Most automakers are a few years behind Tesla when it comes to electric vehicles, though “they can quickly outgun Tesla when it comes to manufacturing capacity and quality,” Wood Mackenzie Principal Analyst Ram Chandrasekaran says. (Source: BoJack / Shutterstock.com)

Electric vehicle (EV) sales are expected to reach 62 million units per year by 2050, with a total global EV stock of 700 million, according to new research from Wood Mackenzie published Feb. 8.

The forecast comes as a push for use of cleaner energy to achieve climate goals by governments around the world, particularly in Western Europe, has caused a surge in EV sales during a global pandemic.

“In 2020, global EV sales surged 38% despite a decline of 20% in all car sales,” Wood Mackenzie Principal Analyst Ram Chandrasekaran said in a statement.

In the U.S., President Joe Biden aims to dramatically boost the sales of EVs as part of his pledge to tackle greenhouse gas emissions. A week after Biden took office, General Motors Co. (GM), the largest U.S. automaker, also joined in on the push with plans to phase out gasoline- and diesel-powered vehicles by 2035.

“Emissions regulations in Western Europe were successful in doubling EV adoption despite the crippling coronavirus pandemic,” Chandrasekaran said adding: “This provides a roadmap for other countries and regions with similar goals to stimulate EV sales growth.”

EV sales are expected to top a combined 7 million a year in China, Europe and the U.S. by 2025. Improved EV costs will propel sales and double EV numbers to a combined 15 million a year in those three regions by 2030.

By 2050, all automobile sales in Europe (86%), China (81%) and North America (78%) will predominantly be EVs, the Wood Mackenzie report said.

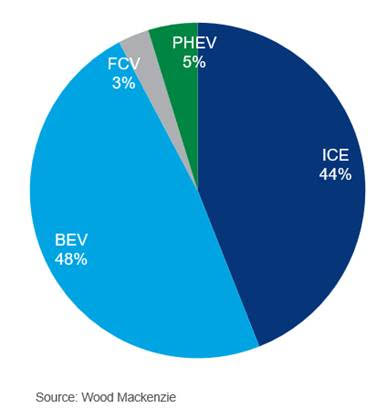

Shortly before that date, in 2047, battery electric vehicle, plug-in hybrid electric vehicle and fuel cell vehicle sales will combine to eclipse internal combustion engine (ICE) sales globally for light-duty vehicles for the first time.

Still, global oil demand from light-duty vehicles is projected to reduce by only 24% over the next 30 years, even with the growing dominance of EVs, Chandrasekaran said.

“Slow erosion of ICE stock and an increased demand from emerging economies are the main reasons for this lethargic drop,” he said.

Volkswagen, Tesla, GM, Fiat-Peugeot, Renault-Nissan and Hyundai will continue to make up a large share of future EV sales, though most automakers are a few years behind Tesla in terms of technology and efficiency, according to Chandrasekaran.

“However, they can quickly outgun Tesla when it comes to manufacturing capacity and quality,” he noted.

Led by electric buses and light trucks, Wood Mackenzie expects annual commercial EV sales to top 3 million by 2025 and triple to nearly 9 million by 2030. Annual commercial vehicle sales are projected to reach 6.4 million by 2050, while global stock will swell to 54 million.

At a whopping 88% of the total 416 million charging outlets globally by 2050, the firm also projects residential chargers to be the primary mode of charging for EVs globally.

Recommended Reading

NatGas Shouldering Powergen Burden, but Midstream Lags, Execs Warn

2025-02-14 - Expand Energy COO Josh Viets said society wants the reliability of natural gas, but Liberty Energy CEO Ron Gusek said midstream projects need to catch up to meet demand during a discussion at NAPE.

NatGas Prices, E&Ps Take a Hit from DeepSeeking Missile

2025-01-28 - E&Ps such as Expand Energy and EQT Corp. saw share prices drop on news of less power-intensive AI, but analysts predict the natural gas market will rebound as LNG exports and overall power demand continues to increase.

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

FERC Chair: Gas Needed to Head Off US Grid’s ‘Rendezvous with Reality’

2025-03-13 - Federal Energy Regulatory Commission Chairman Mark Christie is pushing natural gas to feed U.S. electrical grids before a “rendezvous with reality” occurs.

US LNG Exports May See EU Demand Drop-Off, Asian Surge

2025-03-27 - Ukrainian peace talks could end with Russian gas back on the market, Poten & Partners analysts said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.