The leading players in the geopolitical scenario are Iranian Supreme Leader Ayatollah Ali Khamenei, left; President Donald Trump; and Chinese President Xi Jinping. (Source: Shutterstock, HartEnergy.com)

(Editor’s Note: The Frac Spread feature will not be published next week due to the Independence Day holiday. It will return on July 11.)

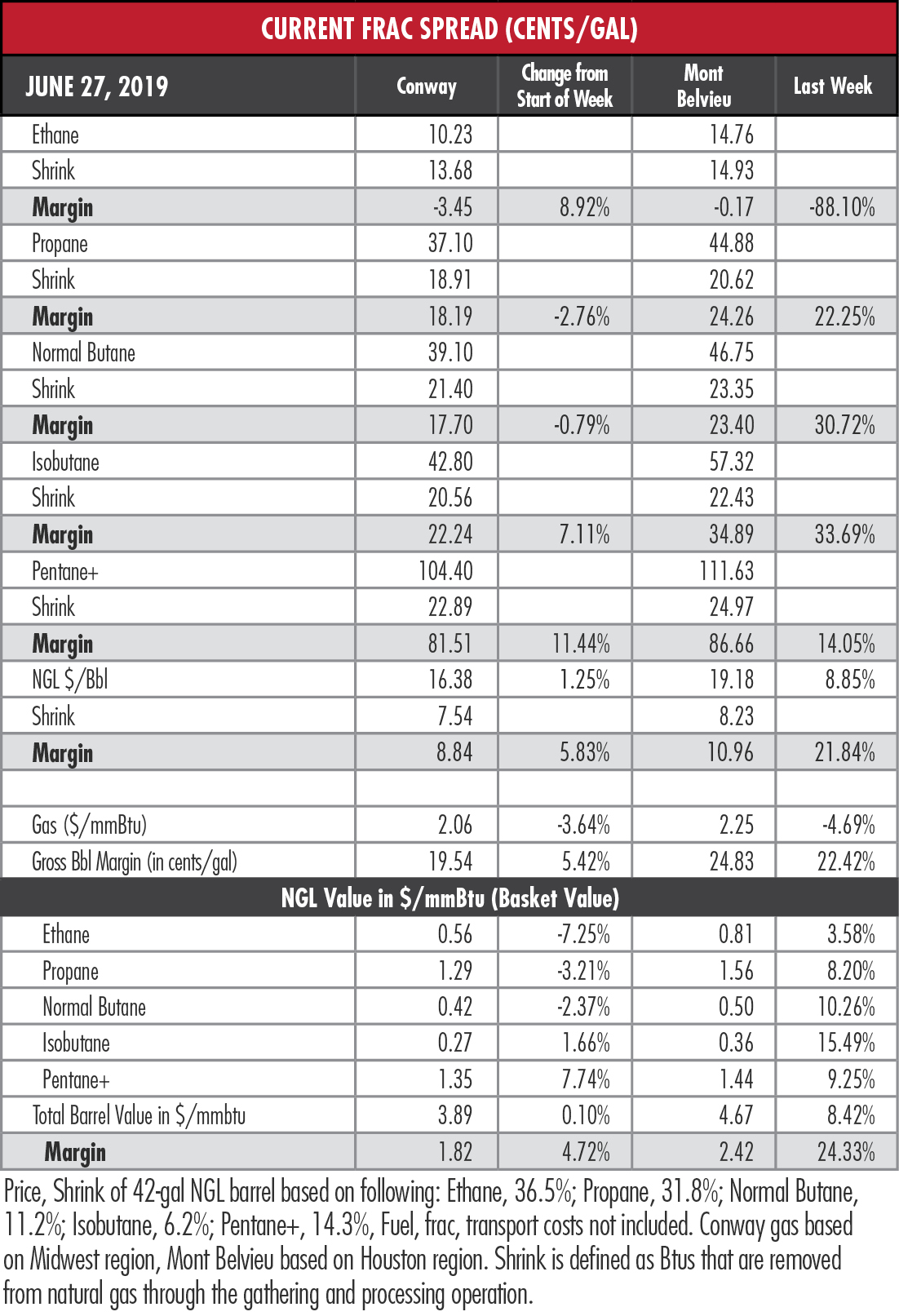

Prices of heavy NGL rebounded strongly last week with Mont Belvieu, Texas, margins improving significantly. But as market fundamentals grapple with geopolitical turmoil, commodities have little room in which to move.

The ramping up of tensions in the Persian Gulf between the U.S. and Iran should have propelled the price of crude skyward but they are overshadowed by the upcoming G-20 talks in Osaka, Japan. Specifically, the scheduled chat this weekend between President Donald Trump and Chinese President Xi Jinping.

“Failure to reach agreement in U.S.-China trade talks has battered sentiment over recent months, stoking fears of recession and a steeper slowdown in the demand for oil,” Fitch Solutions Macro Research said in a report on June 25. “These fears have kept prices subdued in the face of an escalating stand-off between the U.S. and Iran.”

“Failure to reach agreement in U.S.-China trade talks has battered sentiment over recent months, stoking fears of recession and a steeper slowdown in the demand for oil,” Fitch Solutions Macro Research said in a report on June 25. “These fears have kept prices subdued in the face of an escalating stand-off between the U.S. and Iran.”

Blocking the Strait of Hormuz would choke off about one-third of the world’s seaborne oil.

“A key reason that Iran needs the Strait of Hormuz open is because its own crude and natural gas goes through the same passage as the barrels coming from Saudi Arabia, the United Arab Emirates, Kuwait, Qatar and Iraq,” wrote Bloomberg Opinion columnist David Fickling. Strangling Iran’s oil-export market is hurting its economy but hasn’t succeeded in forcing the regime to buckle under to demands from the Trump administration.

“It’s actually increased the risks around Hormuz,” Fickling argued. “With barely any Iranian oil flowing anyway, the further economic pain Tehran would suffer from disrupting traffic through the Strait would be trivial.”

The columnist points out that Iran could well be encouraged to threaten supplies if it has nothing to lose. Choking the waterway wouldn’t take much, either. While the strait itself is 21 miles wide at its narrowest point, the shipping lane is only two miles wide.

The columnist points out that Iran could well be encouraged to threaten supplies if it has nothing to lose. Choking the waterway wouldn’t take much, either. While the strait itself is 21 miles wide at its narrowest point, the shipping lane is only two miles wide.

The situation could be expected to push global prices up, but among the factors pulling in the opposite direction is the ever-growing production from U.S. shale plays, Fatih Birol, executive director of the International Energy Agency, said on June 24 at a conference in Dublin. “It provides a ceiling on the price hikes which is very good news for consumers around the world,” he said.

Which moves us away from the Persian Gulf and toward Japan, where the G-20 will meet beginning on June 28. The market, Fitch notes, is tilting much more toward bearish demand-side drivers than to bullish drivers on the supply side.

“As such, the outcome of the G-20 meeting may be key in shaping the trajectory for prices in the second half of the year,” Fitch noted. “This too seems to be the opinion of OPEC+, which has delayed its meeting until after the G-20 talks are concluded.”

In the week ended June 21, storage of natural gas in the Lower 48 experienced an increase of 98 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. Meanwhile, Stratas Advisors expected a 99 Bcf build and the Bloomberg consensus was 101 Bcf. The EIA figure resulted in a total of 2.301 trillion cubic feet (Tcf). That is 11.4% above the 2.065 Tcf figure at the same time in 2018 and 6.9% below the five-year average of 2.472 Tcf.

In the week ended June 21, storage of natural gas in the Lower 48 experienced an increase of 98 billion cubic feet (Bcf), the Energy Information Administration (EIA) reported. Meanwhile, Stratas Advisors expected a 99 Bcf build and the Bloomberg consensus was 101 Bcf. The EIA figure resulted in a total of 2.301 trillion cubic feet (Tcf). That is 11.4% above the 2.065 Tcf figure at the same time in 2018 and 6.9% below the five-year average of 2.472 Tcf.

Technical issues with Hart Energy’s data provider do not allow us to provide the price of ethane from Conway, Kan., for the last week of March because of a loss of pricing data for that time period. For the same reason, we cannot compare the price of the hypothetical Conway NGL barrel to the previous week. Conway ethane prices are not available for March 2019 and first-quarter 2019. We apologize for the inconvenience.

Recommended Reading

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.