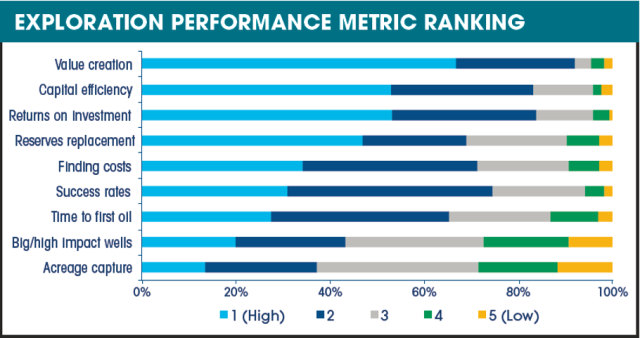

The industry is placing a great deal of importance on value creation, capital efficiency and return on investment. (Source: Wood Mackenzie)

Oil and gas operators are in kind of a Catch-22 right now when it comes to exploration. On the one hand, statistics show that global demand will continue to grow and that fossil fuels will be expected to fill most of that demand in the foreseeable future. On the other hand, cash is a bit tight, and commodity prices remain stubbornly low. Being good future stewards can come at a heavy near-term cost.

With this dilemma in mind, Wood Mackenzie recently conducted its annual “Future of Exploration” survey. The company interviewed more than 200 senior industry leaders and professionals worldwide to obtain their views on the role of exploration vs. other growth options, the approaches that companies are taking and the challenges that need to be overcome.

Several key messages were uncovered this year:

- Conventional exploration and increased recovery from existing assets are the top resource capture options;

- Value creation remains the most important metric to demonstrate performance, followed by capital efficiency and return on investment;

- Most companies have increased their focus on lowcost opportunities so far this year, but national oil companies (NOCs) put more emphasis on growth and higher exploration impact;

- The short-term focus remains in mature basins for high-margin, low-cost and near-field prospects away from deepwater and frontier basins;

- Budget constraint is still the top issue, with opportunity availability and portfolio strength beginning to increase in importance; and

- Most think unconventional exploration needs further price support.

Respondents were asked to rate conventional exploration as a resource capture option compared to increased recovery, mergers and acquisitions (M&A), discovered resource access and unconventional exploration. While conventional exploration was by far the first choice for primary resource capture, increased recovery, M&A and discovered resource access rated highly as secondary and tertiary methods.

Tactics differ based on the size of the company. When asked how their exploration tactics have changed from 2016 to 2017, the majors, large-capital and mid-capital companies all noted a shift to low upfront cost opportunities, while NOCs shifted to high-impact opportunities, a focus on license extensions and renegotiation, and the opportunity to increase their exploration portfolio. Small-capital companies have mostly shifted their strategy to focus on their existing licenses.

Companies were ranked on several criteria, including a consistent track record and success rate; their appetite for risk and the ability to open new plays; their technical knowledge and ability; their portfolio strategy; their commitment to exploration; their focus on capabilities and key strengths; and their large-volume discoveries. Leading the pack was Eni, followed by Anadarko, Kosmos, ExxonMobil, Lundin, Tullow Oil, Shell, Statoil, Cairn and BP.

Contact the author at rduey@hartenergy.com.

Recommended Reading

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Phillips 66 Urges Shareholders to Vote Against Elliott at Annual Meeting

2025-04-08 - Phillips 66’s board of directors is again pushing against one of its largest investors—Elliott Investment Management—with a letter to shareholders detailing how to vote against the investment company at its upcoming annual meeting.

NRG’s President of Consumer Rasesh Patel to Retire

2025-04-07 - NRG Energy anticipates naming a successor during the second quarter. Patel will remain in an advisory role during the transition.

PE Firm Andros Capital Partners Closes $1 Billion Energy Fund

2025-04-07 - Andros Capital Partners maintains a flexible investment mandate, allowing the firm to invest opportunistically across the capital structure in both public and private equity or debt securities.

BKV Appoints Dilanka Seimon to New Chief Commercial Officer Position

2025-04-03 - BKV Corp. has created a new chief commercial officer position and placed industry veteran Dilanka Seimon in the role.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.