Rigs drill the 16-well Megalodon pad for Aethon Energy Management LLC, landing eight in each the Haynesville and Bossier in East Texas. (Source: Aethon Energy)

Woodside’s acquisition of Tellurian is a win-win-win situation—for the Haynesville, for U.S. LNG and for Aethon Energy.

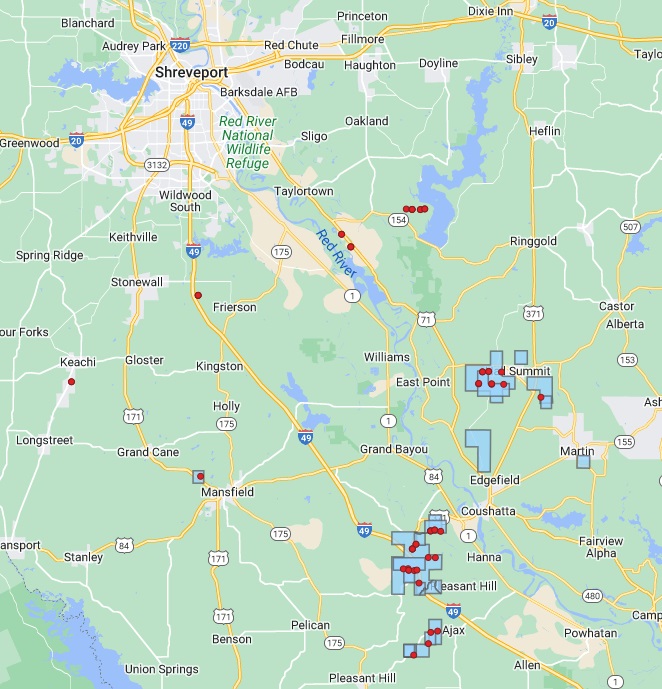

Private equity firm and operator Aethon Energy is one of the largest natural gas producers in the Haynesville Shale, with a footprint stretching across northern Louisiana and East Texas.

Aethon is already a major player in the growing U.S. LNG sector; the company is the second-largest gas supplier to Cheniere’s liquefaction facilities on the Gulf Coast, said Gordon Huddleston, president and partner of Aethon Energy.

The $900 million acquisition of Tellurian Inc. by Australian player Woodside Energy Group Ltd. gives even more momentum to the buildout of U.S. LNG export capacity.

Tellurian’s value stemmed from its fully permitted Driftwood LNG project, a pre-final investment decision (FID) project with a premier site on the Louisiana Gulf Coast.

Tellurian had faced financial uncertainty before agreeing to the Tellurian sale. One of the places Tellurian tapped for liquidity was its integrated upstream gas assets, which the company sold to Aethon in a $260 million deal this summer.

But analysts think having Woodside behind the Driftwood LNG project could help accelerate toward FID.

“I think [the deal] speaks volumes about the quality and importance of this resource and the long-term view that natural gas is going to make up a core part of the energy stack,” Huddleston told Hart Energy in an exclusive interview.

But hurdles remain to get Driftwood LNG off the ground. Analysts at Tudor Pickering Holt & Co. currently do not include the Driftwood project in its gas macro model.

The project will eventually need to reapply for certain certifications subject to the Biden administration’s pause on LNG permits. Securing long-term offtake agreements is also a factor.

So far, Aethon itself has signed the largest offtake agreement from Driftwood LNG: The $260 million deal for Tellurian’s upstream assets also included a head of agreement (HOA) for Aethon to offtake 2 million tons per annum (mtpa) of LNG from the Driftwood project.

The HOA calls for a 20-year agreement, which would be indexed to Henry Hub prices plus a liquefaction fee.

The LNG offtake agreement was a key consideration for Aethon when signing the deal to acquire Tellurian’s upstream gas assets, which added around 31,000 net acres in the Louisiana Haynesville and Bossier shale formations, Huddleston said.

“[Tellurian] needed to do something relatively quickly, we understood the asset and we had the ability to flow some of their gas into our own company-owned midstream system,” Huddleston said.

RELATED

Aethon to Acquire Tellurian Haynesville Shale Assets for $260MM

LNG calls, Haynesville answers

As LNG developers look for shale plays to source feed-gas from, the Haynesville is pulling ahead of the rest of the pack for several reasons.

Dry gas is cheaper to produce in Appalachia’s Marcellus shale play than in the Haynesville, but Appalachia gas is stranded in-basin due to limited pipeline transport capacity.

There’s so much associated gas being produced in the Permian Basin that spot prices frequently dipped negative this spring—but the Permian, too, has limited gas pipeline capacity out of the basin. The much-anticipated Matterhorn Express gas pipeline is expected to begin servicing Permian gas producers later this year, providing some pricing relief.

But the Haynesville has that Goldilocks “just-right” mix of nearness to liquefaction facilities, bountiful dry gas production and adequate midstream access.

Analysts anticipate significant volumes of LNG feed-gas to come out of the Haynesville. The Permian Basin and the Eagle Ford Shale are also poised to supply significant volumes of future U.S. LNG exports.

And LNG developers need a lot of gas: Demand to fuel U.S. LNG exports is expected to grow by over 17 Bcf/d through 2030, according to forecasts from East Daley Analytics.

U.S. LNG exports are expected to increase 2% to average 12.2 Bcf/d this year, according to Energy Information Administration data. In 2025, U.S. LNG exports are forecasted to grow another 18% (2.1 Bcf/d).

“You really have to change your scale and change your overall perspective about how much gas is going to be required for how long,” Huddleston said, “and what the other uses are going to be throughout the country.”

The amount of shale gas needed for future liquefaction and export is immense—but there are relatively few E&Ps owning the physical locations where that gas is produced.

Much of the highest-quality Haynesville drilling inventory is already owned by the likes of Aethon, Chesapeake Energy, BPX Energy, Comstock Resources and a handful of other operators.

“That means that that gas isn’t necessarily going to be available unless we choose to develop it—and that’s going to require the economic incentive long term for that,” Huddleston said.

International economies dependent on natural gas are also working to get ahead on owning a piece of upstream gas production.

Japanese buyers are standing out notably in the Haynesville. Late last year, East Texas gas producer Rockcliff Energy II sold to Tokyo Gas Co. in a $2.7 billion transaction.

In 2019, Osaka Gas Co. acquired Sabine Oil & Gas for $610 million.

Japanese firm Mitsui & Co. Ltd. acquired shale gas assets in the Eagle Ford from private buyers this year.

Compared to the future outlooks for Henry Hub prices and international LNG prices, pricing for shale gas assets “is pretty attractive today” for international buyers.

“It’s a nice natural hedge for them to get that comfort, control and visibility into the gas that they’re ultimately liquefying,” Huddleston said.

“I think that’s why you’re seeing these strategic acquisitions occur, like the Rockcliff deal,” he said.

RELATED

From Tokyo Gas to Chesapeake: The Slow-burning Fuse that Lit Haynesville M&A

Western Haynesville

Gas demand is rising to fuel growing U.S. LNG exports. Demand is also expected to rise to meet growing demand for artificial intelligence (AI) computing and data center operations.

Analysts are unclear about just how much natural gas could eventually be needed to support domestic needs and exports—but it is a vast quantity.

And as top-tier drilling locations become increasingly scarce, gas producers will need to drill into less quality rock.

“Both Tier 2 and Tier 3 acreage, over the long term, is going to have to be developed,” Huddleston said.

Certain operators are also pushing further out and drilling deeper to find future runway. Aethon and Comstock are the two de facto leaders delineating the emerging “Western Haynesville” gas play in Leon and Robertson counties, Texas.

But the Western Haynesville—or “Waynesville”—is ultra-deep and has higher pressures and hotter temperatures to contend with, making it an expensive place to drill.

“We’ve seen great economics out there—but at the same time, it’s early days and we like to iterate on our development as best as possible,” Huddleston said.

RELATED

Comstock Adds Four Whopper Wildcats; Takes Western Haynesville to 450K

Recommended Reading

What's Affecting Oil Prices This Week? (March 24, 2025)

2025-03-24 - Oil demand will be picking up as we move into warmer months for the northern hemisphere. For the upcoming week, Stratas Advisors think the price of Brent crude will move higher and will test $73.

Oil Dives More Than 6%, Steepest Fall in 3 Years on Tariffs, OPEC+ Supply Boost

2025-04-03 - Oil prices swooned on April 3 to settle with their steepest percentage loss since 2022, after OPEC+ agreed to a surprise increase in output the day after U.S. President Donald Trump announced sweeping new import tariffs.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

What's Affecting Oil Prices This Week? (April 7, 2025)

2025-04-07 - From an upside perspective – a favorable resolution of the tariffs will push the price of Brent crude to $75 and the price of WTI to $70.

What's Affecting Oil Prices This Week? (Jan. 27, 2025)

2025-01-27 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will threaten $75.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.