made Jevons Trend Again

2025-03-21 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.