Despite recent slowdowns, the East Texas portion of the Eagle Ford Shale is ripe for a renaissance. There are an estimated four rigs currently running there, but that’s destined to increase, according to New Century Exploration LLC CEO Phil Martin, who spoke at Hart Energy’s annual DUG Eagle Ford Conference & Exhibition.

In the oil business, nothing is stagnant, “and there is no neutral,” Martin said. “If you’re not moving forward, you’re moving back, folks,” and New Century plans to move forward. New Century’s East Texas Eagle Ford position consists of more than 10,000 acres in Burleson and Lee counties. The company began piecing it together back in 2010, starting out small and growing organically.

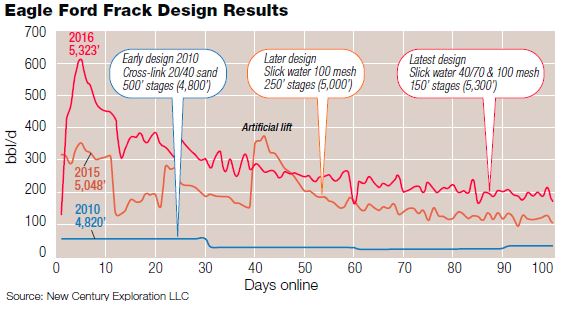

New Century drilled five horizontal Eagle Ford wells in 2015 but drilling “shut down in 2016.” However, New Century did refrack one Eagle Ford well in 2016 using more advanced frack technologies and plans to recommence drilling in the East Texas Eagle Ford this year, along with drilling an Austin Chalk well that utilizes “kind of an Eagle Ford-style frack.” Despite last year’s relative inactivity, New Century is producing five Eagle Ford wells on its block and continues to grow its acreage position until oil prices allow development to begin in earnest.

The latest frack designs provide uplift from tighter-spaced stages, slickwater, 100-mesh proppant and higher proppant density.

East vs. West

The Eagle Ford spans a large portion of Texas, trending from the Mexican border to East Texas. It’s about 50 miles wide, 400 miles long and has an average thickness of 250 feet. The shale proved a bit of a puzzle in its early days, garnering some speculation but not too much attention prior to 2008. Petrohawk Energy Corp. was the first company to economically drill an Eagle Ford well. Over the next eight years, new technology, longer laterals and bigger fracks contributed to the area’s value, Martin said, sparking “serious” delineation and development in 2014 to 2015.

The next step? An evolution in technology. “Technology continues to move forward, and we need a good seat on that bus,” Martin said. Longer laterals, tighter perf clusters and greater proppant loading only make up a small piece of the overall picture.

The similarities between the rocks in the east and west are not great, Martin said, including the core of Karnes County, but the overburden and resulting reservoir energy in Karnes County are significantly greater and result in greater flow rates and EUR. The East Texas Eagle Ford is undergoing the same technological evolution as in the west, “although there has been a slight lag.”

“We all know the Eagle Ford is a very tight rock—the right frack design is critical,” Martin said, pointing to impressive uplifts garnered by slickwater fracks and 100-mesh proppant. New Century set the stage for slickwater fracks in Lee and Burleson counties. It was the first to use slickwater and 100 mesh there, spurring nearby operators to use the technique.

Marlin Energy LLC turned to slickwater fracks in the South Texas Eagle Ford following a conventional hybrid frack that produced unimpressive results. The well drilled with a slickwater frack was “right on our flank and turned out to be the best well anywhere near us. Venado Oil and Gas LLC also drilled wells nearby and also went to slickwater after observing New Century, only to complete the best of their 30-plus wells. That’s something we’re glad we played a little part in,” Martin said.

Slickwater fracks contribute to tighter well spacing, serving to increase ultimate recoverable reserves. New Century has also tightened up stages and perf clusters in its latest frack design based on the results of the last Marlin well.

Someday, sophisticated microseismic data could unlock even more potential by shedding light on which specific perf clusters contribute to production. “If you can actually focus in on those [clusters], then you’re going to do a lot better. We’re doing that with our re-frack,” Martin said.

At press time, there had only been 50-plus refracks in the entire Eagle Ford, according to Martin. He’s aware of only two others in the East Texas Eagle Ford. After three years from first production, that company’s refrack gained “a 550% bounce from where they were at that time.” Fast forward to almost a year of recorded production, and “it’s still 200% higher than it was before.”

New Century’s tactic involves stimulating new rock and opening up under-stimulated zones. Pressuring up before the re-frack is an effective start. After that the objective is to isolate stages, either using diverters or actual perf cluster segregation with special coil tubing tools. Adding additional perf clusters can enhance results but can be expensive.

“The way of the future may be toward cemented sleeves which can be opened up individually instead of balls or diverters, with all their uncertainties,” Martin said. With cemented sleeves, he explained, stages as small as 55 feet can be selected individually and instead of 27 frack stages, companies could do 100 stages or more in a single well.

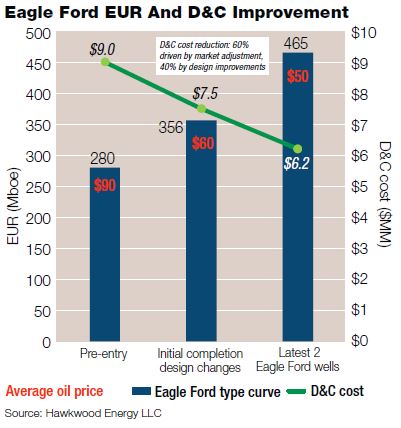

Hawkwood Energy’s drilling and completion costs have lowered dramatically in its latest two Eagle Ford wells.

Exceeding expectations

After devoting a significant amount of technical time, Hawkwood Energy LLC decided to enter the East Texas Eagle Ford as a “fast follower,” making its initial investment in second-quarter 2014. “Needless to say, we had great timing,” said Patrick Oenbring, Hawkwood CEO, as oil prices fell sharply. Despite the early economic challenge, Hawkwood’s fundamental well results in the Eagle Ford have proved even higher than its high-case estimates during its initial acquisition investments. “We feel really good where we are today,” Oenbring said.

Today, Hawkwood is “one hundred percent focused on East Texas Eagle Ford and Woodbine work,” with 100,000 highly contiguous acres located primarily in Brazos and Robertson counties, according to Oenbring. Initially, the company’s strategy centered on drilling and acquisitions. Largely geared toward acreage acquisitions, the shift to PDP-focused acquisitions occurred as oil prices fell. Its first two acquisitions in 2014 came courtesy of Encana Corp. Hawkwood acquired acreage in the northeastern corner of the Eagle Ford in Brazos County, and several days later it acquired a second position from the company in southeastern Robertson County.

In general, the Eagle Ford thickens to the east. The gross thickness over Hawkwood’s acreage is roughly 300 to 400 feet, topping out at nearly 1,000 feet into Madison County. The company’s Eagle Ford area is separated from the primary body of the South Texas Eagle Ford by the San Marcos Arch. Strong similarities exist between both areas in terms of depth and lithology, Oenbring said, but in Hawkwood’s acreage to the east, the clay content is higher, the 25% to 40% range indicating less carbonate present than in the south.

The resulting shale and stability issues have provoked the use of an intermediate casing string in certain areas as needed and greater frack jobs compared to nearby areas like the Woodbine, in the range of 2,000 to 2,500 pounds per foot of proppant. Hawkwood is contemplating going even higher, as competitors in the area have experienced “really good results at up to 3,500 pounds per foot. We are seriously considering that in our upcoming wells.” Multiple benches in the area are considered targets for exploitation; Hawkwood is poised to branch out from its primary bench to “at least two others we think are prospective.”

At the time of Hawkwood’s entrance into the play, the wells in the area had EUR of 280 thousand barrels of oil equivalent (Mboe). Now, the company feels “reasonably comfortable that we can consistently drill” wells with EUR of 400 Mboe and higher, Oenbring said. Its last two wells averaged 465 Mboe.

Utilizing less gel in fracks, refining the landing zones slightly higher in the section and increasing proppant loading have spurred most of the improvements, he said. “At $6.2 million drilling and completion costs and 465 Mboe EUR, we can make solidly economic wells at today’s prices.”

The 60% cost reductions in D&C costs achieved in both the Woodbine and East Texas Eagle Ford “are sustainable due to process changes,” but the permanence of cost reductions owed to service companies are shakier, he said. In order to help “mitigate that service cost increase when activity picks back up, we’re drilling our wells with rotary steerables,” Oenbring said, unlike many competitors in the area.

“Our historical drilling has been a challenge, and our costs have been inconsistent in that area, but recent wells have been better,” Oenbring said. “We feel confident that we can drill these wells at $6 million.

Recommended Reading

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Baker Hughes Wins Contracts for Woodside’s Louisiana LNG Project

2024-12-30 - Bechtel has ordered gas technology equipment from Baker Hughes for the first phase of Woodside Energy Group’s Louisiana LNG development.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

E&P Consolidation Ripples Through Energy Finance Providers

2024-11-29 - Panel: The pool of financial companies catering to oil and gas companies has shrunk along with the number of E&Ps.

Origis Secures $1B in New Investments from Brookfield, Antin

2025-01-15 - Brookfield Asset Management is joining Origis Energy’s investor group alongside existing investor and majority owner Antin Infrastructure Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.