West Texas Intermediate (WTI) crude oil prices continued to trade in the $60 per barrel (/bbl) range the week of May 6. Though the price was down slightly from the previous week, crude fundamentals showed improvements with domestic demand increasing as production and stock levels are slowly falling.

Though prices are improving along with fundamentals, according to Barclays Capital there are still chances of more volatility in the market. The investment firm stated in a May 11 research note that though production cuts are occurring, they are not fast enough to restore balance any time soon. In fact, stock levels reached a record 62 million bbl at Cushing, Okla., though there are indications that growth at this hub is slowing.

“Although there has been some slowing in the rate of U.S. supply growth and a rapid decline in the rig count, offsetting that is the fact OPEC production has risen 500,000 bbl per day (bbl/d) since the start of the year…If OPEC maintains that output level through Q2, then even with a further slowing in U.S. oil production, the oil balances of the major forecasting agencies indicate that global oil stocks will … continue climbing through to year-end at least,” Barclays Capital said.

In addition, the investment firm noted that U.S. crude production could ramp up as prices recover. EOG Resources announced that if WTI prices stabilized at $65/bbl, it would be prepared for “strong double digit” output growth next year. This could also lead to drilled, but uncompleted wells being brought online. “Neither the current trajectory of oil prices nor production looks sustainable … in such a scenario. Something will have to give,” Barclays said.

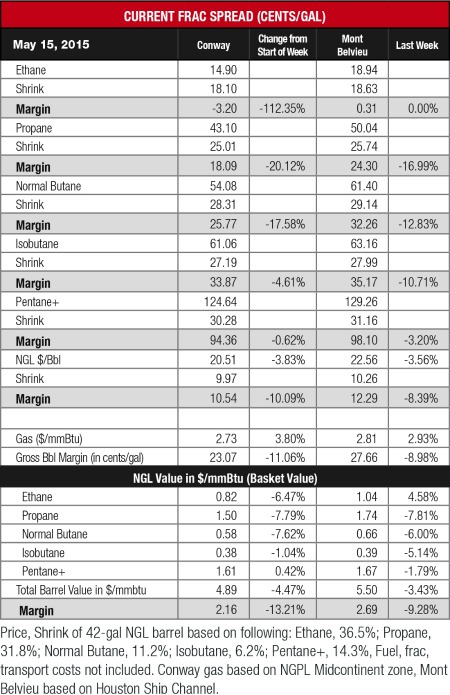

So far heavy NGL prices have yet to keep up with WTI crude movements, as prices fell at both hubs. This wasn’t much different than the story for light NGL prices, which also fell with the exception of Mont Belvieu ethane.

Ethane prices were largely flat this week with Mont Belvieu ethane gaining 1 cent/gal and Conway ethane losing 1 cent/gal from last week. The Gulf Coast increase was a result of improved natural gas prices based on the U.S. Energy Information Administration’s (EIA) revised projection for power generation demand. The organization forecasts gas consumption in the power generation sector to increase by 13% in 2015 before falling by 2% in 2016.

“Low natural gas prices in recent months have significantly increased the use of natural gas rather than coal for electricity generation. EIA expects natural gas generation in April and May will almost reach the level of coal generation, resulting in the closest convergence in generation shares between the two fuels since April 2012,” according to EIA’s Short-Term Energy Outlook for May. This forecast helped improve gas prices rise 9% at Mont Belvieu to $2.63 per million Btu (/MMBtu) and 6% to $2.73/MMBtu at Conway.

Ethane margins remain challenged, but the combination of improved gas prices and continued rejection is having a positive impact on the market. Though there is light at the end of the tunnel for ethane, there are dark days ahead for propane, which is the most challenged NGL.

The lack of transport capacity and an oversupplied market is hurting propane in the Marcellus-Utica, Bakken and Edmonton, where it is now trading below natural gas’ Btu value. Since production out of these regions is primarily sent to other hubs, it is helping to further drive prices down around the U.S. Prices at both Conway and Mont Belvieu were down 8% and it is likely that this oversupply situation will grow until the winter heating and crop-drying seasons begin in late 2015.

Overall the NGL bbl fell 1% at both hubs with the Mont Belvieu price down to $23.39/bbl with a 5% drop in margin to $13.42/bbl while the Conway price fell to $21.32/bbl with a 9% decrease in margin to $11.72/bbl.

The most profitable NGL to make at both hubs was C5+ at $1.01/gal at Mont Belvieu and 95 cents/gal at Conway. This was followed, in order, by isobutane at 39 cents/gal at Mont Belvieu and 36 cents/gal at Conway; butane at 37 cents/gal at Mont Belvieu and 31 cents/gal at Conway; propane at 29 cents/gal at Mont Belvieu and 23 cents/gal at Conway; and ethane at nil at Mont Belvieu and negative 2 cents/gal at Conway.

The EIA reported that natural gas storage levels increased by 111 billion cubic feet to 1.897 trillion cubic feet (Tcf) the week of May 8. This was 66% above the 1.145 Tcf posted last year at the same time and 2% below the five-year average of 1.935 Tcf.

Cooling demand should increase in parts of the U.S. based on the National Weather Service’s forecast for the week of May 20. The forecast anticipates warmer-than-normal temperatures in the Southeast and parts of the Northeast and Pacific Northwest.

Recommended Reading

Post Oak Backs New Permian Team, But PE Faces Uphill Fundraising Battle

2024-10-11 - As private equity begins the process of recycling inventory, likely to be divested from large-scale mergers, executives acknowledged that raising funds has become increasingly difficult.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Midstream M&A Adjusts After E&Ps’ Rampant Permian Consolidation

2024-10-18 - Scott Brown, CEO of the Midland Basin’s Canes Midstream, said he believes the Permian Basin still has plenty of runway for growth and development.

ONEOK Offers $7B in Notes to Fund EnLink, Medallion Midstream Deals

2024-09-11 - ONEOK intends to use the proceeds to fund its previously announced acquisition of Global Infrastructure Partners’ interest in midstream companies EnLink and Medallion.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.