NGL prices continued to improve as West Texas Intermediate (WTI) prices held firm at $45.00 per barrel (/bbl) and some customers took advantage of attractive prices to prepare for the upcoming heating and crop-drying demand seasons.

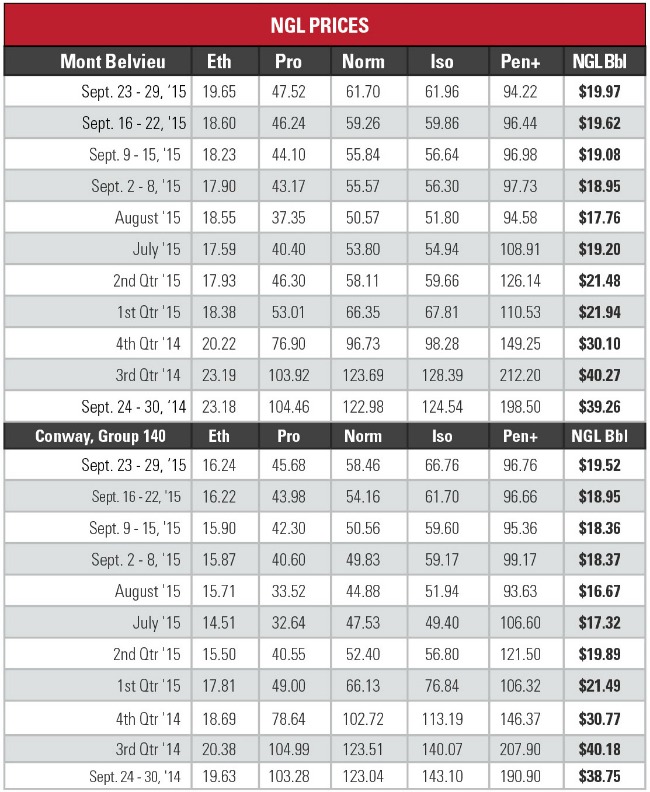

In addition to the improved WTI prices, butane and isobutane also benefitted from refineries coming back online after many underwent turnarounds. This resulted in both Mont Belvieu prices improving 4% to 62 cents per gallon (/gal) each and the Conway prices increasing 8% to 59 cents/gal for butane and 67 cents/gal for isobutane.

While butane and isobutane prices improved at both hubs, the same could not be said for the NGL with the closest relationship to crude as C5+ took a downturn at Mont Belvieu and remained flat at Conway. Until crude shows real improvement it is difficult to see C5+ gaining much support.

Unfortunately the crude market remains very uncertain with nearly as many claims that can support a price increase as can support a further downturn. On the downward side, China’s economy outlook is unclear, and it is expected that Iranian crude will further flood an already oversaturated market once trade sanctions are lifted against the country.

The more optimistic viewpoint is that both current and forward prices will not support production and will need to be corrected. “The market is taking for granted that ample crude supplies will be available for a foreseeable period of time and is ignoring the fact that a considerable amount of crude production resides in very unstable countries … It is very difficult to predict whether oil prices will see another correction over the short term, but any correction from these levels will do even more damage to the global supply picture,” En*Vantage said in its Oct. 1 Weekly Energy Report.

En*Vantage anticipates the global supply surplus will fall from 2 million bbl/d to less than 500 million bbl/d even with Iran producing 1 million bbl/d. If this forecast is correct, it would result in a significant change in crude prices.

Propane prices continued to post gains at both hubs despite very large storage levels that are expected to reach record highs before the end of the year as the market prepares for the demand seasons. The Conway price rose 4% to 46 cents/gal, the largest it has been since the end of April when it was 47 cents/gal. The Mont Belvieu price increased 3% to 48 cents/gal, the highest level at the hub since it was the same price the week of May 13.

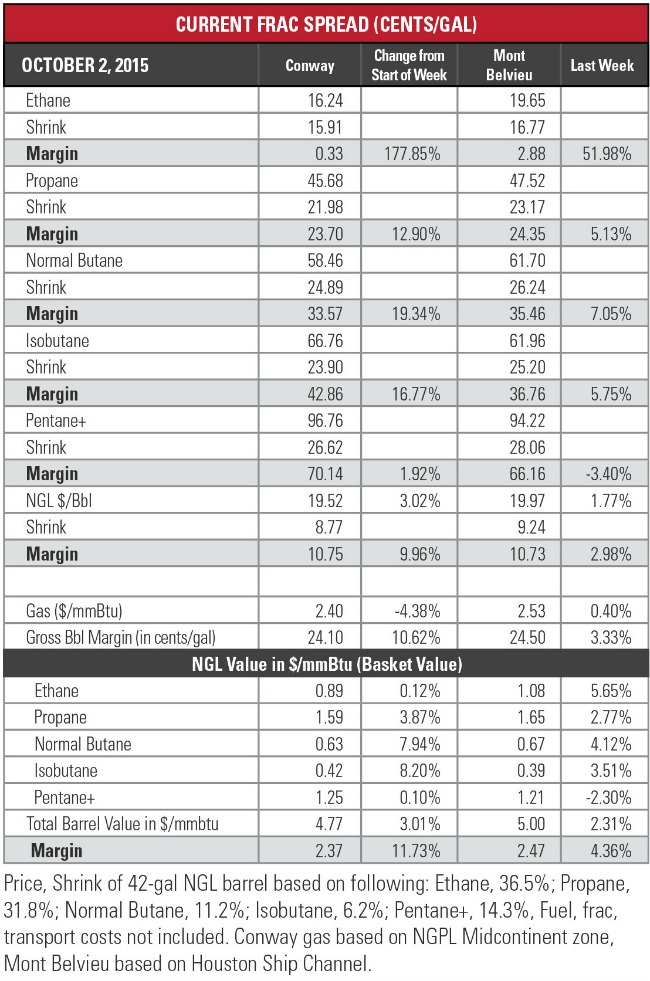

The theoretical NGL bbl price improved 3% at Conway to $19.52/bbl with a 10% gain in margin to $10.75/bbl while the Mont Belvieu price rose 2% to $19.97/bbl with a 3% gain in margin to $10.73/bbl.

The most profitable NGL to make at both hubs remained C5+ at 70 cents/gal at Conway and 66 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 43 cents/gal at Conway and 37 cents/gal at Mont Belvieu; butane at 34 cents/gal at Conway and 36 cents/gal at Mont Belvieu; propane at 24 cents/gal at both hubs; and ethane at nil at Conway and 3 cents/gal at Mont Belvieu.

Natural gas storage levels posted a high injection of 98 billion cubic feet to 3.538 trillion cubic feet (Tcf) the week of Sept. 25 from 3.44 Tcf the previous week, according to the latest data available from the U.S. Energy Information Administration. This was 15% greater than the 3.084 Tcf posted last year at the same time and 5% greater than the five-year average of 3.386 Tcf.

Unfortunately heating demand is expected to be muted the week of Oct. 7 as the National Weather Service’s forecast anticipates warmer-than-normal temperatures around the country. Though there may be some cooling-demand days in the mix for this forecast, it is not likely enough to avert another large storage injection.

Recommended Reading

Non-op Rising: NOG’s O’Grady, Dirlam See Momentum in Co-purchase M&A

2024-09-05 - Non-operated specialist Northern Oil & Gas is going after larger acquisitions by teaming up with adept operating partners like SM Energy and Vital Energy. It’s helping bridge a capital gap in the upstream sector, say NOG executives Nick O’Grady and Adam Dirlam.

DT Midstream Moves on Network Expansion, See Gas Demand Up in ‘25

2024-10-30 - DT Midstream expects an increase in natural gas demand in the Haynesville Shale in 2025, despite a third-quarter earnings miss.

Chevron, in Hess Holding Pattern, Sells $6.8B in Alaska, Canada

2024-10-08 - Chevron Corp., waiting to close a $55 billion takeover of Hess Corp., is selling off non-core assets in Canada and Alaska.

Asset Manager Buys SandRidge Stake, Looks for More Midcon M&A

2024-10-22 - Investment manager Third Avenue believes Midcon E&P SandRidge Energy is primed for M&A and a boost to shareholder returns.

Devon Ups Delaware Basin Ante With 21-Well Pad, Secondary Zones

2024-11-06 - Devon Energy is producing record volumes from the Delaware Basin—its biggest asset—where the company drilled a 21-well pad targeting six different intervals in recent months.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.