(Source: Shutterstock.com; image of FPSO offshore Mexico courtesy of Fieldwood Energy LLC)

Fieldwood Energy LLC filed for Chapter 11 bankruptcy on Aug. 4, making it the second time for the Houston-based offshore producer to enter bankruptcy in the past two years.

The bankruptcy also follows the departure of Fieldwood’s founder, Matt McCarroll, in early July.

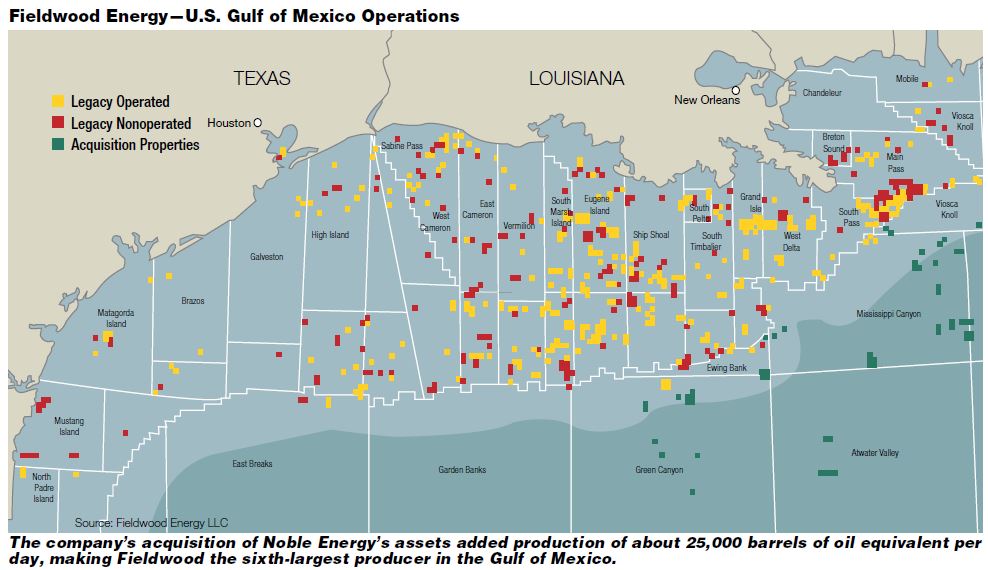

McCarroll had served as president and CEO since Fieldwood’s formation in 2013. The privately held company has the largest footprint of any operator in the shallow continental shelf of the Gulf of Mexico (GoM) in addition to a portfolio of deepwater assets, according to a Fieldwood release.

Following McCarroll’s departure on July 1 to pursue other opportunities, Fieldwood formed an executive leadership team, reporting directly to the board and the leadership transition committee established by the coard to fill the office of the CEO until the board finds a replacement.

The executive leadership team is comprised of: Michael T. Dane, senior vice president and CFO; Thomas R. Lamme, senior vice president and general counsel; and Gary D. Mitchell, senior vice president of production.

In an Aug. 4 statement commenting on the Chapter 11 process, Dane said: “Today’s announcement reflects the next step in our efforts to respond to the challenging market environment and Fieldwood’s liabilities. Over the last several months, we have worked collaboratively with numerous important stakeholders to evaluate our options and proactively manage our balance sheet.”

Fieldwood has about $1.8 billion of debt, according to court filings.

As part of the Chapter 11 process, Fieldwood entered into a restructuring support agreement with the support of key members of its lender group, which include holders of approximately two-thirds of the obligations under its first lien term loan facility.

RELATED:

Fieldwood Energy: Voyage From Debt To The Deep featured in the July 2018 edition of Oil and Gas Investor

Fieldwood has filed a series of motions with the bankruptcy court which, when granted, are expected to enable the company to maintain its operations as usual throughout the restructuring process. The company also said it expects to have access to sufficient liquidity to meet financial obligations during the restructuring, including cash on hand and a debtor-in-possession facility provided by certain of its first lien term loan lenders.

Fieldwood’s Chapter 11 case is being heard in the U.S. Bankruptcy Court for the Southern District of Texas.

As of June 30, 23 E&P companies in North America have filed for bankruptcy so far this year, according to Haynes and Boone LLP.

The number of E&P bankruptcies is expected to increase significantly in the second half of 2020, with expectations of around 100 total filings this year, Jeff Nichols, partner and co-chair of Haynes and Boone’s energy practice group, said during a recent webinar.

During the previous oil crash of 2014-16, more than 100 bankruptcy filings were made by North American oil and gas producers. One of those companies, Fieldwood, completed a Chapter 11 reorganization in 2018 to address about $3.3 billion in debt as well as accrued and unpaid interest. The restructuring was tied to the company’s acquisition of GoM deepwater assets from Noble Energy Inc. for $480 million in cash.

Recommended Reading

Hirs: America Confronts Sovereign Risk with Recession on the Horizon

2025-03-21 - The risk to U.S. oil and gas production comes from within, and a recession looms on the horizon.

DOE Approves Venture Global’s CP2 LNG to Export to Non-FTA Countries

2025-03-20 - The U.S. Department of Energy approved Venture Global’s Calcasieu Pass 2 LNG project in Cameron Parish, Louisiana, to export LNG to non-FTA countries.

Golar LNG Signs $1.2B FLNG Gimi Debt Facility with Chinese Consortium

2025-03-20 - Golar has agreed to a $1.2 billion sale leaseback facility with a consortium of Chinese leasing companies for the refinancing of its existing FLNG Gimi debt facility.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

Pipeline Maintenance Drives Waha Negative, Again

2025-03-20 - Analysts predict plenty of natural gas demand on the Gulf Coast is coming as LNG operations ramp up.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.