It appears as though any recoupling that took place between crude and NGL prices in the past year was a coincidence more than a return to the old form of normalcy given the decoupling between the two produces that has taken place in the past month.

While West Texas Intermediate (WTI) crude has been trading at an average of $60 per barrel (/bbl) for the past month, NGL prices have lost nearly 10% in value at Conway and Mont Belvieu. Interestingly, there is more evidence to suggest that prices should recouple on the downward cycle more than a further widening of the delta between the two markets.

NGL prices are expected to continue to face headwinds throughout the rest of the summer with the possible exception of ethane, which may begin to see improvements. The biggest headwind facing the NGL market is the large storage build for most liquids with ethane being the only product that can reasonably anticipate a tightening of volumes in the near term. This situation has caused most NGL prices to hit their lowest level in nearly a decade.

Interestingly, the global crude market is also oversupplied, but prices have been improving. According to Barclays Capital prices may reverse as the market reacts to the large storage levels for crude. “The market has benefitted from several one-off and seasonal factors over the past six months,” the investment firm said in a June 26 research note.

“In Q1, winter weather added to price-dependent demand and a precipitous decline in drilling activity. Remarkably, over three-quarters of Europe’s oil demand growth in January and February came from weather-related gasoil demand. In Q2, one-off refining outages kept non-OECD (Organization for Economic Co-operation and Development) throughputs in check, amid strong gasoline demand, which created strong margins and high demand for crude. The conflict in Yemen erupted and is likely not going away anytime soon. The winter was severe, Saudi-Yemeni conflicts continue, refining outages have been acute, OPEC and non-OPEC unplanned outages are at record levels, and the Chinese have continued their opportunistic crude buying. So OPEC managed to squeak by the shoulder season without too steep of a price decline. Put in the context of the past several years, these events are exceptional and almost all bullish in nature. What if the next group of factors is the opposite of this?” the report said.

Further, Barclays Capital noted that the oil glut hasn’t sufficiently cleared and instead only shifted geography. Additionally, North American balances have been supported by very high refining runs, declining output from the Bakken, wildfires in Canada, and synthetic crude oil maintenance. It is unlikely that crude prices will reach their lows from earlier in this year, but it wouldn’t be surprising if it holds firm.

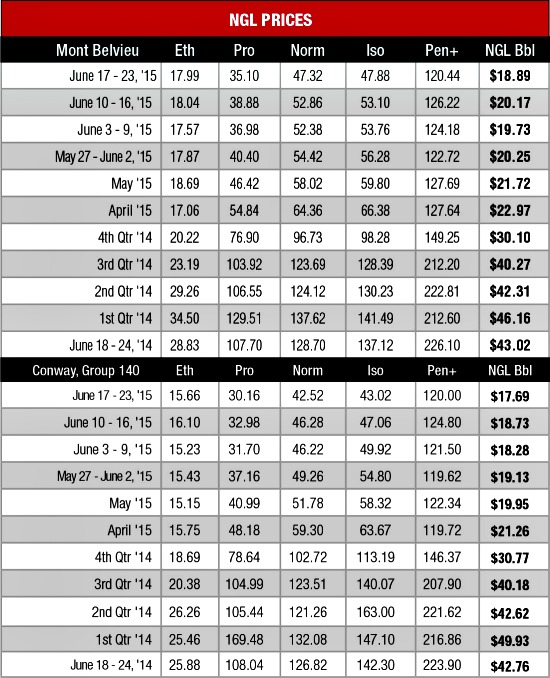

The story is starker for NGL prices, especially for propane, which hit 14-year lows at both Mont Belvieu and Conway at 35 cents per gallon (/gal) and 30 cents/gal, respectively. While margins remain positive, the Midcontinent frac spread is very thin. There is a silver lining though and that’s the fact that storage builds have been lower than expected the past few weeks as LPG exports grow.

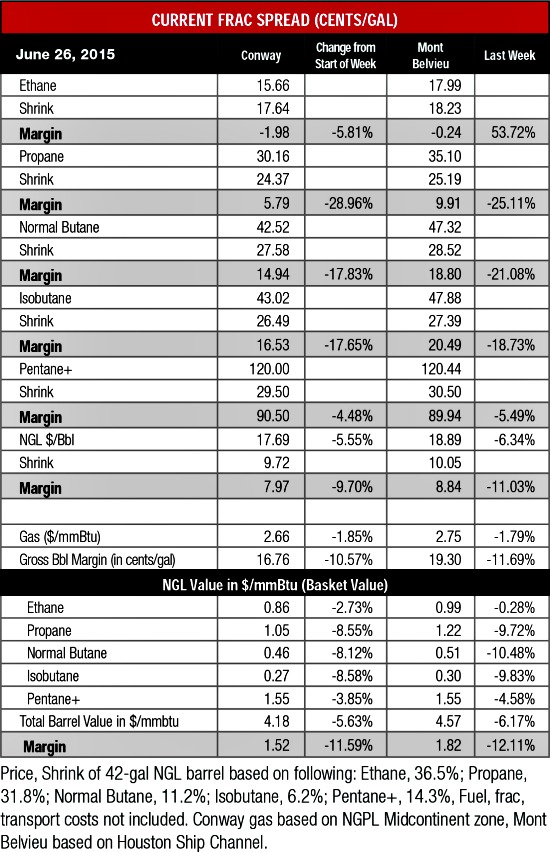

Ethane margins are negative at both hubs, but balances are tight due to rejection of approximately 540,000 bbl/d. According to En*Vantage, next month frac spread margins will need to rise to economically dispatch rejected volumes in areas with the lowest transportation costs to Mont Belvieu.

The theoretical NGL bbl price had a 6% decline at both hubs with the Mont Belvieu price down to $18.89/bbl with an 11% drop in margin to $8.84/bbl and the Conway price dropped to $17.69/bbl with a 10% drop in margin to $7.97/bbl.

The most profitable NGL to make at both hubs was C5+ at 91 cents/gal at Conway and 90 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 17 cents/gal at Conway and 21 cents/gal at Mont Belvieu; butane at 15 cents/gal at Conway and 19 cents/gal at Mont Belvieu; propane at 6 cents/gal at Conway and 10 cents/gal at Mont Belvieu; and ethane at negative 2 cents/gal at Conway and nil at Mont Belvieu.

The U.S. Energy Information Administration reported that natural gas storage injection was down to 75 billion cubic feet the week of June 19 due to increased cooling demand. This increased the storage level to 2.508 trillion cubic feet (Tcf) from 2.433 Tcf. This was 38% higher than the 1.813 Tcf posted last year at the same time and 1% greater than the five-year average of 2.473 Tcf.

Cooling demand should remain high on both the East and West coasts according to the National Weather Service’s forecast for the week of July 1, which anticipates warmer-than-normal temperatures. However, demand from the Midwest will be less as it expects cooler-than-normal temperatures.

Recommended Reading

Post Oak Backs New Permian Team, But PE Faces Uphill Fundraising Battle

2024-10-11 - As private equity begins the process of recycling inventory, likely to be divested from large-scale mergers, executives acknowledged that raising funds has become increasingly difficult.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Sheffield: E&Ps’ Capital Starvation Not All Bad, But M&A Needs Work

2024-10-04 - Bryan Sheffield, managing partner of Formentera Partners and founder of Parsley Energy, discussed E&P capital, M&A barriers and how longer laterals could spur a “growth mode” at Hart Energy’s Energy Capital Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.