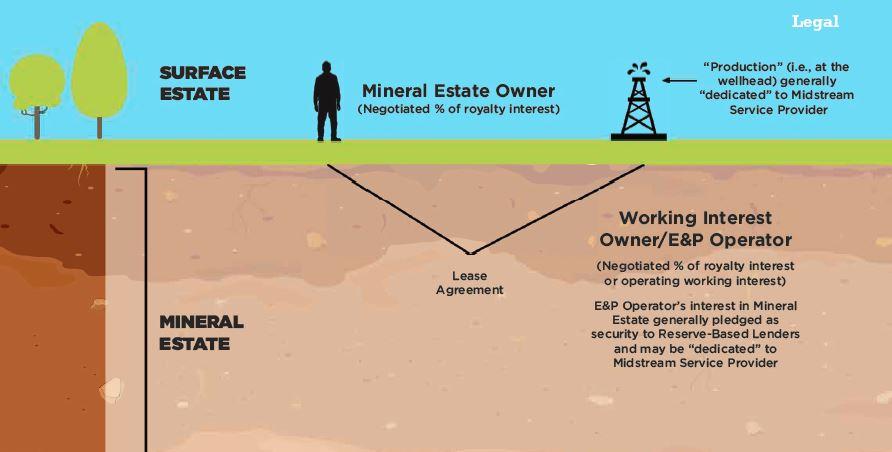

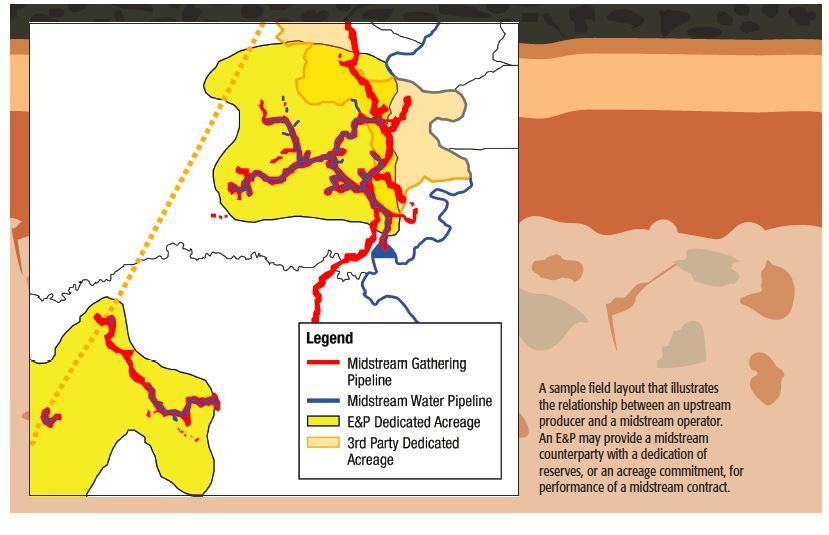

Exploration and production companies typically enter into wellhead service contracts with midstream operators for gathering, processing and transportation services. In exchange, the E&P may provide the midstream counterparty with a dedication of reserves or acreage commitment for performance of these midstream contracts. A dedication of reserves is intended to assure an adequate utilization of gathering and pipeine systems and is often accompanied by a hydrocarbon purchase contract between the E&P and the midstream service provider.

In many cases, midstream contracts also include a minimum volume commitment (MVC) of oil or gas that is produced and processed from the land on which the E&P operates, which requires the E&P to pay a fixed fee to the midstream service provider if volume requirements are not met.

Creditors of, and potential investors in, both the E&P and the midstream service provider should analyze the precise language and mechanics in the relevant party’s midstream contracts because the provisions relating to dedication and MVCs will be significant in

determining whether or not the midstream contract can be rejected and how the midstream contract claim will be treated in an E&P bankruptcy case.

determining whether or not the midstream contract can be rejected and how the midstream contract claim will be treated in an E&P bankruptcy case.

While case law addressing the treatment of midstream agreements is unclear and incomplete—and the outcome in each case is fact-specific and dependent on state law where it is heard—recent bankruptcy case developments, for example Sabine Oil & Gas Corp. and In re Quicksilver Resources Inc., provide some measure of guidance for creditors and investors. Ultimately, the legal analysis of whether a midstream contract can be rejected must be incorporated into an economic analysis of these contracts and the alternatives available to the E&P and midstream service provider.

What’s at stake?

Midstream providers have argued that midstream contracts with acreage dedications and language identifying such interests as “covenants that run with the land” are not property of the E&P’s bankruptcy estate and not capable of being rejected as an executory contract. If midstream providers are correct, they would have significant leverage in renegotiating the terms of services with E&Ps, and the resulting decrease in the size of asset pool available for the E&P’s creditors could lead to substantially diminished recoveries.

In response, E&Ps and their creditors have argued that dedications merely create for a service provider a contractual interest that may be rejected in bankruptcy, resulting in a prepetition general unsecured claim for the damages flowing from rejection.

The dedication language and mechanics of a midstream contract can be granular and esoteric, but they require careful analysis given their potential implications in a bankruptcy case. To illustrate, based on Texas law— where oil or gas in the ground is real property but once separated from the earth, becomes personal property—a provision that purports to dedicate an interest in the E&P’s oil or gas “in place” (in the ground) would seem to create a covenant running with the land, whereas one dedicating an interest in its oil or gas “as and when produced” (at the surface or wellhead) may be read by a court to create a mere contractual interest.

To determine whether or not midstream contracts are executory agreements that can be rejected, a bankruptcy court will likely consider numerous factors, including:

- The parties’ expressed intent to create (or not create) a conveyance of a real property interest or covenant that runs with the land;

- The point at which such interest is deemed fully vested;

- Real property filings recorded or agreed to be recorded;

- Holder(s) of title to production;

- Rights to control and risk for losses;

- Definition of the dedicated interests (i.e., minerals in place, production or both);

- The E&P’s right to sell or transfer minerals and leases with or without binding successors and assigns; and

- The existence of MVCs.

Priority of dedication

Secured creditors to E&Ps historically may have given little thought to the possibility of competing claims by midstream providers because it was generally accepted by market participants that any such claims would be junior to the secured creditors’ claims in the E&P’s bankruptcy case. Recently, however, some midstream providers have argued that, even though no transfer of any interest in the debtor’s mineral estate took place, the dedications in their contracts are actually real property interests or covenants running with the land that are not subject to the preexisting liens or claims of any of the debtor’s other creditors and should receive payment—in amounts calculated based on any MVC and remaining contract term—prior to any cash flowing into the creditor waterfall, or be afforded an elevated payment priority in the E&P’s bankruptcy.

A distressed E&P may determine that its midstream contracts render development of its assets uneconomical, especially where such a contract includes an MVC that is not being satisfied or is too expensive. Under Section 365 of the U.S. Bankruptcy Code, an E&P debtor has the ability to reject executory contracts. Rejection means that the E&P debtor may, with the bankruptcy court’s approval, choose to stop performing under the contract, leaving the counterparty with a prepetition unsecured damages claim that will be paid pro rata with other unsecured creditors.

A covenant running with the land, however, is treated as attached to the underlying real property, and therefore may not be capable of being rejected. A dedication that is deemed to be a covenant running with the land could thus dilute other creditors’ recoveries, potentially including those of senior secured claims, by siphoning value from the mineral estate.

Unsettled case law

The case law regarding interpretation of dedication provisions—whether as real property interests, a covenant that runs within the land, some type of senior interest or mere contractual rights—is unsettled, and some dedications may not fit neatly into a single category. Even if it appears in the express terms of the document, and real property records indicate that an interest in the mineral estate or leases has been conveyed by dedication, it may be that a dedication is not one of the state-law-recognized ways of transferring such an interest and, accordingly, that no such interest has, in actuality, been transferred.

The inclusion of MVCs may make a midstream contract more prone to rejection if the E&P is unable to satisfy the MVC, thereby forcing the E&P to pay additional fees when it is not meeting the minimum volume. MVCs also may be viewed as inconsistent with a real property interest or covenants running with the land, as the credit support they provide may be viewed as less consistent with transfers of the risks associated with ownership and more consistent with an unsecured borrowing.

Breakdown of claims

Timing and use of a gathering system also impact a midstream provider’s potential claim against an E&P debtor. A midstream contract claim may arise from activity or damages that accrued:

- From utilization of a gathering system before the Chapter 11 petition was filed, which gives rise to a prepetition unsecured claim;

- In connection with rejection of a contract, for the remaining term of the contract and MVC fees (e.g., from an E&P debtor’s rejection of a midstream contract, which gives rise to a prepetition damages claim); or

- From an E&P debtor’s post-petition utilization of the midstream provider’s services, which may give rise to a higher priority administrative claim.

A prepetition claim may arise for as-yet-unpaid-for services rendered by the midstream provider and generally will share in the recovery pool pro rata with other unsecured creditors. A rejection damages claim would arise after a midstream contract is rejected, as discussed above, and would also result in a prepetition general unsecured claim for damages flowing from the rejection and established by the counterparty in an amount reflecting the total remaining value due under the contract.

A post-petition administrative claim, on the other hand, may arise after a debtor utilizes the services of the midstream provider during the pendency of its bankruptcy case. Valid post-petition administrative claims must be paid in full in cash before any plan of reorganization can be confirmed, thereby ensur-ing that the midstream provider receives payment ahead of general unsecured creditors and potentially diluting their recovery pool.

The Sabine case

Midstream contract rejection was recently litigated in the Sabine bankruptcy case. In Sabine, the debtors filed a motion to reject two gathering agreements. Nordheim Eagle Ford Gathering LLC and HPIP Gonzales Holdings LLC, the gatherer counterparties, opposed rejection on the basis that their contracts contained covenants that ran with the land and were not capable of being rejected. The gatherer counterparties relied heavily on the U.S. Court of Appeals for the Fifth Circuit’s decision in In re Energytec Inc., which held that certain interests securing fees owed to an affiliate of the seller of a gas pipeline were covenants running with the land and therefore could not be rejected.

On March 8, 2016, Bankruptcy Judge Shelley Chapman issued an opinion and order approving the debtors’ motion to reject the midstream gathering agreements with the gatherer counterparties. Judge Chapman’s analysis focused largely on covenants running with the land—an area of law that she referred to as an “unspeakable quagmire” that extended as far back as 1583 English common law. Judge Chapman also distinguished the Energytec case and noted that the agreements with the gatherer counterparties did not convey any of the five traditional real property rights within the mineral estate recognized in Texas.

State law application

The issue of whether or not  the contract creates a real property interest is governed not by bankruptcy law but by applicable state law. Often that is Texas law, which provides that a covenant running with the land is not created simply by being denominated as one in a contract. Instead, under Texas law, a covenant runs with the land when:

the contract creates a real property interest is governed not by bankruptcy law but by applicable state law. Often that is Texas law, which provides that a covenant running with the land is not created simply by being denominated as one in a contract. Instead, under Texas law, a covenant runs with the land when:

1. There is “privity” of the estate;

2. It touches and concerns the land;

3. It relates to a thing in existence or specifically binds the parties and their assigns;

4. It is intended by the original parties to run with the land; and

5. The successor to the burden has notice.

Of course, Texas law does not apply in other states; each state has its own statutes and case law that require tailored consideration. Nonetheless, an analysis of the required elements in Texas for a covenant that runs with the land is instructive for investors and creditors that wish to evaluate the like-lihood of a dilution in the value of their claims against an E&P debtor. The first, second, and fourth elements above are likely to be the most heavily contested.

Defining privity

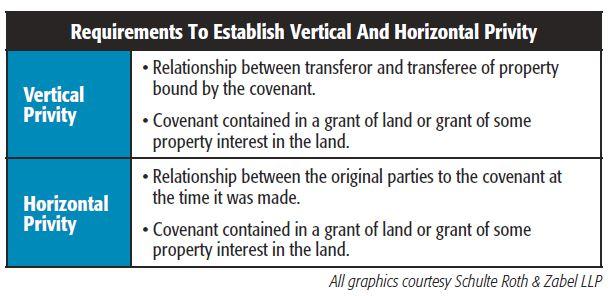

The Texas Supreme Court has held that privity of the estate is required for a covenant to run with the land. However, the court has not clarified whether this “privity” requirement refers solely to “vertical privity,” or whether “horizontal privity” is required as well.

Horizontal privity requires a relationship between the original parties to a covenant at the time the covenant was made. According to Judge Chapman, horizontal privity generally means that there are “‘simultaneous existing interests or mutual privity’ between the original covenanting parties as either landlord and tenant or grantor and grantee.” Such a relationship may be created by a grant of a legally recognized interest in real property; the covenant takes the form of a promise made by the recipient of that interest.

Vertical privity, on the other hand, requires a successor relationship between a transferor and transferee of a property bound by a covenant.

Texas intermediate appellate courts have interpreted the privity requirement to include both vertical and horizontal privity, holding that “for a covenant to run with the land, the covenant must be made, and must be contained in a grant of land or in a grant of some property interest in the land.” In the Energytec case, however, the Fifth Circuit cast some doubt on the viability of the horizontal privity doctrine, noting that it was guided, but not bound, by the decisions of these intermediate courts.

Nonetheless, in Sabine, Judge Chapman noted, “Many courts have also required that the parties have horizontal privity of estate. Neither Nordheim nor HPIP has identified any governing authority that has rejected the horizontal privity requirement, and so the court has considered the issue of horizontal privity of estate in its analysis.” It is therefore reasonable to assume that courts may consider horizontal privity going forward.

In evaluating whether horizontal privity was present, Judge Chapman noted that the debtors did not “reserve any interest” for the gatherer counterparties, but rather, “they simply engaged Nordheim and HPIP to perform certain services related to the hydrocarbon products produced by Sabine from its property.”

Judge Chapman also noted that the agreements with the gatherer counterparties did not convey any of the five traditional real property rights within the mineral estate recognized in Texas, including the right to:

1. Develop (the right of ingress and egress);

2. Lease;

3. Receive bonus payments;

4. Receive delay rentals; and

5. Receive royalty payments.

None of these rights, according to Judge Chapman, include a right to transport or gather produced gas. Therefore under Texas law, the debtors did not transfer any portion of their real property interests to the gatherer counterparties and horizontal privity was not present.

Touching the land

The Texas Supreme Court has acknowledged that the tests used to determine whether a covenant touches and concerns the land “are far from absolute.” However, the court has noted two tests that have been applied in Texas:

1. A covenant will run with the land “if it affected the nature, quality or value of the thing demised, independently of collateral circumstances, or if it affected the mode of enjoying it;” and

2. “If the promisor’s legal relations in respect of the land in question are lessened—his legal interest as owner rendered less valuable by the promise—the burden of the covenant touches or concerns the land; if the promisee’s legal relations in respect to the land are increased—his legal interest as owner rendered more valuable by the promise—the benefit of the covenant touches and concerns the land.”

In Sabine, the gatherer counterparties alleged that the dedications touched and concerned the land because the debtors sought to use their mineral interests to produce hydrocarbons, and because market rates for gas and transportation could have rendered their mineral interests either more or less valuable. Where contracts specifically dedicate an interest in “production,” as opposed to an interest in the mineral estate, however, this argument likely will not survive scrutiny.

Judge Chapman noted that once minerals are extracted from the ground, they cease to be real prop-erty and instead become personal property. As a result, the agreements related to personal property. Because only the debtors’ personal property rights were affected, the land remained unburdened. Moreover, an E&P debtor’s reserves are often subject to the liens of their reserve-based lenders. A court may examine, as Judge Chapman did, whether such lienholders approved of a conveyance of an interest in the real property subject to such liens.

Parties’ intent

Under Texas law, the language used in an agreement is the primary evidence of intent. A valid transfer of an interest in the mineral estate requires “operative words or words of grant showing an intention of the grantor to convey an interest to the grantee.” In addition, courts “attempting to ascertain the intention of the parties … must look to the entire instrument in the light of the stated covenant.” Texas appellate courts have also held that where an agreement inures to the benefit of successors and assigns, this is suggestive (but not determinative) of an intent for a covenant to run with the land.

In Sabine, the gatherer counterparties argued that the gathering agreements expressly state that the dedications are covenants running with the land and contain provisions specifying that the agreement is enforceable by, and binding on, the parties’ successors and assigns. The Sabine debtors did not specifically dispute these arguments; rather, they simply reiterated their previous position that the debtor did not convey any interest to the counterparties in a manner recognized by state law. Ultimately, Judge Chapman did not reach an analysis of the parties’ intent, after having found that the dedications did not “(i) readily fit into the traditional paradigm for horizontal privity of estate or (ii) ‘touch and concern’ the debtors’ land.”

Whether the parties to an agreement (in Sabine or in any E&P bankruptcy) actually intended to convey a covenant running with the land may be evident from the specific interests actually conveyed. As discussed above, in Texas a mineral estate contains five interests. Bonus payments, delay rentals and royalties “have a well understood meaning in the oil and gas business” as interests in real property. The presence of several or all of these elements as part of a dedication may persuade a court that the intent of the parties was to convey an interest in the mineral estate.

Oklahoma and other states

Sabine, Energytec and other cases cited above all applied Texas law. The analysis and outcome of a dedication provision in a midstream contract may vary by state, however, and the predictability of that outcome depends on how similar the relevant state’s laws are to those of Texas.

The laws of other oil- and gas-producing states, such as Oklahoma, are similar to Texas law regarding covenants running with the land and mineral estates. For example, Oklahoma also requires that for a covenant to run with the land, there must be privity and the covenant must “touch and concern” the land.

Accordingly, one might expect bankruptcy judges applying Oklahoma law to find, as Judge Chapman did with Texas law, that dedications of produced oil and gas are not covenants running with the land. But the laws of other states, such as North Dakota, are less similar to Texas’ with respect to these issues. Under North Dakota law, covenants running with the land are generally defined by statute rather than by common law (as in Texas and Oklahoma). A “mineral interest” in North Dakota typically includes the right to sell all or part of the estate, the right to explore and develop the estate, the right to execute oil and gas leases, and the right to create fractional shares of the mineral estate.

As a result, a bankruptcy court’s disposition of a midstream contract and any dedication therein will be highly state-specific, making it difficult to generalize regarding future outcomes.

Production payments

The legal status of certain interests, such as the right to receive royalty production payments, can be particularly confounding under state law. Production payments may be construed or characterized as either conveyances of real property (true sales), or as disguised financings or borrowings that are merely contractual in nature.

Under Texas law, production payments, whether volumetric or dollar-denominated, are real property interests if they are dependent on production from the mineral estate. However, where the production payments contain provisions for minimum net volume, fixed duration, minimum interest rate thresholds and/or minimum payments due, which are not correlated with production or market risks associated with commodity prices, the contract may be recharacterized as a disguised financing (borrowings), regardless of its label.

In this regard, dedication provisions with an MVC may be somewhat analogous to certain types of production payments; whether such agreements should be characterized as real property interests or contractual obligations will be highly dependent on the terms of the agreement. If a midstream provider is entitled to payments regardless of whether oil and gas are produced from the mineral estate (from MVCs), such an agreement could be more likely to be characterized as a contractual interest that could be rejected by an E&P in bankruptcy.

‘Free and clear’

While certain contracts in Sabine were the subject of rejection litigation, the debtors acknowledged they had other midstream contracts in place with explicit language that appeared to meet all state law requirements for a dedication to be recognized as a covenant that ran with the land. As a result, the debtors did not attempt rejection. But even if a midstream contract is found to be (or contains) a covenant running with the land, an E&P debtor may still be able to sell the underlying land free and clear of that interest pursuant to Section 363(f)(5) of the Bankruptcy Code.

Under this section, a debtor may sell property of the estate free and clear of any third party’s interest in the property if “such entity could be compelled, in a legal or equitable proceeding, to accept a money satisfaction of such interest.” Based on existing case law, it is possible that a debtor could sell “free and clear” of a covenant running with the land pursuant to this section because the midstream provider could be compelled to accept money satisfaction of its interest.

The Energytec case

In Energytec, the debtor sold a pipeline that was burdened by a security interest and lien securing the debtor’s obligation to pay the transportation fee. The sale was approved by the bankruptcy court as well as by the district court on appeal, but the district court’s judgment was ultimately vacated and remanded for further proceedings. The jurisprudence remains unsettled as to when a midstream provider may be compelled to accept money satisfaction of its covenant running with the land.

The outcome of a Section 363 sale may depend heavily on the status of an E&P’s midstream contracts and any rejection damages claims. First, the resolution of midstream contract issues may provide the opportunity for a more economic agreement to be put in place, which in turn may facilitate drilling, profitability and the receipt of higher bids from any interested buyers. Second, as illustrated in the Quicksilver Resources bankruptcy case, it is less likely that a potential buyer will be willing to purchase assets that are subject to a battle over rejection damages claims; instead, the buyer may want to have midstream contract issues resolved before consummation of the sale.

In Quicksilver, the debtor commenced a process to sell substantially all of its assets via a Section 363 sale process. The winning bidder for Quicksilver’s Barnett Shale assets, Bluestone Natural Resources II LLC, conditioned its bid on the rejection of certain midstream contracts with Crestwood Midstream Partners LLP. While it is possible that the bidder and Crestwood may settle, or agree to amend and assume and assign a modified version of the midstream contract, by its actions Bluestone has made it clear it is not interested in buying into a contract rejection dispute.

The impact

Midstream contract claims may significantly impact the recovery value of a creditor’s claim against an E&P debtor’s estate, and uncertainty over treatment of midstream contracts may impair asset sale prospects. Depending on the precise language used and applicable state law, dedication provisions could be classified by a court either as mere contractual interests granted within the scope of a services agreement, or as covenants that run with the land or conveyances of real property to a third party.

Should a court reach the latter finding, secured and unsecured E&P creditors alike may face significant claim dilution.

No blanket rule

Judge Chapman’s holding in Sabine, for example, is very fact-specific and applies only to the gathering agreements (and dedications) with respect to the case’s specific gathering counterparties. She did not articulate a blanket rule of law for all midstream contracts.

Moreover, a bankruptcy court’s decisions are not binding on other bankruptcy courts—though they may be given some precedential value. Even other bankruptcy judges in the Southern District of New York are not bound by Judge Chapman’s decision because bankruptcy courts are only bound by the decisions of higher federal courts. That said, this is a white hot issue for which there is very little case law. Judge Chapman’s Sabine decision thus will likely inform the decisions of other courts examining similar issues.

Recommended Reading

Judgment Call: Ranking the Haynesville Shale’s Top E&P Producers

2025-03-03 - Companies such as Comstock Resources and Expand Energy topped rankings, based on the greatest productivity per lateral foot and other metrics— and depending on who did the scoring.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

Expand Lands 5.6-Mile Lateral in the Utica in Five Days

2025-03-11 - Expand Energy reported its Shannon Fields OHI #3H in northern West Virginia was drilled with just one bit run in some 30,000 ft.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.