In Mitchell County, Texas, where the Midland Basin transitions into the Eastern Shelf, the number of horizontal wells can be counted by hand.

If far eastern Howard County, to the west of Mitchell, seemed a reach for tight-rock wildcatters in the past decade, jumping the border now into Mitchell is a newer frontier. After all, county seat Colorado City hews closer to Abilene than the unofficial Permian capital of Midland.

The straight lines in the Railroad Commission of Texas’ GIS viewer in Mitchell County are county roads and section lines—typically, the same thing.

The rare horizontal well darts like an exclamation mark across the map, making a visual placeholder in Mitchell’s 916 square miles—particularly in the county’s northwestern corner.

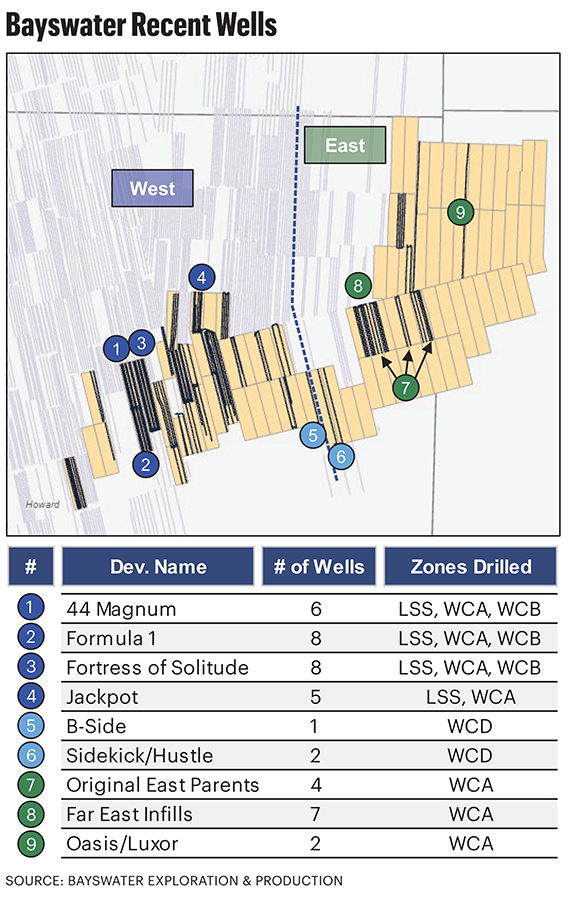

There, privately held Bayswater Exploration & Production has taken a hunch and some subsurface clues—logs and old cores of the ancient stratigraphy—that suggest the Wolfcamp A works in Mitchell, too.

Oil and water

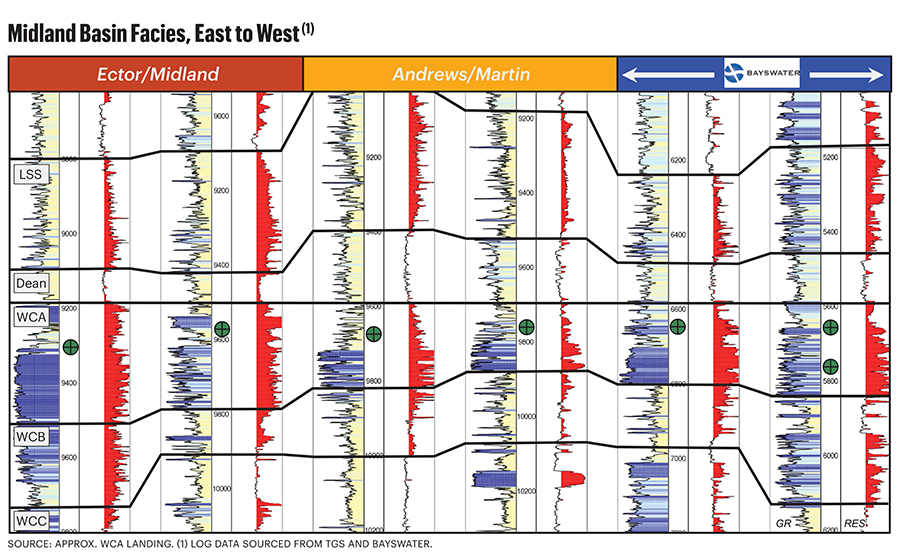

The Wolfcamp A is some 250 feet thick at the Howard-Mitchell border, where surface elevation sinks a bit into a mostly imperceptible valley.

There, the “A” is at about 5,500 feet vertical depth compared with some 9,500 feet in the Midland Basin core.

And Denver-based Bayswater’s pilot laterals to date are vouching for prospecting.

Its Luxor #H4W lateral’s first nine full months online has surfaced 140,467 bbl of oil, according to Railroad Commission data through February 2024. Casinghead gas was 140.5 MMcf.

A second pilot, Oasis #H4W, made 173,271 bbl of oil in its first 10 full months online with casinghead gas at 81.3 MMcf.

Drilled from the same pad 12 miles northwest of the city of Westbrook, Luxor was taken 2.5 miles north, crossing under Texas Highway 350. The first-24-hour IP in July 2023 tested 805 bbl of oil and 515 Mcf of solution gas, peaking at 977 bbl/d in November.

The Oasis well—taken some 2.5 miles south to make a toe under a pasture just west of the silty Lake Gregory—IP’ed in May 2023 with 621 bbl of oil and 347 Mcf of gas. It peaked a couple of months later at 1,025 bbl/d.

Initial water came on strong, like in early Wolfcamp A horizontals in the Midland core when operators began pilots there more than a decade ago. The initial test of a combined 9,100 bbl from Luxor and Oasis had been anticipated, though: Bayswater included a water-injection well in the pad.

Shale-sourced

Wolfcamp A is what operators in the Midland’s core southwest in Midland and Martin counties have successfully targeted. So, what’s different here?

The “A” for Mitchell doesn’t resemble the traditional Wolfcamp model, said John Dyer, Bayswater senior vice president for the Permian.

“It’s very different. We’re drilling in a high-percentage carbonate reservoir compared with what other companies are developing to the west,” Dyer said. “The lithology is remarkably different on the eastern edge of the play.”

In the early Permian period in western Mitchell about 300 million years ago, a shallow shelf was along the edge of an ocean that covered the Midland Basin.

The Wolfcamp was deposited at that time. Some 50 million years later, the Permian period came to an end with a third mass extinction in a series of five to date.

“As our drilling program approaches the shelf edge from the west, we’re encountering detrital carbonate sediments, which have mixed with the shalier Wolfcamp,” Dyer said.

Carbonate content increases in the Wolfcamp, just as it does approaching the Central Basin Platform (CBP) that flanks the far western edge of the Midland.

“In the early mapping days of the Permian shale targets, operators typically wrote this [eastern] area off as not being prospective due to the high-carbonate lithology observed on the vertical control wells,” Dyer said.

“There’s so much carbonate in this section it’s really not a shale play anymore.”

In Howard County initially, adjacent to Mitchell’s western border, Bayswater and other operators got to work where the Wolfcamp A is generally shale, but carbonate content is greater than in the Midland core.

“The organic richness from the shale is critical for sourcing the hydrocarbons,” Dyer said. “But the oil-storage capability and deliverability of the reservoir may be more determined by the interbedded carbonates.”

As Bayswater continued to step out farther east, “We found the carbonates becoming more and more porous.”

Porosity is up to 12%. “They are getting sourced locally from the intermixed shale section, resulting in high hydrocarbon saturation.”

The reservoir

The carbonates are limestone and dolomite. “Shale can be deposited closely with other sediments—sandstones, siltstones, carbonates. We’re producing all of those together in one package,” Dyer said.

The rock is up to 75% carbonate.

“I remember watching the gamma-ray logs while drilling the first of the eastern-asset wells,” Dyer said. It made for some insomnia, “lying awake at night thinking, ‘We’re drilling just all carbonate in these wells. Is this going to work?’”

But as cuttings and gas shows were coming in, “I was thinking, ‘Wow, we’re still in a very hydrocarbon-rich environment.’ Both the shales and carbonates fluoresce with oil.”

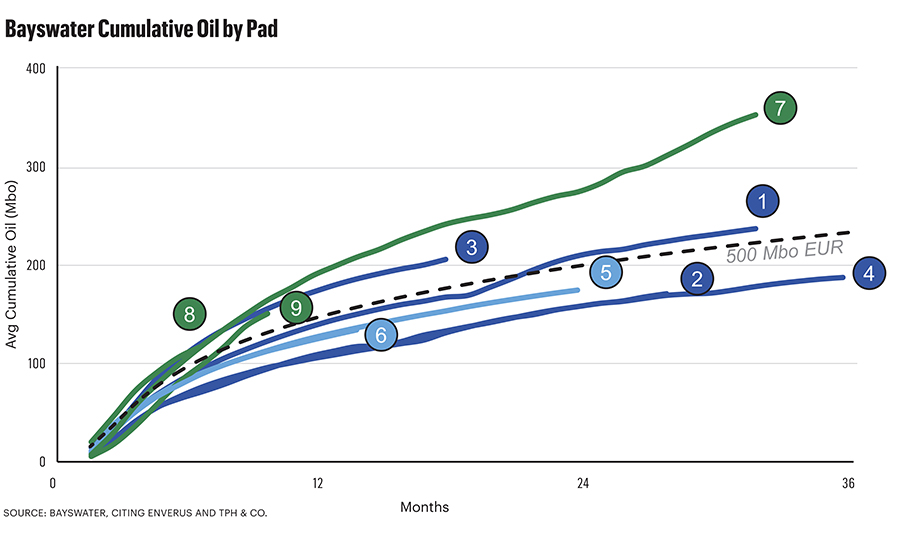

Without a reason to plug and pack up, Bayswater completed the well: Far East 1-12 #H3W in Howard County near the Mitchell County line.

It IP’ed 1,298 bbl/d of oil in 2021.

“I thought ‘Wow, this is not my father’s shale model!’”

Cumulative production is more than 430,000 bbl.

Going to Mitchell

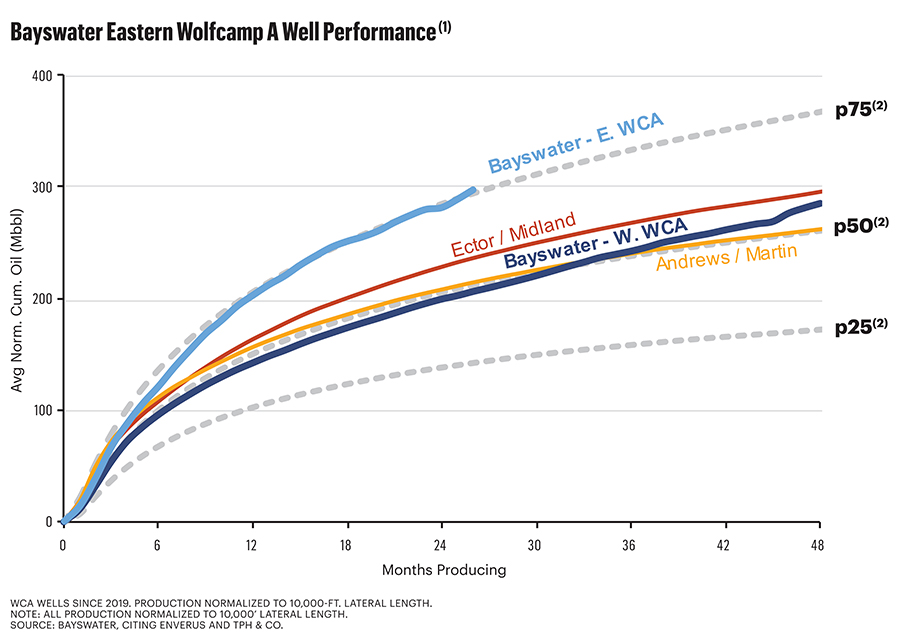

Farther east than the Far East well, the Luxor and Oasis wells are further outperforming their older Howard wells that were landed in the Lower Spraberry and Wolfcamp A, B, and D, said Steve Struna, Bayswater founder, president and CEO.

In addition to Far East and continuing the Asian theme, the eastern Howard pads are the Orient, Rising Sun, Samurai, Morning Calm and Kamikaze, totaling 16 wells inside Howard at the Mitchell border.

“The carbonate-rich wells are better than the traditional shale wells in our neighborhood,” Struna said. “You have the porosity, and it’s a little more brittle. It fracs better.”

The Howard wells “are all really attractive, economic wells,” he added. “But our best ones are out here on this [farther] eastern edge where you have more carbonates.”

Some 1.75 miles east of the Oasis/Luxor pad, Bayswater has landed two additional 2.5-mile laterals—the Xerxes #H3W and Moses #H3W.

In spring 2024, the operator began drilling six more 2.5-mile laterals, including a four-well pad, between the first two pads. Completion is expected this summer.

Spraberry trend

Bayswater’s initial Permian package—in Howard County—was leased in 2016. Its first production was in 2018.

Northeastern Howard and northwestern Mitchell are semi-circled on the east by vintage Clear Fork vertical oil fields—overlying Wolfcamp, such as Westbrook and Coleman Ranch, that have made more than 240 MMbbl.

“It’s a very robust petroleum system we’re drilling in,” Dyer said.

Bayswater’s total Mitchell County production through February is 300,000 bbl, all from the Spraberry Trend Area Field.

From Howard, where it’s operated longer, Bayswater has produced 12 MMbbl, also from the Spraberry Trend Area, primarily from leases 44 Magnum (1 MMbbl), Formula One (1 MMbbl) and Fortress of Solitude (1.5 MMbbl).

Bayswater’s leasehold is mostly HBP. It has one rig drilling it currently. “So, if it’s not HBP, it will be shortly,” Struna said.

Vertical control

While the venture into Mitchell was in frontier rock for lateral taps, well control was plentiful from all the legacy verticals punctuating the landscape from the past century.

Bayswater also found core that had been pulled from the old wells.

“The vertical well control gave us confidence that this mixed-lithology, carbonate/shale reservoir was capable of producing all the way into Mitchell County,” Dyer said.

As for also landing in Spraberry and in Wolfcamp B, C, and D, as well as in any other formations in Mitchell, “We are evaluating those as we go,” Dyer said.

But Wolfcamp A “will be our primary focus.”

The “B” is thin and it’s “fairly clay-rich in the eastern-asset area. It doesn’t seem to be a primary target for us right now.”

Generally, though, all of the Wolfcamp sections are more carbonate easterly, approaching the Eastern Shelf.

Eight days, spud to release

At some 5,500 feet, Wolfcamp A in the area “is some of the shallowest in the basin, which gives us a chance to really compete with the big guys on our drilling cost to total depth,” Dyer said.

Drilling and completion (D&C) for the 2.5-milers is less than $7.5 million. “These should be some of the lowest D&C wells in the basin.”

The 2.5-mile lateral is looking like “our sweet spot,” he added.

The wells are drilling in eight days from spud to release for the total of nearly four miles of hole—5,500 feet vertically and 2.5 miles from heel to toe.

“Over the years, the bit technology, the oil-based mud, everything out there [in the industry] has made us able to drill these wells in about the same time as you would drill a shale well,” Dyer said.

Three-mile laterals are possible. “We can do three [miles]. We’ve done some three-milers [farther west].” But the completion becomes more complicated, he added.

The higher carbonate content does result in a better frac though.

“We think we’re getting better frac complexity in this carbonate system, so it helps us there,” Struna said.

EUR from the far eastern Wolfcamp A is 73 bbl of oil per foot and 88 boe. It adds up to about 900,000 boe for a two-mile lateral.

The results are greater than Bayswater’s western A wells (58 bbl and 79 boe), as well as the western Lower Spraberry (43 bbl and 56 boe), Wolfcamp B (34 bbl and 58 boe) and Wolfcamp D (38 bbl and 58 boe).

Bayswater calculates its eastern Wolfcamp A gross location inventory at 163 wells and breakeven at $40 WTI. “On a lateral-foot basis, this is probably some of the best in the basin,” Struna said.

Mitchell v. Midland

In June 2023, Mitchell County’s oil production was some 6,000 bbl/d, according to Railroad Commission data.

Virtually all of this is from verticals and the total is about half as much as in 2014 before producers turned their capex fully onto their core leasehold after emerging from the late 2014 to early 2016 oil-price collapse.

In comparison, June 2023 production from Midland County was 628,000 bbl/d, up tenfold from 67,000 bbl/d in 2014.

Recommended Reading

Chord Announces $750MM Notes Offering to Reduce Debt

2025-03-05 - Chord Energy said it will use part of the funds to reduce its credit facility borrowings. The company is also looking to sell its Marcellus non-operated gas interests.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Ring Energy Slashes 2Q Capex by 50% After Oil Price Collapse

2025-04-25 - Permian E&P Ring Energy is cutting spending and prioritizing debt reduction with oil prices hanging around $65/bbl.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

EQT Buys Private Marcellus E&P Olympus Energy for $1.8B

2025-04-23 - EQT’s acquisition from Blackstone-backed Olympus adds 90,000 net Marcellus and Utica acres and 500 MMcf/d of production.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.