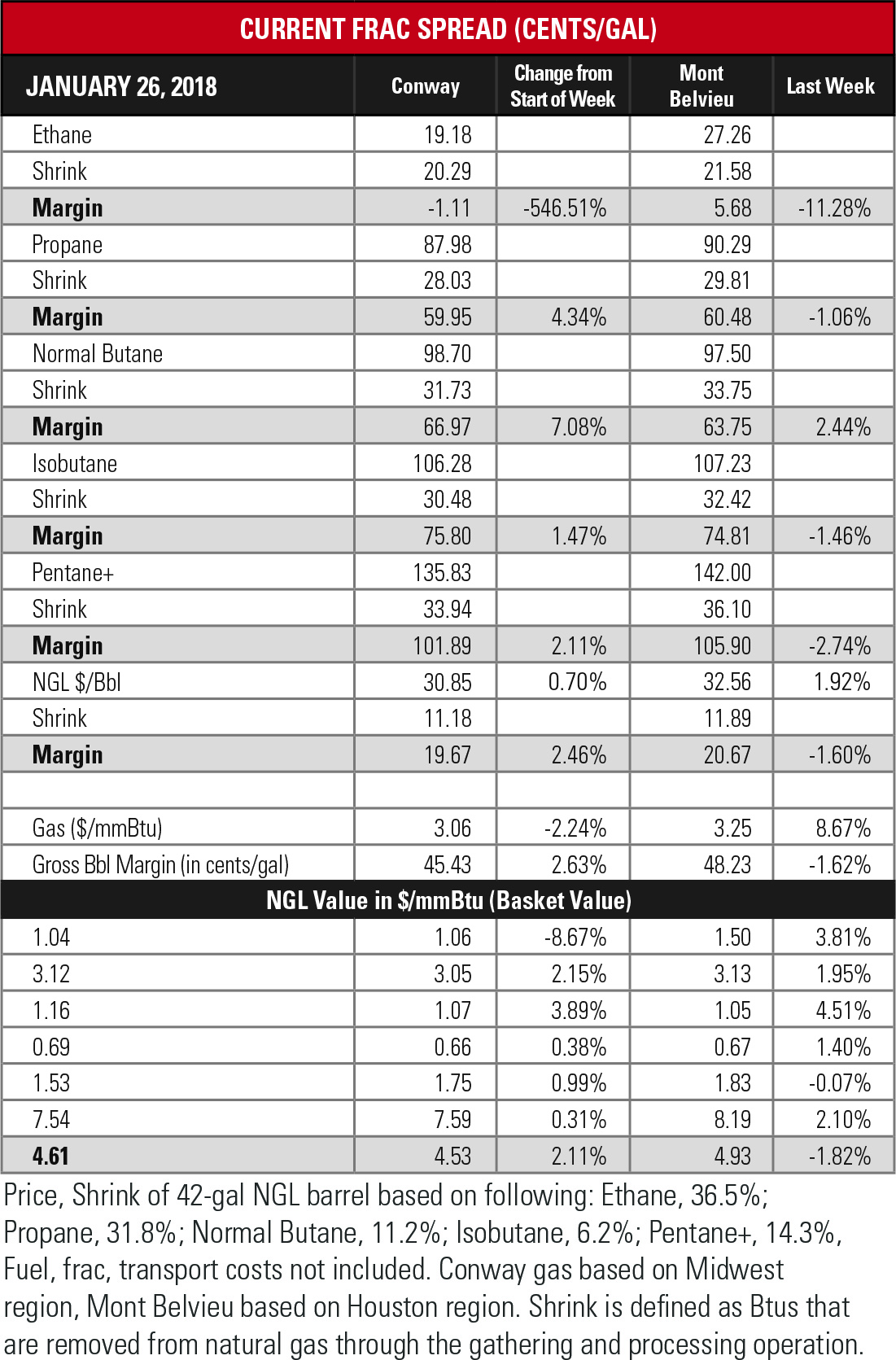

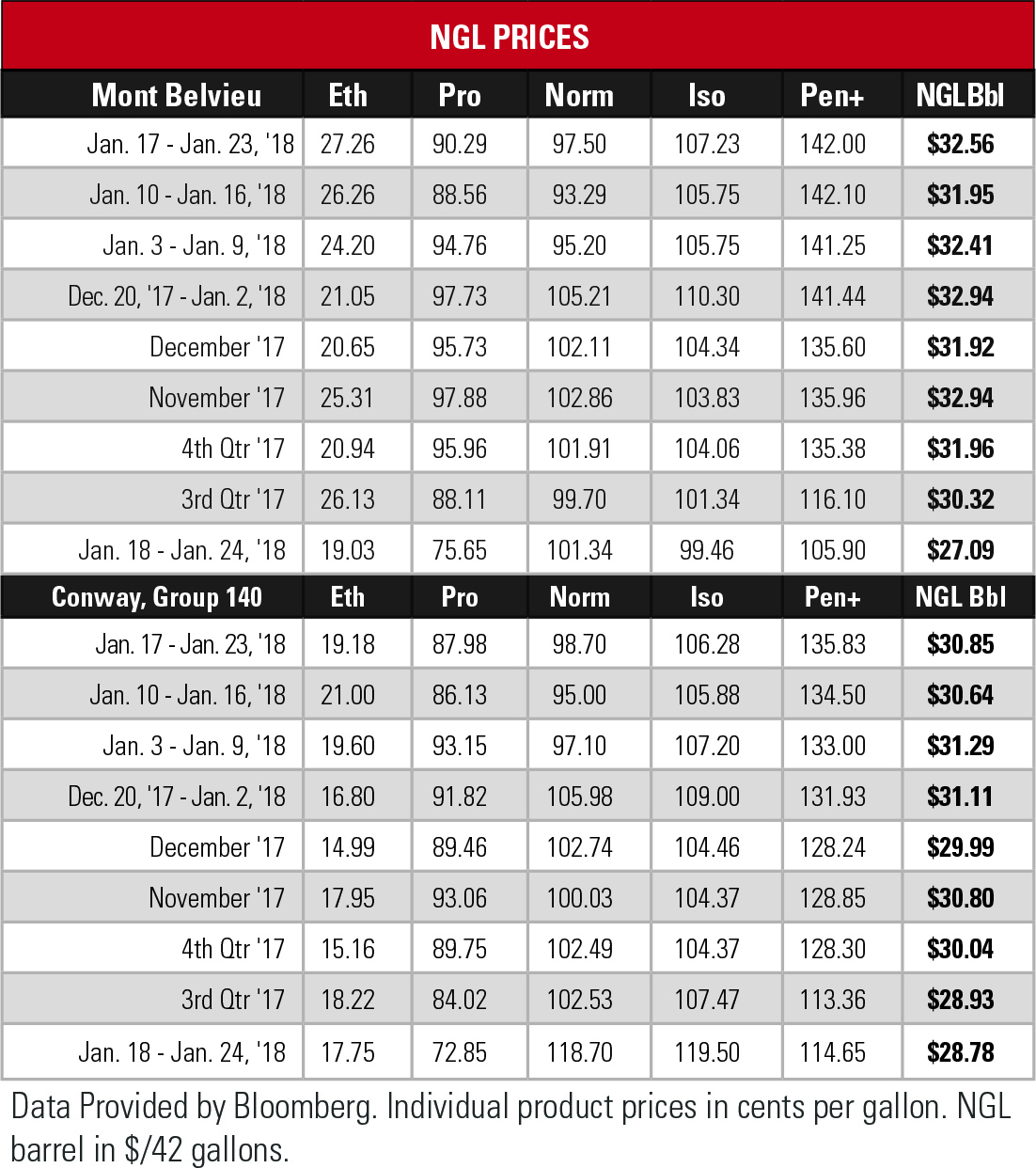

The spike in Henry Hub’s price helped ethane return to its happy place above 27 cents per gallon (gal) at Mont Belvieu, Texas, in the past week.

Credit persistent cold weather for cutting into natural gas storage, and the higher price of natural gas for encouraging what was likely a higher rate of ethane rejection, En*Vantage said. The margin narrowed at Mont Belvieu to under 6 cents/gal. Ethane is still the preferred feedstock for ethylene, En*Vantage said, but propane and normal butane are experiencing improved economics as heavier propylene feedstocks.

An LPG tanker departed Houston earlier this month and delivered a shipment of ethane to the Port of Pajaritos, Mexico. Platts reported that ethane production in Mexico could decline as much as 20% to an average of 80,000 barrels a day in 2018, according to a Pemex internal analysis. The shipment, En*Vantage said, is a trial cargo.

An LPG tanker departed Houston earlier this month and delivered a shipment of ethane to the Port of Pajaritos, Mexico. Platts reported that ethane production in Mexico could decline as much as 20% to an average of 80,000 barrels a day in 2018, according to a Pemex internal analysis. The shipment, En*Vantage said, is a trial cargo.

Also at sea were two tankers laden with propane—one from Algeria and the other from Norway—destined for Sea-3 LLC’s Newington, N.H., terminal. Propane supplies in the Northeast have tightened with the winter chill, En*Vantage said, and the Jones Act—the legislation that causes aggravation—makes it more economical to import from another hemisphere than to ship from the Gulf Coast.

Butane prices were up at both the Mont Belvieu and Conway, Kan., hubs last week. Margins widened at both hubs, as well. In comparison to the year-ago prices, Mont Belvieu butane was down 3.8% and Conway was down 16.8%. Mont Belvieu’s margin was slightly narrower than it was at this time in 2017.

Butane prices were up at both the Mont Belvieu and Conway, Kan., hubs last week. Margins widened at both hubs, as well. In comparison to the year-ago prices, Mont Belvieu butane was down 3.8% and Conway was down 16.8%. Mont Belvieu’s margin was slightly narrower than it was at this time in 2017.

C5+ is in considerably better shape than it was one year ago. At Mont Belvieu, the price was up 34.1%; Conway’s gain was 18.5%. Margins at both hubs were over $1/gal, compared to 70.76 cents/gal at Mont Belvieu and 79.49 cents/gal at Conway a year ago.

In the week ended Jan. 19, storage of natural gas in the Lower 48 experienced a decrease of 288 Bcf, the U.S. Energy Information Administration reported, higher than the Wells Fargo estimate of a 278 Bcf draw. The figure resulted in a total of 2.296 trillion cubic feet (Tcf). That is 18.4% below the 2.815 Tcf figure at the same time in 2017 and 17.5% below the five-year average of 2.782 Tcf.

In the week ended Jan. 19, storage of natural gas in the Lower 48 experienced a decrease of 288 Bcf, the U.S. Energy Information Administration reported, higher than the Wells Fargo estimate of a 278 Bcf draw. The figure resulted in a total of 2.296 trillion cubic feet (Tcf). That is 18.4% below the 2.815 Tcf figure at the same time in 2017 and 17.5% below the five-year average of 2.782 Tcf.

Joseph Markman can be reached at jmarkman@hartenergy.com and @JHMarkman.

Recommended Reading

As US Ethane Production Soars to Record High, Low Prices Expected

2024-10-29 - Tied to natural gas production, which has suffered from weak demand, ethane is also headed for bearish prices, according to an analyst.

Natural Gas Storage Moves Closer to Average

2024-10-17 - Producers put 76 Bcf of natural gas into U.S. storage—a little less than market expectations—as the traditional storage season nears an end and prices continue to fall.

Marcellus Waiting to Exhale But Held Back by Regional, Economic Factors

2024-11-06 - After years of exploitation as one of the country’s first unconventional shale plays, the Marcellus still has plenty of natural gas for producers, even if regional and economic factors have kept much of it bottled up.

EIA Reports Natural Gas Storage Jumped 58 Bcf

2024-09-19 - The weekly storage report, released Sept. 19, showed a 58 Bcf increase from the week before, missing consensus market expectations of 53 Bcf, according to East Daley Analytics.

EPA Gives OK to Texas GulfLink Deepwater Port

2024-11-04 - Sentinel Midstream’s Texas GulfLink project is one of several proposals for an offshore oil terminal in the Gulf.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.