Processing plant at a lithium mine. (Source: Shutterstock)

China’s relentless global pursuit of critical minerals, especially in places where the U.S. lacks a presence, means the U.S. must strengthen its supply chains at home and abroad.

This is according to panelists during an event by the Aspen Institute’s Energy and Environment Program, which released a report in June with recommendations to help policymakers address critical minerals challenges.

“We need to up the profile of metals and minerals and develop strategic pathways for protecting these supply chains that we need,” Melanie Kenderdine said, principal and executive vice president of the Energy Futures Initiative, a Washington D.C.-based nonprofit focused on technology and policy innovation to accelerate the clean energy transition. “We are never going to have all of the supplies of metals and minerals that we need in the United States.”

Stressing the importance of ongoing discussions with allies and trading partners—including China—as recommended in the Aspen Institute report, Kenderdine shared how she noticed China’s footprint years ago on a trip to Rwanda.

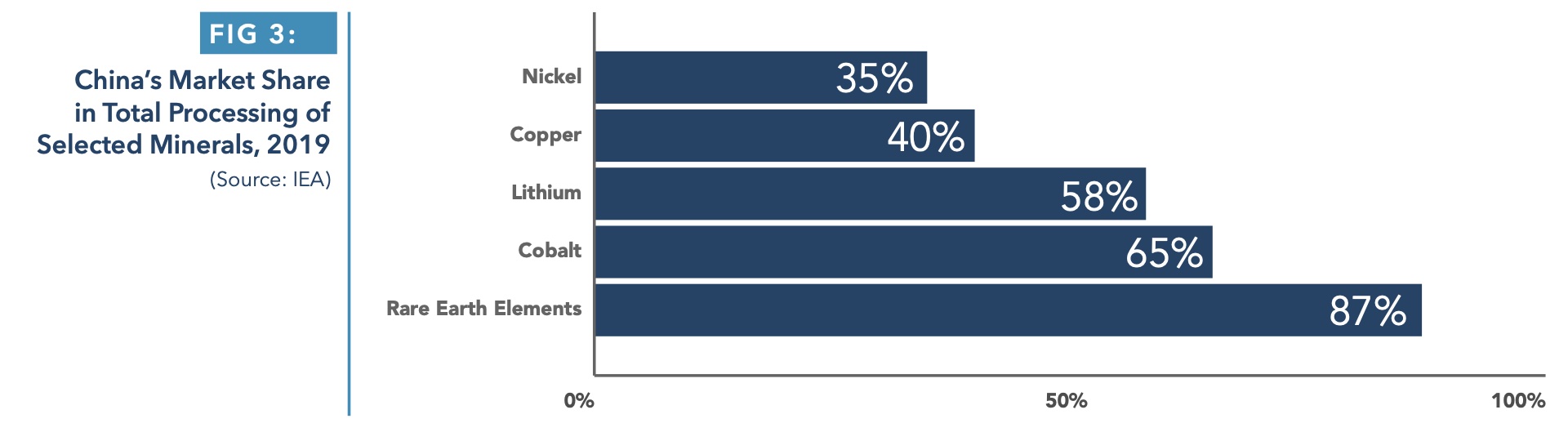

Since then, China—which dominates the global market for processing and refining critical minerals such as cobalt, lithium and rare earths—has purchased lithium mines in Australia, South America and parts of Africa. “They are aggressively, smartly pursuing some of the things that they know we’re going to need. …We need to be very, very mindful of their activities. We need to be very mindful that we are a major customer of theirs and at the same time where we can, do what we can to meet some of the metals and minerals needs that we have for a clean energy transition.”

Critical minerals are essential for clean energy technologies—such as energy storage and wind turbines—expected to play a pivotal role in the transition to a lower carbon economy. The report showed that the U.S. imported more than half of its consumption of over 51 different minerals in 2022. The country relied 100% on imports of 15 of these minerals, including natural graphite, a heat-resistant material used in solar panel and lithium-ion batteries, and manganese, which is also used to make batteries.

Critical minerals recommendations

The U.S. unveiled a strategy to address the critical minerals challenge during the Trump administration, and focus has continued with the Biden administration with efforts to secure the supply chain.

Still, “critical minerals require urgent attention from policymakers” not only because of their role in the climate and economy but also for national security interests. Demand is rising, supply chains are fragile and supplies are heavily geographically concentrated, the Aspen Institute said in its report.

Congress should focus on two objectives: responsibly [increasing] domestic and global production and processing of critical minerals at scale, and securing “responsible and resilient critical mineral supply chains that minimize vulnerability to external risks,” according to Aspen.

Recommendations, which resulted from a task force of experts who met in 2022 and 2023, centered on developing the “domestic foundation for more responsible and resilient supply chains” and maximizing “connections with strategic exporting and importing countries.”

Meghan O’Sullivan, co-chair of the Aspen Institute and former Deputy National Security Advisor under President George W. Bush, pointed out that permitting reform, addressing both supply and demand, and having a just and equitable development of resources in the U.S. were prominent in discussions.

“Even under the best circumstances, the United States would not be able to meet all of its needs by itself. And so, we urge Congress not to become too enamored with the Buy American provisions,” O’Sullivan said. “Instead, we urge Congress to really focus on working with friends and allies and other partners around the world to agree on a common set of clearly defined environmental, social and governance standards for the production and processing of minerals.”

Eyeing areas with abundant metals and minerals, Kenderdine honed in countries not currently exporting to the U.S. She said the U.S. could develop bilateral relationships with countries that include Bolivia, Chile, Kahzakstan, Laos, Madagascar, Mozambique, Tanzania and Ukraine, among others.

China’s dominance covers the entire value chain. It produces about 70% of mined rare earth elements globally, controls nearly 90% of separation and about just as much of metallization and magnet production in the rare earth element supply chain.

“This dominance takes on additional significance since the United States relies on imports for all of its refined rare earth elements. …China is aware of its leverage,” the report stated, “and the government has signaled strategic intent to wield rare earth elements as an economic and geopolitical tool, as it did when it restricted exports of rare earth elements to Japan in 2010 following a diplomatic dispute.”

Addressing tech, community concerns

Technology innovation is also part of the equation. Experts suggested Congress take steps to reduce demand for critical minerals by encouraging investment in technology and recycling.

“Substitutions are also incredible,” said Rich Powell, CEO of ClearPath, which develops policies aimed at advancing emissions reduction technology.

Form Energy is among the companies behind such technology. The energy storage company developed a rechargeable iron-air battery technology that it says can deliver electricity for 100 hours and at less than one-tenth of the cost of lithium-ion.

“That’s an entirely new battery chemistry that switches from a critical mineral like lithium to earth abundant minerals like air and iron, one of the most abundant minerals on the planet,” Powell said. “That’s the kind of break we might see through further investments in innovation, substitution.”

Addressing community concerns is also critical, according to the experts.

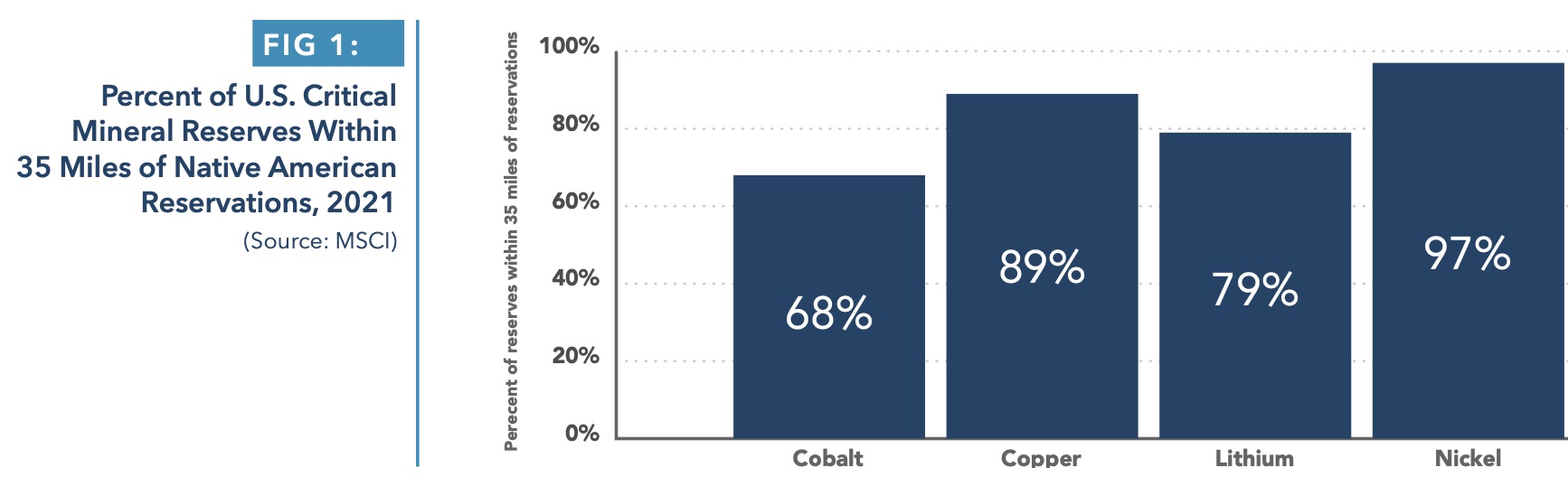

The report recommends Congress “clarify and endorse the concept of Free, Prior and Informed Consent, making clear that it should be received from Tribal Nations directly impacted by critical minerals development.” The concept involves obtaining consent from Indigenous Peoples for activities that take place on their land.

Heidi Heitkamp, former U.S. senator and panelist, shared her experience in working with tribal nations in North Dakota.

“I think that the question is how likely is it that we’re going to get a reset, especially with indigenous populations because the history’s not good,” Heitkamp said, going back to colonization before referring to Black Hills. “No one had any interests until they found gold and literally violated the Laramie Treaty. People don’t want to hear that, but that's the truth. What about today would tell anyone that would soon be different tomorrow?”

Though not directly related to the critical minerals’ discussion, Heitkamp brought up challenges associated with plans to site a CO2 pipeline coming from ethanol plants into North Dakota.

“The pipeline is being stopped by communities all along the path,” she said.

Heitkamp added, “We’ve got to have a realistic conversation about the societal impacts of this transition.”

Such conversations must be had if the U.S. is actually going to develop its own mineral resources. “We haven't even talked about the environmental impact,” she added, referring to the impacts of extracting iron ore. The Iron Range in Minnesota, where taconite can be found, is also the site of conflict where the community fears tourism loss and other economic impacts.

“I think we go a long way in this report to acknowledge the past, because you cannot fix this without [an] acknowledgment of the past and reparations for the past. That’s the dirty little secret here,” Heitkamp said. “The second thing that you have to do is you have to build trust.”

Recommended Reading

Dividends Declared Week of Feb. 24

2025-03-02 - As 2024 year-end earnings wrap up, here is a compilation of dividends declared from select upstream and midstream companies.

Q&A: Patterson’s OFS Perspective on the Shale Boom, Pandemic and Current Upswing

2025-02-27 - Former Basic Energy Services CEO Roe Patterson details his perspective on the shale boom and the lessons learned to get back to the current upswing in the industry.

2025 Pinnacle Award: Christine Ehlig-Economides is a Pioneer in the Field and Classroom

2025-02-27 - University of Houston petroleum engineering professor Christine Ehlig-Economides has left an indelible mark on the industry and blazed a trail for women.

Civitas Adds Former EOG Exec Lloyd Helms to Board

2025-02-26 - In conjunction with its recent $300 million Midland Basin bolt-on, Civitas Resources has increased its board to 10 directors.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.