Kim Jong-Un had just assumed the title of supreme leader of North Korea and Steve Nash had just been traded from the Suns to the Lakers in July 2012, which was also the last time the Conway, Kan., price of ethane was as low as it was this past week.

Point guard Nash retired from the NBA two years ago and will be inducted into the Hall of Fame in September. Kim Jong-Un … let’s just say he keeps himself busy. Ethane’s price outlook, however, is appearing less certain all the time.

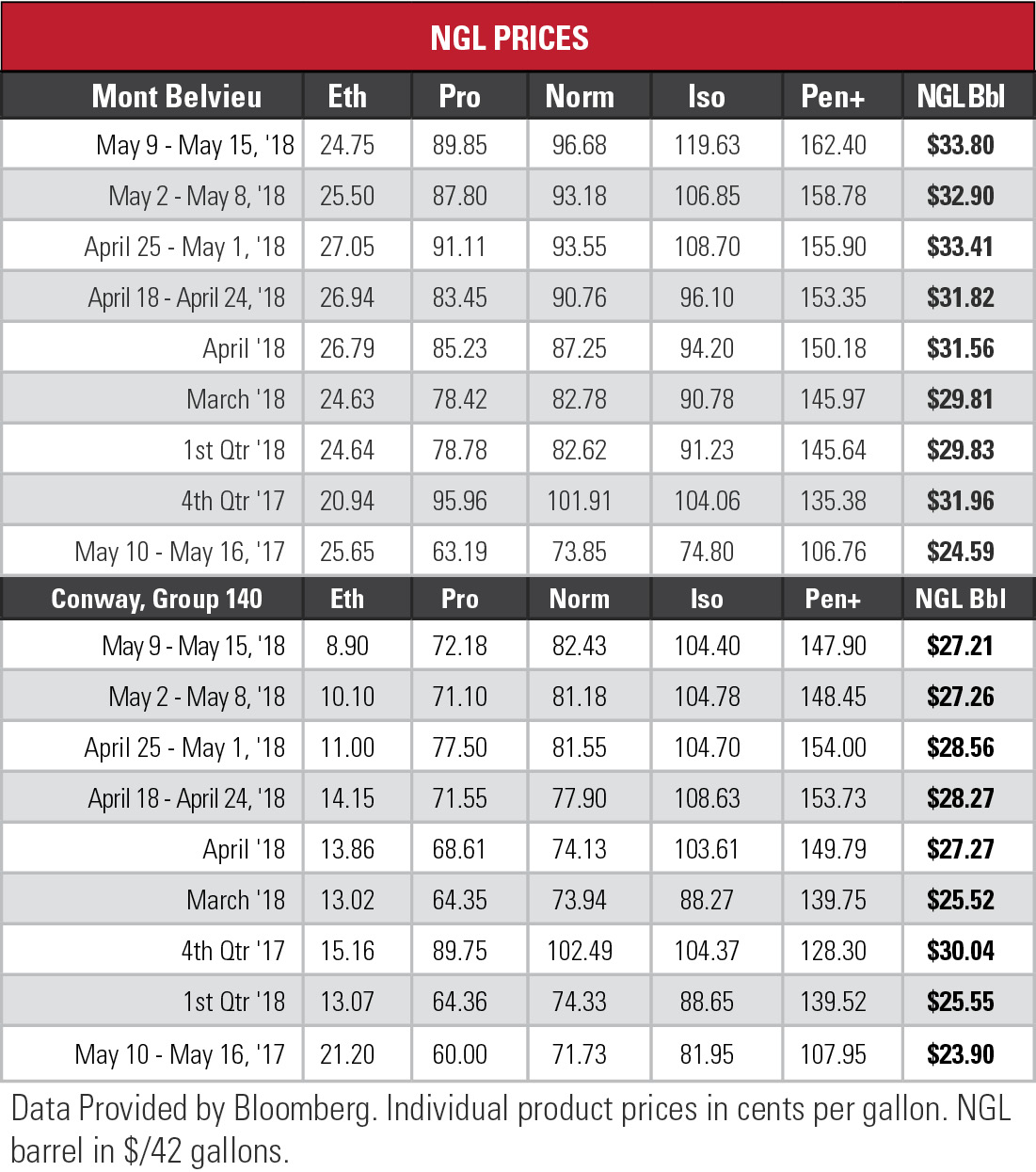

While the Mont Belvieu, Texas, ethane price dipped 2.9% to 24.25 cents per gallon (gal), what might be of greater concern is the downward trend. In the last two trading days of the five-day tracking period, Mont Belvieu ethane tumbled 5.1%. At Conway, the drop was 30% to 7 cents/gal.

The margins aren’t looking that great, either. At Mont Belvieu, ethane narrowed by almost 17% in the past week to just above 6 cents/gal. Conway’s continued to drop to -7.5 cents/gal.

The margins aren’t looking that great, either. At Mont Belvieu, ethane narrowed by almost 17% in the past week to just above 6 cents/gal. Conway’s continued to drop to -7.5 cents/gal.

“Despite strong ethane demand,” wrote En*Vantage Inc. analysts, “the current fear that many have is that the U.S. ethylene industry cannot continue to operate above 90% of capacity given the vast surplus of ethylene on the Gulf Coast that is weighing down spot ethytlene prices.”

That surplus could last another 18 months until more export capacity becomes operational. The U.S., En*Vantage noted, only has one ethylene export terminal—Targa Resources Inc.’s (NYSE: TRGP) Galena Park, Texas, facility—with capacity of about 365,000 metric tons per year. Meanwhile, ethane crackers are running hot, with En*Vantage reporting that one new plant is at 108% of nameplate capacity.

Propane’s prices and margins drifted upward at both hubs, but traders are becoming bearish, En*Vantage said. The U.S. Energy Information Administration (EIA) forecasts that, by October, inventories will surpass 2017 levels by 9%.

It’s not happening yet. The EIA reported that propane and propylene stocks for the week ending May 11 increased to 40.4 million barrels, but that is 23.4% below the five-year average level for this time of the year.

It’s not happening yet. The EIA reported that propane and propylene stocks for the week ending May 11 increased to 40.4 million barrels, but that is 23.4% below the five-year average level for this time of the year.

En*Vantage said the EIA forecast is on track, but prices could still spike with the completion of the Mariner East 2 pipeline, expected by the end of the third quarter. The pipe could push up exports from the Marcus Hook, Pa., terminal by 50,000 barrels per day (bbl/d). On the Gulf Coast, terminals could handle another 100,000 bbl/d.

If supply is available, there is a possible motivation for demand as well. The price of propane in northwest Europe is about 13 cents/gal higher than at Mont Belvieu. New U.S. sanctions could crimp not just Iranian crude oil exports but its LPG shipments, further tightening the market.

In the week ended May 11, storage of natural gas in the Lower 48 experienced an increase of 106 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 104 Bcf, the EIA reported. The figure resulted in a total of 1.538 trillion cubic feet (Tcf). That is 34.8% below the 2.359 Tcf figure at the same time in 2017 and 24.6% below the five-year average of 2.039 Tcf.

In the week ended May 11, storage of natural gas in the Lower 48 experienced an increase of 106 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 104 Bcf, the EIA reported. The figure resulted in a total of 1.538 trillion cubic feet (Tcf). That is 34.8% below the 2.359 Tcf figure at the same time in 2017 and 24.6% below the five-year average of 2.039 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Baker Hughes Wins Contracts for Woodside’s Louisiana LNG Project

2024-12-30 - Bechtel has ordered gas technology equipment from Baker Hughes for the first phase of Woodside Energy Group’s Louisiana LNG development.

Venture Global LNG Files Paperwork for IPO

2024-12-20 - Venture Global LNG filed initial paperwork for an IPO on Dec. 20, about a week after the company’s Plaquemines LNG facility started production.

Mexico Pacific Working with Financial Advisers to Secure Saguaro LNG I FID

2024-10-23 - Mexico Pacific is working with MUFG, Santander and JP Morgan to arrange the financing needed to support FID and the anchor phase of Saguaro Energía LNG.

Kimmeridge Texas Gas Prices $500MM in Senior Notes Offering

2025-01-09 - Kimmeridge Texas Gas said the senior unsecured notes will be used to repay a portion of outstanding revolver borrowings and support the buildout of the company.

Artificial Lift Firm Flowco Seeks ~$2B Valuation with IPO

2025-01-07 - U.S. artificial lift services provider Flowco Holdings is planning an IPO that could value the company at about $2 billion, according to regulatory filings.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.