There was hope that the crude market had turned the corner after West Texas Intermediate (WTI) prices rose to more than $60 per barrel (/bbl) in the spring and early summer. However, since July prices have tumbled fast as they’ve lost more than $20/bbl and stand just above $40/bbl with many forecasters feeling that they could fall to $30/bbl or even lower.

The U.S. Energy Information Administration (EIA) lowered its forecast for WTI prices to an average of $49/bbl in 2015 and $54/bbl in 2016, which indicates that it is likely prices linger in their current range for some time.

Most troubling for domestic producers, operators and traders is that there isn’t much the U.S. market can do to turn things around as the biggest influencers on crude prices remain production levels from OPEC nations and the strength of the Chinese economy. OPEC’s strong production has flooded the global market even as North America dials back production while China is the largest demand center for crude.

There is good news and bad news coming from these two fronts. The good news is that poorer countries in the OPEC cartel are making noises about reducing production. The bad news is that the Chinese economy continues to show weakness. Representing a mixed bag is growth in U.S. crude storage levels, but there is the likelihood that storage levels will not reach capacity.

The crude market could rally if one or more of the following happens: OPEC indicates a reduction in production either through an official announcement or a dire financial outlet is provided by one or more of their poorer members; the Chinese economy improves or stabilizes; or U.S. crude storage levels begin to fall back.

Similar to the U.S. crude market, any possible NGL market rally is reliant on improvements in other markets. The heavy NGL market depends on improved crude prices while the light NGL market is largely dependent on improved natural gas prices.

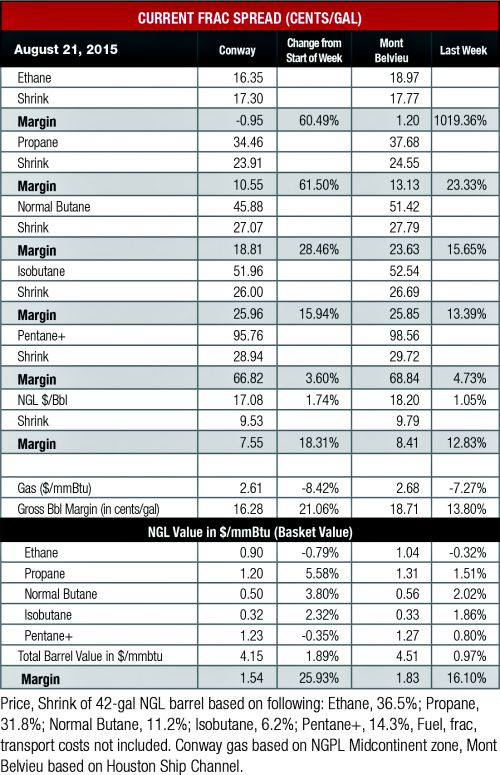

Consequently butane, isobutane and C5+ prices experienced modest gains while ethane prices dipped slightly at Conway and Mont Belvieu as natural gas fell at both hubs. Natural gas was down 8% to $2.61 per million Btu (/MMBtu) at Conway and 7% to $2.68/MMBtu at Mont Belvieu as the shoulder season is quickly approaching.

The decrease in gas prices improved the frac spread margins for ethane at both hubs with the Mont Belvieu margin improving 100% to a positive state while Conway margins improved by 62% to a near positive state.

Propane prices were the lone outlier in the NGL market as prices improved despite inventory levels remaining high and the downturn in gas prices. It is assumed that retail customers are taking advantage of low prices to prepare for the winter heating season and the crop-drying season. This was given further credence as the Conway price rose 6% to 35 cents per gallon (/gal), its highest price since the final week of May. The Mont Belvieu price rose 2% to 38 cents/gal.

Overall the theoretical NGL bbl improved 2% at Conway to $17.08/bbl with an 18% improvement in margin to $7.55/bbl. The Mont Belvieu bbl increased by 1% to $18.20/bbl with a 13% improvement in margin to $8.41/bbl.

The most profitable NGL to make at both hubs remained C5+ at 67 cents/gal at Conway and 69 cents/gal at Mont Belvieu. This was followed, in order by, isobutane at 26 cents/gal at both hubs; butane at 19 cents/gal at Conway and 24 cents/gal at Mont Belvieu; propane at 11 cents/gal at Conway and 13 cents/gal at Mont Belvieu; and ethane at negative 1 cent/gal at Conway and 1 cent/gal at Mont Belvieu.

The EIA reported that natural gas storage levels increased by 53 billion cubic feet to 3.03 trillion cubic feet (Tcf) the week of Aug. 14 from 2.977 Tcf the previous week. This was 19% greater than the 2.542 Tcf level reported last year at the same time and 3% greater than the five-year average of 2.95 Tcf. The bulk of this growth is attributed to increased production out of the Marcellus and Utica shales as the EIA reported that storage levels in the Eastern region rose by 1.457 Tcf. Cooling demand should remain strong with the National Weather Service forecasting warmer-than-normal temperatures along the East Coast, Gulf Coast and much of the Midwest.

Recommended Reading

Despite Big Oil’s SAF Ramp Up, Concerns Linger as Trump 2.0 Nears

2024-11-27 - Concerns remain about the scaleup of sustainable aviation fuel under a Trump administration, even as some see progress continuing as the world demands cleaner fuels and Big Oil steps up.

Don’t Get Distracted by Emissions Politics, Energy Executives Say

2024-11-20 - Eyeing profit with a keep-it-in-the-pipe mentality, executives’ thoughts are on lowering emissions, getting premiums and producing compliance-ready molecules for the EU.

WoodMac Sees Lighter Hand on Emissions, Departure From Paris Under Trump

2024-11-19 - Much of the Inflation Reduction Act is likely to remain in place, forecasting firm Wood Makenzie says.

NatGas Powerhouse EQT Reaches Net Zero Feat Ahead of Schedule

2024-10-31 - EQT says it lowered Scope 1 and Scope 2 greenhouse gas emissions by more than 900,000 tons.

Oxy CEO Takes Swing for Oil, Climate at Agitator-Disrupted Program

2024-09-26 - After a New York City event was disrupted, Occidental Petroleum President and CEO Vicki Hollub said agitators were after publicity and funding to “continue a business.”

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.