For those too young to remember, the Bakken Shale was once an up-and-coming oil and gas behemoth, the darling of the North, a key component of U.S. energy security.

That was prior to the downcycle, prior to the mandate that all energy-related articles make reverent mention of the Permian Basin. But now the Bakken, the second-largest unconventional play in the U.S., is growing again, propped up by oil prices that are comfortably above $60 per barrel (bbl).

Andeavor Logistics LP (NYSE: ANDX) has filed to build an NGL pipeline from Oasis Midstream Partners LP’s (NYSE: OMP) Wild Basin plant to its own fractionator in Belfield, N.D., about 70 miles south. The proposed pipeline—partly new-build, partly converted BakkenLink crude line—would have an initial capacity of 15,000 barrels per day (bbl/d), expandable to 34,000 bbl/d.

Andeavor Logistics LP (NYSE: ANDX) has filed to build an NGL pipeline from Oasis Midstream Partners LP’s (NYSE: OMP) Wild Basin plant to its own fractionator in Belfield, N.D., about 70 miles south. The proposed pipeline—partly new-build, partly converted BakkenLink crude line—would have an initial capacity of 15,000 barrels per day (bbl/d), expandable to 34,000 bbl/d.

“The solution is a creative way to increase utilization on ANDX’s Belfield fractionator and Fryburg Rail Terminal, which both have likely seen declines from lack of production in that area,” noted East Daley Capital in its Feb. 18 report.

East Daley found the timing curious, though. Both Kinder Morgan Inc. (NYSE: KMI) and ONEOK Inc. (NYSE: OKE) are exploring large-scale NGL takeaway options in the region. Oasis is a counterparty to the Hiland gathering system, which Kinder Morgan acquired three years ago in a $3 billion deal with Harold Hamm and certain Hamm family trusts.

Why then, East Daley wondered, would Oasis choose to rail NGL out of the play instead of holding off for a Kinder Morgan option to Mont Belvieu, Texas?

ONEOK recently completed its application to expand the Bear Creek natural gas processing plant near Killdeer, N.D., from 80 million cubic feet per day (cf/d) to 175 million cf/d. If all approvals are received, ONEOK could start the expected 18-month expansion in the first half of this year.

ONEOK recently completed its application to expand the Bear Creek natural gas processing plant near Killdeer, N.D., from 80 million cubic feet per day (cf/d) to 175 million cf/d. If all approvals are received, ONEOK could start the expected 18-month expansion in the first half of this year.

The quiet Bakken has not been slumbering. It set a North Dakota natural gas production record in November by averaging 2.1 Bcf/d. Hess Corp. (NYSE: HES) and Targa Resources Inc. (NYSE: TRGP) in January announced plans to build the Little Missouri Four gas processing plant that will boast a capacity of 200 million cf/d. The $150 million investment in the plant is coupled with a $100 million plan to build gathering pipelines for Little Missouri Four, which will be operated by Targa.

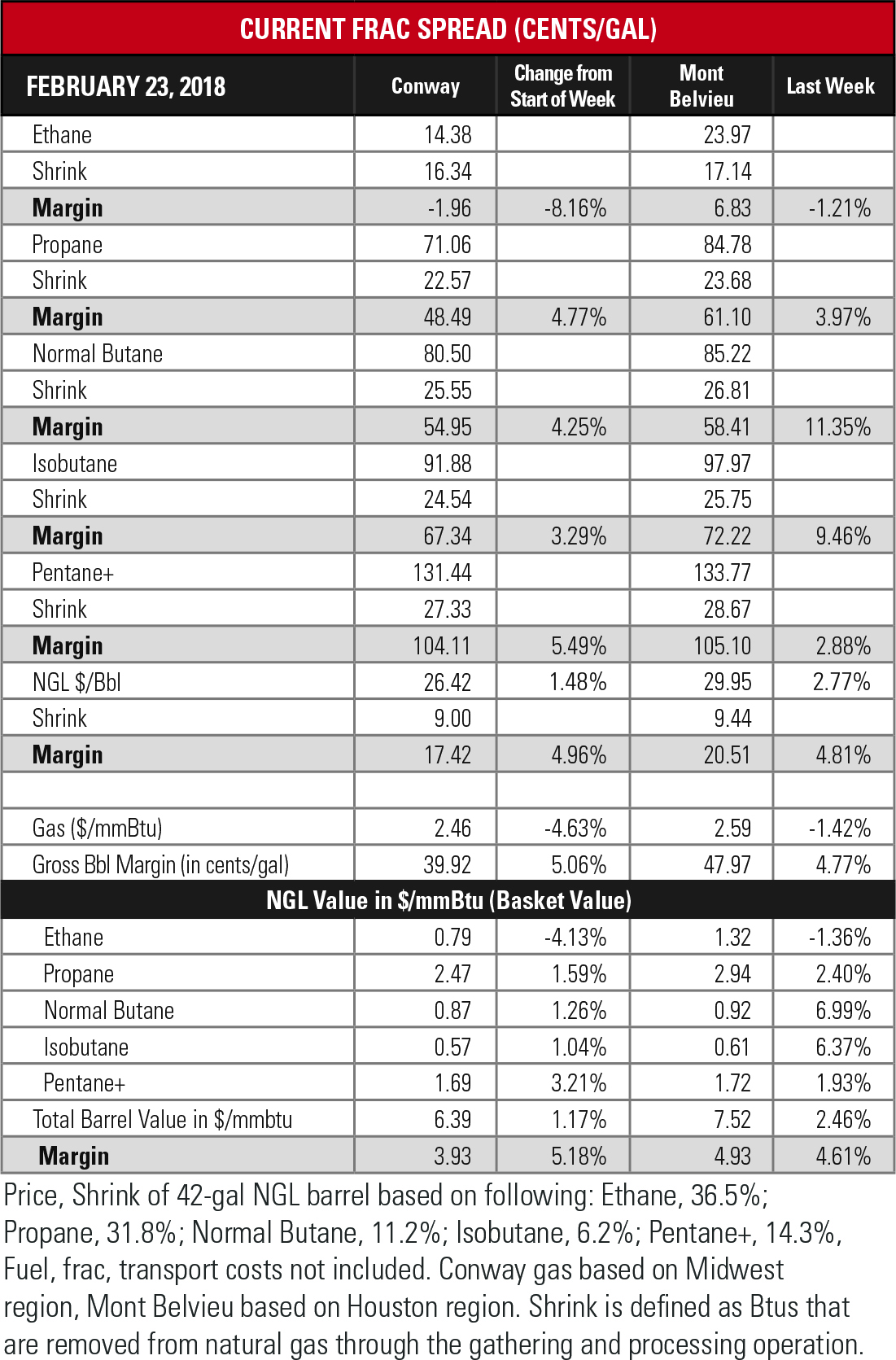

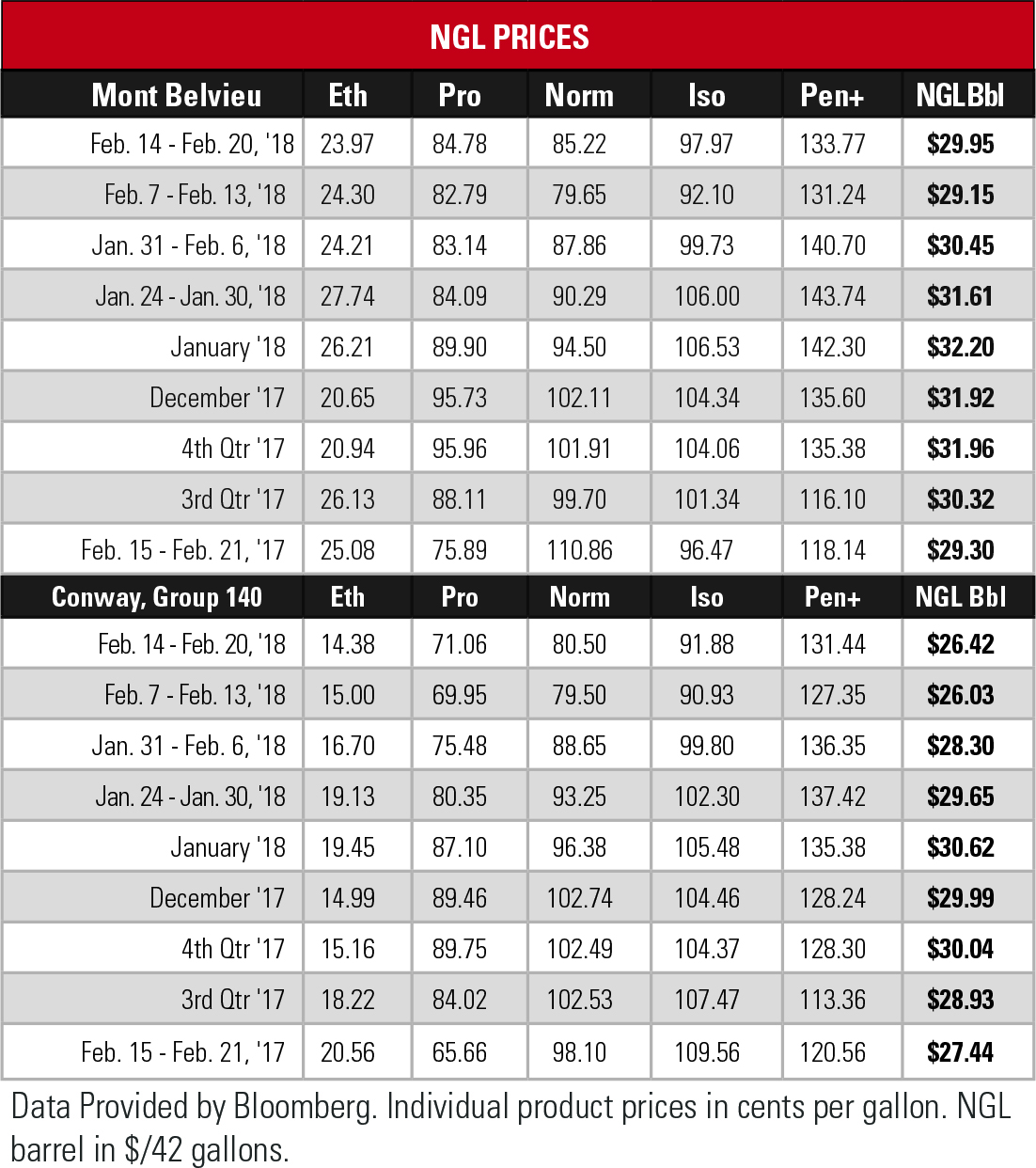

NGL prices were generally flat in the four-day Hart Energy tracking period that was shortened by the Presidents Day holiday. The butanes bounced back after last week’s sharp drop, but not quite to their level of two weeks ago. The hypothetical NGL barrel at Mont Belvieu rose, too, but remained a nickel shy of returning to $30 territory.

With the exception of Mont Belvieu ethane, margins widened in the past week. Mont Belvieu ethane is still very close to 7 cents per gallon.

In the week ended Feb. 16, storage of natural gas in the Lower 48 experienced a decrease of 124 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, slightly more than the Bloomberg consensus of a 122 Bcf draw and below the five-year average of 145 Bcf. The figure resulted in a total of 1.76 trillion cubic feet (Tcf). That is 25.7% below the 2.369 Tcf figure at the same time in 2017 and 19% below the five-year average of 2.172 Tcf.

In the week ended Feb. 16, storage of natural gas in the Lower 48 experienced a decrease of 124 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, slightly more than the Bloomberg consensus of a 122 Bcf draw and below the five-year average of 145 Bcf. The figure resulted in a total of 1.76 trillion cubic feet (Tcf). That is 25.7% below the 2.369 Tcf figure at the same time in 2017 and 19% below the five-year average of 2.172 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Constellation Bets Big on NatGas in $16.4B Deal for Calpine

2025-01-10 - Constellation Energy will acquire Calpine Corp. in a $26.6 billion deal, including debt, that will give the pure-play nuclear company the largest natural gas power generation fleet.

Permian EOR Firm Plans Reverse Merger with Coconut Water Brand

2024-12-05 - Roosevelt Resources, which is developing an EOR project in the Texas Permian Basin, aims to go public through a reverse merger.

Standard Solar Acquires California Solar Project

2024-11-13 - Located in Kern County, the Windhub Solar B solar project will have 112 acres dedicated to the solar array, Standard Solar says.

Hollub: Oxy Low Carbon Ventures Bolsters US Energy Independence

2024-11-18 - Occidental Petroleum is making a number of low-carbon moves in the Permian—a maneuver that will bolster the U.S.' energy independence, CEO Vicki Hollub told Hart Energy in an exclusive interview.

GridStor Acquires Battery Storage Project from Black Mountain

2025-01-16 - GridStor’s acquisition of the battery energy storage project in Oklahoma from Black Mountain Energy Storage comes amid a need for new power resources to support the region’s electric system reliability.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.