Regina Balderas is the EY Americas Oil & Gas and Chemicals Strategy and Transactions Leader. Heith Rothman is a principal at EY-Parthenon in the Strategy and Transactions Practice. Sean Heinroth is a principal at EY-Parthenon in the Strategy and Transactions Practice.

With a change in administrations, it is natural for dealmaking activity to take a pause as the industry assesses both the economic and political climate. For oil and gas companies, however, transactions could pick up quickly owing to three factors which have underpinned the strong M&A market over the past two years.

Pricing outlooks pave path for M&A

While headlines may continue to add volatility in day-to-day trading, the sector enters 2025 with a relatively positive outlook for medium-term oil and international gas prices. This consensus on longer-term price expectations—which have more of an impact on strategic decision-making around acquisitions—creates a positive outlook for M&A as bid and ask valuations should stay roughly synchronized. This alignment will allow deal flow to continue.

Inorganic growth fuels cost advantages in core business

As detailed in this year’s annual study of U.S. oil and gas production and reserves, focusing on building out core areas of growth enables companies to expand production, add reserves and keep cost increases at or below the levels of prevailing general inflation.

Consolidation is critical and is likely to continue to deliver improvements, efficiency and value throughout 2025.

Although many of the deals announced in recent years are complex and involve global portfolios of assets, each transaction included a core value driver around consolidation in the unconventional space. This consolidation offers the opportunity to optimize operations and implement technology.

Additionally, the scale of these enterprise deals will spur further M&A activity as the evaluation of the new portfolio unveils assets that are no longer core to the future business. Inorganic growth will continue to be a go-to-method for oil and gas companies to capture cost advantages and deliver returns.

Sector M&A firepower

The oil and gas sector has built up firepower, meaning the ability of companies in the sector to fund transactions from their balance sheet.

The EY Strategy and Transactions practice measures firepower by examining a company’s cash position, market capitalization and debt positioning. For oil and gas companies, rising oil prices have helped increase revenues and valuations, driving up their firepower. The sector experienced a wave of megadeals in 2023 and 2024, with only a recent slowing, which was expected as dealmakers awaited both the U.S. election outcome and signals from the new administration concerning its appetite for further consolidation.

RELATED

As Permian Targets Grow Scarce, 3Q M&A Drops to $12B—Enverus

It is likely that deal activity will resume relatively quickly—further spurred by a perception of fewer regulatory hurdles to getting deals approved, encouraging a broader range of participants. Recent and expected interest rate cuts add to this expectation, but the opportunities are not the same for all players.

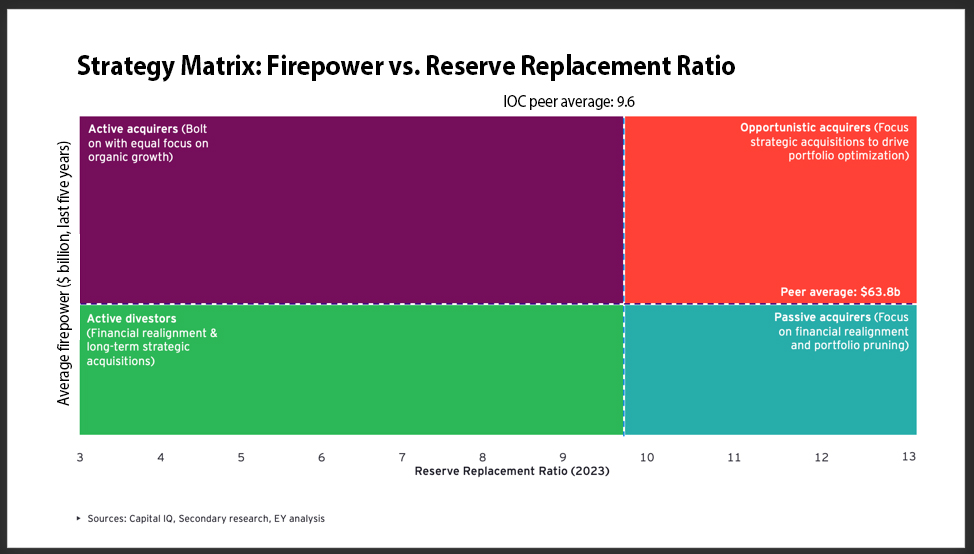

Firepower represents the ability to execute deals, but recent growth trends also underscore the need for more activity. The intersection of these two trends defines four zones.

Companies that have seen relatively weaker recent performance and have low firepower are in a zone where active divestments should be part of their strategic thinking. These companies need to undertake financial realignment to increase their ability to undertake longer-term strategic acquisitions.

Companies with higher firepower but that are lagging their peers in terms of performance populate the active acquisition zone, where companies should be equally focused on organic growth and bolt-on acquisitions. They have the firepower but need growth opportunities.

The passive zone is defined by companies with good performance, but weaker firepower. The balance sheet needs to be addressed, but acquisitions able to enhance cash flow in particular will be targeted.

Companies with both strong recent performance and a high level of firepower define the zone of opportunity, where companies can take advantage of strategic acquisitions that may appear.

There are situations in which, despite having low firepower, some firms need to execute large deals. This doesn’t mean those companies are incapable of making strategic acquisitions, but they will be challenged to do it from the balance sheet, requiring different deal structures, or more complex transactions.

RELATED

Industry Consolidation Reshapes List of Top 100 Private Producers in the Lower 48

Subsector outlook

For 2025, the subsectors of oil and gas will see different M&A activity levels and motivations:

Upstream companies—Strategic acquisitions in this subsector have been motivated by a desire to boost competitiveness, access reserves, focus on operational efficiency and stakeholder benefits. While dealmaking in the prolific Permian Basin is making this the domain of deep-pocketed, large producers, independents are also driving a push to increased activity beyond the Permian. U.S. natural gas assets remain attractive due to the potential for LNG exports to meet Europe’s demand.

Notably, international oil companies (IOCs) account for more than 50% of the industry firepower, so there is an expectation these players will continue to target both traditional assets and new green technologies such as carbon capture and hydrogen. On the other hand, pure-play independents, particularly those with large U.S. shale acreages, are attractive targets for their ability to enhance competitiveness and gain access to reserves.

Midstream companies have historically accounted for about a quarter of oil and gas sector deals despite already being consolidated. Looking ahead, the subsector will be impacted by continued upstream integrating into downstream operations to secure offtake and may see further consolidation within its own as midsized players combine to achieve scaled economies.

RELATED

Midstream M&A Adjusts After E&Ps’ Rampant Permian Consolidation

Downstream companies have trended toward consolidation to enhance operational efficiencies, but current pressure on refining margins and economics is having a dampening effect on firepower. Deals in 2025 will likely be prompted by moves to adapt to shifting consumption patterns, efficiency and sustainability.

Oilfield services companies have been tremendously impacted by the consolidation in the U.S. upstream subsector, but this has been somewhat offset by stronger performances in offshore and international business. Overall oil and gas capex in 2025 is expected to rise 4%, further bolstering oilfield equipment and services firepower, and M&A will be driven by the need for scale, competitive cost structures and access to capital.

RELATED

As Upstream M&A Settles, Oilfield Services Gear Up for More Deals

In oil and gas, discipline has differentiated this current wave of consolidation from previous merger activity. This trend is expected to continue as companies determine what to retain and what to spin-off as non-core, which is allowing other players in turn to consolidate their own positions in those “non-core” areas.

Recommended Reading

Williams to Invest $1.6B for On-Site Power Project with Mystery Company

2025-03-07 - Williams Cos. did not name the customer or the location of the power project in a regulatory filing.

FERC Reinstates Permit for Williams’ Mid-Atlantic Project

2025-01-27 - The Federal Energy Regulatory Commission’s latest move allows Williams’ Transco natural gas network to continue operations after a D.C. court shot down the expansion plan.

Williams Commissions Two NatGas Projects to Expand Transco Network

2025-04-01 - Midstream company Williams Cos. added to its network capacity in the southern U.S. with the commissioning of the Southeast Energy Connector and the Texas to Louisiana Energy Pathway.

Williams’ CEO: Pipeline Permitting Costs Twice as Much as Steel

2025-03-12 - Williams Cos. CEO Alan Armstrong said U.S. states with friendlier permitting polices, including Texas, Louisiana and Wyoming, have a major advantage as AI infrastructure develops.

DC Circuit Denies Rehearing for Williams’ Mid-Atlantic Project

2025-01-23 - Williams Cos.’ Regional Energy Access will continue operating as the midstream company seeks an emergency FERC certificate to keep supplying natural gas to Pennsylvania, New Jersey and Maryland.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.