As this is being written, we are in a period of great uncertainty. How far will oil and gas prices fall? When will they stabilize? How fast will the transaction market rebound from the deep freeze of November and December 2014? These are questions that sellers, buyers and bankers are asking.

Most have seen this movie before: Commodity prices plummeting due to supply/demand concerns, as well as other geopolitical factors.

Market analysts can always point to why this time is different from the last. We believe it always is a bit different, because of the variety of factors that come into play, including high oil inventories, weak global demand, a strong U.S. dollar and Saudi Arabia’s commitment to hold the line on production.

The transaction market in 2014 started slowly in the first quarter, but took off with a vengeance in the second and third quarters, with a trajectory to be a record year. As oil prices began to plunge in the fourth quarter, activity fell off a cliff and many deals in progress were re-traded. Everyone tried to predict how low it would go.

For a brief period, it looked like natural gas was the safe haven, but pressures have also mounted on oil’s sister commodity. Oil continued to fall into the middle of January, although as the end of January approached, oil began to show some resilience in the high-$40-per-barrel range.

As the new year emerged, the phone began ringing with companies anxious to get into what they see as a bountiful buyer’s market. They want to see every deal. Some of these companies include new entities with fresh private equity eager to put acquisition capital to work.

In addition, international investors, utilities and industrials have emerged once again, and are willing to step back into the sector. Sellers, however, are being patient, not as anxious to transact in a commodity market at five- to six-year lows. Buyers will need to be patient and wait until prices stabilize and sellers get comfortable with the new price environment and transaction metrics, which will certainly be reset.

When the price collapse is no longer the hot topic of discussion, we will get back to business in the property transaction market. This could potentially be three to six months.

We do expect to see some sales in the interim. Some of these are already occurring and include deals that were already in process but were re-traded to better match current market conditions.

Other deals expected to come to market include distressed sales or discretionary decisions to strategically sell to right-size the balance sheet and to plug gaps in capex budgets. Although cash will be tight, banks will be patient with their credit clients, and sellers will look for ways to extend and hold on for better prices. Restructuring groups will be at the ready, as some companies may not be successful in waiting out the cycle.

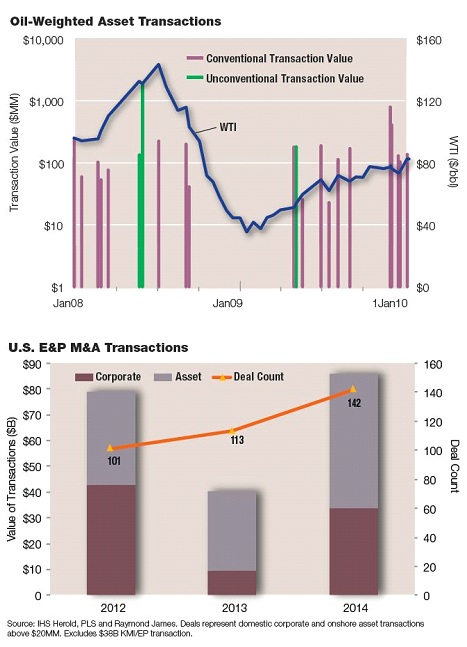

The accompanying chart may provide some comfort that the oil transaction market does not sit still for very long. Going back as far as late 2004, the number and size of transactions only slowed for very short periods of time, except for the one we all remember—2008—which took approximately eight months to recover. The good news is that the market came back dramatically as soon as there was an uptick in prices.

Eventually, bid-ask spreads will converge. The question is when.

Contact the author, Chris Simon, Raymond James, at chris.simon@raymondjames.com.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.