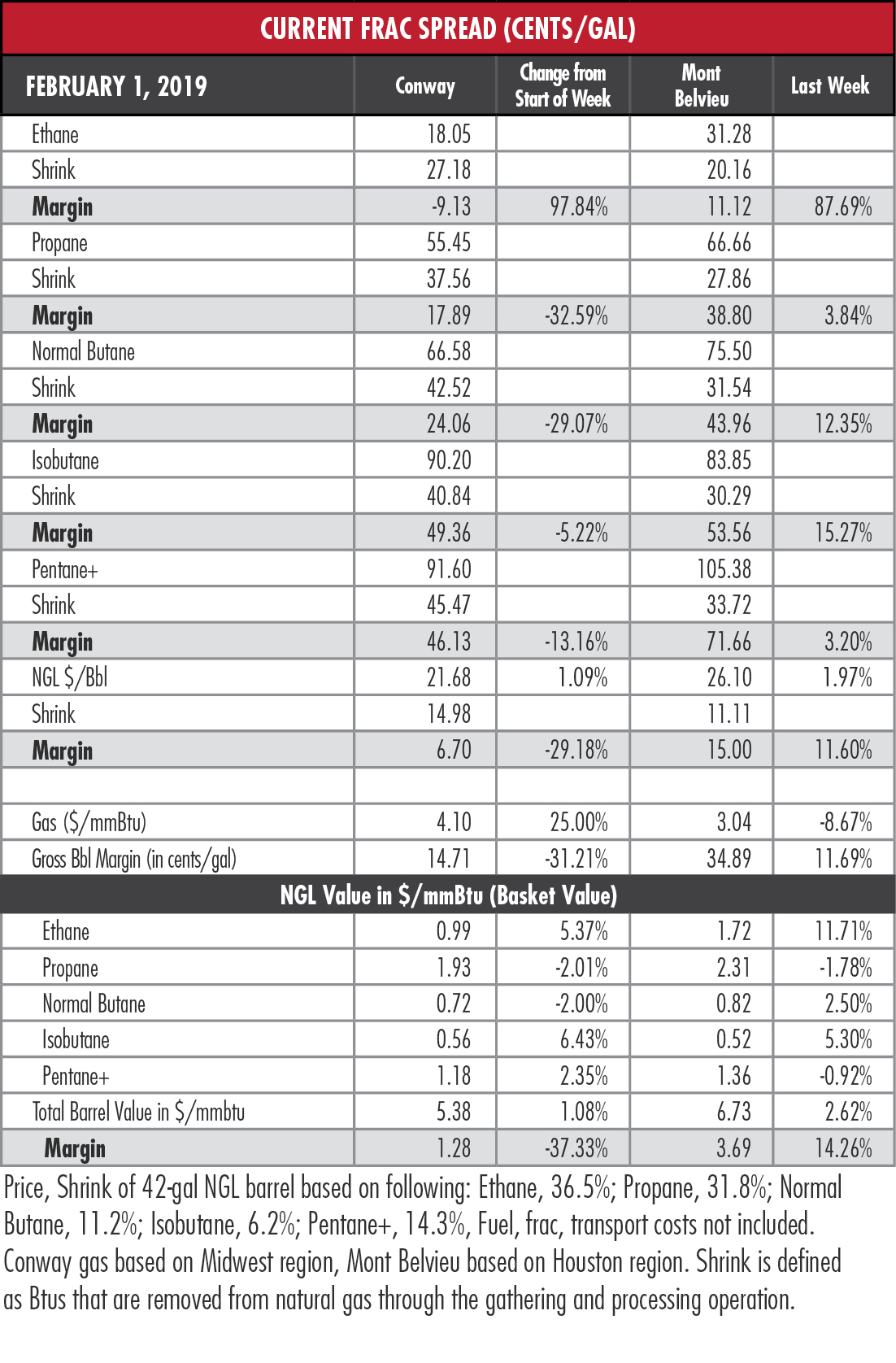

This version has been updated to correct the NGL Prices table. The table now reflects new figures for fourth-quarter 2018 at both Mont Belvieu, Texas, and Conway, Kan. We apologize for the error.

A high school classmate who still lives in the Chicago area posted a local TV station’s seven-day weather forecast on Facebook. The expectation for Jan. 30, what would be the city’s second-coldest day on record, called for 20 mph gusts that would drop the wind chill to as low as -55 degrees. The description was “breezy.”

Yeah, breezy, it’s just Chicago weather, suck it up. And here’s the weird part: the Henry Hub five-day average natural gas price fell 8.7% in the five days leading up to the massive arctic blast, seemingly a market salute to grizzled Chicagoans who don’t need gas to heat their homes because they don’t feel cold like mere mortals. (To be fair, an article on that station’s website labeled the chill as “barbaric.”)

Of course that price trend is for the country as a whole, but dangerously cold weather is sweeping across a wide swath from the Midwest to the Northeast and gas inventories have been below the five-year average for months. Isn’t this a strange time to become a (Chicago) bearish trader?

The Chicago City Gate price skyrocketed 133% in the two trading days leading up to the big freeze but the market as a whole was intent on looking ahead. By Groundhog Day, the high was expected to be 36 degrees and anticipated early-February warmth was tempering enthusiasm.

But that may be premature: “The significant thing to remember from last year was that enough cold hung around that withdrawals continued well into April instead of the normal small injections that occur,” wrote the analysts at EnVantage Inc.

But that may be premature: “The significant thing to remember from last year was that enough cold hung around that withdrawals continued well into April instead of the normal small injections that occur,” wrote the analysts at EnVantage Inc.

Prices for propane and C5+ fell last week at Mont Belvieu, Texas, while ethane and the butanes moved higher. Ethane pulled itself above 30 cents per gallon (gal) for the first time in six weeks and its margin soared from just under 6 cents/gal to over 11 cents/gal. All NGL margins at Mont Belvieu improved last week, most in double digits.

Gulf Coast ethane stocks likely increased between October and January as cracking demand fell by at least 100,000 barrels per day (bbl/d), EnVantage said. That means that a move outside the 30 cents/gal to 35 cents/gal range is unlikely until Sasol’s and Formosa Petrochemical Corp.’s crackers in Louisiana come online in the second half of the year, adding about 170,000 bbl/d of demand.

What could mess up this projection? Glad you asked. No new major fractionators are scheduled to come online in the second half of 2019, EnVantage points out. But if completion of the Sasol or Formosa crackers is delayed then the chances of an ethane price spike are diminished. Mont Belvieu is expecting 535,000 bbl/d of new fractionation capacity to come online in first-quarter 2020.

“So the fate of ethane prices is extremely dependent on the timing of the new ethane crackers vs. the timing of new fractionation capacity,” said EnVantage’s analysts. “A major misalignment can cause considerable price volatility for ethane as was seen in the second half of 2018.”

In the week ended Jan. 25, storage of natural gas in the Lower 48 experienced a decrease of 173 billion cubic feet (Bcf), the U.S. Energy Information Administration reported, compared to the Stratas Advisors expectation of a 222 Bcf withdrawal. The figure resulted in a total of 2.197 trillion cubic feet (Tcf). That is 0.6% below the 2.211 Tcf figure at the same time in 2018 and 13% below the five-year average of 2.525 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman.

Recommended Reading

Exxon Mobil Appoints Imperial’s Evers to Managerial Role

2025-01-10 - Sherri Evers, Imperial Oil’s senior vice president of sustainability, commercial development and product solutions, has been appointed general manager for Exxon Mobil North America Lubes.

Kimmeridge Texas Gas Prices $500MM in Senior Notes Offering

2025-01-09 - Kimmeridge Texas Gas said the senior unsecured notes will be used to repay a portion of outstanding revolver borrowings and support the buildout of the company.

Lion Equity Partners Buys Global Compression from Warren Equipment

2025-01-09 - Private equity firm Lion Equity Partners has acquired Warren Equipment Co.’s Global Compression Services business.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.