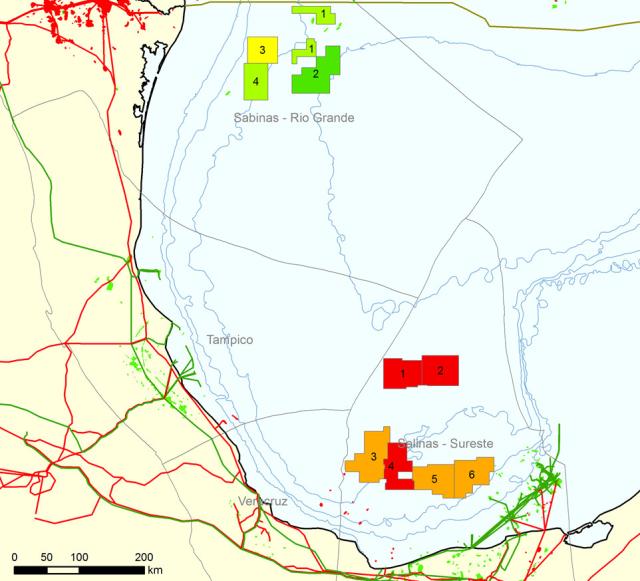

This heat map shows the volume potential of the Perdido and Salinas area blocks. (Source: Petroleum Edge, EV2; CNH)

Oil and gas exploration has always had a strong element of risk, not only in terms of making a discovery but also due to fluctuating product prices and ever-changing geopolitics. Many variables influence the potential value of a hydrocarbon discovery, and the evaluation of exploration acreage for investment decisions is always complicated by the limited amount of data available. The value of a prospect is not necessarily related to its volume, especially in today’s volatile economic and political environments. So the need to understand and quantify the geologic risks and carefully model the complexities of petroleum economics is imperative.

EV2 is an exploration valuation platform that has been designed to assist in this decision-making process. It has been jointly developed by CGG and Wood Mackenzie to provide an independent, transparent and consistent analysis of undrilled acreage. EV2 uses the latest economic data and commercial insight from Wood Mackenzie combined with Robertson’s geologic knowledge and expertise within CGG’s GeoConsulting group to provide a user-friendly economic modeling tool. Currently it contains block-level geologic risk, volume and value data for more than 100 prospective basins and 700 geologic plays, and this will increase to more than 180 basins and 1,000 geologic plays to provide a global assessment tool for exploration.

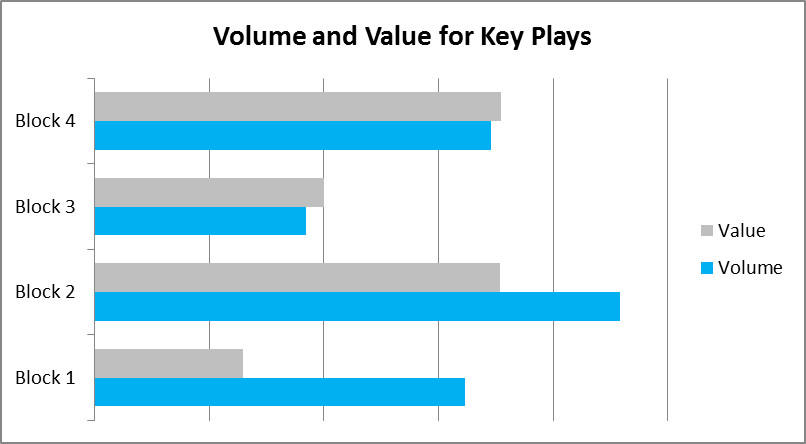

Relative pretax valuations are lower in blocks 1 and 2 because of their water depths. (Source: Petroleum Edge, EV2)

EV2 allows geologic assumptions to be changed to accommodate different views of play risk or lead density. Scenarios can be tested to provide a range of possible outcomes so that budgets and resources can be planned. Play and basin metrics can be compared in a transparent and objective manner to evaluate corporate portfolios for petroleum economists and financial institutions.

Where additional proprietary information is available, this can be used to edit the underlying geologic assumptions in EV2 to refine the baseline volumetric assessments. This enables users to create their own customized scenarios quickly in a confidential in-house environment and to maximize their competitive advantage. The platform provides the means for new ventures and exploration teams to compare prospects in a consistent manner to guide license round screening and farm-in evaluation.

Evaluation of the exploration acreage that was recently on offer in Mexico’s Licensing Round One provides a good example of how using EV2 for the fast assessment of potential volume and value can give valuable insights to participants and interested parties.

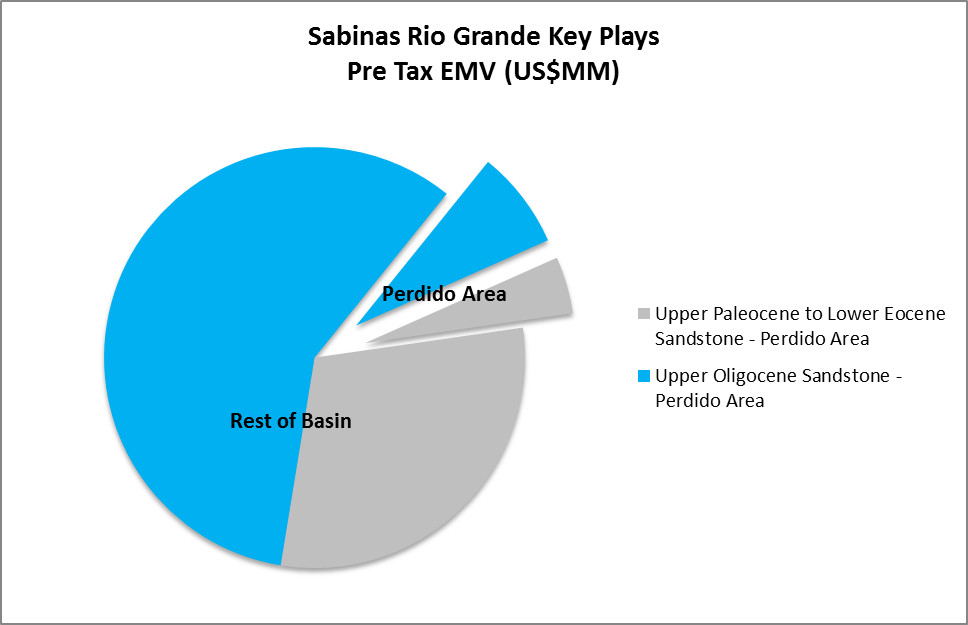

The EV2 data for the Sabinas-Rio Grande Basin identify eight geologic plays based on the interpretation of a number of data sources by CGG Robertson’s regional experts. Most of the yet-to-find reserves (more than 80%) are expected to be found in the Upper Oligocene, Lower Oligocene and Upper Paleocene to Lower Eocene plays. The platform identifies the most exciting play to be the Upper Paleocene to Lower Eocene, with potential volumes of between 6 Bboe and 10 Bboe estimated.

Considering the blocks on offer in the Mexican deepwater licensing round, the Perdido area blocks within the Sabinas Rio Grande Basin have been assessed as having the greater volume potential vis-à-vis the Salinas Area blocks.

Perdido and Salinas area blocks

The greater prospectivity in the Perdido area is reflected in the bidding within the licensing round, with successful bidders in these blocks due to drill five out of the eight wells committed to in the round. All the blocks on offer in the Perdido area were licensed, while there were no bids on Block 2 and Block 6 of the Salinas Area.

However, value depends on more than just volume, and EV2 enables pretax and post-tax expected monetary values to be assessed at various price scenarios so that economic attractiveness can be quickly evaluated. An assessment of the Sabinas-Rio Grande Basin reveals that the Upper Oligocene play has greater value creation potential than the Upper Paleocene to Lower Eocene play as a result of lower expected development costs.

EV2 provides an understanding of how all the plays intersect with the license blocks on offer, and the mapping can guide further efforts in analyzing opportunities. Comparing pretax expected monetary values vs. volumes of the Perdido area blocks for the two most interesting plays highlights that volumes and values do not have a linear relationship. Pretax valuations are somewhat lower in blocks 1 and 2 due to likely higher costs resulting from their deeper water locations compared to blocks 3 and 4.

More than 80% of the Sabinas Rio Grande Basin volumes and value are in open acreage. (Source: Petroleum Edge, EV2)

Focusing on post-tax valuations and assuming a 10% additional royalty in all blocks for a clear comparison, the EV2 results show the Upper Paleocene to Lower Eocene will, in the mean statistical case, be sub-commercial in these deepwater blocks under the base case assumptions. The Middle Eocene also has been determined to be sub-commercial. Of the remaining six commercial plays, the Upper Oligocene will likely be the standout play from a valuation perspective.

Following on from this a priori analysis, it is useful to provide a contrast to the actual results of bidding in the Perdido area as individual company strategic considerations are an important driver. Generally, companies in a strong financial position will be looking to take on countercyclical investments in exploration acreage motivated by their existing portfolios and exploration strategy. Apparent from the round is the aggressive bidding of Asian national oil companies, reflecting an eagerness to secure a foothold as they face a long-term growth challenge. Blocks 1 and 2 in the Perdido area received additional royalty bids of 15% and 17%, respectively, from CNOOC, with work unit commitments of two wells in Block 1 and one well in Block 2. The majors also have been active, bidding in consortia but less aggressively, perhaps as a result of already large portfolios and muted price expectations. None of the consortia involving Chevron, ExxonMobil and Total in the Perdido area exceeded an 8% royalty bid. This mixture of strategic considerations, combined with EV2 value and volumetric outputs, makes for valuable insight into the risks and likely rewards from the first Mexican deepwater bid round.

Looking to future bid rounds, the potential of Mexican exploration acreage is not in doubt. Under the base case assumptions EV2 results show that more than 80% of the Sabinas Rio Grande Basin volumes and values are in open acreage. As more work is done on the blocks and more data are acquired, extra information can be incorporated into the platform to give additional insight to those owning the new data.

This fast but rigorous evaluation demonstrates that EV2 can be used to analyze exploration acreage and provide information to new ventures teams as well as all interested analysts in government and financial services. The flexibility of the platform, enabling assumptions to be changed and different scenarios to be tested, provides answers quickly for informed decision-making.

Recommended Reading

Arc Resources to Supply Exxon with LNG Offtake from Cedar LNG

2025-03-11 - Exxon Mobil Asia Pacific Pte. Ltd. has agreed to buy 1.5 million tonnes per annum of ARC Resources’ LNG offtake from the Cedar LNG Project when the facility begins commercial operations.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Westgate Energy Adds to Mannville Stack Assets in Canada

2025-03-11 - Westgate Energy Inc. is buying Mannville Stack-focused assets in Alberta for CA$7 million from an undisclosed private oil and gas company.

HIF Global Receives First US Approval for E-Fuels Design Pathway

2025-03-11 - Houston-based HIF Global, which develops projects focused on producing fuels with renewable energy, has won U.S. approval for an e-fuels pathway certification.

Smackover Lithium Derisks Direct Lithium Extraction Technology

2025-03-11 - With the completion of a final field test, the Smackover Lithium joint venture's direct lithium extraction technology moves toward commercialization, Standard Lithium says.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.