Source: Shutterstock

It’s that time of year to fire up the LeBron-O-Meter and gauge NGL prices.

The last time isobutane approached $1.60 per gallon (gal), as it did last week, was the last year that the Golden State Warriors and Cleveland Cavaliers were not in the NBA Finals.

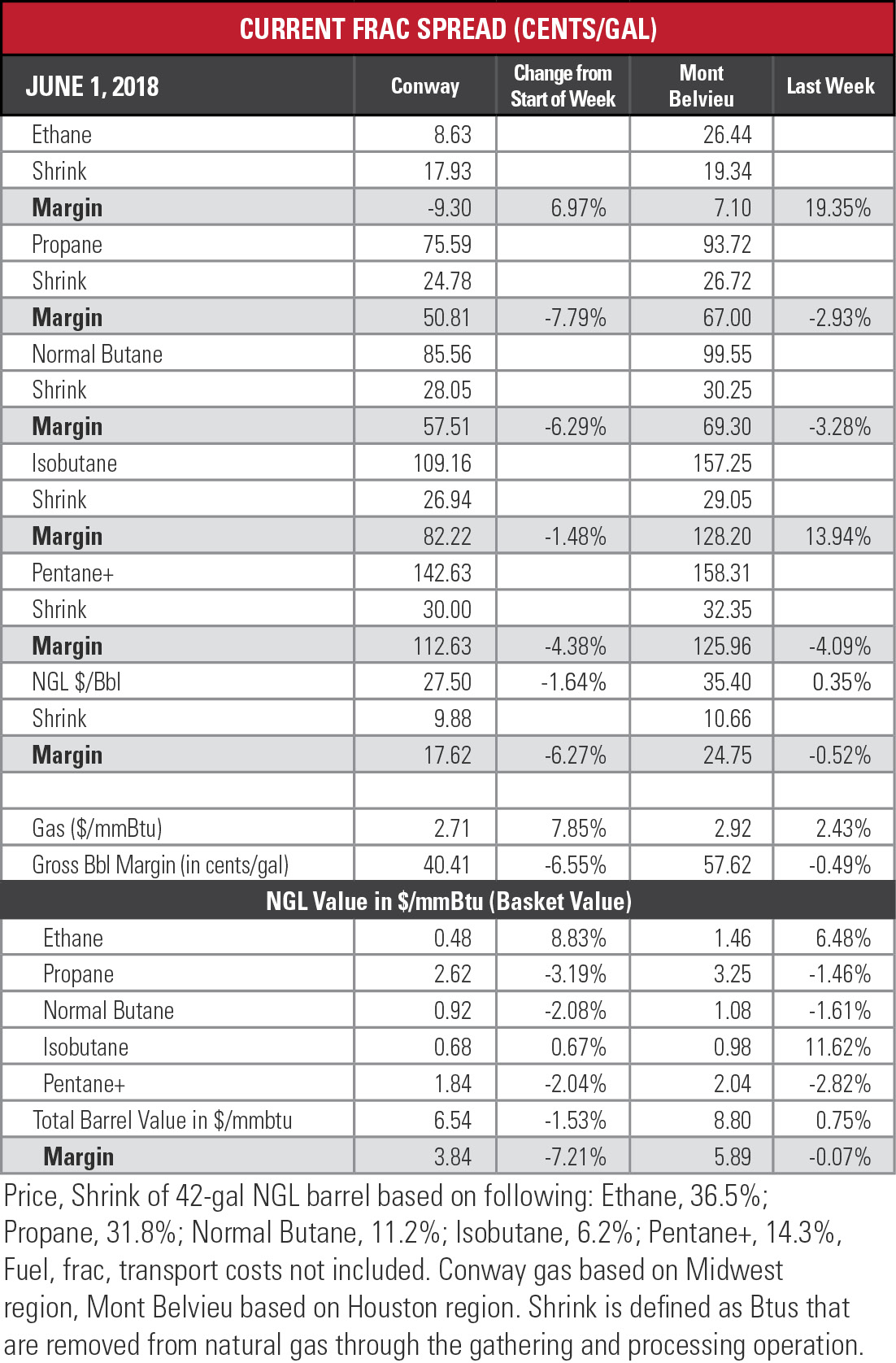

It’s been 52 months since isobutane reached that level in early February 2014, just a few months before the San Antonio Spurs knocked off the Miami Heat in five games. The hypothetical NGL barrel at Mont Belvieu, Texas, that week was $51.27. This week’s barrel price of $35.40 marks the second straight week of highs for 2018.

It’s been 52 months since isobutane reached that level in early February 2014, just a few months before the San Antonio Spurs knocked off the Miami Heat in five games. The hypothetical NGL barrel at Mont Belvieu, Texas, that week was $51.27. This week’s barrel price of $35.40 marks the second straight week of highs for 2018.

Which begs the obvious question on the minds of all who carefully track NGL: What were prices the last time LeBron James did not play in the league championship series? Place your bar bets, folks, and I’ll consult the LeBron-O-Meter.

In the first half of June 2010 (yes, it’s been that long) when the Los Angeles Lakers knocked off the Boston Celtics, the Mont Belvieu hypothetical barrel was between $44 and $45, or about 20% above where it is now. Ethane was priced at 53.6 cents/gal, or more than double this week’s price.

Natural gas prices that month averaged $4.79 per million Btu (MMBtu), a healthy 64% higher than Henry Hub’s average $2.92/MMBtu last week. And LeBron’s field-goal accuracy that year was 50.3%, compared to this season’s 54.2%.

Natural gas prices that month averaged $4.79 per million Btu (MMBtu), a healthy 64% higher than Henry Hub’s average $2.92/MMBtu last week. And LeBron’s field-goal accuracy that year was 50.3%, compared to this season’s 54.2%.

But back to isobutane: in the last seven weeks, the Mont Belvieu price has soared 81.3%. In the past week, isobutane’s Mont Belvieu margin widened by almost 14%. A recent report by OPIS attributed the jump to short covering, refinery upsets and high alkylate prices because the octane market is tight.

En*Vantage Inc. has a different take.

“The magnitude of the increase over such a short period of time could indicate that there is an outage of a C4 splitting tower at one of the Mont Belvieu fractionators or that at isomerization unit is down at either Enterprise’s Mont Belvieu isomerization complex or at one of the major refineries on the Gulf Coast,” the analysts speculated in a recent report.

Most NGL prices shuffled along in the past week, although Mont Belvieu ethane rose 6.5% to its fourth-highest price of the 22-week year. The margin also enjoyed a 19.35% boost to above 7 cents/gal.

In the week ended May 25, storage of natural gas in the Lower 48 experienced an increase of 96 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 102 Bcf, the U.S. Energy Information Administration reported. The figure resulted in a total of 1.725 trillion cubic feet (Tcf). That is 31.4% below the 2.513 Tcf figure at the same time in 2017 and 22.5% below the five-year average of 2.225 Tcf.

In the week ended May 25, storage of natural gas in the Lower 48 experienced an increase of 96 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 102 Bcf, the U.S. Energy Information Administration reported. The figure resulted in a total of 1.725 trillion cubic feet (Tcf). That is 31.4% below the 2.513 Tcf figure at the same time in 2017 and 22.5% below the five-year average of 2.225 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

DNO Makes Another Norwegian North Sea Discovery

2024-12-17 - DNO ASA estimated gross recoverable resources in the range of 2 million to 13 million barrels of oil equivalent at its discovery on the Ringand prospect in the North Sea.

Wildcatting is Back: The New Lower 48 Oil Plays

2024-12-15 - Operators wanting to grow oil inventory organically are finding promising potential as modern drilling and completion costs have dropped while adding inventory via M&A is increasingly costly.

DNO Discovers Oil in New Play Offshore Norway

2024-12-02 - DNO ASA estimated gross recoverable resources in the range of 27 MMboe to 57 MMboe.

Freshly Public New Era Touts Net-Zero NatGas Permian Data Centers

2024-12-11 - New Era Helium and Sharon AI have signed a letter of intent for a joint venture to develop and operate a 250-megawatt data center in the Permian Basin.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.