After starts and stops in the prolonged sale of Fidelity Exploration & Production Co., parent MDU Resources Group Inc. (NYSE: MDU) said Nov. 3 that it had secured agreements to divest nearly all of the company’s assets.

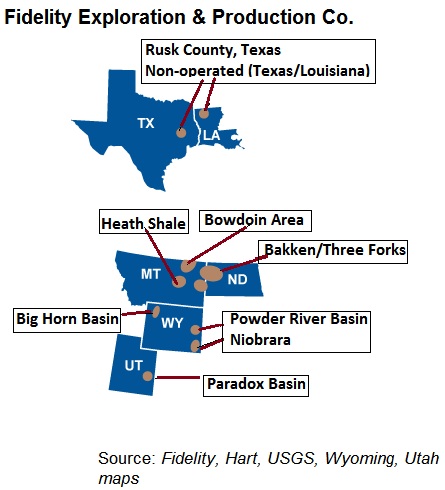

Fidelity, an indirect subsidiary of MDU, holds assets in the Bakken Shale, Paradox Basin, Powder River Basin, Texas and Louisiana.

MDU said Nov. 2 it has closed a sale of one property in October and has four additional purchase and sale agreements representing more than 90% of total year-to-date production as of Sept. 30. The sale proceeds and tax benefits total $450 million.

Buyers were not disclosed. The funds will primarily be used to repay debt, MDU said.

With the exception of one remaining “small property” that continues to be marketed, the deals effectively ends Denver-based Fidelity’s 85-year history. The company at one time produced oil and natural gas in the Rocky Mountain, Midcontinent and Gulf States regions.

"We are pleased to be nearly complete with the sale process for our oil and natural gas assets," said David L. Goodin, president and CEO of MDU Resources. "The sale prices are in line with current and prospective market conditions, and exiting the exploration and production business will allow us to focus more fully on our remaining businesses.”

In January, MDU said it had delayed plans to market Fidelity because until commodity prices rebounded. MDU said it was spending about $100 million in capex on Fidelity's operations.

But by the end of the second quarter of 2015, it was actively seeking a buyer.

In September, Mark Young, senior analyst with Evaluate Energy, said MDU had started to “treat its upstream segment as discontinued operations as it attempts to sell its E&P subsidiary Fidelity Exploration and Production.”

At one time Fidelity’s properties were lucrative. In July 2014, Fidelity sold 4,363 net acres in Mountrail County, N.D., for $200 million. At the time, the company continued to hold 12,000 net acres in Mountrail County.

In an earlier 2014 transaction, Fidelity acquired 24,500 net acres in the southern Powder River Basin in Wyoming for $200 million.

The company had also invested in Utah’s Paradox Basin, where it had operated since 2007.

In August 2014, the company owned 140,000 net acres of leaseholds and planned to spend $150 million. At the time, well costs ranged from $8 million to $11 million. The company also began engineering and construction of a $70 million natural gas pipeline and processing plant. The 24-mile pipeline and facilities were substantially complete by November 2014.

MDU said that it continued to see “attractive investment opportunities. However, capital required to grow the business would compromise ability to fund the substantial opportunities at other lines of business.”

Contact the author, Darren Barbee, at dbarbee@hartenergy.com.

Recommended Reading

Tech Gains Show Up in Emissions Reductions, Midstream Efficiency

2025-04-23 - Midstream giants Williams and Enbridge have deployed better equipment and AI to ensure more fuel gets to where it’s supposed to go.

Stonepeak Launches Data Center Company Montera Infrastructure

2025-04-23 - Stonepeak has committed $1.5 billion to Montera Infrastructure to develop and operate data centers in metro areas.

Drones Proving to be More than Just a Toy in Chevron Operations

2025-04-22 - Chevron Corp. has partnered with drone maker and operator Percepto to get a better look at its operations in two U.S. basins.

Aris Takes on the Permian’s ‘Wall of Water’

2025-04-21 - Aris Water Solutions CEO Amanda Brock rings the alarm bell on the Permian’s water takeaway and recycling challenges and how they can be solved.

Halliburton, Nabors Collab to Deploy Drilling Automation in Oman

2025-04-15 - The companies integrated Halliburton’s Logix automation with Nabors Industries’ SmartROS rig operating system.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.