Perhaps the best way to describe the current commodities market would be deceptively improving, especially when it comes to frac spread margins. Though margins were largely up at both Conway and Mont Belvieu, these were based on incremental NGL price improvements and natural gas prices that are struggling even as heating demand has been increasing.

Despite a blizzard that impacted such high demand centers like New York City, Philadelphia and Washington, DC, gas prices traded at just above $2.00 per million Btu (/MMBtu). Of course, low gas prices are nothing new as Henry Hub prices averaged $2.62/MMBtu in 2015, the lowest average price since 1999. The U.S. Energy Information Administration (EIA) reported that storage levels reached a record 4.009 trillion cubic feet (Tcf) in November.

Though the news for gas markets has not been upbeat, improvements could be coming to the market in the second-half, according to Barclays Capital.

“[A]lthough high storage levels are set to remain an albatross around the neck of the bulls, we still think slowing production and incremental demand will give natural gas prices some room to run in the second-half of 2016 relative to the current curve,” the investment firm said in its Jan. 21 Gas and Power Kaleidoscope.

Barclays Capital anticipates the average gas price in 2016 to further dip to $2.56/MMBtu, but average $2.87/MMBtu in the second-half as more gas-fired power generation comes online in the summer with increased coal plant retirements. The investment firm estimates that power generation in 2015 was a record 26.4 billion cubic feet per day (Bcf/d) and forecasts a similar total of 26.2 Bcf/d with normal summer temperatures, but if temperatures are similar to this past summer it could set another record with an additional 400 million cubic feet per day (MMcf/d) to 500 MMcf/d in demand. This would place the storage level at under 3.7 Tcf, according to the report.

While lower gas prices are improving margins for ethane, these margins are still very thin and the NGL has been pushed aside as the most preferred ethylene feedstock by propane. Though propane is trading at twice the price of ethane, its higher Btu content makes up for this price disparity and encourages ethylene producers to make the feedstock switch.

Heavy NGL prices have taken an obvious hit with the drop in crude values, but butane and isobutane experienced upticks this week as West Texas Intermediate crude rebounded from just over $26 per barrel (/bbl) to more than $30/bbl. However, refiners will begin to manufacture summer-grade gasoline, which will reduce the demand for butane.

Overall the theoretical NGL bbl price fell 1% to $13.69/bbl with a 1% decline in margin to $6.35/bbl at Conway while holding firm at $14.18/bbl with a 2% decline in margin to $6.58/bbl at Mont Belvieu. It goes without saying that these figures are the lowest in more than a decade and will take a combination of decreased production in 2016 and increased demand to restore balance to the market.

The most profitable NGL to make at both hubs was C5+ at 44 cents per gallon (/gal) at both hubs. This was followed, in order, by isobutane at 29 cents/gal at Conway and 25 cents/gal at Mont Belvieu; butane at 23 cents/gal at Conway and 25 cents/gal at Mont Belvieu; propane at 11 cents/gal at Conway and 12 cents/gal at Mont Belvieu; and ethane at nil at Conway and 1 cent/gal at Mont Belvieu.

The EIA reported that natural gas storage levels fell by 211 Bcf to 3.086 Tcf the week of Jan. 22 from 3.297 Tcf the previous week. This was 21% greater than the 2.556 Tcf posted last year at the same time and 16% greater than the five-year average of 2.654 Tcf.

Recommended Reading

Companies Hop on Digital Twins, AI Trends to Transform Day-to-day Processes

2024-10-23 - A big trend for oil and gas companies is applying AI and digital twin technology into everyday processes, said Kongsberg Digital's Yorinde Lokin-Knegtering at Gastech 2024.

Push-Button Fracs: AI Shaping Well Design, Longer Laterals

2024-11-26 - From horseshoe wells to longer laterals, NexTier, Halliburton and ChampionX are using artificial intelligence to automate drilling and optimize completions.

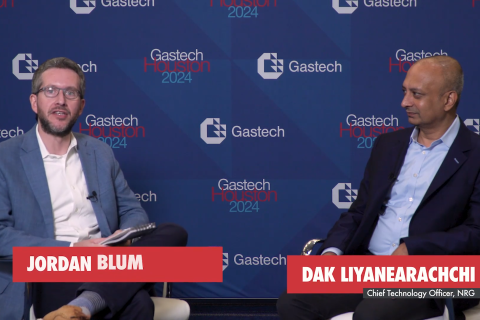

Exclusive: Embracing AI for Precise Supply-Demand Predictions

2024-10-17 - Dak Liyanearachchi, the CTO with NRG, gives insight on AI’s capabilities in optimizing energy consumption and how NRG is making strides to manage AI’s growth, in this Hart Energy exclusive interview.

Fugro’s Remote Capabilities Usher In New Age of Efficiency, Safety

2024-11-19 - Fugro’s remote operations center allows operators to accomplish the same tasks they’ve done on vessels while being on land.

Liberty Capitalizes on Frac Tech Expertise to Navigate Soft Market

2024-10-18 - Liberty Energy capitalized on its “competitive edge” when navigating a challenging demand environment in third-quarter 2024, CEO Chris Wright said in the company’s quarterly earnings call.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.