The U.S. and Canada will produce about 3 million barrels per day (MMbbl/d) of LPG this year, a 200,000 bbl/d increase over 2017, with ESAI Energy LLC expecting considerable growth in 2019.

All told, output should rise by about 400,000 bbl/d from 2017 to 2019, said Andrew Reed, principal of ESAI Energy, during an Aug. 15 webinar. Of that 3 million bbl/d of production, exports of 1.1 million bbl/d are split between the Atlantic Basin and Asian markets.

Growth in LPG supply is opening up a world of selling opportunities for U.S. exporters, who are now challenging for market share in areas traditionally dominated by Mideast producers, Reed said. That means shipping to old markets like China, Japan, South Korea and Taiwan, but also to new markets in Southeast Asia like Indonesia.

Growth in LPG supply is opening up a world of selling opportunities for U.S. exporters, who are now challenging for market share in areas traditionally dominated by Mideast producers, Reed said. That means shipping to old markets like China, Japan, South Korea and Taiwan, but also to new markets in Southeast Asia like Indonesia.

“Since Southeast Asia is a big butane importing market, the U.S. emergence as a major butane exporter should encourage the continued expansion of market share in that region,” Reed said.

A lot has changed since 2016, he said. Until that point, a lack of export terminals created a bottleneck, hindering U.S. efforts to move surplus product. Spare export capacity emerged in 2016 when Enterprise Products Partners LP (NYSE: EPD) opened its Morgan’s Point terminal on the Houston Ship Channel. This had a profound effect on trade.

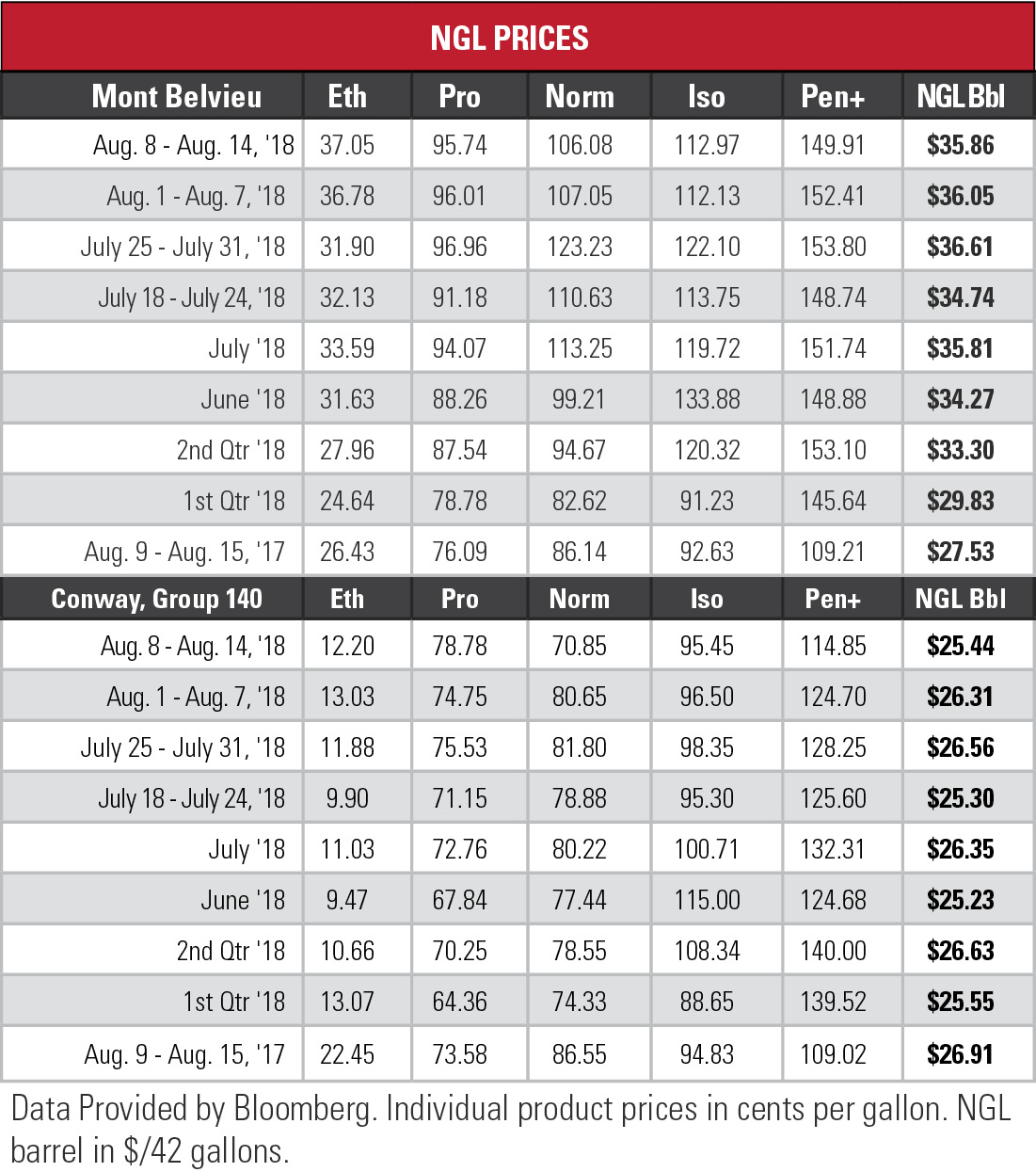

The export bottleneck before 2016 effectively created two separate markets, Reed said. As inventories accumulated in North America, propane prices at Mont Belvieu, Texas, fell to a $20 per barrel discount to the Far East. The Morgan’s Point opening was a game-changer. Suddenly, there was efficient interaction between the markets and the discount fluctuated at about $7 per barrel, which is in line with shipping costs.

“In November 2015, when exports were still impeded, the Mont Belvieu discount to the Far East was $24 per barrel,” Reed said. “Three months later, once there was surplus capacity, the discount fell to $6.”

“In November 2015, when exports were still impeded, the Mont Belvieu discount to the Far East was $24 per barrel,” Reed said. “Three months later, once there was surplus capacity, the discount fell to $6.”

ESAI estimates that global LPG demand, outside of the U.S. and Canada, is roughly 8 MMbbl/d. North American exports meet a little over 1 MMbbl/d of that demand with other sources making up. The U.S. carries an advantage, however, because importers seek marginal barrels.

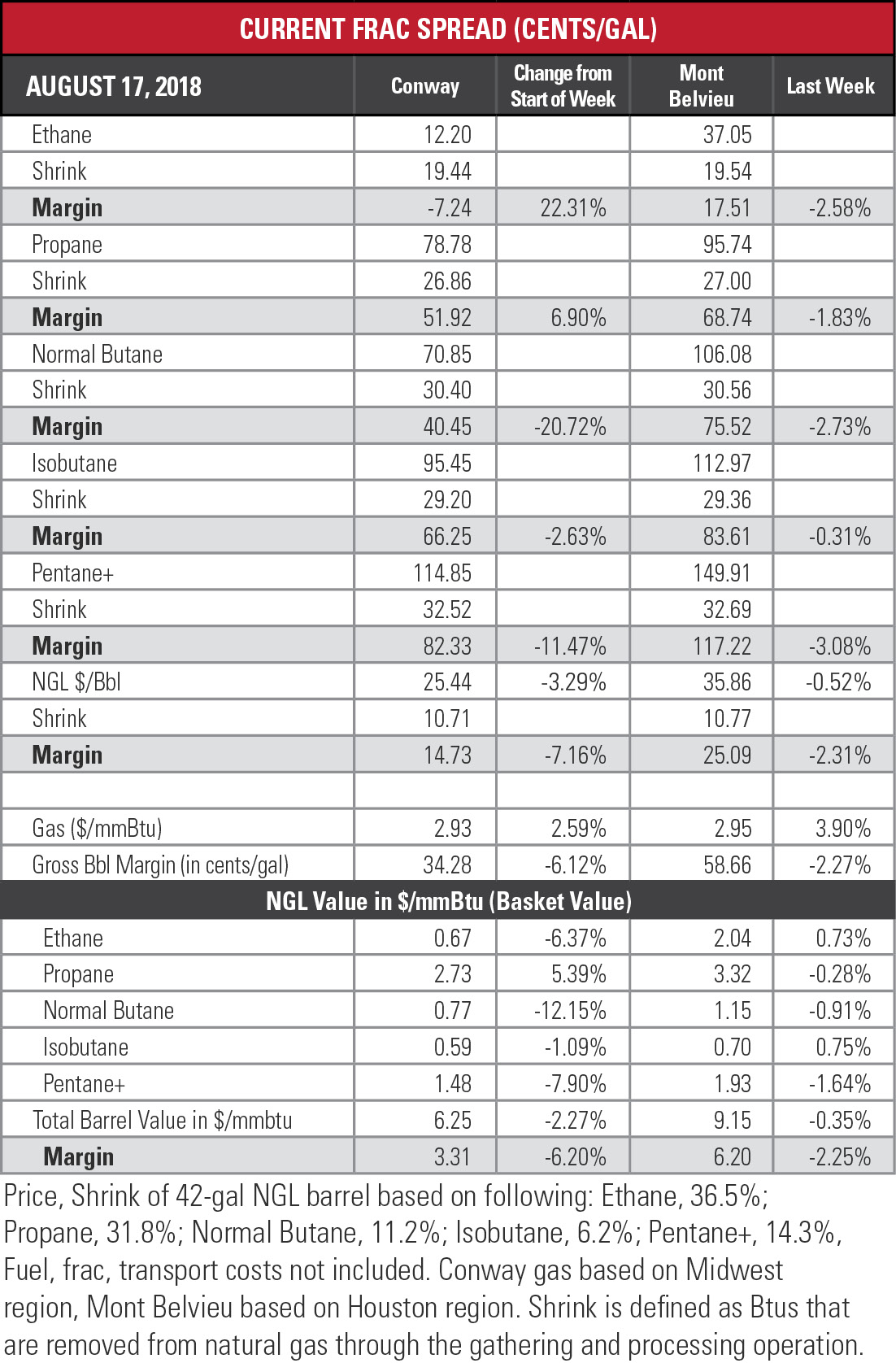

Ethane cracked 37 cents per gallon (gal) at Mont Belvieu last week for the first time in three and a half years. The price of Henry Hub natural gas, however, was up, cutting into ethane’s margin by 2.58%.

Envantage Inc. attributes the price increase—76% for the year—to the surge in demand from new crackers and rising exports. The market is primed for an uptick in supply but additional transport and fractionation infrastructure, while announced, will not be fully operational until the end of 2020.

Envantage projects tighter ethane balances on the Gulf Coast for the remainder of 2018, putting frequent upward pressure on prices. The analysts expressed concern, however, that Gulf Coast storage capacity will not keep up in the long term.

Envantage projects tighter ethane balances on the Gulf Coast for the remainder of 2018, putting frequent upward pressure on prices. The analysts expressed concern, however, that Gulf Coast storage capacity will not keep up in the long term.

In the week ended Aug. 10, storage of natural gas in the Lower 48 experienced an increase of 33 billion cubic feet (Bcf), the U.S. Energy Information Administration reported. The figure, above the Bloomberg survey’s consensus average of 29 Bcf, resulted in a total of 2.387 trillion cubic feet (Tcf). That is 22.3% below the 3.074 Tcf figure at the same time in 2017 and 20% below the five-year average of 2.982 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com or @JHMarkman.

Recommended Reading

Novel EOR Process Could Save Shale from a Dry Future

2024-12-17 - Shale Ingenuity’s SuperEOR, which has been field tested with positive results, looks to remedy the problem of production declines.

Permanent Magnets Emerge as a Game-Changer for ESP Technology

2024-12-19 - In 2024, permanent magnet motors installations have ballooned to 11% of electric submersible pump installations, and that number is growing.

Push-Button Fracs: AI Shaping Well Design, Longer Laterals

2024-11-26 - From horseshoe wells to longer laterals, NexTier, Halliburton and ChampionX are using artificial intelligence to automate drilling and optimize completions.

EnerMech Secures Contract with Major North Sea Operator

2024-11-13 - EnerMech will monitor the condition of the U.K. assets in accordance with safety and operational standards.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.