Source: Shutterstock

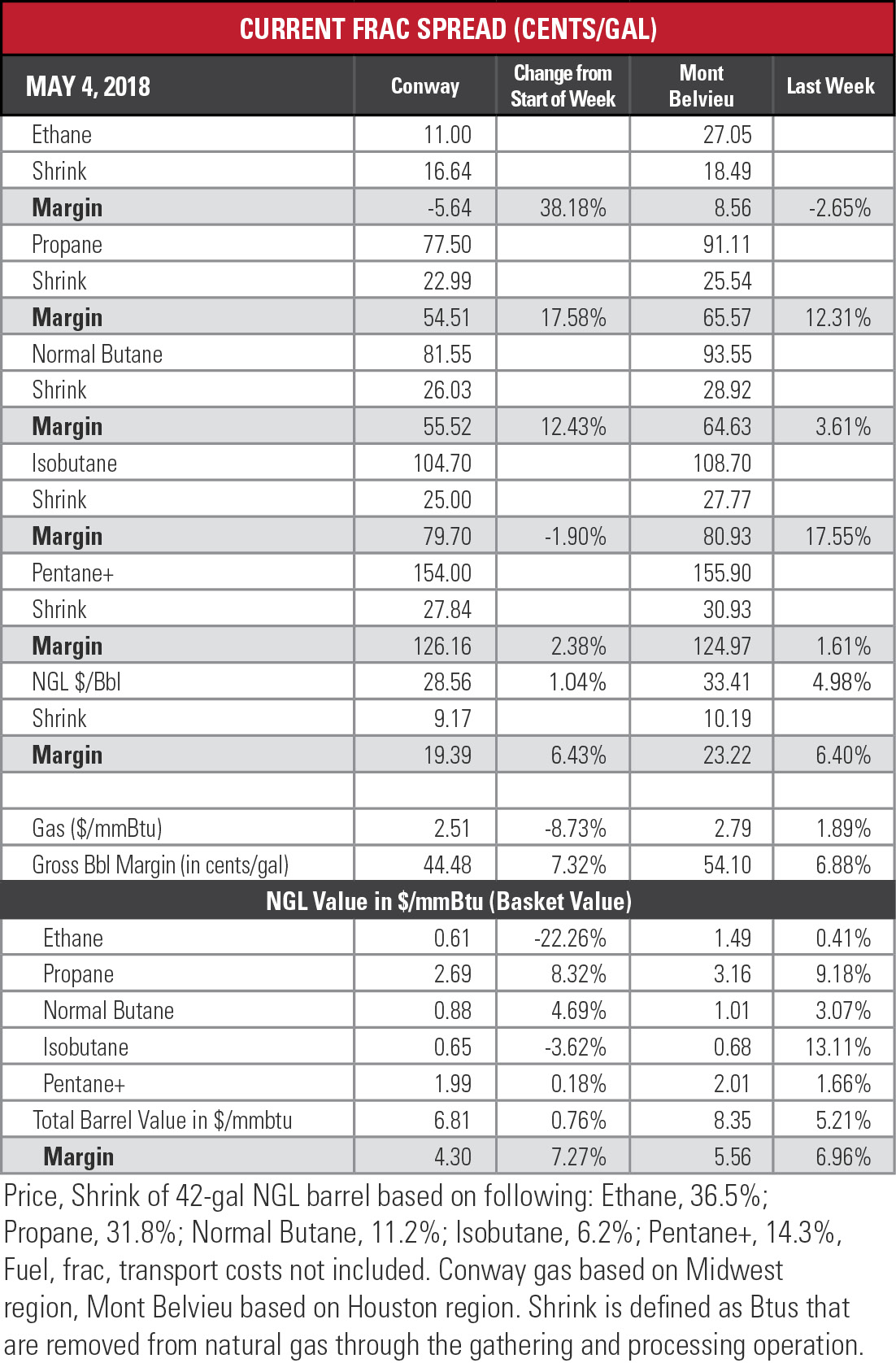

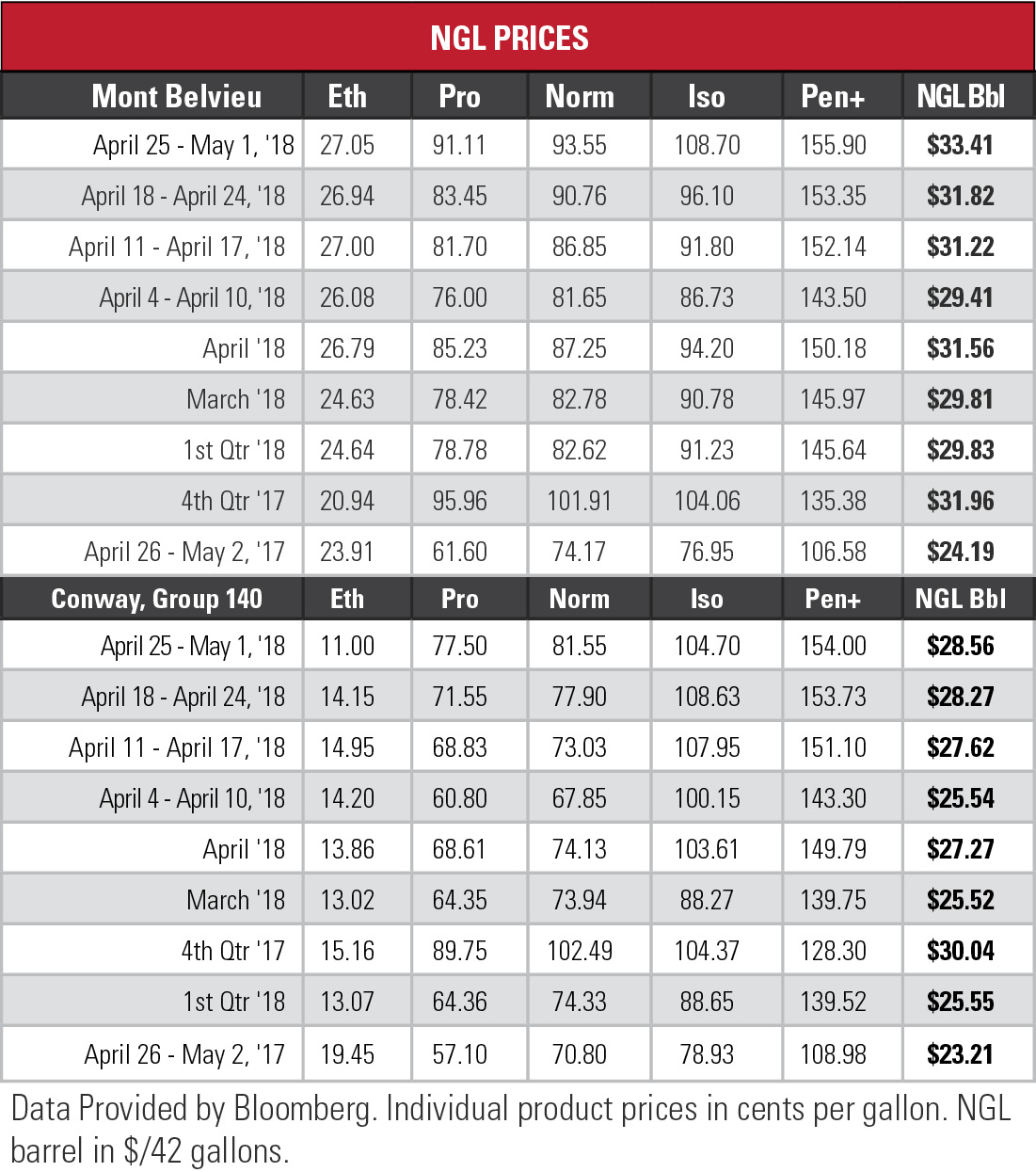

The Mont Belvieu, Texas, hypothetical NGL barrel jumped 5% last week to a 42-month high, driven by sharp increases in the prices of propane and isobutane.

The “barrel” is defined as how much NGL would cost in a 42-gallon (gal) unit if the five components were added to it on a percentage basis that corresponded to their share of the market. It exists as an imaginary gauge to track how NGL prices are performing.

The “barrel” rose 1% at Conway, Kan., to its highest point in three months, but the strength in propane and butane prices was balanced by a 22.3% plunge in the price of ethane to its lowest weekly average level since year-end 2015. That put Conway ethane, at 11 cents per gallon (/gal) 47.6% below its high for the year of 21 cents/gal in early January.

The “barrel” rose 1% at Conway, Kan., to its highest point in three months, but the strength in propane and butane prices was balanced by a 22.3% plunge in the price of ethane to its lowest weekly average level since year-end 2015. That put Conway ethane, at 11 cents per gallon (/gal) 47.6% below its high for the year of 21 cents/gal in early January.

The last two days of the five-day, Wednesday-to-Tuesday price-averaging “week” saw Conway ethane fall below 10 cents/gal into single-day, single-digit territory for the first time since July 23, 2012. The previous week, July 11-17, was the last weekly average in single digits at 6.52 cents/gal, capping off a miserable six-week span in which the price slumped as far down as 2.25 cents/gal.

Energy Transfer Partners LP (NYSE: ETP) sought to convince Pennsylvania regulators to allow the Mariner East 1 pipeline to resume operations this week. The pipe has been shut since March 7 when sinkholes developed near its route.

Energy Transfer Partners LP (NYSE: ETP) sought to convince Pennsylvania regulators to allow the Mariner East 1 pipeline to resume operations this week. The pipe has been shut since March 7 when sinkholes developed near its route.

The impact of the shutdown, says En*Vantage Inc., is that ethane that would have flowed through the pipeline now stays in the natural gas stream. Dominion Energy (NYSE: D) has informed the Pennsylvania Public Utility Commission that the continued shutdown of Mariner East has put operations at risk at its Cove Point LNG export terminal in Maryland.

En*Vantage surmised that the facility was using ethane as a refrigerant. Dominion noted that while it had sufficient supplies for the short term, a prolonged outage would force the terminal to seek ethane sources elsewhere at a considerably higher price. That type of maneuvering could threaten Cove Point’s economic advantage in the competitive global LNG market. A cut in LNG exports, En*Vantage said, could profoundly alter the summer natural gas injection season.

Ethane has ranged from 25 cents/gal to 27 cents/gal at Mont Belvieu for seven weeks. While ethane demand from crackers remains strong, En*Vantage said, the low spot prices of ethylene may convince some plants to simply buy it rather than purchase ethane as a feedstock to produce ethylene.

In the week ended April 27, storage of natural gas in the Lower 48 experienced an increase of 62 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 52 Bcf, the U.S. Energy Information Administration reported. The figure resulted in a total of 1.343 trillion cubic feet (Tcf). That is 40.2% below the 2.246 Tcf figure at the same time in 2017 and 28.4% below the five-year average of 1.877 Tcf.

In the week ended April 27, storage of natural gas in the Lower 48 experienced an increase of 62 billion cubic feet (Bcf), compared to the Bloomberg consensus forecast of 52 Bcf, the U.S. Energy Information Administration reported. The figure resulted in a total of 1.343 trillion cubic feet (Tcf). That is 40.2% below the 2.246 Tcf figure at the same time in 2017 and 28.4% below the five-year average of 1.877 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

Vantage Drilling Names Williams Thomson as New COO

2024-12-31 - Thomson is currently Vantage’s chief commercial officer and CTO and has served the company since 2008.

In Memoriam: Jay Precourt (1937-2024)

2024-10-22 - Legendary wildcatter Jay Precourt leaves behind legacy of philanthropy in Colorado and at Stanford University.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

SLB Earnings Rise, But Weakened 4Q and 2025 Ahead Due to Oil Glut

2024-10-22 - SLB, like Liberty Energy, revised guidance lower for the coming months, analysts said, as oilfield service companies grapple with concerns over an oversupplied global oil market.

Baker Hughes Wins Contracts for Woodside’s Louisiana LNG Project

2024-12-30 - Bechtel has ordered gas technology equipment from Baker Hughes for the first phase of Woodside Energy Group’s Louisiana LNG development.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.