In Haynes and Boone’s Spring 2024 Borrowing Base Redeterminations Survey, the oil market has found “newfound positivity’ as the natural gas market presents a more challenging picture. (Source: Shutterstock)

In the storied oil patch of the U.S., themes of great literature abound, whether it’s a fairy tale startup taken to new heights by a strapping supermajor or a dystopian look (think natural gas prices) of what’s looming on the horizon.

Now in its ninth year of taking an industry pulse on producers and those who lend them money, Haynes and Boone’s Spring 2024 Borrowing Base Redeterminations Survey (BBR) “reads a bit like the opening paragraph of ‘A Tale of Two Cities,’” the law firm’s lead author, Kraig Grahmann, said.

“It is (among) the best of times for oil producers, but the worst of times for natural gas producers,” Grahmann, a partner in the firm’s energy, power and natural resources practice, told Hart Energy.

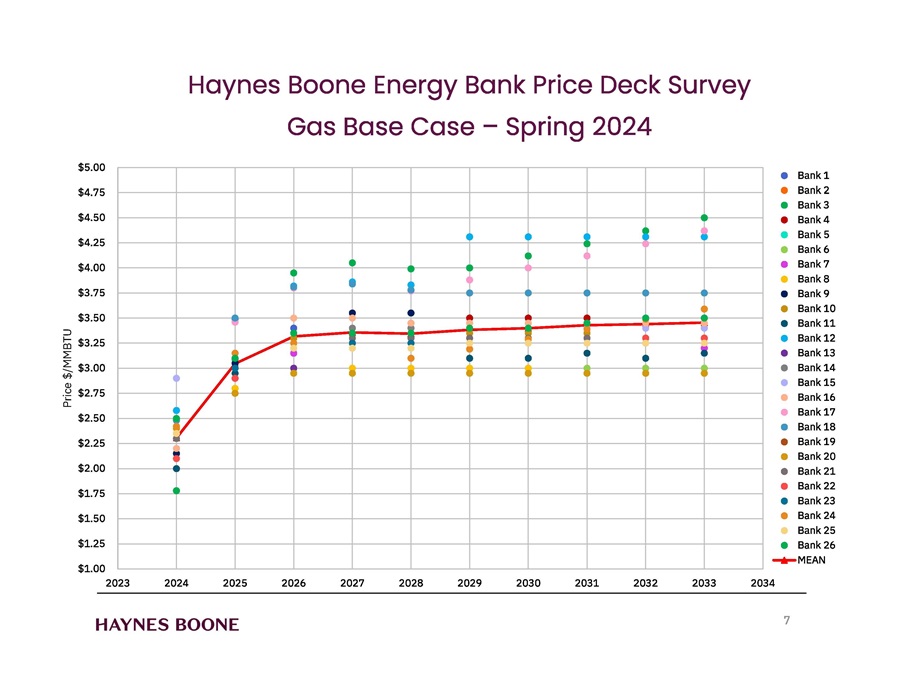

The Cliffs Notes version: The oil market has found “newfound positivity’ as the natural gas market presents a more challenging picture, with survey respondents seeing prices potentially rise to $3/MMBtu driven by rising electricity demand fueled by AI expansion.

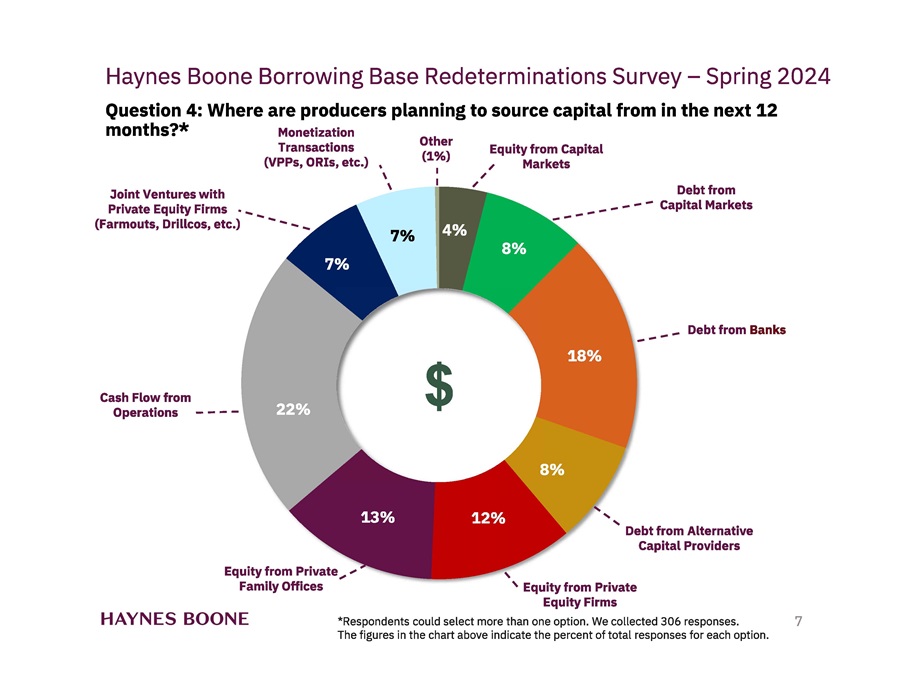

For capital needs, respondents are expecting a “meaningful drop” in the use of equity capital markets, with the shortfall being made up by increases in the use of equity from family offices and private equity.

Following the release of the BBR survey and the adjacent Energy Bank Price Deck survey, Grahmann discussed the high points of the findings and how the industry’s next chapter may take shape.

Editor’s note: The following has been edited for clarity.

Deon Daugherty, editor-in-chief, Oil and Gas Investor: What strikes you as the most important takeaways from the two surveys?

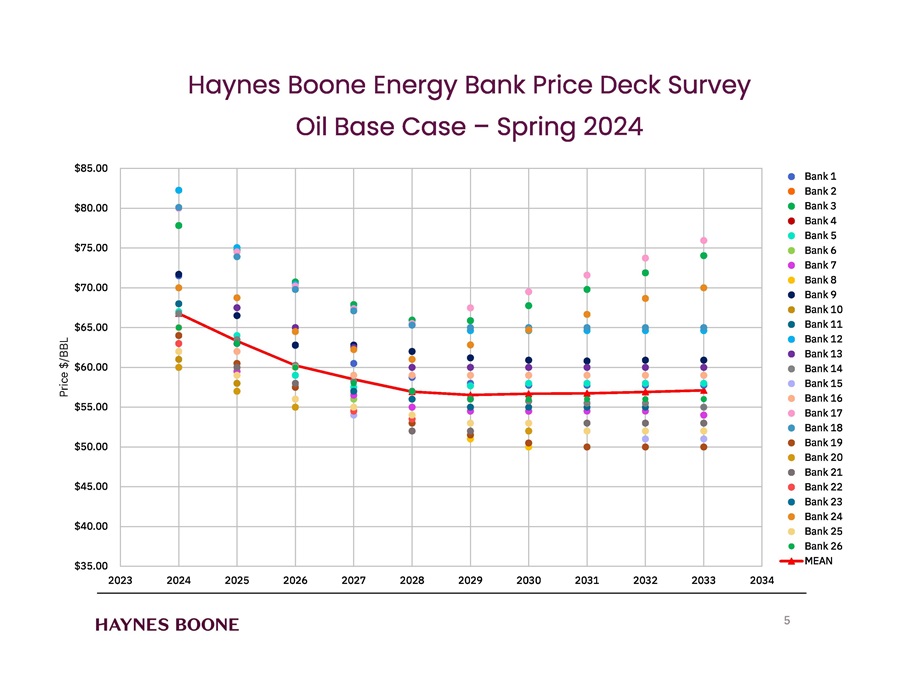

Kraig Grahmann, partner, Haynes and Boone: Oil-weighted producers are certainly receiving much more attention now from lenders and equity funders, and their capital raising prospects have improved. However, low natural gas prices are causing general pessimism in that space and hampering funding availability and deal activity. Struggling natural gas prices are also creating complexity for producers who are more evenly weighted between oil and natural gas production. Despite all of the current negativity in the natural gas space, the Energy Price Deck Survey does indicate that banks expect natural gas prices to recover in 2025.

DD: On BBR, what do you think is driving the changes in respect to expected use of equity capital markets?

KG: This sector had a couple of serious downturns in the last decade, each occurring at a time when public stockholders made up a significant portion of the capital stack. Equity is paid last in a bankruptcy, and in most instances the public equity investors walked out of the restructurings that occurred during these downturns with nothing. These experiences have made public equity investors hesitant to return—this is evidenced by the dearth in IPOs and minimal number of follow-on offerings in the upstream oil and gas space.

DD: Why are private equity firms and family offices making up the shortfall?

KG: From a cost of capital perspective, public equity is typically preferred over higher cost private equity and family office money. The use of these higher costs capital sources is driven by the lack of cheaper public equity capital. The other driving factor, at least for family offices, is that the upstream oil and gas financial model has shifted from an ‘outspend your cash flow and then sell the asset’ model to a ‘generate positive free cash flow for your investors and hold the asset’ model. Family offices often have flexibility with respect to investment horizons and seek out opportunities that generate meaningful, regular distributions. One other advantage for family offices—they rarely are subject to external pressure regarding ESG concerns.

DD: Have family offices traditionally been a big part of the mix?

KG: Given the nature of family offices, we do not have publicly available data to precisely track their investment interest in oil and gas over time. However, there are certainly family offices that have been players in the space over the last several decades. Anecdotally, we are also now coming across names we haven’t previously seen in the space, which indicates a broader family office audience than in prior decades.

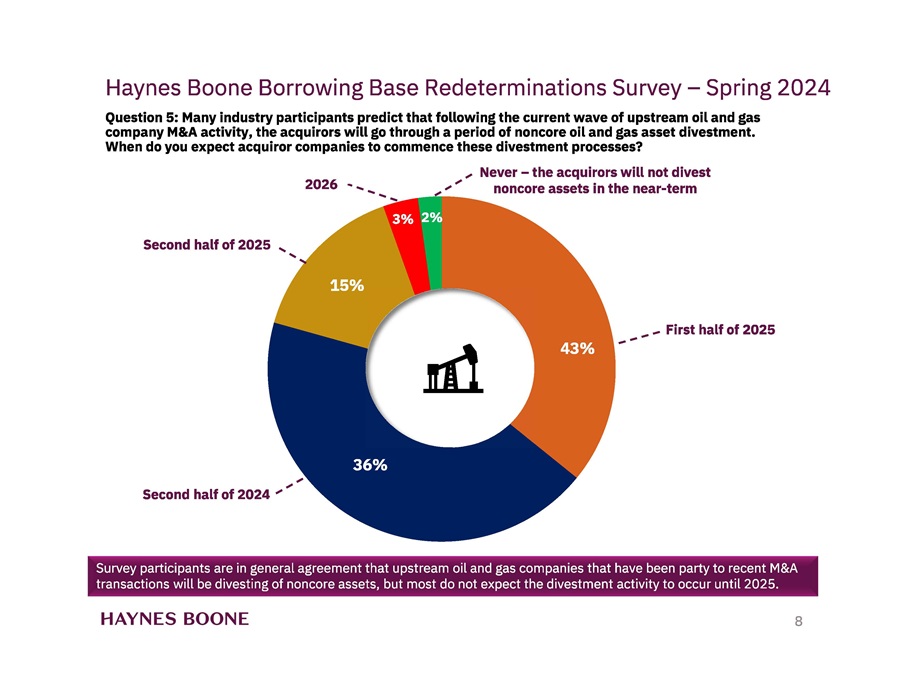

DD: What’s your estimate of how much noncore asset divestment activity is coming up?

KG: We expect a sizeable amount of activity coming up, with more of it occurring in 2025 than 2024. Many of the larger companies engaged in major M&A in 2023 and early 2024. Though most of these transactions were stock-for-stock mergers that did not require a significant leveraging up, each of them still involved assumption of indebtedness that resulted in the pro forma combined company having higher leverage than desired long-term. Noncore asset sales are an ideal way to reduce that indebtedness down to targeted levels. Additionally, the combined company will want to streamline operations to ensure that stated M&A synergies can be achieved—an asset area that made sense operationally for the acquired company doesn’t always make sense for the combined company.

DD: Which assets strike you as most likely to generate buyer interest, and why?

KG: A number of the M&A transactions had a Permian focus, which has both the Midland Basin and the Delaware Basin. The Midland Basin is generally considered more top tier, so combined companies looking to divest will probably first look to sell the Delaware Basin assets. There are a lot of management teams out there currently hunting for assets that know the Delaware Basin well, so those asset packages should generate buyer interest. Across the board, there is extremely strong interest right now in the minerals and royalties space, so anyone looking to divest of fee owned minerals or royalty interests acquired as part of a larger M&A transaction will likely find robust interest. There is a sizeable universe of investors that likes to own midstream and infrastructure assets. Many producers develop their own gathering, processing, water disposal and pipeline assets (particularly in fields where that infrastructure is in short supply), so combined companies may look to monetize those.

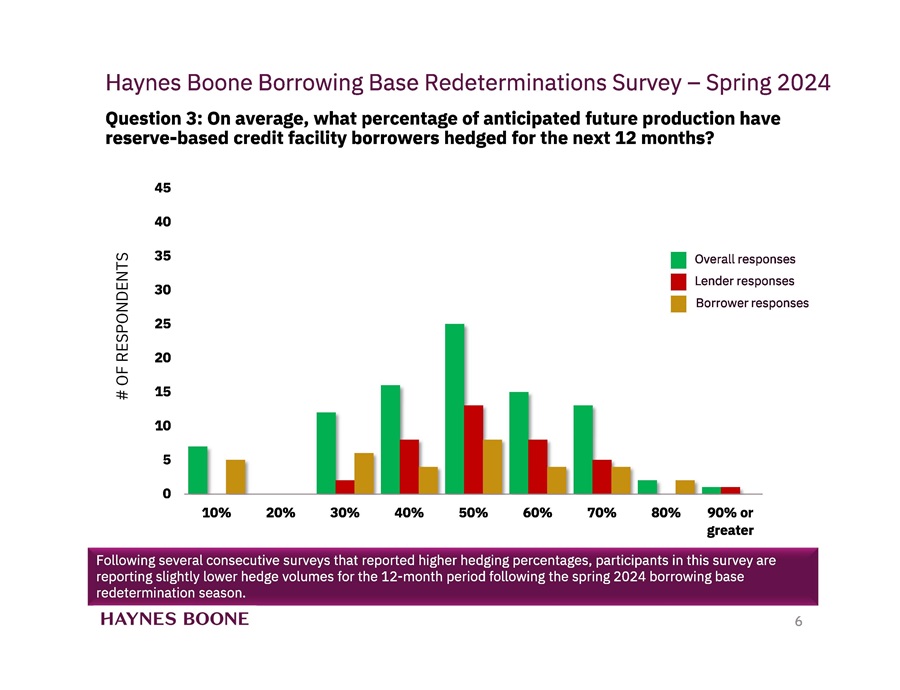

DD: Based on the last two surveys’ hedging responses, where do you expect the strategy to go forward?

KG: Despite the reduction in hedging levels we saw when comparing the Spring 2024 survey to the Fall 2023 survey, we still expect to see a material portion of production hedged. [Reserve-based] lenders typically condition credit availability on a producer hedging a certain percentage of production and the current positive free cash flow model often necessitates hedging to ensure the producer can consistently generate that cash flow when operating in a volatile commodity-based business. The main change today is that natural gas producers will need to be much more strategic in how and when they layer on their hedges.

Recommended Reading

NGP Backs Wing Resources with $100MM to Buy Permian Mineral Interests

2025-04-02 - Wing Resources VIII, which is backed by NGP Royalty Partners III, will focus on acquiring “high-quality” mineral and royalty interests across the Permian Basin, the company said.

Exxon Mobil Vice President Karen McKee to Retire After 34 Years

2025-04-02 - Matt Crocker will succeed Karen T. McKee as vice president of Exxon Mobil and president of its product solutions company.

Double Eagle Team Re-Ups in Permian, Backed by EnCap’s $2.5B

2025-04-02 - The fifth iterations of Double Eagle Energy and its minerals subsidiary, Tumbleweed Royalty, have received a $2.5 billion equity commitment from EnCap Investments LP—the day the E&P finalized a $4.1 billion sale to Diamondback Energy.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Kissler: Gas Producers Should Still Hedge on Price

2025-03-27 - Recent price jumps and rising demand don’t negate the need to protect against future drops.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.