Korean rapper PSY performs “Gangnam Style” on the “Today” show in 2013. (Source: Shutterstock)

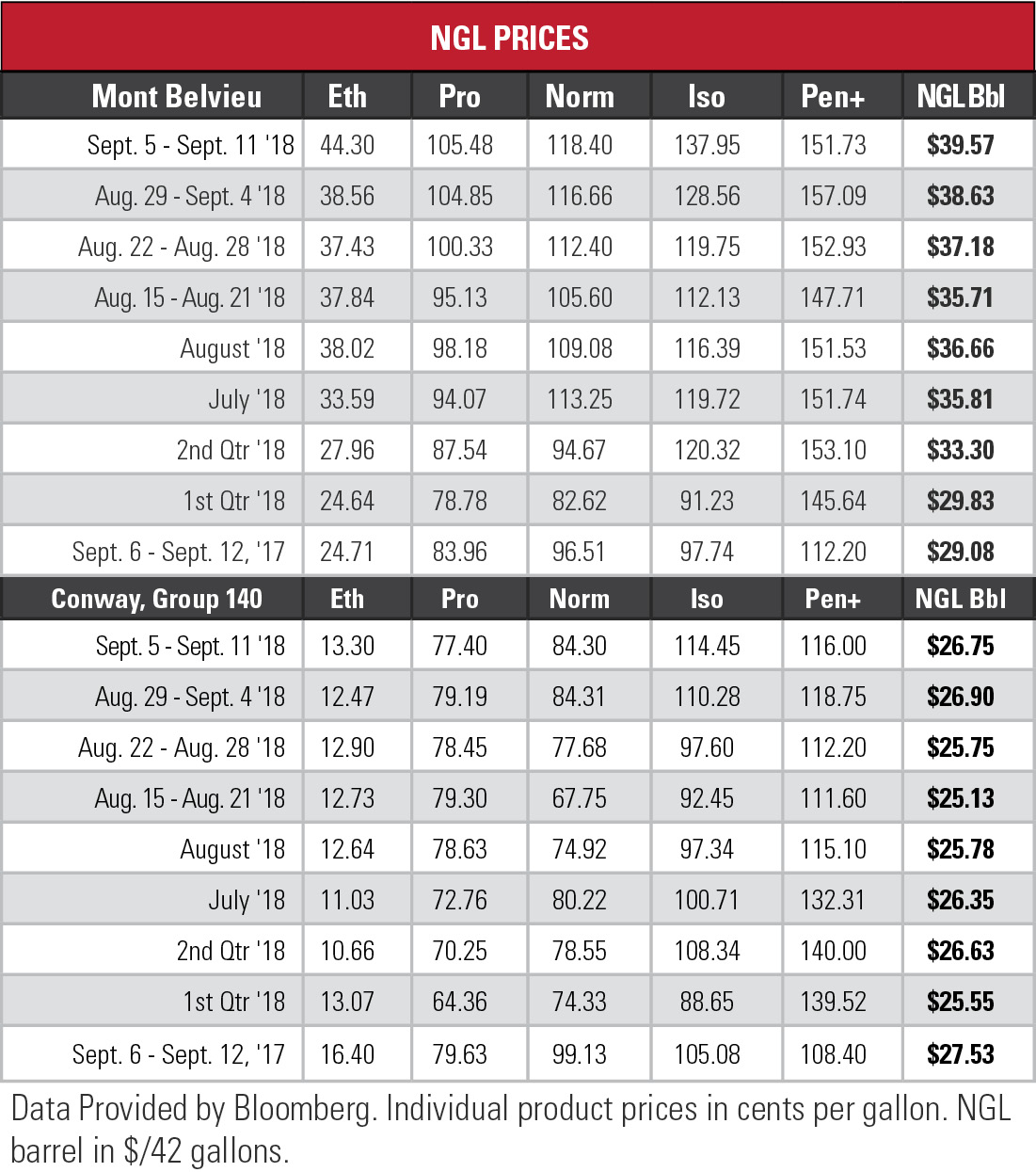

The ethane price at Mont Belvieu, Texas, broke through—no, more like exploded through the 40 cents per gallon (gal) ceiling last week to its highest level since the week ending May 1, 2012.

How long has it been? The last time ethane surpassed 44 cents/gal, future Houston Texan Deshaun Watson was still seven months away from setting the Georgia state high school passing record as quarterback of the Gainesville Red Elephants; Shohei Otani graduated high school and signed with the Hokkaido Nippon-Ham Fighters; and “Gangnam Style” first appeared on YouTube (3.2 billion views later, it’s still there).

Ethane’s dramatic price rise shows how it gives 110%. Literally. The price is up 110% for the year and the margin leapt more than 32% last week to close in on 26 cents/gal. Since the end of July, ethane’s price has zoomed 39%.

Ethane’s dramatic price rise shows how it gives 110%. Literally. The price is up 110% for the year and the margin leapt more than 32% last week to close in on 26 cents/gal. Since the end of July, ethane’s price has zoomed 39%.

Ethane balances have been tightening for a while, said EnVantage Inc. U.S. Energy Information Administration (EIA) data show declining commercial inventories—down 1.75 million barrels in June—while Gulf Coast demand, including exports, is up 430,000 barrels per day (bbl/d) in the last two years.

That demand does not include Exxon Mobil Corp.’s (NYSE: XOM) new Baytown, Texas, cracker that began operations in late July and sports a capacity of 1.5 million tons per year.

“As ethane inventories drop, accessing incremental ethane supplies from salt dome storage on the Gulf Coast becomes more difficult,” EnVantage said. “Consequently, ethane prices and frac spreads are rising to levels to induce more ethane extraction in gas processing regions furthest from the Gulf Coast demand centers.”

Rising ethylene prices are also pulling ethane higher, EnVantage said. The margins of propane and heavier NGL have slipped into the negative for petrochemical companies and ethane has moved up on the feedstock chain. EnVantage observed that petrochemical companies are:

Rising ethylene prices are also pulling ethane higher, EnVantage said. The margins of propane and heavier NGL have slipped into the negative for petrochemical companies and ethane has moved up on the feedstock chain. EnVantage observed that petrochemical companies are:

- Running new ethane crackers at above-designed rates; and

- Willing to pay a higher price for ethane as long as it generates in or around breakeven economics.

But now that ethane prices are up, what will it take to bring them down? More infrastructure in the way of pipelines and fractionation facilities, the analysts say. Until those projects to deliver ethane to the growing market are completed in 2020, prices can continue to rise and frac spread margins can continue to expand.

Mont Belvieu propane registered another high for 2018 with its third straight week above $1/gal. The last such $1-plus streak, which ended in October 2014, ran for 62 weeks. EnVantage noted that, because the price relative to West Texas Intermediate is lower than it was at this time last year and Gulf Coast balances are tight, propane may be able to climb higher in the coming weeks. Any price corrections, the analysts say, will be minor.

In the week ended Sept. 7, storage of natural gas in the Lower 48 experienced an increase of 69 billion cubic feet (Bcf), the EIA reported. The figure, compared to the Bloomberg survey’s consensus average of 66 Bcf, resulted in a total of 2.636 trillion cubic feet (Tcf). That is 20.1% below the 3.298 Tcf figure at the same time in 2017 and 18.4% below the five-year average of 3.232 Tcf.

In the week ended Sept. 7, storage of natural gas in the Lower 48 experienced an increase of 69 billion cubic feet (Bcf), the EIA reported. The figure, compared to the Bloomberg survey’s consensus average of 66 Bcf, resulted in a total of 2.636 trillion cubic feet (Tcf). That is 20.1% below the 3.298 Tcf figure at the same time in 2017 and 18.4% below the five-year average of 3.232 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman

Recommended Reading

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Geologist James Parr Joins Ring as EVP of Exploration, Geosciences

2024-11-26 - James Parr joins Ring Energy with over 30 years of experience as a petroleum geologist and leader in multiple energy organizations.

Lion Equity Partners Buys Global Compression from Warren Equipment

2025-01-09 - Private equity firm Lion Equity Partners has acquired Warren Equipment Co.’s Global Compression Services business.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.