Source: BASF Corp., Hart Energy

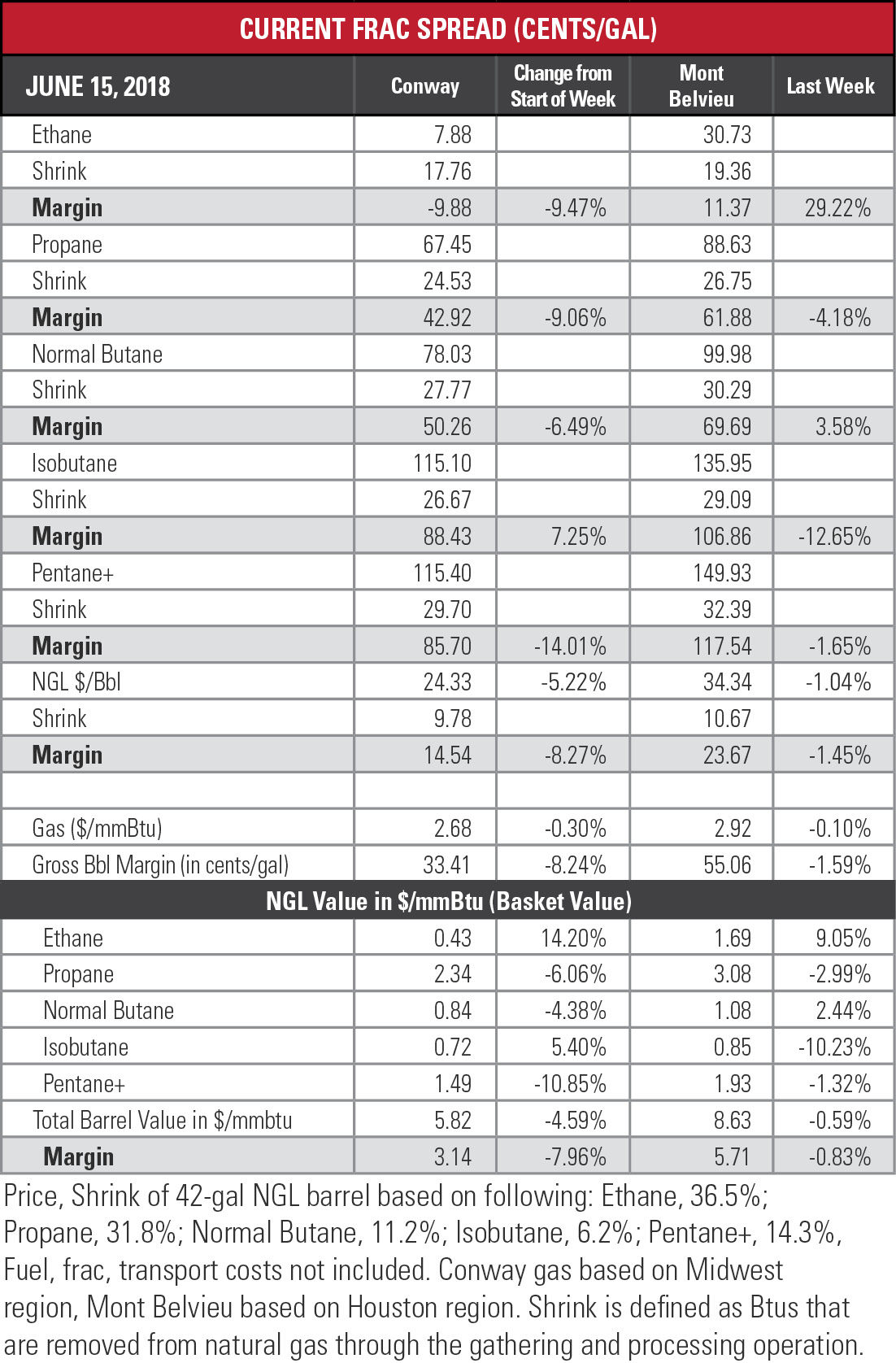

The Mont Belvieu, Texas, ethane price broke through 30 cents per gallon (gal) last week for the first time since March 2014—a 51-month stretch. The ethane margin at Mont Belvieu rose 29.22%, sailing past 11 cents/gal.

Overall NGL prices were static, with the hypothetical Mont Belvieu barrel slipping 36 cents to $34.34.

Mont Belvieu ethane has rallied for the last month, climbing 24.2% while the barrel is up only 1.6%. Will it last?

Probably not in the short term, said En*Vantage Inc. in a report. The analysts stuck to their contention that higher prices and frac spreads will prevail over the long term.

Probably not in the short term, said En*Vantage Inc. in a report. The analysts stuck to their contention that higher prices and frac spreads will prevail over the long term.

“As much as we thought that ethane was oversold in mid-May,” they wrote, “Mont Belvieu ethane might be overbought currently.”

That could be because the market overreacted to the idling of Chevron Phillips Chemical Co.’s Sweeny #22 cracker in mid-May. Then there was the ordered shutdown by the Pennsylvania Public Utility Commission of the Mariner East 1 pipeline because of sinkhole issues. The result of that, they said, was a redirection of ethane from Marcus Hook, Pa., to Morgan’s Point on the Houston Ship Channel.

The U.S. Energy Information Administration’s (EIA) report of a decline in ethane inventories in March, En*Vantage said, came as extraction hit an all-time high. Traders may also be trying to get ahead of the upcoming demand push with ExxonMobil Chemical Co.’s Baytown ethane cracker expected to start up in July.

The U.S. Energy Information Administration’s (EIA) report of a decline in ethane inventories in March, En*Vantage said, came as extraction hit an all-time high. Traders may also be trying to get ahead of the upcoming demand push with ExxonMobil Chemical Co.’s Baytown ethane cracker expected to start up in July.

There was also the recurring theme from the recent Midstream Texas Conference in Midland: the era of ethane rejection is winding down.

Mont Belvieu propane has dropped again last week and has taken a 6.8% hit in the last three weeks. En*Vantage attributes this in part to EIA data showing propane inventories rising by rose by 4 million barrels in the week in the week ending June 1. For the following week, a higher-than-expected 3.7 million barrels were added.

That, combined with a lower level of exports, is likely pushing bearish sentiment among traders. It makes sense except that En*Vantage, which is expecting exports to be the main driver of propane prices this summer, has closely examined export data and believes that the EIA is underestimating the volumes of propane shipped.

The Mont Belvieu normal butane price rose by 2.4% last week as isobutane took a 10.2% hit, narrowing isobutane’s premium—which peaked at 57.8 cents/gal two weeks ago—to about 36 cents/gal. Butane has averaged $1/gal or more in only two weeks out of 24 so far this year, compared to seven times in the same period of 2017.

In the week ended June 8, storage of natural gas in the Lower 48 experienced an increase of 96 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 89 Bcf, the EIA reported. The figure resulted in a total of 1.913 trillion cubic feet (Tcf). That is 29.1% below the 2.698 Tcf figure at the same time in 2017 and 21% below the five-year average of 2.42 Tcf.

In the week ended June 8, storage of natural gas in the Lower 48 experienced an increase of 96 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 89 Bcf, the EIA reported. The figure resulted in a total of 1.913 trillion cubic feet (Tcf). That is 29.1% below the 2.698 Tcf figure at the same time in 2017 and 21% below the five-year average of 2.42 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

McKinsey: Big GHG Mitigation Opportunities for Upstream Sector

2024-11-22 - Consulting firm McKinsey & Co. says a cooperative effort of upstream oil and gas companies could reduce the world’s emissions by 4% by 2030.

E&P Highlights: Nov. 18, 2024

2024-11-18 - Here’s a roundup of the latest E&P headlines, including new discoveries in the North Sea and governmental appointments.

Darbonne: The Power Grid Stuck in Gridlock

2025-01-05 - Greater power demand is coming but, while there isn’t enough power generation to answer the call, the transmission isn’t there either, industry members and analysts report.

Nabors Takes to Global Expansion in 3Q as Rig Count Shrinks in Lower 48

2024-10-25 - Nabors Industries saw broad growth across key international geographies in third-quarter 2024, with more rig deployments expected.

What Chevron’s Anchor Breakthrough Means for the GoM’s Future

2024-12-04 - WoodMac weighs in on the Gulf of Mexico Anchor project’s 20k production outlook made possible by Chevron’s ‘breakthrough’ technology.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.