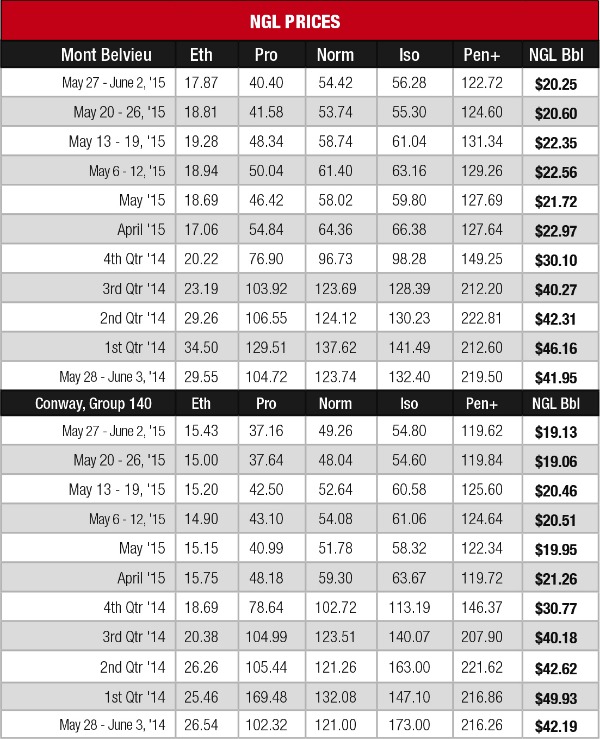

NGL prices were once again largely flat the week of May 27 even as activity increased with traders seeking to consolidate positions before the month ended. The good news is that it is possible that several products hit their floor level the previous week, but this won’t be certain for at least a few more weeks until the spring shoulder season comes to an end and summer cooling season fully begins to ramp up.

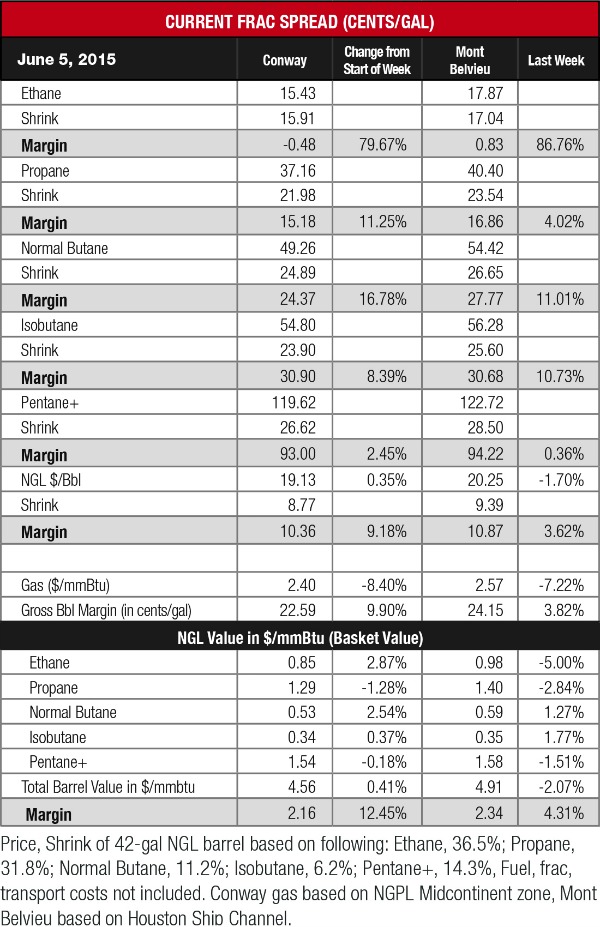

Frac spread margins improved across the board at both Conway and Mont Belvieu as natural gas prices fell 8% at Conway to $2.40 per million Btu (/MMBtu) and 7% to $2.57/MMBtu due to a larger-than-anticipated storage build.

According to the U.S. Energy Information Administration, natural gas storage levels rose by 132 billion cubic feet to 2.233 trillion cubic feet (Tcf) the week of May 29. This was a staggering 51% higher than the 1.482 Tcf figure posted last year at the same time, although it is only 1% higher than the five-year average of 2.211 Tcf. Of course, the natural gas has been oversupplied throughout much of this five-year period. As a point of reference the five-year average was 1.6 Tcf the final week of May 2008 just before the natural gas market began to get flooded with supplies.

“The market seemed to shift its focus back to the fundamentals and the persistent supply overhang,” Barclays Capital said in a June 1 research note. “Despite encouraging signs of incremental demand from the power sector and pipeline exports to Mexico, these factors alone will not be enough to move the market back into balance. A hotter-than-normal summer could help the market move higher, but from a purely fundamental standpoint we still expect prices to drift lower through this quarter.”

The NGL with the most improved margin was ethane, which rose by at least 80% at both hubs. While margins are challenged─they’re only theoretically positive at Mont Belvieu and narrowly negative at Conway–they could turn positive should gas prices stay at current levels. According to En*Vantage, margins are likely to turn positive to encourage shipments of volumes currently being rejected to Mont Belvieu, which is beginning to experience tighter supplies as the rejection policy is finally beginning to pay off.

The situation remains less positive for propane, which is experiencing its own oversupply situation. En*Vantage noted in its June 4 Weekly Energy Report that based on average summer inventory increases, propane stocks could hit 96 million bbl by the end of September. Not only would this be a record, it could easily exceed propane storage capacity.

“Another perspective is that if winter started tomorrow, current propane inventories of about 72 million bbl would be more than adequate to meet normal winter seasonal demand for propane. Something has to give. Petrochemical cracking of propane could increase by another 100,000 to 150,000 bbl/d, but that will eventually lead to a flood of propylene. …If additional petrochemical demand for propane does not kick in soon then we could see refiners burn propane and it is possible that producers will have to throttle back rich gas production,” according to En*Vantage. This situation caused propane to fall to another 13-year low as it was down 3% to 40 cents per gallon (/gal) at Mont Belvieu and 1% to 37 cents/gal at Conway.

The most profitable NGL to make at both hubs remained C5+ at 93 cents/gal at Conway and 94 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 31 cents/gal at both hubs; butane at 24 cents/gal at Conway and 28 cents/gal at Mont Belvieu; propane at 15 cents/gal at Conway and 17 cents/gal at Mont Belvieu; and ethane at negative 1 cent/gal at Conway and 1 cent/gal at Mont Belvieu.

Recommended Reading

Midstreamers Say Need for More Permian NatGas Pipelines Inevitable

2024-11-26 - The Permian Basin’s associated gas output could outstrip the region’s planned capacity well before the end of the decade, pipeline company executives said.

Matterhorn NatGas Pipeline Ramps Up Faster Than Expected

2024-10-22 - The Matterhorn Express natural gas pipeline has exceeded expectations since its ramp up on Oct. 1 for deliveries to interstate systems owned by Kinder Morgan, Williams and Enbridge.

Private Midstream Executives: More M&A, More Demand, More Gas Pricing Woes

2024-10-17 - Private midstream CEOs discuss the growth, opportunities and challenges that lie ahead.

Finding a Niche: Midstream Giants Target Private G&P Assets

2024-10-23 - Smaller, non-publicly owned midstream companies are moving quickly for a position in a consolidation-driven market.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.