Updated on Dec. 15 at 10:19 a.m.

’Twas two weeks before Christmas, when all were upset

They had bet on cold weather and were filled with regret;

Projections had claimed that the climes would be brisk

Surely Q1 gas futures seemed a reasonable risk;

Oh, the exports were loaded all snug in their tankers

But domestic demand showed no pleasers, no thankers;

For natgas had fallen from its perch oh so high

And few had a need, whether wet gas or dry;

On ethane, on propane, on butane, on iso!

You can’t let us down just ’cause New Yorkers don’t have snow!

This slump is a fluke and we hope it can’t laster

“It’s an inexact science,” shrugged the weather forecaster.

Natural gas futures for first-half 2018 took a dive in the past week as the latest winter forecasts convinced market bulls to retreat.

In the short term, the Northeast braced for arctic air from an Alberta clipper from Canada racing from Michigan to New York. Fast-moving storms like this can be counted on for flight delays but not necessarily for a sustainable bump in natural gas prices.

Other news from Europe—the shutdown of the Forties Pipeline System in the North Sea and an explosion at Austria’s main gas pipeline hub—is worth keeping an eye on.

“It looks like the disruption in Austria has been short-lived and is going to be back online,” Jeff Quigley, director of energy markets for Stratas Advisors, told Hart Energy. The Forties disruption, however, appears to be more of an issue

“It does seem like NBP [U.K. National Balancing Point natural gas] prices are continuing to move higher and the weather report in the U.K. is looking colder by the day, so I think U.S. LNG exports are becoming a real possibility—specifically to the U.K.—to backfill storage over the coming days,” he said.

Because the global LNG spot market has become more liquid, U.S. exporters could theoretically fill a shortfall, Quigley said, but long travel times make it difficult to take advantage of the arbitrage window. There is the opportunity for backfill storage, he said, but that would require a sustained higher price spread.

Colder weather in Asia has already diverted one LNG tanker shipment originating at Cheniere Inc.’s Sabine Pass, La., terminal from Brazil to China.

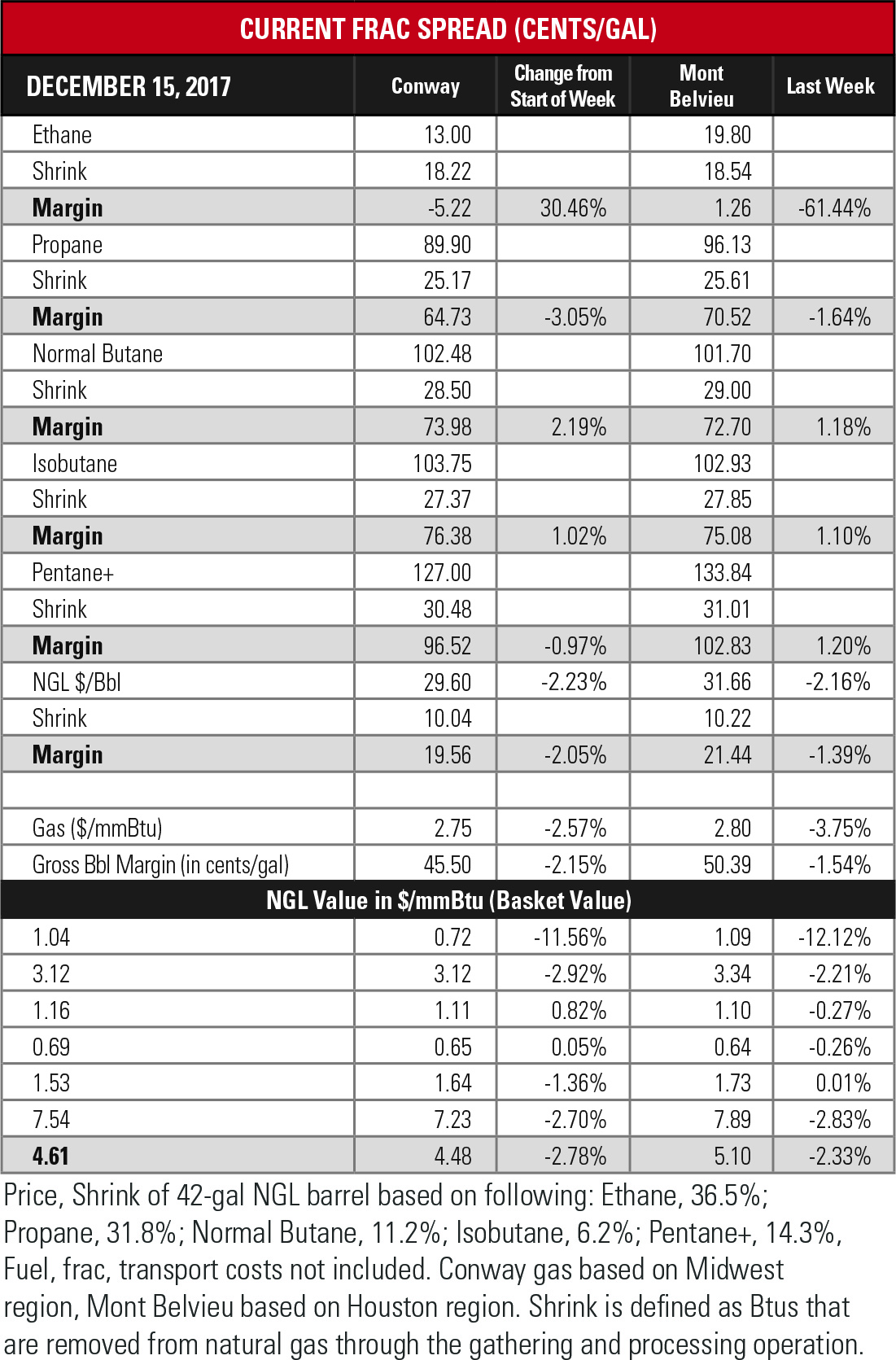

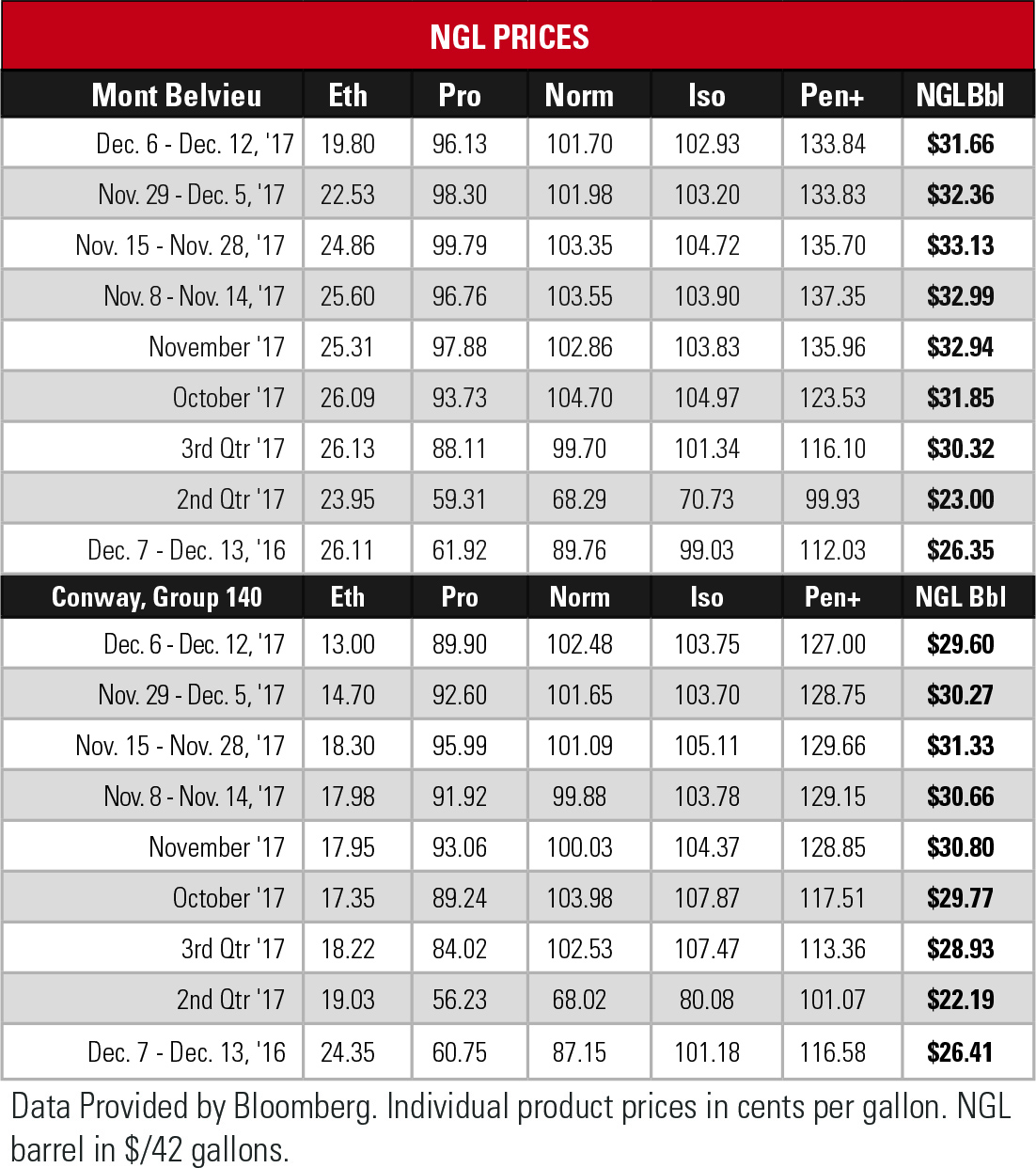

NGL prices, except for ethane, remained steady with the hypothetical barrel still above $30 at Mont Belvieu, Texas, for the 12th straight week. At Conway, Kan., the barrel dipped below the weekly average of $30 for only the fourth time since mid-September.

Ethane, once thought likely to reach 30 cents per gallon (gal) by year-end, crashed as demand disappeared. En*Vantage Inc. reported on a slew of issues, including Dow’s new light hydrocarbon 9 (LHC-9) ethylene cracker in Freeport, Texas, which is running at reduced rates or could be fully down for three weeks. Dow’s LHC-3 plant at Plaquemine and Shell’s Norco OL-5 plant could also be sidelined.

Start-up delays at ChevronPhillips’ and ExxonMobil’s facilities aren’t helping to buck up prices, nor are inflated ethylene inventories and the U.S. Energy Information Administration’s (EIA) report of all-time high ethane inventories in September.

Since the five-day tracking “week” that ended Aug. 22, ethane has plunged 27.1% from a high for the year to below 20 cents/gal at Mont Belvieu. The last time ethane was this low was in late January. In that same 14-week period, ethane’s price at Conway has fallen 44.6%.

Then there is the matter of the disappearing margin. One month ago, Hart Energy calculated an ethane margin at Mont Belvieu of 7.76 cents/gal. In the last weekly period, Hart Energy estimates a margin of 1.26 cents/gal or a narrowing of 84%. At Conway, the margin has been in the negative since the end of October.

Propane fundamentals appear strong, with the EIA’s September inventory below what was expected, En*Vantage said. Butanes were steady, with the push from the winter fuel blending season and the pull from the expected drop in exports.

Storage of natural gas in the Lower 48 increased by 69 billion cubic feet (Bcf) in the week ended Dec. 8, the EIA reported, compared to the Bloomberg consensus of a 60 Bcf draw and the 2016 draw of 132 Bcf. The figure also contrasts with the five-year average decrease of 78 Bcf, resulting in a total of 3.626 trillion cubic feet (Tcf). That is 5.3% below the 3.827 Tcf figure at the same time in 2016 and 0.7% below the five-year average of 3.653 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Oxy’s Stratos Direct Air Capture Project Nears Finish Line

2025-02-20 - Stratos Phase 1 is 94% complete overall and 98% complete on construction, Occidental Petroleum says.

California Resources Continues to Curb Emissions, This Time Using CCS for Cement

2025-03-04 - California Resources’ carbon management business Carbon TerraVault plans to break ground on its first CCS project in second-quarter 2025.

BKV Reaches FID, Forms Midstream Partnership for Eagle Ford CCS Project

2025-02-13 - If all required permits are secured, BKV’s CCS project in the Eagle Ford Shale will begin full operations in first-quarter 2026, the Barnett natural gas producer says.

CF Industries Form JV to Build $4B Low-Carbon Ammonia Project in Louisiana

2025-04-08 - CF Industries has reached a FID with JERA and Mitsui for an ammonia production facility in Louisiana. CF Industries sealed a deal with Occidental’s 1PointFive to capture and store CO2 from the facility.

Cella Mixes Two Approaches to Keep CO2 Solidly Underground

2025-04-01 - Cella, a startup in partnership with Halliburton, injects CO2 into basaltic reservoirs, where it reacts and hardens.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.