Source: Shutterstock

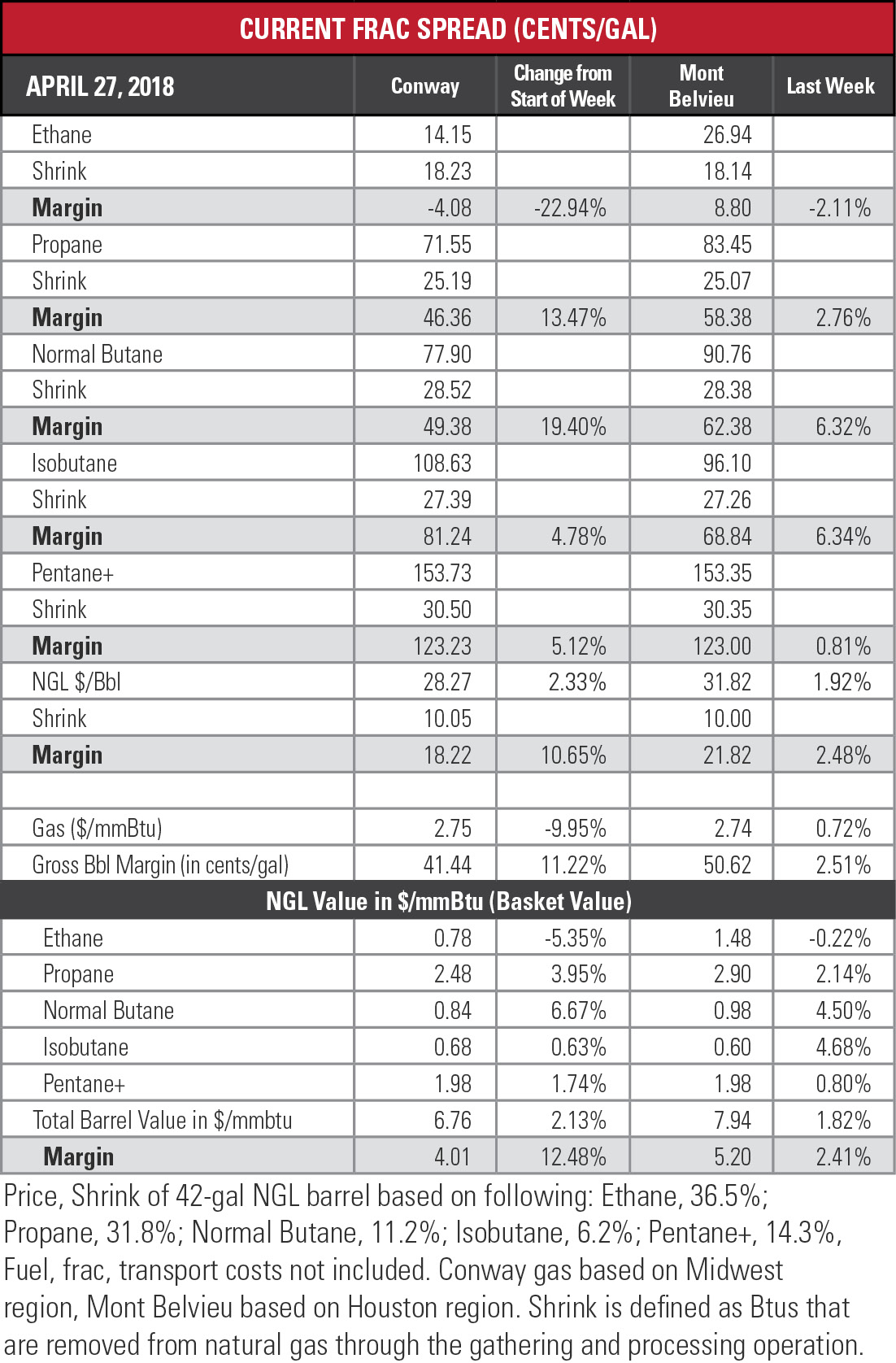

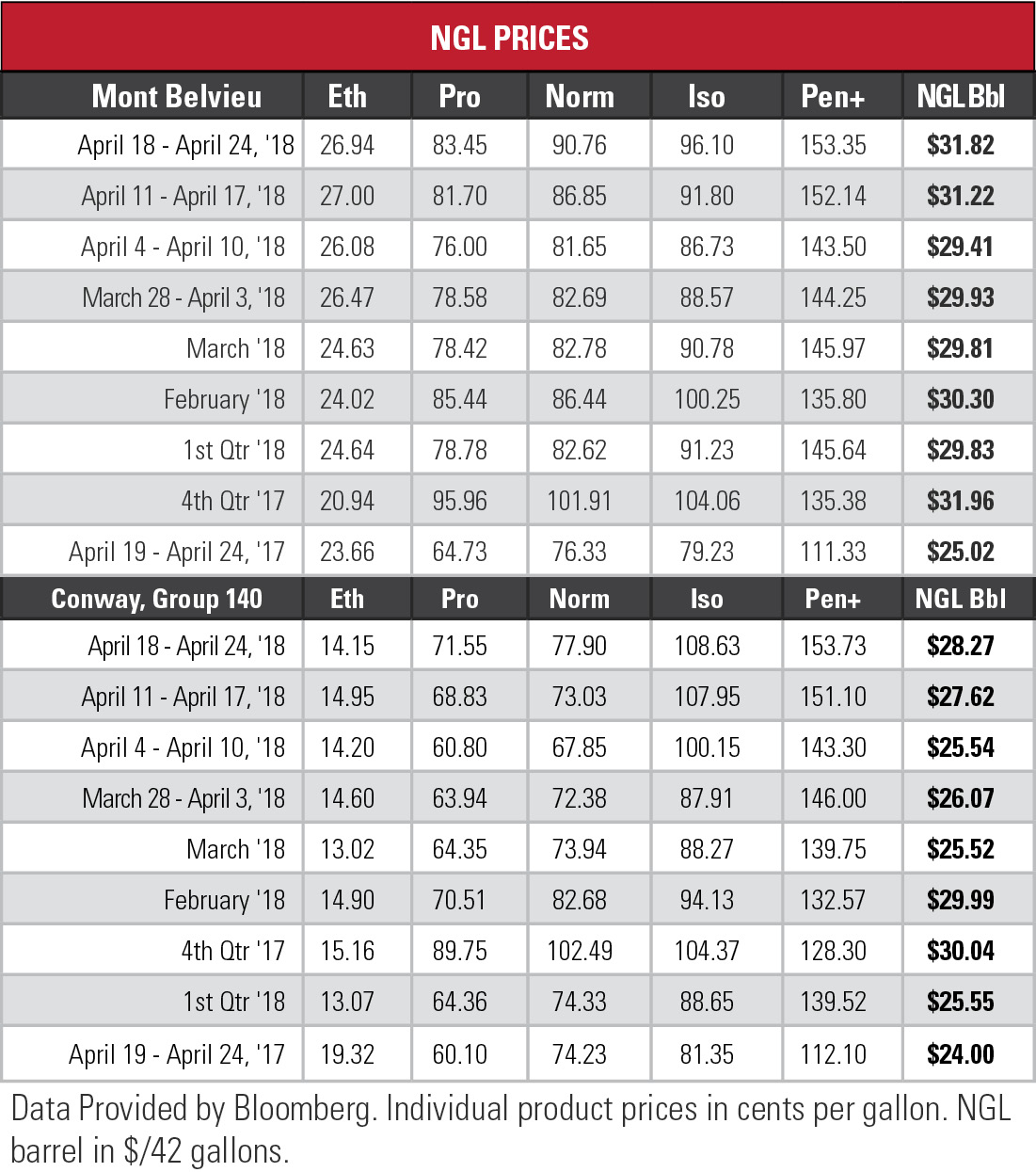

Natural gasoline reached a 41-month high last week at Mont Belvieu, Texas, as the two-week run of the hypothetical NGL barrel returned to levels not seen since the start of the year.

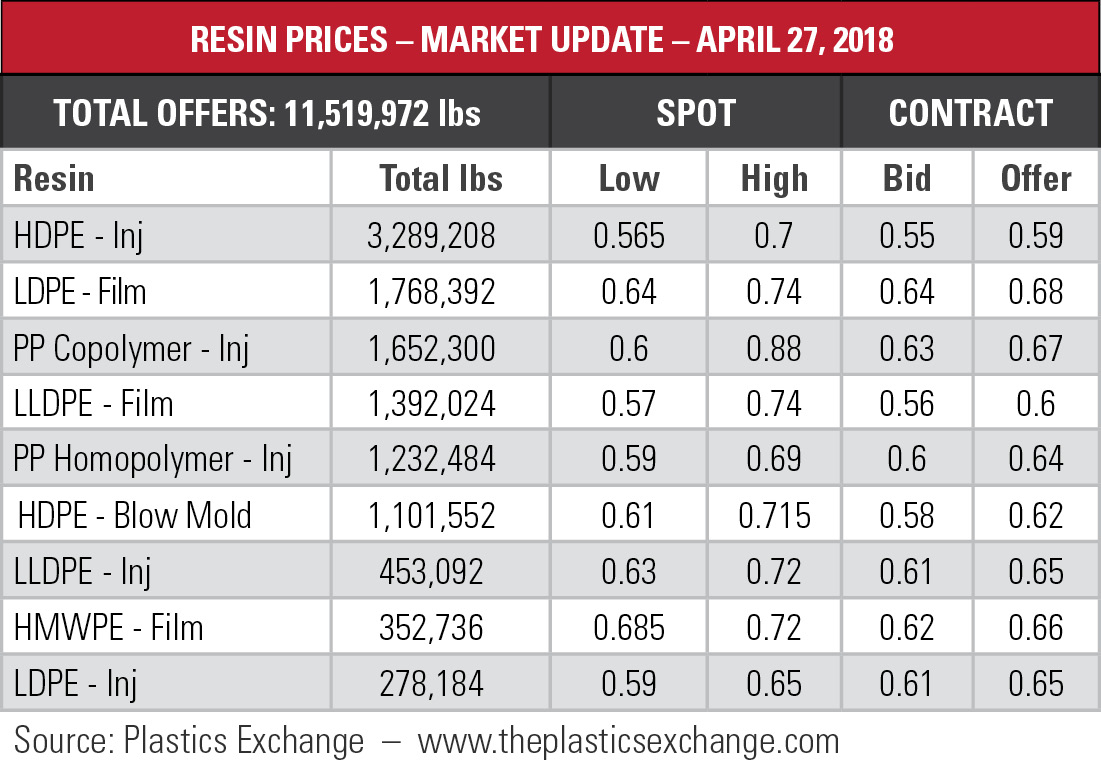

Countering that upswing was the relatively stagnant price of ethane at just under 27 cents per gallon (gal). Ethylene prices are weak, said En*Vantage Inc., but there is no indication that ethane crackers are easing up. Polyethylene production is up, which translates into higher demand for ethylene but most of it is going into storage.

The positive spin is that a significant jump in polyethylene exports will solve this problem. More realistically, En*Vantage fears a major bottleneck in the value chain if those exports don’t pick up as the year moves along.

The positive spin is that a significant jump in polyethylene exports will solve this problem. More realistically, En*Vantage fears a major bottleneck in the value chain if those exports don’t pick up as the year moves along.

In short, ethane demand is rising but higher production is creating a downstream bottleneck in storage. That puts demand on the road to a possible slump and En*Vantage’s previous forecast of 30 cents/gal at Mont Belvieu by mid-year could be at risk.

Propane, with its price up 10.2% in the past three weeks and 28.9% in the past year at Mont Belvieu, saw its margin widen by 2.76% to a bit over 58 cents/gal. The price of propane is riding along the price of crude oil and balances will not be a problem, En*Vantage’s Peter Fasullo said in the company’s recent presentation at the GPA Midstream conference.

That’s because poor economics have brought down propane cracking demand. En*Vantage also listed:

That’s because poor economics have brought down propane cracking demand. En*Vantage also listed:

- The shaky status of the Mariner East system means that more Northeast propane is likely to be railed to the Gulf Coast this summer;

- The market may be concerned about tariff retaliation from China over U.S. propane exports; and

- Growing supplies from gas processing.

The analysts’ hunch is that these worries will not play out, that many traders will find themselves short on propane heading into the summer and that a squeeze is possible by the fourth quarter.

And natural gasoline’s stunning strength, with its price above $1.50/gal at both Mont Belvieu and Conway, Kan.? That can be attributed to the increased flow of Canadian heavy crude oil south to the U.S. Gulf Coast that is in need of diluent to move through pipelines.

And natural gasoline’s stunning strength, with its price above $1.50/gal at both Mont Belvieu and Conway, Kan.? That can be attributed to the increased flow of Canadian heavy crude oil south to the U.S. Gulf Coast that is in need of diluent to move through pipelines.

In the week ended April 20, storage of natural gas in the Lower 48 experienced a decrease of 18 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 12 Bcf, the U.S. Energy Information Administration reported. It’s the second week in a row that storage has dropped during what is typically the summer injection season. The figure resulted in a total of 1.281 trillion cubic feet (Tcf). That is 41.2% below the 2.178 Tcf figure at the same time in 2017 and 29.1% below the five-year average of 1.808 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Baker Hughes Wins Contracts for Woodside’s Louisiana LNG Project

2024-12-30 - Bechtel has ordered gas technology equipment from Baker Hughes for the first phase of Woodside Energy Group’s Louisiana LNG development.

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Mexico Pacific Working with Financial Advisers to Secure Saguaro LNG I FID

2024-10-23 - Mexico Pacific is working with MUFG, Santander and JP Morgan to arrange the financing needed to support FID and the anchor phase of Saguaro Energía LNG.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.