Operators in North Dakota drilling in the Bakken Formation wanted to explore possible cost savings without sacrificing quality. The operators, who were drilling long laterals, communicated a need for improved efficiencies to minimize their drilling fluid costs.

To one operator, Newpark proposed two changes to drilling practices: using a fluid conditioner and changing the application method of the high-performing drilling enhancer (HPDE). The benefits were presented to a second operator, which also implemented the practices and realized substantial results. The following discussion summarizes drilling practice modifications and then outlines both operators’ results.

Using fluid conditioner

The first operator outlined concerns about using the current fluid system more efficiently. The most obvious concern was that the fluid’s lubricity diminished after it was circulated over the solids control equipment. This is a common challenge with most lubricants. Newpark suggested additions of EvoCon II, a high-performing fluid conditioner, to best optimize the fluid so that the lubricant coexisted with the cuttings more synergistically.

The fluid conditioner allowed cuttings removal so that the drilling fluid had the lubricant intact. Newpark was given the opportunity to measure the effectiveness of the fluid conditioner on lubricity and fluid costs savings.

Changing HPDE application method

Continuing its quest for improved efficiencies, the first operator wished to explore lubricant application options, perhaps with an option that was not conventional. To increase drilling fluid lubricity, two conventional HPDE application methods dominate: maintaining a constant lubricant concentration and running lubricant sweeps.

Maintaining a constant concentration can be difficult because real-time measurement of lubricant concentration throughout the wellbore remains a challenge. A relative concentration might be approximated from the fluid’s lubricity coefficient, which is measured with an extreme pressure and lubricity meter.

The other method, running lubricity sweeps, involves adding a higher concentration of lubricant into a small volume of drilling fluid. The sweep is applied by circulating this small volume downhole so the high concentration of lubricant inundates the drillstring. The sweep is followed by a regular regimen of fluid. This technique of lubricant application is short-lived. In particular, this method typically results in high torque and drag, which can be detrimental to operations.

To address this issue, a steady but small stream of EvoLube DPE was flowed into the drilling fluid as it was going downhole. This modification required close monitoring of the flow from a tote to the pit near the outlet line.

The ideal flow rate was determined by measuring the fluid’s relative lubricity coefficient by an extreme pressure and lubricity tester, modifying the flow so the fluid maintained a target value of less than 0.2.

Results

To validate the effect of the fluid conditioner, Newpark measured the lubricity coefficient of the active system and the lubricity coefficient of the effluent (the fluid removed by the solids control equipment).

Prior to fluid conditioner treatment, the lubricity coefficient of the effluent was more than twice that of the active system. After treatment, the two coefficients closely aligned, with only a slightly higher rate in the effluent. This demonstrates that fluid conditioner use allows the lubricant to remain in the fluid so that it may be circulated again with minimal additions.

This operator saved an average of 17% in fluid costs when compared to applications without the fluid conditioner. Additionally, the rigs that implemented the “steady stream” of HPDE to the fluid experienced a lubricant savings of 28.3% compared to drillsites that used fixed-percent and sweeps methodologies.

This operator compared lateral drilling days of wells drilled using the novel approaches to wells drilled with CaCl2 brine and with oil-based fluid (OBF). The Newpark Drilling Fluids’ Evolution High-performing Waterbased Fluid System (HPWFS) averaged a total drilling time of 13.7 days. The brine and OBFs averaged total drilling days of 25 and 24.7, respectively. ROPs for the brine, OBF and HPWFS were measured to be 266.5 m/d (873.3 ft/d), 202 m/d (663.7 ft/d) and 706 m/d (2,315.3 ft/d), respectively.

The second operator, who was new to Newpark, implemented these two changes, realizing additional benefits. This operator experienced reduced motor wear. For one well, the operator used only one bit to drill a 3,201-m (10,500-ft) lateral through the Three Forks Formation. On average, the operator observed a 136.3% increase in constant differential pressure in comparison to offset wells.

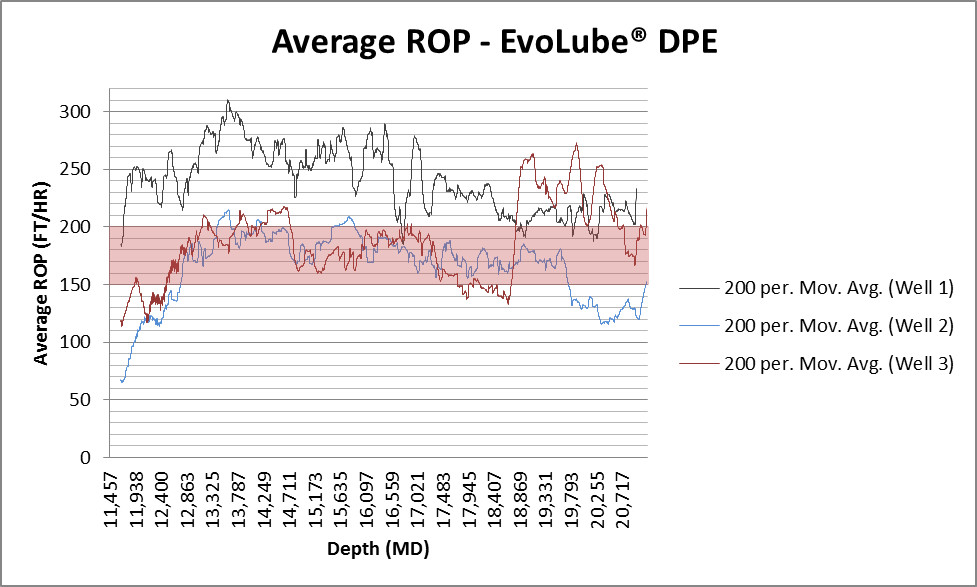

This differential pressure, which remained relatively constant throughout the remainder of the drilling process, transferred into increased weight on bit (WOB). The increased WOB resulted in an average 20% increase in ROP. Compared to a competitor’s lubricant and methodology on surrounding wells, the operator saw an 18% decrease in rotational torque spikes (calculated as a standard deviation). Lubricant costs were 51.3% lower using the Evolution system and these methodologies in comparison to the operator’s other wells in the vicinity.

Lessons learned

Collaboratively working with the operator, Newpark changed fluid properties by product additions and method application to everyone’s advantage. Evolving from previous knowledge and then continuing in that progression allowed the drilling fluid to perform more efficiently.

This occurs when the operator is open to suggestions and change and if the service company is experienced enough to offer the recommendations. The outcomes of these implementation changes resulted in a reduction of drilling days for the lateral, reduction in trips for motor failures and a notable improvement in sliding for directional drilling.

Recommended Reading

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Exclusive: LNG Takes Control in Meeting Data Center Reliability, Capacity Needs

2025-04-02 - William Seller, solutions architect at DartPoints, shares insight on the impact that data center power demand will have on the natural gas industry, in this Hart Energy Exclusive interview.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.